Search results for 1000x

People

Not Found

Tweets including 1000x

VOTE $XRP AND 1000X YOUR RIZZ

$XRP (3) vs. $LTC (15)

cast your vote in the poll! 🗳️

0

0

1

8

4

又一个四百倍达成 #百倍币# #SolanaGems# #1000xgem#

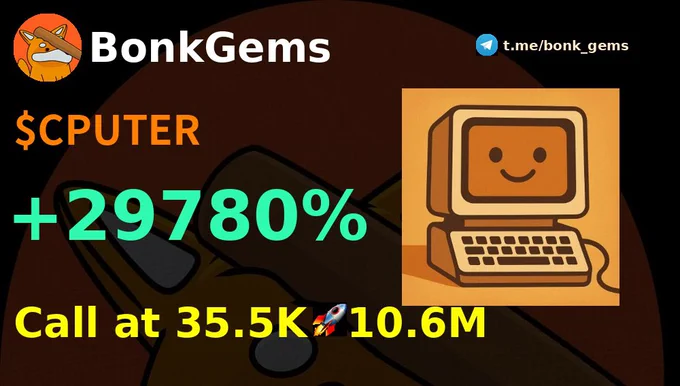

💹 Claudeputer (#CPUTER#)

ErgAfNEtv1SpjG5q1T7dmooSqr7kt7wAfNqZq8azbonk

🔥From 35.5K To 14.0M. Gain: 392.7x https://t.co/zqYN7xca7r

三百倍了

💹 Claudeputer (#CPUTER#)

ErgAfNEtv1SpjG5q1T7dmooSqr7kt7wAfNqZq8azbonk

🔥From 35.5K To 10.6M. Gain: 297.8x

🌙🌙⭐⭐⭐⭐⭐⭐⭐⭐⭐ https://t.co/A52J6Oe5hI

0

0

0

0

0

MyShell x MCP: On-Chain Intelligence. Redefined.

Imagine the full power of MCP unlocked as intuitive widgets in ShellAgent.

Picture 1000x efficiency, tangible deliverables, and seamless access for all MCP servers.

The future of AI, forged today.

Show more

0

0

11

80

35

If you look at the history of tax tokens, it all started with a 1% tax ,Hoge on ETH being one of the first. That token did a 1000x. Then came the Safemoon devs, who copied the model but cranked the tax up to 10%.

At the time, everything on BNB Chain was pumping. People were printing money, so they aped hard into Safemoon without thinking twice.

But now we’re in a bear market. If you’re launching a token with taxes above 1%, nobody’s going to buy it. It’s that simple. Start with 1% and gradually increase.

Show more

0

0

20

75

14

💹 Opendoor Technologies Inc. (#OPEN#)

C2aEa7v1NWUCyN9SYbWGhtCLRRpzXtbCqqRxz1mKbonk

昨晚22点04时 市值还在33.3K时播报, 90分钟后最高市值 已达3.0M. 涨幅: 88.6x

🤑 KOL/VC Traders:

1️⃣ 0xKeyNG🧲: +25,069$

2️⃣ CryptoD | 1000X GEM: +21,931$

3️⃣ Cupsey: +6,433$

4️⃣ Loopierr: +4,417$

5️⃣ 𝑲𝒆𝒚.✰: +3,464$

6️⃣ dv: +2,500$

7️⃣ AdamJae: +2,471$

8️⃣ 0n10n: +1,876$

9️⃣ K99 | 1000X GEM: +1,529$

🔟 WALL STREET BINANCE: +720$

📖 叙事: 项目OPEN疑似借用美股Opendoor Technologies Inc.(股票简称OPEN)meme概念,结合GME等逼空热点进行市场包装。名称“OPEN”象征敞开、透明、机会,易与炒作、‘打开新机会’、敞开财富大门等在Crypto语境下广受欢迎的情绪共振。此外,推特/微博多将其与GME美股逼空或open door梗关联,从而吸引大众FOMO情绪,营造巨大利润回报的梦境,核心叙事为“平民抱团、顺势套利”。

