Search results for Argentina

People

Not Found

Tweets including Argentina

Vamos Argentina!! @Cricketarg

The road to the 2020 ICC U-19 World Cup for the Americas region starts July 8th, 10:30 am EST. The first 2 matches see @usacricket take on @cayman_cricket streamed live https://t.co/9MK8ibs17Z and @canadiancricket vs @CricketBermuda live stream https://t.co/ptAFKKdsng https://t.co/U4UN8UEc6k

Show more

0

0

0

11

1

JUST IN: 🇦🇷 Argentina President Javier Milei shuts down unit investigating Libra crypto scandal.

0

0

340

1.1K

104

0

0

0

1

0

Just worked LU1WFU in Argentina 🇦🇷 (Gridsquare: FE64 / distance: 13083.6 km) on 6m using FT8 #hamr# #wavelog# #SV0SYH# https://t.co/ddrL23j9x9

0

0

1

10

1

Im coming back to Argentina🇦🇷 https://t.co/juIV6bLcLR

0

0

2.1K

217.4K

4.2K

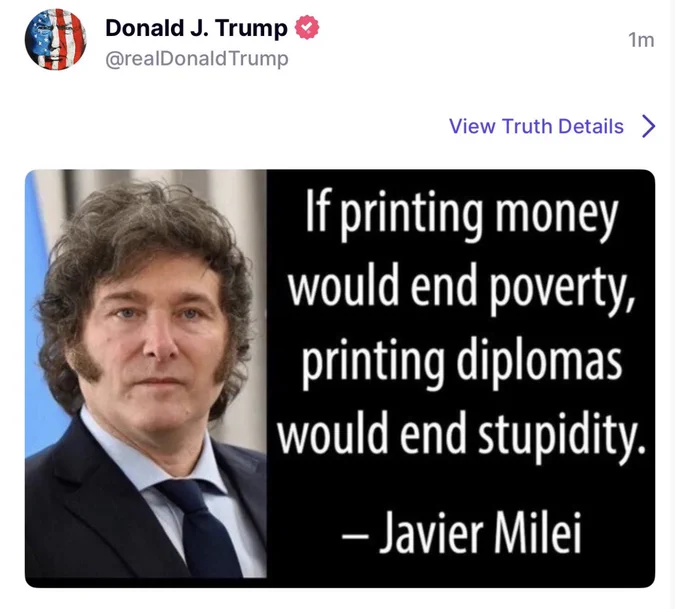

🚨HOLY COW: President Trump has posted Argentina’s President, Javier Milei’s famous quote. HUGE! https://t.co/tJ7K5uSCdp

0

0

324

49.3K

9.3K

🚨🇦🇷MILEI’S “CRAZY” PLAN WORKED—ARGENTINA’S PAYCHECKS JUST HIT A 6-YEAR HIGH

Private sector wages in Argentina just spiked to their best level since 2018—real wages hit 107 in Feb 2025, up from a sad 91 in late 2023.

What changed? Oh, just Milei dropping economic reforms like they were hot. People called it “shock therapy.” Turns out, it was more “money therapy.”

Critics yelled, “He’ll crash the economy!” Workers are now yelling, “Payday!”

Love him or hate him, Milei’s free-market rollercoaster is actually handing folks fatter checks—for the first time in forever.

Source: Observatory of Employment and Business Dynamics, @JMilei, @ArgMilei

Show more

0

0

386

10.2K

2.3K

The victory of #JavierMilei# in #Argentina# confirms that a Fourth Wave of Populism has been consolidated in Latin America. Certainly, @JMilei’s party is sui generis in many ways (=bizarre), but it fits a well-identified previous pattern of #populism#. Open thread🧵

Show more

0

0

2

39

8

Red Fox Agates from Patagonia, Argentina, are a type of agate featuring vivid red hematite inclusions, which form when iron oxide (hematite) crystallizes within the silica gel during the agate's formation in volcanic rock cavities

https://t.co/FyYvJoo3Zm

Show more

0

0

25

146

11

Devconnect is coming to Buenos Aires, Argentina from 17-22 November 2025!! 🌞🇦🇷

Devconnect ARG will be different: We want to support an effort the local community has already started — bringing Argentina onchain.

Read about Devconnect ARG & how you can get involved👇 https://t.co/F9tWZTeFIB

Show more

0

0

287

3K

765

This should be a requirement. If Argentina can do it, so can America!

