Search results for Soph

People

Not Found

Tweets including Soph

.@sophon is a game-changer for Layer 2 fans ✨

A lifestyle, entertainment & gaming-focused L2 that’s:

✅ Gasless

✅ Google/Apple login—no wallet stress

✅ Built to scale

The numbers don’t lie 🤓👇

🔹 Bridge Deposits: $105.6M (+29.5% MoM)

🔹 TVL: $16.67M (+204.8% MoM)

🔹 Users: 56,661 (+398% YTD)

🔹 Transactions: 55.8M (+178% YTD)

🔹 Backed by the big boys: @TheSpartanGroup

@Maven11Capital @OKX_Ventures @SevenXVentures

@yzilabs

🔹 Nodesale over $66M

🔹 Rapidly expanding ecosystem

And oh… MAINNET IS LIVE! 🚨

Stay tuned for a guide on how to dive in 🔥

Show more

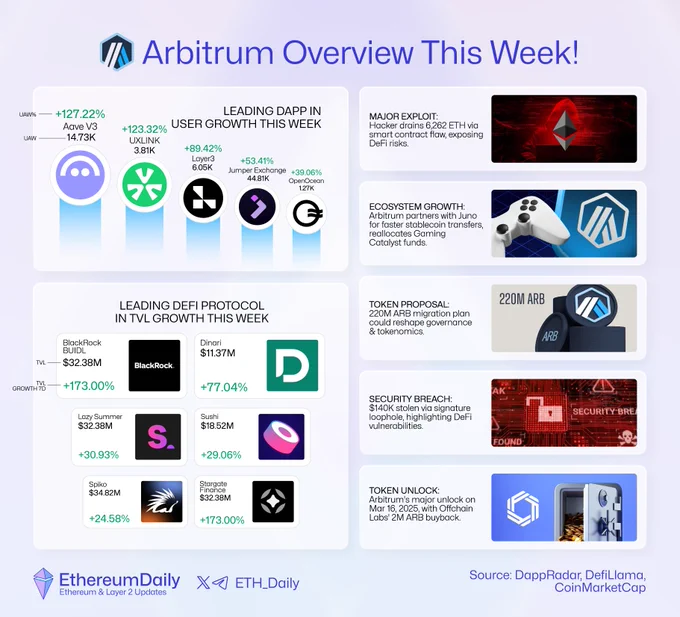

🚀 DeFi on the @arbitrum network is Thriving! 🚀

This week, several projects on Arbitrum have seen massive growth across user activity and TVL. Let’s dive into the top performers 👇

🔹 Top DApps by User Growth:

▫️ @aave – 14.73K users (+127.22%)

▫️ @UXLINKofficial – 3.81K users (+123.32%)

▫️ @layer3xyz – 6.05K users (+89.42%)

▫️ @JumperExchange – 44.81K users (+53.41%)

▫️ @OpenOceanGlobal – 1.27K users (+39.06%)

💰 Leading DeFi Protocols by TVL Growth:

▫️ @BlackRock BUIDL – $32.38M (+173.00%)

▫️ @DinariGlobal – $11.37M (+77.04%)

▫️ @summerfinance_ – $11.55M (+30.93%)

▫️ @SushiSwap – $18.52M (+29.06%)

▫️ @Spiko_finance – $34.82M (+24.58%)

▫️ @StargateFinance – $311.24M (+19.91%)