⭐⭐⭐⭐⭐⭐⭐⭐

Show more

0

0

1

0

0

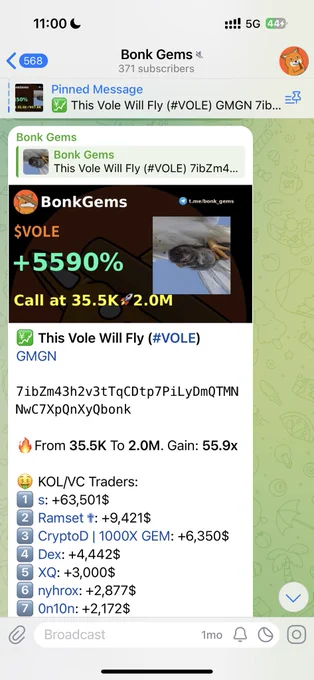

更新:每次倍率播报时,增加了 Kol 的盈利情况,相当于金狗信号➕聪明钱的玩法!

💹 This Vole Will Fly (#VOLE#)

7ibZm43h2v3tTqCDtp7PiLyDmQTMNNwC7XpQnXyQbonk

🔥From 35.5K To 2.0M. Gain: 55.9x

https://t.co/qYz69oEq6w

🤑 KOL/VC Traders:

1️⃣ s: +63,501$

2️⃣ Ramset ✟: +9,421$

3️⃣ CryptoD | 1000X GEM: +6,350$

4️⃣ Dex: +4,442$

5️⃣ XQ: +3,000$

6️⃣ nyhrox: +2,877$

7️⃣ 0n10n: +2,172$

8️⃣ JW: +2,082$

9️⃣ risk: +1,632$

🔟 Jeets: +1,351$

⭐⭐⭐⭐⭐

Show more

0

0

0

2

1

Avoiding the $1.5 Billion Bybit Attack with web3://

# What Happened?

The root cause of Bybit’s historic $1.5 billion attack was finally uncovered yesterday. The attacker exploited a vulnerability by maliciously replacing the frontend of Safe hosted on its centralized server. By deploying a nearly identical frontend, they tricked Bybit operators into signing a fraudulent transaction that transferred the ownership of Bybit's multi-signature wallet to the attacker. Once they gained control, they drained the entire $1.5 billion to their own account, marking the largest financial attack in history.

This attack highlights a critical weakness in the current web3 infrastructure. Despite the robust security of Ethereum's smart contracts, most web3 frontends rely on centralized components such as DNS and centralized servers, making them vulnerable to attacks with several key risks:

- Integrity of Frontend Files: Frontend files can be maliciously altered through DNS hijacking or server breaches.

- Transparency: Changes to frontend files are difficult to detect, with no transparent change history. We currently rely on third-party services like the Internet Archive for version tracking.

- Availability: Centralized components are vulnerable to censorship (e.g., Infura blocking requests from certain regions) or server outages.

# Can We Do Better for Web3?

Enter web3://—a fully on-chain frontend protocol (ERC-4804/6860) designed to address these vulnerabilities. The core idea is to host the frontend on the blockchain, ensuring it enjoys the same level of security as the smart contract itself. With web3://, we can achieve:

- Integrity of Frontend Files: The frontend cannot be modified without the contract owner's explicit action. Additionally, users can verify that the frontend they see matches the on-chain version using Ethereum’s light client verification technologies.

- Transparency: Any changes to the frontend are made through on-chain transactions, ensuring a public, immutable change history.

- Availability: By leveraging Ethereum’s network, the frontend achieves the same level of uptime as the blockchain itself — virtually 100% since genesis.

# How to Use web3://?

You can experience the power of web3:// today by

- using our gateways, such as w3url dot io, or

- through the native EVM browser: https://t.co/rMIfhmQRHr.

Several project homepages, including web3://, EthStorage, QuarkChain, and even a copy of Vitalik’s blog, are already hosted on-chain and accessible via web3://.

# Ongoing and Future Directions

While web3:// addresses critical security issues, several challenges remain:

- Storage Cost: Ethereum’s storage cost is prohibitively high — around $1M per gigabyte - a major barrier to widespread adoption. @EthStorage , an Ethereum L2 solution, aims to reduce this cost by 1000x.

- Transaction Cost: The high transaction fees on Ethereum can be prohibitive, especially for frequently updated websites. The Super World Computer project by @Quark_Chain is developing a custom OP L2 designed for EthStorage as L3, providing both low transaction and storage costs.