0

0

16.8K

366.3K

78.7K

𝕏 is now the #1# News App on the AppStore in

United States 🇺🇸

Canada 🇨🇦

Germany 🇩🇪

Japan 🇯🇵

France 🇫🇷

Italy 🇮🇹

Spain 🇪🇸

Argentina 🇦🇷

Brazil 🇧🇷

El Salvador 🇸🇻

Hong Kong 🇭🇰

Mexico 🇲🇽

New Zealand 🇳🇿

Phillipines 🇵🇭

United Arab Emirates 🇦🇪

Qatar 🇶🇦

Indonesia 🇮🇩

Saudi Arabia 🇸🇦

Show more

0

0

434

2.8K

401

The longest walking route is from Cape Town, South Africa, to Puerto Almanza, Argentina https://t.co/fPuo2ASy8J

0

0

69

748

73

Another game, another assist for James and through to the final. World champions Argentina await on Sunday and Colombia will need to step up a gear for that test.

0

0

1

6

0

I don't know why @rickawsb wrote his article in Chinese but here's an unfiltered English version of it:🧵👇

The “GENIUS Act” and the New East India Company: How USD Stablecoins May Challenge Fiat Systems and Nation-States

By: Rick AWSB

“This is an extremely sophisticated asymmetric strategy. The U.S. is exploiting its adversaries’ weakest point fear of losing control to build its own moat.

I. Ghosts of History: The Digital Return of the East India Company

History doesn’t repeat, but it does rhyme.

When Trump happily signed the GENIUS Act into law, what came to mind was a powerful image from history: the East India Companies of the 17th and 18th centuries commercial behemoths granted sovereign powers by their nations. These were not mere merchants, but corporate sovereigns, blending soldiers, diplomats, and colonizers.

This Act, though appearing like a regulatory tweak, in truth marks the chartering of 21st-century “New East India Companies” stablecoin issuers gaining legitimacy through U.S. law. It's the beginning of a transformation in global power dynamics.

1a. Charters of a New Power

Four centuries ago, the Dutch and British East India Companies (VOC and EIC) had the power to hire armies, mint currency, make treaties, and wage wars. Their state-backed monopolies defined the age of globalized sea trade.

Today, the GENIUS Act essentially charters modern-day equivalents stablecoin giants like Circle (USDC), potentially Tether, and possibly tech giants like Apple, Google, Meta, and X. No longer rebellious crypto startups, they are now pillars of U.S. financial strategy. Their “routes” aren’t sea lanes, but 24/7 borderless financial rails the new arteries of global commerce.

1b. From Trade Routes to Financial Rails

The old companies controlled physical routes with cannons and forts. These new “digital East India Companies” will control global value flows. If a U.S.-regulated stablecoin becomes the default for cross-border payments, DeFi, and real world asset trading, its issuer gains immense soft power defining compliance, freezing assets, and setting financial norms.

1c. Symbiosis and Conflict with Nation-States

Like their historical predecessors, today’s stablecoin giants may evolve from tools of national strategy to independent power centers. Initially supporting U.S. hegemony and countering China’s e-CNY, they may eventually act in ways that contradict U.S. foreign policy, especially as their shareholder interests diverge from state agendas.

The U.S. may face tension between control and dependence, possibly leading to future updates to the stablecoin legal framework.

II. Global Monetary Tsunami: Dollarization, Deflation, and the End of Non-Dollar Central Banks

The GENIUS Act is more than a charter. It’s the start of a monetary tsunami. The collapse of the Bretton Woods system in 1971 laid the groundwork. In the coming era, people in fragile economies may prefer stablecoins over failing national currencies, leading to hyper-dollarization and devastating local deflation.

2a. The Ghost of Bretton Woods

Under Bretton Woods, the dollar was tied to gold and all other currencies to the dollar. This created a paradox (Triffin Dilemma): to support global trade, the U.S. had to run deficits which eventually undermined confidence. Nixon severed the gold link in 1971, ending the system.

The dollar was reborn as a fiat instrument backed by U.S. strength and network effects. Now, U.S.-approved stablecoins elevate this to a new level bypassing national banks and reaching every smartphone directly.

2b. Hyper-Dollarization

In places like Argentina and Turkey, people flee inflation by using dollars. Stablecoins remove friction: no banks, no capital controls, no physical risk.

From Vietnam to Dubai, and Yiwu to Hong Kong, stablecoin usage is exploding. When inflation rises even slightly, capital doesn’t “flow out”. it vanishes instantly into the crypto ether. This threatens national currencies with obsolescence.

2c. Deflation and the Disappearance of State Power

Once hyper-dollarization hits, governments lose:

• Seigniorage (printing money)

• Monetary policy tools

The result: plummeting local currencies, collapsing tax bases, and failed governance.

The GENIUS Act, combined with tokenized real-world assets (RWAs), may accelerate this collapse.