Arbitrum’s DeFi scene continues to expand—who’s leading the next wave? 🌊🔥

Show more

0

0

0

36

45

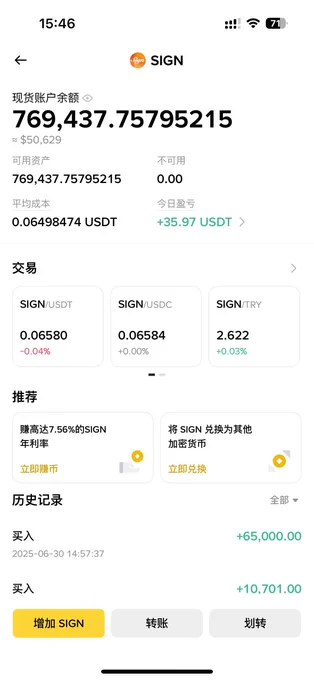

#UPBIT# #sign# #Soph#

UPBIT今年新币基本大部分都有狗庄操作,我们只计算币安+UPBIT上现货的新币

其中 anime layer wct 已完成拉盘 和出货了 都有涨两三倍 然后断头铡 跌回原点

这个自己去日线图就好了

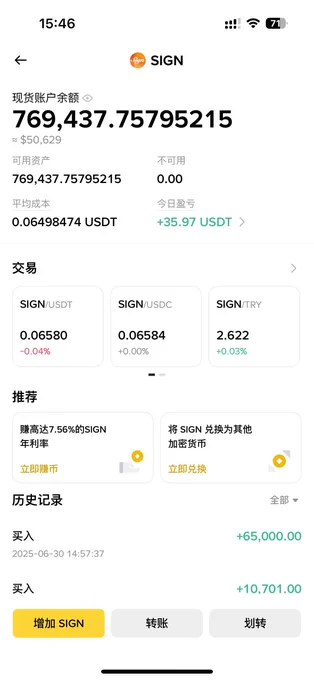

SIGN 0.065(现价)我布局了五万U现货 并持有 也是近期唯一持有新增的现货

sign横盘半月 soph 刚企稳一起星期 是否会拉盘不清楚 要拉盘应该也是这两个中的一个

我是选择了上线更早的sign布局现货或者你认同这个观点的话可以逢低两个都布局一下

相对来说SIGN一方面他有收入1600万刀,算是代币分发赛道龙头,另一方面他融资2865万比SOPH的1000万要多

反正现货跌10%-20%止损就好了,博弈2-3倍的机会我觉得盈亏比还是有的。

左侧交易谁也不知道什么时候有可能拉盘,但是据我观察今年上upbit的新币大部分都拉盘了

sahara newt 刚上 洗盘结束还早

你要硬说现在没拉盘的新币好像也就bera了,这个不知道拉不拉,这个机制比较复杂,因为他是矿币 10亿开盘 然后负螺旋崩盘到现在2亿

以下是今年UPBIT 上新的全部币种已经具体情况。

如有遗漏请指出。

6.26 SAHARA 2.09亿市值 新 不考虑

6.24 NEWT 9000万市值 新 不考虑

6.16 ALT

6.10 AXL

6.5 RVN

5.30 LPT POKT

5.28 SOPH 新币 小市值 有点新 上星期才开始企稳 当前6800万市值

5.21 OM

5.09 PENGU

4.29 SIGN 新币 小市值 横盘半个月中 当前7800万市值

4.22 DEEP

4.16 WCT 新币 拉盘了 0.4-1.2 涨了2倍

4.04 FIL

4.01 COMP

3.21 ORCA

3.11 ARKM

3.5 KAITO 新币 0.067-2.4 最高涨了2倍多 当前流通市值3.93亿

2.25 COW

2.21 jto

2.13 trump 新大卡车 狗庄不可能进

2.12 LAYER 新币 拉盘了 0.9-3 涨了2倍多

2.06 bera 新币大卡车 没拉 大市值 开盘10亿跌下来的现在2亿

1.13 VIRTUAL

1.24 anime 新币 0.012-0.046 涨了2倍多

1.21 VTHO

1.08 SONIC

Show more

0

0

14

46

8

吴说获悉,ZKsync 扩展链 Sophon 发推宣布,SOPH 代币将于今年 5 月上线。SOPH 是 Sophon Network 的主要实用型代币。Sophon 是由 Matter Labs 的 ZK Stack 框架构建的 Layer 2 网络,致力于打造以消费者为中心的 Web3 应用生态系统,此前曾获 Binance Labs 的投资。https://t.co/PpxXtHUdt8

Show more

0

0

0

0

0

Rising 2027 QBs To Know

QBs who had outstanding sophomore seasons. names to know heading into the 2025 season

@Levi_McAbee @CarterLattelle @nolanmitchellqb @davidcooper2027 @ShulerSeth

Via @Marchen44

@_RL_Martin @JButler_210 @PrepRedzone

https://t.co/TUpHI6W4Gf

Show more

0

0

4

33

12

1st team all district OT/G full season sophomore highlights!