- Client-Side Verification: To guarantee file integrity, we need a robust client-side verification mechanism. Light-client verification, such as that used by Helios by @NoahCitron , is a promising approach we are actively exploring.

- Browser Integration: For a seamless user experience, client-side verification should be integrated into the browser, ensuring that all web3:// websites are verified automatically.

- Decentralized Access to Ethereum: To protect against censorship from centralized RPC servers, decentralized access to the Ethereum network is essential. We are collaborating with the Ethereum Portal Network to achieve this fully decentralized solution.

# Want to Learn More?

Visit our website for more details or contact us directly. If you’re attending EthDenver, feel free to stop by our booth!

使用 web3:// 避免 Bybit 15 亿美元攻击

# 事件回顾

Bybit 历史性 15 亿美元攻击的根本原因昨日终于被揭露。攻击者通过恶意篡改托管在 Safe 服务器上的前端页面,伪造了几乎一模一样的前端界面,诱导用户签署了一笔恶意交易,从而将 Bybit 多签钱包的所有权转移到攻击者手中。获取控制权后,攻击者迅速将全部 15亿美元转入自己的账户,造成了有史以来最大的金融攻击事件。

这一事件暴露了当前 Web3 基础设施的重大安全隐患。尽管以太坊智能合约本身具有高度安全性,但大多数 Web3 前端仍依赖于中心化组件,如 DNS 和中心化服务器,这使其面临多种风险:

- 前端文件完整性:前端文件可能因 DNS 劫持或服务器攻击而被恶意篡改。

- 透明性:前端文件的变更难以察觉,且缺乏透明的变更历史。目前只能依赖第三方服务(如互联网档案馆)进行追溯。

- 可用性:中心化组件容易受到审查(如 Infura 曾屏蔽特定区域的请求)或服务器宕机的影响。

# Web3 是否能更安全?

为了解决这些安全问题,web3:// 协议应运而生,它提供了一种完全上链的前端解决方案。其核心思想是:将前端文件托管在区块链上,使前端逻辑与应用逻辑享有同等的安全保障。这种方式带来了以下优势:

- 前端文件完整性:前端文件只有在合约所有者明确操作下才能被修改。此外,用户可以通过以太坊轻客户端和验证技术,确保浏览器中显示的前端与链上版本完全一致。

- 透明性:前端文件的任何修改都需要通过链上交易进行,变更历史公开且不可篡改。

- 可用性:前端将享有以太坊网络同等的可用性 —— 自创世以来几乎 100% 的在线率。

# 如何使用 web3://?

你可以通过以下方式体验 web3:// 的强大功能:

- 使用我们的网关,如 w3url . io

- 或者通过原生 EVM 浏览器: https://t.co/rMIfhmQRHr

目前,web3://、EthStorage、QuarkChain,以及 Vitalik 的博客等多个网站已上链,并可通过 web3:// 协议访问。

# 现状与未来方向

尽管 web3:// 能有效解决安全问题,但仍面临以下挑战:

- 存储成本:以太坊的存储成本极高 —— 每 GB 大约 100 万美元,这成为大规模应用的主要障碍。@EthStorage 作为以太坊 L2 存储解决方案,目标是将存储成本降低 1000 倍。

- 交易成本:以太坊上的高交易费用同样是一个难题,尤其是在网站频繁更新的情况下。@QuarkChain 的 “Super World Computer” 项目正在开发专为 EthStorage 定制的 OP L2,以同时提供低交易费用和低存储成本。

- 客户端验证:为了保证文件完整性,需要可靠的客户端验证机制。我们正在积极探索轻客户端验证技术,如 Helios。

- 浏览器集成:为了提供更好的用户体验,客户端验证需集成到浏览器中,并能自动验证所有 web3:// 网站的完整性。

- 去中心化的以太坊网络访问:为避免中心化 RPC 服务器的审查风险,需要实现对以太坊网络的去中心化访问。我们正与以太坊 Portal Network 合作,推动这一完全去中心化的解决方案。

# 想了解更多?

请访问我们的官网了解详情,或直接联系我们。如果你正在参加 EthDenver,欢迎到我们的展台交流!

Show more

0

0

9

62

34

Lessons To My Future Bull Market Self:

This is partly to keep me accountable during bull market euphoria and also serves as a guide for those coming into the markets for their first cycle.