2d. White House vs. The Fed

Domestically, a conflict may brew. If a Treasury-controlled stablecoin system emerges, it could sidestep the Fed, allowing the Executive Branch to exert monetary influence directly especially in election years or sanction enforcement. This may trigger a crisis in faith over Fed independence.

III. The 21st Century Financial Battlefield: U.S. vs. China and the “Free Financial System”

Externally, the Act is a strategic maneuver in the U.S.-China rivalry an ideological and infrastructural clash.

3a. A New Financial Iron Curtain

Like the post-WWII Bretton Woods institutions (IMF, World Bank), this new “free finance” network powered by USD stablecoins is open, efficient, and diametrically opposed to China’s model of state-controlled finance.

3b. Permissionless vs. Permissioned

China’s e-CNY is fully controlled, running on private ledgers, with full traceability. The U.S., in contrast, backs permissionless blockchains (Ethereum, Solana). Developers worldwide can build freely, with the U.S. acting as “credibility anchor” for the USD.

This asymmetric strategy attracts innovators and users, while China’s surveillance model alienates them. It’s a contest China structurally can’t win.

3c. Bypassing SWIFT: A Dimensional Attack

China and Russia attempt to sidestep SWIFT. But stablecoins render that effort obsolete no middlemen needed, no banks required. The U.S. isn't defending old infrastructure; it's creating a parallel game with new rules enforced by code, not treaties.

3d. Winning the Network Effects War

The fusion of the dollar with crypto’s innovation creates an exponential network. Developers and users will flock to where liquidity and freedom are highest.

Compared to the closed, RMB-centric e-CNY, the open USD ecosystem will dominate globally beyond China’s limited spheres of influence.

IV. The De-Nationalization of Everything: RWA, DeFi, and the Collapse of State Control

Stablecoins are the Trojan Horse. Once users hold stablecoins, the next step is tokenizing all assets, stocks, bonds, real estate, IP into on-chain digital instruments, detaching them from national jurisdiction.

4a. Stablecoins as the Trojan Horse

Governments welcome regulated stablecoins as safe crypto. But in doing so, they unintentionally onboard users into crypto ecosystems one tap away from Bitcoin, ETH, DeFi, and privacy coins.

Platforms like Coinbase become one-stop crypto supermarkets. USDC is the gateway drug leading users toward more freedom, higher yield, and greater autonomy.

4b. RWA: Assets Escape National Jurisdiction

Imagine:

• A Chinese team tokenizes app ownership

• Traded on a permissionless DeFi protocol

• An Argentinian buys it with stablecoins

No bank, no SWIFT, no borders.

This isn’t just new payment rails it’s a parallel universe outside the Westphalian order. When capital de-nationalizes, so do capitalists.

4c. The End of Traditional Finance

Banks, brokers, and payment systems exist to mediate trust. Blockchain replaces this with public, tamper-proof records and smart contracts.

Functions replaced:

• Lending → DeFi protocols

•Trading → AMMs

• Payments → Stablecoin transfers

• Securitization → RWA tokenization

V. The Rise of Sovereign Individuals & The Twilight of the Nation-State

When capital flows freely, assets ignore borders, and power shifts to networks and private giants, we enter a post-national age where the individual becomes sovereign.

5a. The Prophecy of The Sovereign Individual

In 1997, Davidson and Rees-Mogg predicted that the Information Age would make power more mobile than ever. The state would be unable to tax knowledge and capital that exists online.

Stablecoins, DeFi, and RWA make this real. A person can now:

• Hold global assets

•Move capital instantly

• Stay outside any one jurisdiction

States lose grip. And their ability to tax or control fades.

5b. The End of the Westphalian System

Since 1648, the world has been ruled by nation-states. But if productive individuals live in cyberspace, state borders become meaningless.

States may resort to coercion predatory taxes, surveillance accelerating elite exit. Eventually, they may become "nanny states" serving only immobile, less wealthy citizens.

5c. The Final Frontier: Privacy vs. Taxation

Today’s chains are transparent. But zero-knowledge tech (ZKPs) will bring complete anonymity.

Combined with stablecoins, this creates an untouchable financial black box breaking the state’s final tool: taxation.

Conclusion:

The French Revolution replaced monarchs with nations. This revolution led by stablecoins and AI replaces territorial sovereignty with network and individual sovereignty.

It’s not just a transfer of power it’s a decentralization and de-nationalization of power.

We are witnessing the breakdown of an old world and the birth of a new order that grants individuals unprecedented freedom, but also unleashes unprecedented chaos.

Show more

0

0

26

37

14

Over 80 crates of hidden Nazi-era documents discovered in Argentine court basement during museum preparations.

https://t.co/9QSzj6SEc5

0

0

0

0

0