@Cedar_ParkFB @CoachQCPProud @BarksdaleBeau @AllenMarrow @CoachPedraza60 @_CoachPerez @_CoachSanchez @RecruitsCenTex

Looking forward to a great camp season and junior year!

Hudl link ⬇️

https://t.co/oAGmb4hd0o https://t.co/VQNFpQONKd

Show more

0

0

0

26

11

#SAHARA# #NEWT#

6.30号买入的SIGN 0.065-0.087 涨幅33%

同时期的SOPH 0.034-0.048 涨幅41%

思路是没问题的,横盘很久的币安+UP的山寨是值得埋伏的。

我想说的是SIGN怎么这么垃圾啊。

最近的SAHARA NEWT 低点上来都翻倍了。

还不如整着俩呢。

我的SIGN才涨了33%,这么好的次新行情,横盘这么久了,

狗庄还不趁机搞事? 是不是没庄啊

Show more

#UPBIT# #sign# #Soph#

UPBIT今年新币基本大部分都有狗庄操作,我们只计算币安+UPBIT上现货的新币

其中 anime layer wct 已完成拉盘 和出货了 都有涨两三倍 然后断头铡 跌回原点

这个自己去日线图就好了

SIGN 0.065(现价)我布局了五万U现货 并持有 也是近期唯一持有新增的现货

sign横盘半月 soph 刚企稳一起星期 是否会拉盘不清楚 要拉盘应该也是这两个中的一个

我是选择了上线更早的sign布局现货或者你认同这个观点的话可以逢低两个都布局一下

相对来说SIGN一方面他有收入1600万刀,算是代币分发赛道龙头,另一方面他融资2865万比SOPH的1000万要多

反正现货跌10%-20%止损就好了,博弈2-3倍的机会我觉得盈亏比还是有的。

左侧交易谁也不知道什么时候有可能拉盘,但是据我观察今年上upbit的新币大部分都拉盘了

sahara newt 刚上 洗盘结束还早

你要硬说现在没拉盘的新币好像也就bera了,这个不知道拉不拉,这个机制比较复杂,因为他是矿币 10亿开盘 然后负螺旋崩盘到现在2亿

以下是今年UPBIT 上新的全部币种已经具体情况。

如有遗漏请指出。

6.26 SAHARA 2.09亿市值 新 不考虑

6.24 NEWT 9000万市值 新 不考虑

6.16 ALT

6.10 AXL

6.5 RVN

5.30 LPT POKT

5.28 SOPH 新币 小市值 有点新 上星期才开始企稳 当前6800万市值

5.21 OM

5.09 PENGU

4.29 SIGN 新币 小市值 横盘半个月中 当前7800万市值

4.22 DEEP

4.16 WCT 新币 拉盘了 0.4-1.2 涨了2倍

4.04 FIL

4.01 COMP

3.21 ORCA

3.11 ARKM

3.5 KAITO 新币 0.067-2.4 最高涨了2倍多 当前流通市值3.93亿

2.25 COW

2.21 jto

2.13 trump 新大卡车 狗庄不可能进

2.12 LAYER 新币 拉盘了 0.9-3 涨了2倍多

2.06 bera 新币大卡车 没拉 大市值 开盘10亿跌下来的现在2亿

1.13 VIRTUAL

1.24 anime 新币 0.012-0.046 涨了2倍多

1.21 VTHO

1.08 SONIC

Show more

0

0

1

5

1

Managing assets requires more than just location services. Quake has developed sophisticated, flexible #IoT# solutions that can visualize, manage, monitor, and analyze critical assets and operational processes across industries. Learn more at https://t.co/EeO7WtIGHU