I’d be extremely impressed if you managed to “make it” the first time and even more impressed if you managed to keep it.

The former isn’t even the hard part. It is very much the latter. A blind Bored Ape Yacht Club member could make money in a roaring bull market. This is why many enter the markets for the first time and throw money at something they saw on Twitter, hear from a colleague or (the best one) get shilled by their Uber driver and convince themselves they have cracked the markets.

Stuff goes up because more money flows into the system. The opposite is also true. Hence the past 2 years of pain.

Your mission, if you choose to accept it… is to bet on the fastest and fittest horses in the race. This way you don’t miss an opportunity of a lifetime sat holding some worthless piece of shit whilst the rest of the people around you are making serious dough.

There are plenty of ways to get to that arbitrary number that you think will help you achieve eternal happiness. Whether it will or not is a different matter.

The following are some of the most important points that I have sat and stewed over which I think were at times the parts I personally went wrong in the last cycle, primarily.

2017 was just a blur. I didn’t have a clue what I was doing if I am honest. If you check the residuals in my Coinbase account it would be very embarrassing indeed.

The last cycle was infinitely better from a performance perspective. That being said, in hindsight, there were still so many stupid and silly mistakes that either stunted my portfolio growth or cost me a small fortune in losses.

Let’s get to it.

Disclaimer: If you are not mature enough to read this and take responsibility for your own actions in the markets please just stop reading. There are probs a few things I have missed that I will add on as time goes by and I get a brain zap and remember. This is not financial advice, I am extremely stupid. You will lose all your money listening to me

Stay Curious and Try Shit - Funnily enough, I think this applies more to people who may be on their second or third cycle. Naturally, when you come into the markets for the first time, all you want to do is digest information and buy shit. The further down the rabbit hole you go the more likely you are to find something early. The reinforcement of making great returns from being early encourages you to continue your exploration of the crypto/on-chain world. Always maintain this edge of being one of the first to try shit out. You never know when you will stumble upon something great.

As a bull cycle goes on the edge in the markets tends to erode due to increased competition both on a capital and skill front. People will outwork and outsmart you and there’s always someone with more capital around the corner.

Edge can be reestablished by trying shit early and deciding for yourself whether it has something about it. There were many different times last cycle that you could have picked up assets before the masses just by trying the protocol and seeing for yourself. Never leave it down to someone else to tell you. They can’t and won’t do it for you.

It has happened recently with Solana. The masses tell you one thing when in reality it is the other. This results in the majority of the market being offside on something that clearly has a lot going for it. Stay curious and try shit.

Don’t Chase Yield - If you are new to this market, DO NOT try and chase yield. You do not need to earn 20% on a position less than $200,000 (minimum).

There are going to be plenty of times when you are drawn in by a very tasty yield on stable assets. There are also going to be plenty of times when you are drawn in by ridiculous APRs. You’re probably going to provide liquidity on a DEX and get rekt there too.

The long and short of it is this. You do not need to concern yourself with earning yield when you don’t have a worthwhile portfolio size.

Why earn 20% on stable(ish) assets when you could have liquid capital and earn much more than that, oftentimes in one day (if you choose correctly)? The additional complexity, counterparty risk and smart contract risk are categorically not worth it at this stage.

If you play the farm and dump game with new ponzis that come online, please do not even entertain for one second that you should purchase the token that everyone is farming. There are bigger fish with more capital and experience that know how to play these games to a tee. You will be bait.

I’d even go as far as saying if this is your first or second time around just buy tokens and don’t do anything else with them (other than sell of course).

Maybe there are a few exceptions:

Holding an LST like stETH, rETH, swETH or pxETH over ETH if you have a long-term view (again, not really for everyone).

Staking a token to match inflation i.e. SOL (in this case use the most lindy SOL LST stSOL or mSOL).

If TIME makes a comeback and we go full ponzi season and run it back turbo

Don’t chase yield, it doesn’t make sense until you make it.

Let Others Drink the Kool-Aid - I was definitely caught sipping from the communal ponzi Kool-Aid fountain a few times last cycle. It’s quite funny because you know deep down that there is something cult-like about certain founders, communities and tokens but at the time everyone is printing money so nobody cares.