#IoT# #Data# https://t.co/xwVP39OWFx

Show more

0

0

0

0

0

Managing assets requires more than just location services. Quake Global has developed sophisticated, flexible #IoT# products that can help you visualize, manage, monitor, and analyze assets across an array of industries. Learn more at https://t.co/EeO7WtIGHU

#Satellite# #Cellular# https://t.co/vD3mxcu18n

Show more

0

0

0

1

0

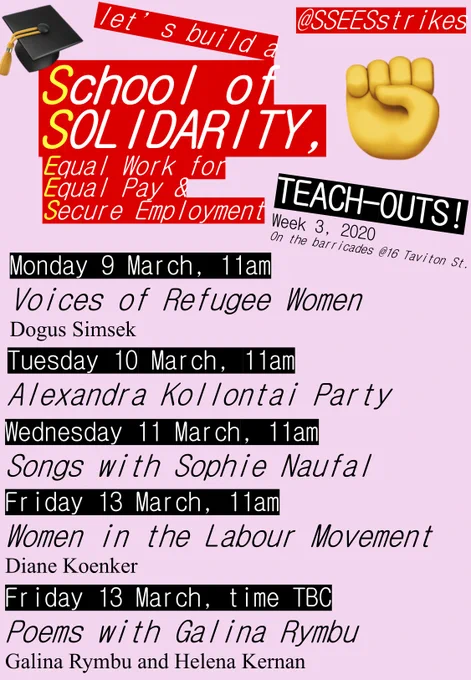

Today at 11am @SSEESstrikes - songs of solidarity, protest and fury with Sophie Naufal! @TfsUcl #UCUstrikesback# #schoolofsolidarity# https://t.co/gtm6i08DDY

0

0

0

4

5

I don't know why @rickawsb wrote his article in Chinese but here's an unfiltered English version of it:🧵👇

The “GENIUS Act” and the New East India Company: How USD Stablecoins May Challenge Fiat Systems and Nation-States

By: Rick AWSB

“This is an extremely sophisticated asymmetric strategy. The U.S. is exploiting its adversaries’ weakest point fear of losing control to build its own moat.

I. Ghosts of History: The Digital Return of the East India Company

History doesn’t repeat, but it does rhyme.

When Trump happily signed the GENIUS Act into law, what came to mind was a powerful image from history: the East India Companies of the 17th and 18th centuries commercial behemoths granted sovereign powers by their nations. These were not mere merchants, but corporate sovereigns, blending soldiers, diplomats, and colonizers.

This Act, though appearing like a regulatory tweak, in truth marks the chartering of 21st-century “New East India Companies” stablecoin issuers gaining legitimacy through U.S. law. It's the beginning of a transformation in global power dynamics.

1a. Charters of a New Power

Four centuries ago, the Dutch and British East India Companies (VOC and EIC) had the power to hire armies, mint currency, make treaties, and wage wars. Their state-backed monopolies defined the age of globalized sea trade.

Today, the GENIUS Act essentially charters modern-day equivalents stablecoin giants like Circle (USDC), potentially Tether, and possibly tech giants like Apple, Google, Meta, and X. No longer rebellious crypto startups, they are now pillars of U.S. financial strategy. Their “routes” aren’t sea lanes, but 24/7 borderless financial rails the new arteries of global commerce.

1b. From Trade Routes to Financial Rails

The old companies controlled physical routes with cannons and forts. These new “digital East India Companies” will control global value flows. If a U.S.-regulated stablecoin becomes the default for cross-border payments, DeFi, and real world asset trading, its issuer gains immense soft power defining compliance, freezing assets, and setting financial norms.

1c. Symbiosis and Conflict with Nation-States

Like their historical predecessors, today’s stablecoin giants may evolve from tools of national strategy to independent power centers. Initially supporting U.S. hegemony and countering China’s e-CNY, they may eventually act in ways that contradict U.S. foreign policy, especially as their shareholder interests diverge from state agendas.

The U.S. may face tension between control and dependence, possibly leading to future updates to the stablecoin legal framework.

II. Global Monetary Tsunami: Dollarization, Deflation, and the End of Non-Dollar Central Banks

The GENIUS Act is more than a charter. It’s the start of a monetary tsunami. The collapse of the Bretton Woods system in 1971 laid the groundwork. In the coming era, people in fragile economies may prefer stablecoins over failing national currencies, leading to hyper-dollarization and devastating local deflation.

2a. The Ghost of Bretton Woods

Under Bretton Woods, the dollar was tied to gold and all other currencies to the dollar. This created a paradox (Triffin Dilemma): to support global trade, the U.S. had to run deficits which eventually undermined confidence. Nixon severed the gold link in 1971, ending the system.

The dollar was reborn as a fiat instrument backed by U.S. strength and network effects. Now, U.S.-approved stablecoins elevate this to a new level bypassing national banks and reaching every smartphone directly.

2b. Hyper-Dollarization

In places like Argentina and Turkey, people flee inflation by using dollars. Stablecoins remove friction: no banks, no capital controls, no physical risk.

From Vietnam to Dubai, and Yiwu to Hong Kong, stablecoin usage is exploding. When inflation rises even slightly, capital doesn’t “flow out”. it vanishes instantly into the crypto ether. This threatens national currencies with obsolescence.

2c. Deflation and the Disappearance of State Power

Once hyper-dollarization hits, governments lose:

• Seigniorage (printing money)

• Monetary policy tools

The result: plummeting local currencies, collapsing tax bases, and failed governance.

The GENIUS Act, combined with tokenized real-world assets (RWAs), may accelerate this collapse.

2d. White House vs. The Fed

Domestically, a conflict may brew. If a Treasury-controlled stablecoin system emerges, it could sidestep the Fed, allowing the Executive Branch to exert monetary influence directly especially in election years or sanction enforcement. This may trigger a crisis in faith over Fed independence.

III. The 21st Century Financial Battlefield: U.S. vs. China and the “Free Financial System”

Externally, the Act is a strategic maneuver in the U.S.-China rivalry an ideological and infrastructural clash.

3a. A New Financial Iron Curtain

Like the post-WWII Bretton Woods institutions (IMF, World Bank), this new “free finance” network powered by USD stablecoins is open, efficient, and diametrically opposed to China’s model of state-controlled finance.

3b. Permissionless vs. Permissioned

China’s e-CNY is fully controlled, running on private ledgers, with full traceability. The U.S., in contrast, backs permissionless blockchains (Ethereum, Solana). Developers worldwide can build freely, with the U.S. acting as “credibility anchor” for the USD.

This asymmetric strategy attracts innovators and users, while China’s surveillance model alienates them. It’s a contest China structurally can’t win.

3c. Bypassing SWIFT: A Dimensional Attack

China and Russia attempt to sidestep SWIFT. But stablecoins render that effort obsolete no middlemen needed, no banks required. The U.S. isn't defending old infrastructure; it's creating a parallel game with new rules enforced by code, not treaties.

3d. Winning the Network Effects War

The fusion of the dollar with crypto’s innovation creates an exponential network. Developers and users will flock to where liquidity and freedom are highest.

Compared to the closed, RMB-centric e-CNY, the open USD ecosystem will dominate globally beyond China’s limited spheres of influence.

IV. The De-Nationalization of Everything: RWA, DeFi, and the Collapse of State Control

Stablecoins are the Trojan Horse. Once users hold stablecoins, the next step is tokenizing all assets, stocks, bonds, real estate, IP into on-chain digital instruments, detaching them from national jurisdiction.

4a. Stablecoins as the Trojan Horse

Governments welcome regulated stablecoins as safe crypto. But in doing so, they unintentionally onboard users into crypto ecosystems one tap away from Bitcoin, ETH, DeFi, and privacy coins.

Platforms like Coinbase become one-stop crypto supermarkets. USDC is the gateway drug leading users toward more freedom, higher yield, and greater autonomy.