It always ends up in tears, literally every time. That being said, when you see a ponzi cult that has a founder that people would jump off a bridge for, just buy it. These folks never tend to realise they’ve been dumped or that they in fact were in a cult until it’s too late. The beauty of this (for you; an awakened market participant) is that people tend to wrap their whole online personality up in, said cult and when you are selling they are writing 40 Tweet threads about why the recent fud is unjustified. Let them be the exit liquidity they desire to be.

TLDR; Scams pump the hardest, Let others drink the Kool-Aid.

Position Sizing - I was too small on the way up and too large on the way down at times. This ain’t good. Larger more concentrated bets on less volatile yet sure-fire wins whilst rotating proportions into higher-beta assets to make more of the underlying position is my typical play.

Be wary of liquidity, particularly for on-chain assets. You may get away with poorly timed entries in a bull market but if liquidity thins out you get screwed entering a position and also screwed exiting a position. If they have a buy-and-sell tax which is more popular now, then you get screwed again.

I don’t really have much more to say on this one other than pick your poison (which I already have) and don’t fuck up the remainder of your portfolio oversizing into lower conviction plays, undoing the great entry on the large position.

If you can’t outperform BTC, ETH and maybe even SOL this cycle. Just buy those and forget about it until McDonald’s puts the minimum wage up to $50 an hour because all their workers got paper rich and left, again.

I can’t reiterate the above enough, if you aren’t serious about this and you don’t have the time don’t bother. Just keep it simple.

Shitcoins are Generally Good - First, we should define a shitcoin. In my opinion, anything that is purely created for speculation. The irony is that 99.99% of the market are shitcoins but some projects are more honest about it than others.

You are gonna lose a fuck tonne of money playing the shitcoin markets. You also stand the chance of making large amounts of capital very quickly, which if you are smart, you can then play the games mentioned above.

I can’t stress the fact that you can go completely flat-ass broke trading shitcoins not knowing what you are doing. These trenches are well-trodden by professionals who have more capital, more experience and more information than you. They haven’t stopped all bear market, they are fucking born ready for the next PEPE or SHIB. What is your edge?

The chances of you buying a shitcoin out of pure luck that goes on to make you serious money is slim to fuck-all. There are thousands of complete rugs launched Every. Single. Day. Learn the trade if you must, sniff out the good accounts to follow and get ready to have sleepless nights and to start spamming the group family message with /wen_marketing, because this shit will take over your life.

If this isn’t for you stick to the point above BTC, ETH and SOL. If you are a born fucking nugget degenerate then see “Position Sizing”.

If you don’t get it, buy it - I am becoming a lot better at this next point but still struggle. A lot of the time because I struggle to think like an absolute fucking moron. But, you must be the idiot. Eat, sleep and think like an idiot, if you are to catch the almighty pump led by redacted coins.

I know I would have missed the Stepn seed round. Move to earn, like what?! GTFO. I knew better, I was investing in the future of financial technologies. All the while it went 1000x and I had 0 position. Come to think of it move to earn was such an easy sell for the rest of the world outside of the echo chamber of CT. I just didn’t get it at the time and I paid the price. Never again.

If you have a visceral reaction to something good or bad, investigate it more, there is probably something there. After all we are emotional beings and charts are just human emotions expressed in candle sticks… I think RT taught me that one.

Write, write, write - This is simple. Writing is the fastest way to growthhack your understanding of anything. You have to check your own understanding of things before you publish them or you look like a tit. Just write and do it even if you aren’t going to publish, it helps clear your mind and structure your thoughts.

Stay Healthy - I got fat as fuck during the bull market. More money, more time spent sitting at the desk. DO NOT DO IT. You need to train as you would for anything. Staying fit and healthy is a way to perform better.

You Can’t Own Everything - There will be unlimited shiny objects during a bull market. You can own them all but you will not perform well. Do your research, get the best entry you can get and let the thesis play out. If you are wrong, you will know a lot sooner in a bull market.

Over-diversification is terrible if you are looking to grow the portfolio quickly and well. You can’t physically manage all those positions as much as you would like to think so. There is also no way you know all the bull and bear cases for each token you hold too. If you do, then come work for us at blocmates because that is impressive.

The crypto markets are so reflexive that it makes no sense to be over-allocated across too many assets. Winners can often move alone but the full market pulls back together. Get conviction and stop being a little bitch.