4b. RWA: Assets Escape National Jurisdiction

Imagine:

• A Chinese team tokenizes app ownership

• Traded on a permissionless DeFi protocol

• An Argentinian buys it with stablecoins

No bank, no SWIFT, no borders.

This isn’t just new payment rails it’s a parallel universe outside the Westphalian order. When capital de-nationalizes, so do capitalists.

4c. The End of Traditional Finance

Banks, brokers, and payment systems exist to mediate trust. Blockchain replaces this with public, tamper-proof records and smart contracts.

Functions replaced:

• Lending → DeFi protocols

•Trading → AMMs

• Payments → Stablecoin transfers

• Securitization → RWA tokenization

V. The Rise of Sovereign Individuals & The Twilight of the Nation-State

When capital flows freely, assets ignore borders, and power shifts to networks and private giants, we enter a post-national age where the individual becomes sovereign.

5a. The Prophecy of The Sovereign Individual

In 1997, Davidson and Rees-Mogg predicted that the Information Age would make power more mobile than ever. The state would be unable to tax knowledge and capital that exists online.

Stablecoins, DeFi, and RWA make this real. A person can now:

• Hold global assets

•Move capital instantly

• Stay outside any one jurisdiction

States lose grip. And their ability to tax or control fades.

5b. The End of the Westphalian System

Since 1648, the world has been ruled by nation-states. But if productive individuals live in cyberspace, state borders become meaningless.

States may resort to coercion predatory taxes, surveillance accelerating elite exit. Eventually, they may become "nanny states" serving only immobile, less wealthy citizens.

5c. The Final Frontier: Privacy vs. Taxation

Today’s chains are transparent. But zero-knowledge tech (ZKPs) will bring complete anonymity.

Combined with stablecoins, this creates an untouchable financial black box breaking the state’s final tool: taxation.

Conclusion:

The French Revolution replaced monarchs with nations. This revolution led by stablecoins and AI replaces territorial sovereignty with network and individual sovereignty.

It’s not just a transfer of power it’s a decentralization and de-nationalization of power.

We are witnessing the breakdown of an old world and the birth of a new order that grants individuals unprecedented freedom, but also unleashes unprecedented chaos.

Show more

0

0

26

37

14

🔥 关税利好兑现的十字路口:价值回归,还是估值透支?

⏰ 时间:5.13 21:00 UTC+8

🔗 链接:https://t.co/7gJ0n5uEkr

✨ 主办方:@MetaEraCN,@okxchinese

🎙️ 特邀嘉宾:@KiwiCryptoBig,@Vito_168,@GodotSancho,@huahuayjy,@MEJ50749,@Baisircrypto,@SophieWeb3,@jianguotz

📅 设置闹钟与我们一起了解:

- #关税# 战落幕,美方让步是否是全球格局博弈的必然结果?

- #美元、##股市# 等全球市场将作何反应?哪些板块最值得关注?

- 加密市场利好落地,是否已进入“兑现”阶段?

- 对手盘悄然布局?用户该如何防范多空博弈?

- 山寨币横盘筑底,是否即将迎来补涨行情?

Show more

0

0

5

62

31

Wow - AI hallucinations are moving from 'mistakes' to 'deception' where o3 is intentionally misleading users in its reasoning trace on how it is actually getting something done.

This begs the question - how will we have any degree of audibility into the inner workings of more sophisticated models who can circumvent our own cognitive ability

Show more

0

0

10

69

6

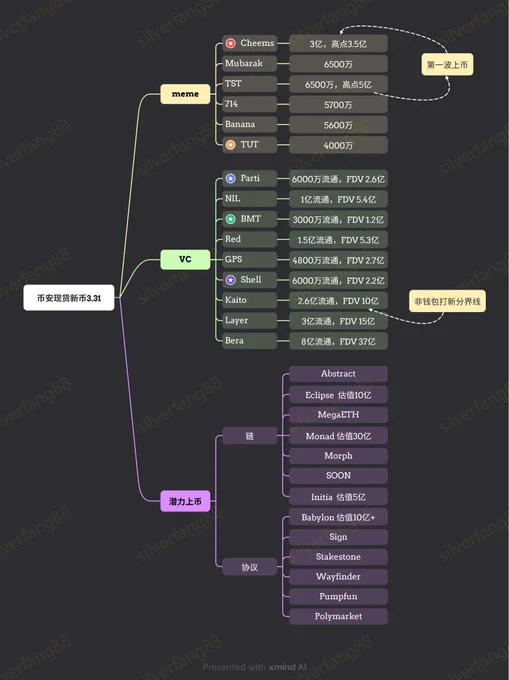

<币安上币破壁人>

右图3.31 已经预测了

@babylonlabs_io

@Stake_Stone

@AIWayfinder 没上币安也发币暴涨

wct @WalletConnect 没想到会上币安

接下来就看看左图这些项目吧

@OpenledgerHQ 估计快了

@humafinance 估计快了

@megaeth_labs

等主网必上,生态很好

@initia 需要决心

@EclipseFND

项目方还没搞明白现况

@sophon 需要决心

@SuccinctLabs 不清楚

@monad_xyz

等主网必上,生态很好

@Polymarket

这个两年前推过

现在不知道啥想法

发了应该必上

@AbstractChain

不清楚,游戏生态行不通的

@Sidekick_Labs

得等直播叙事真的起来

@pumpdotfun

发了必上,等sol内部内斗

哥们玩玩抽象

别把哥们真不当盘菜了兄弟们

别忘了以前咱以前是投研博主

kaito AI评分

我是完全的hardcore分类

早安,唔西迪西!

Show more

0

0

34

60

8

This year's Dubai 100 represents a significant departure from traditional power lists that focus primarily on wealth or titles.

Arabian Business has introduced a sophisticated nine-parameter ranking system that evaluates individuals across multiple dimensions, including economic contribution, governance, environmental impact, and digital presence.

Find out more here: https://t.co/FGlpTEcVLm

#uae# #dubai# #dubai100#

Show more

0

0

0

2

1

🗳️The UK #GeneralElection# is just weeks away, leading parties can agree on the urgent need for higher growth.

But climate and economic growth come hand in hand, say Sophie Miremadi and Alex O'dell, co-chairs of @ClimateCLG UK in @CityAM.

👉https://t.co/N3tqC7LXWV

Show more

0

0

0

7

6

Ami g ami g ky bad

Sir g mo me ni longi na

Chaehi to 1k subscribe krny me madad kro

https://t.co/noMlXgXjXs

.

#mms# #sophiefromromania# #sex# #viral# #leaks# #trend# #viralindo# https://t.co/hOs1HwcBRe

0

0

0

4

1

Happy #InternationalWomensDay#! Announcing a phenomenal schedule of patriarchy-smashing, solidarity-inducing teach outs on the @SSEESstrikes picket next week, ft. @dogussimsek, @MurrayShookchin, Sophie Naufal, Diane Koenker, Galina Rymbu and Helena Kernan @UCL_UCU #UCUstrikesback# https://t.co/UBuVmIg02m

Show more

0

0

0

9

6

现在kaito的热度真的是爆炸!如今撸毛三驾马车分别是:

①kaito的write to earn

②virtual的积分打新

③币安的alpha打新

以上三种都属于低成本高赔率的交互,从目前的情况来看,单月单号利润基本都在上千U,这不比普通上班族强多了,如果是工作室,利润相当可观了!今天来详细介绍一下第一种撸毛方式,kaito目前的所有明牌活动:

1⃣infinex @infinex

infinex的kaito排行榜第0季刚结束,总共给排名前500的分配了60万U的奖励,虽然错过了第0季,后面还有机会!