Break your bags - This stems from the point above. You best know the bear argument for your position because if it begins to come true then you need to exit and move on. If there is no bear argument for your position then congrats you have joined a cult.

Supply Dynamics are Everything - Tokenization is such a difficult dynamic to wrap your head around if you are just starting out. But, know this... You best be aware of large token unlocks, who is getting unlocked, the inflation schedule for the tokens you hold and what the supply of your token will be 12 months from now.

If you do not know this, then you should not own a token. If you think you can simply beat the market because some 1920’s data said that HODL outperforms, then you are my exit liquidity, thank you.

Token supply increases in crypto are absolutely brutal. Large unlocks and cliffs can increase a token supply by 2x overnight. Many tokens from the last cycle will not reach their previous ATH because of the drastic increase in supply. They might hit their market cap ATH but the price could still be lightyears away. Choose wisely.

The flip side of this is that a lot of OG tokens from the early DeFi summer days are nearing complete unlocks so no additional supply is left to come onto the market. This is as close to fair pricing as you are going to get. I am not revealing what these are you will have to subscribe to The Meal Deal once it goes live.

“Just One More 2x” - If you are in the fortunate position where you say to yourself “Just one more 2x” or if you begin to look at your dream home, just sell everything right that moment. A portfolio ATH is always a good time to take some of the more fruity positions off. If you are thinking it, others are too, you are not special and you are not a market outlier. Do yourself a favour, and secure the bag.

Don’t Paperhand Bear Market Entries - If you have just been through the past two years and hated every minute of it but you stuck to the plan and bought as much of a specific asset as possible, the worst thing you can do is sell it early trying to chase other people’s winners. Put it in cold storage out of the way so you aren’t tempted to even “take a bit off and buy back lower”. If you are talented then yeah go for it, most aren’t.

Other tips not worth writing a lot about:

- Use a DEX and birdge aggregator to make sure you are getting the best price

- Always use a Ledger

- Check DeFi llama directory to find the correct URL of a site. If that faults go to their Twitter and verify.

- Get authenticator 2FA. Get off of your phone number for security backup.

- Find your crew, you can’t be everywhere.

- Make your own decisions

If you enjoyed this then please consider subscribing to The blocmates Newsletter which covers a lot of our thoughts on the market, every Friday!

Link - https://t.co/B3KNx1TkNz

We also talk to a lot of projects, founders, builders, traders and investors about this kind of thing on our podcast which is also linked below

📺 - https://t.co/QOqnROq9d9

Show more

0

0

136

1.1K

327

1000万美金的收入 @SpheronFDN

除了币圈的交易所,个别的市场产品

有哪些可以做到这个收入可以出来走几步

这倒是一个新的思路

其实Web3的项目做数据:说多少用户、多少链上数据没啥意义

毕竟都可以低成本造假

直接发收入吧,还有利润和支出

这个东西其实才是决定币价的最核心因素

1000万只是开始,后面1亿在看

1000万也是榜样,期待其他Web3项目学习

1000万更是力量,算是突破了“Web3没有办法创造真实收入”的困境

期待更多Web3项目能够发掘自己的真实收入场景和产品

Show more

$10M ARR. Hit it while the world was asleep.

Decentralized compute isn’t the future.