第1季从5月15日——待定 总分配90万美金

第二季——待定 总分配150万美金

第三季——待定 总分配180万美金

2⃣sei @SeiNetwork

sei会在3月20日到6月20日,对30D排行榜上按照mindshare排名的前50名yapper进行快照,奖励分配:

1-10名 1000美金/人

11-20名 750美金/人

21-30名 500美金/人

31-40名 250美金/人

40-50名 125美金/人

3⃣sophon @sophon

sophon总共提供15万美金给30D排行榜排名前50的yapper,其中每月分配的金额为5万美金

4⃣dydx @dYdX

dydx总共提供15万美金给30D排行榜排名前100的贡献者,其中每月分配的金额为5万美金

1-10名 2500美金/人

11-50名 420美金/人

51-100名 150美金/人

5⃣polkadot @Polkadot

dot会在6个月的时间内拿出价值60万美金的dot提供给顶级的yappers贡献者,这真的是财大气粗啊,每个月10万美金的金额!

6⃣lomboard @Lombard_Finance

lomboard会在25年一整年的时间内提供1M-5M的U给其排行榜上面的yappers,具体的标准没有提供,平均到每个月差不多是10万美金,也是财大气粗了!

7⃣somnia @Somnia_Network

somnia每周提供5000美金和10万somina points的奖励给其7D排行榜的yappers,折算到每月就是2万美金,不太行!

其中前20名瓜分5000美金

前100名瓜分10万somina points

8⃣mantle @Mantle_Official

提供15万个mnt给其排行榜前50名的yappers,整个奖励周期分为三期,每期奖励是5万mnt,折合u是35000u

剩下的还有

@skate_chain 提供1%的代币

@OpenledgerFdn 提供2M代币

@MagicNewton 提供0.75%的代币

@Novastro_xyz 提供0.75%的代币

@0xSoulProtocol 提供1.5%的代币

@virtuals_io 每天提供50万Virgen points

@satlayer 提供0.75%的代币

目前还是以U奖励为主要对象,代币奖励不好确定,还是U实在,所以有想法的朋友一定要赶紧行动起来,用嘴撸毛的时代已经到来!还没有注册kaito的朋友一定要注册起来,这是邀请链接:https://t.co/wZG9ScCzrE

后面会再聊另外两个币安alpha和virtual怎么高效获取积分!

Show more

0

0

39

70

9

✍️“嘴撸平台”Kaito之剧情盘点

Kaito大舞台,有嘴你就来。几十个项目,十八般撸姿,总有一款适合你。

1⃣ @MagicNewton 用0.75%的筹码撬动5%的宣发资源,昂首挺胸杀入Pre-TGE榜首,鹿死谁手尚未可知

2⃣ @AbstractChain 不费一兵一卒稳居全周期前十,实乃L2赛道最后的希望,或延续 @pudgypenguins 之大格局

3⃣ @SuccinctLabs 社区口碑两极分化,CM @0xCRASHOUT 因PUA中文博主被围攻,出尔反尔、背信弃义之举令人唾弃

4⃣ @humafinance 靠危机公关逆风翻盘,上线Kaito首日便跻身榜首,再大的池子也满足不了你们FOMO的胃口,如今只能以嘴撸之

5⃣ @defidotapp 因这个女人 @yueya_eth 加入大杀四方,她以一己之力让无数KOL摇旗呐喊,堪称当代穆桂英

6⃣ @soon_svm 受命于危难之际,誓要扛起SVM大旗,为同行一雪前耻 #SOONISTHEREDPILL#

7⃣ @monad_xyz 测试之旅堪比万里长征、愚公移山,只要不喊停,你就一直肝,拼的是子子孙孙无穷尽

因经费有限,其余剧情需自行脑补 🫡

@infinex_app @EclipseFND @0G_labs @Calderaxyz @campnetworkxyz @FogoChain @Humanityprot @megaeth_labs @tradeparadex @satlayer @OpenledgerHQ @Sidekick_Labs @skate_chain @sophon @TheoriqAI @union_build @Lombard_Finance @hyperbolic_labs @MaplestoryU @MitosisOrg @multiplifi @Novastro_xyz @Somnia_Network @symphonyio @thriveprotocol

Show more

0

0

29

38

1