It’s happening now with @SpheronFDN https://t.co/vYmDQGL56U

0

0

5

5

0

背包🎒 被严重低估了,还没有上车的要尽快上车

推荐理由:凡是能承接WEB3真实需求的产品,尤其是能承接资金场景的项目 毫无疑问都可以冲击百亿FDV

Show more

0

0

25

113

6

1000刀挑战第一个100万

进度百分之58了

搞个抽奖,送10套币安的8周年纪念款周边。

抽奖评论区随机,会公布

要求点赞关注 https://t.co/Nsz5qlePcY

0

0

91

106

19

这个帖子专门给一些不睡觉的人看

以后晚上凌晨的时候我会发一些物联网逆向技巧更新在这个帖子下面

一些敏感的早上睡醒我会删除

简单的比如解锁车门、远程破解摄像头、操纵道闸

难一些的比如pos机、起搏器、交通灯、刹车方向盘

这个帖子相关的任何问题我都不会回答,只记录我的生活

Show more

0

0

67

3.2K

338

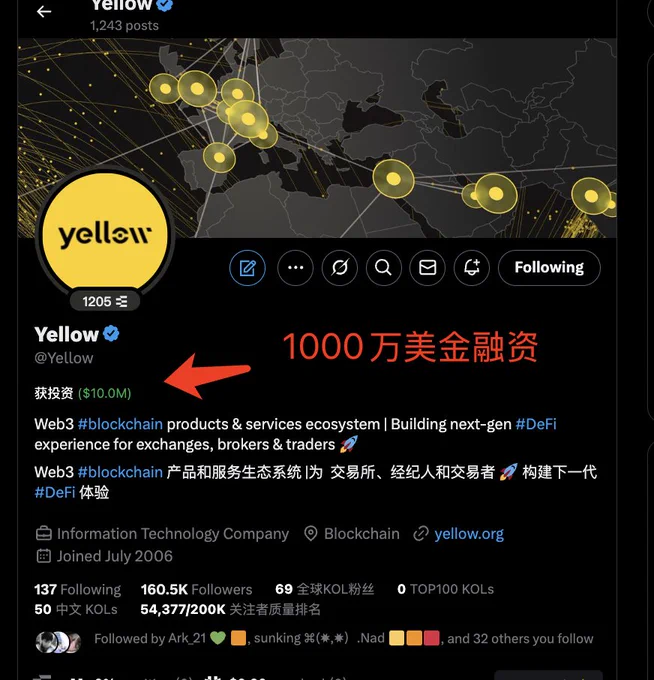

1000万美金融资的 @Yellow 项目交互教程

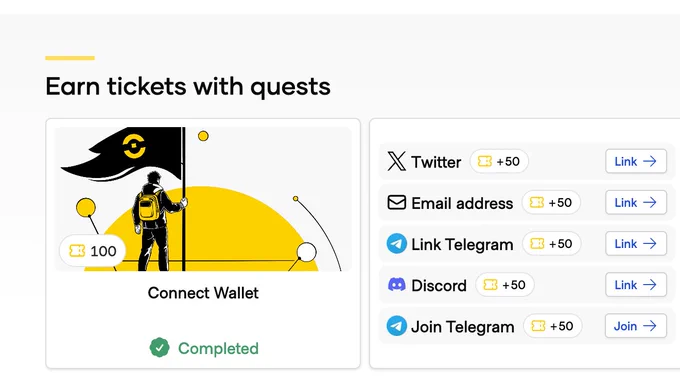

Yellow发起了“Connect & Win”活动,完成一些简单的社交任务,获得相应的门票和潜在空投,教程开始👇

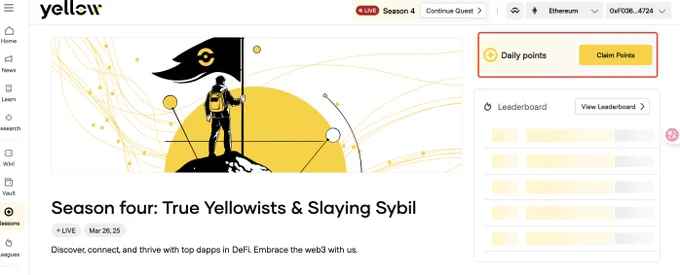

①进入https://t.co/L9oKoxjhhE

链接 #okxwallet# 钱包

②点击win进入活动界面,完成任务获得奖券

③点击season4进入任务界面每日签到,完成任务获得抽奖机会

④持续做任务

以上就是交互教程的全部,开始吧✅

Show more

先别睡!我搞了一个 #Bybit# 大毛,新人存100u就送20个 $NXCP ! 价值60u(小500rmb),速度冲了!!

不说废话了这个肯定是大毛,具体步骤按头做👇

1️⃣走先知链接注册(必须,33%手续费返还)https://t.co/x8a5QHGDgF

2️⃣USDT存入100美元,获得20个 $NXCP 代币(目前价值60美元USDT)

问清楚了,5-7天发奖,发奖的时候我会跟大家说!

全球限量11000个,今天刚开始的活动,肯定来得及。

怕币不值钱的做完了随手做个空套保锁定利润就行

@Bybit_Official

Show more

0

0

0

3

1