Search results for TradFi。

People

Not Found

Tweets including TradFi。

Who said #DeFi# and #TradFi# can’t work together to deliver market changing solutions in #crypto# - here’s the proof🚀

Link: https://t.co/1Vefxry5nH

Standard Chartered and OKX have launched a collateral mirroring program, allowing institutional clients to use crypto and tokenized money market funds held by Standard Chartered on the OKX exchange. Brevan Howard Digital will be the first to participate, using Franklin Templeton's tokenized platform.

Roger Bayston, Franklin Templeton Head of Digital Assets: “Leveraging blockchain technology, our platform is built to support the dynamic and ever-evolving financial ecosystem. We take an authentic approach, from directly investing in blockchain assets to developing innovative solutions with our in-house team. By ensuring assets are minted on-chain, we enable true ownership, allowing them to move and settle at blockchain speed – eliminating the need for traditional infrastructure.”

Show more

0

0

28

497

104

in the last 2 months at defillama we've had lots of tradfi institutions contact us about defi data, way more than what we saw before

feels like tradfi interest in defi is significantly picking up

0

0

93

862

83

币圈公司业务瓶颈了就发个 U 卡,打通一下 tradfi,搞搞大规模领养(mass adoption),就和男人有钱就会变坏,女人有钱就会变漂亮一样亘古不变。

0

0

1

22

1

🌳 Treehouse is now valued at $400M.

Backed by leading institutions from TradFi & crypto, we're building the infrastructure to accelerate fixed income in digital assets.

Learn more 👇

https://t.co/38OQNTroAz https://t.co/2l07Vtkfi9

Show more

0

0

96

376

119

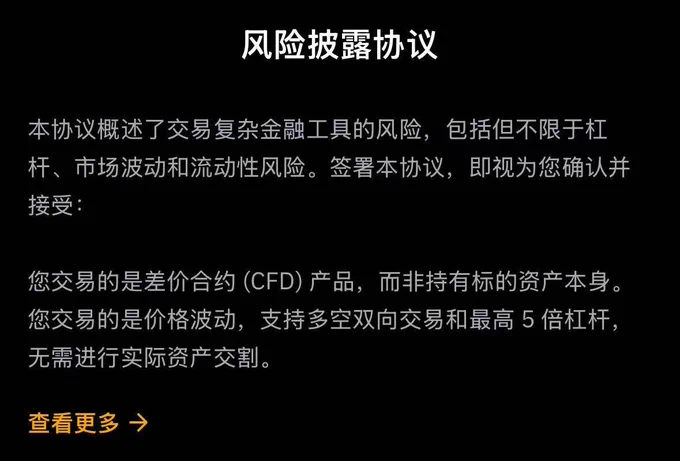

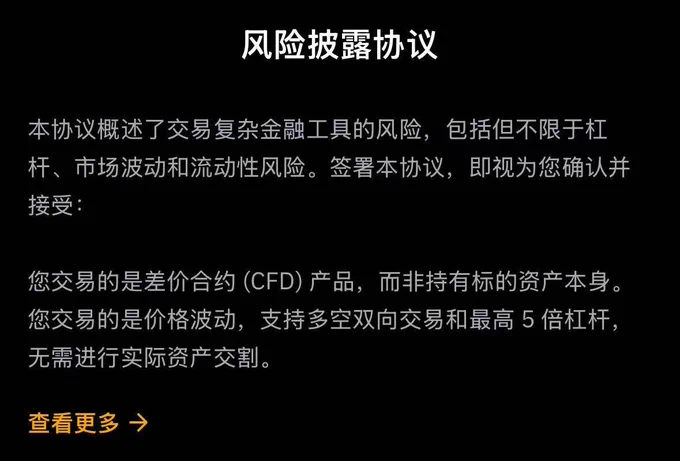

上次在研究 #Bybit# 的xStocks时把app功能都摸索了一遍,今天来介绍Bybit另一个好产品——#TradFi。#

一句话总结:就是把股票、外汇、大宗商品这些传统资产整合到一个平台交易,而且全部用USDT作为抵押资产。

对于习惯炒币的人来说最大的好处就是不用再开多个账户了,直接在Bybit App里就能操作。 @Bybit_Official @Bybit_ZH

从7月23日开始Bybit还下调了TradFi的美股CFD手续费。

具体说说这个产品的几个亮点:

🔸 统一交易体验 - 不用装一堆App了,一个平台搞定外汇、大宗商品、指数股票CFD,还能操作加密现货和杠杆交易。

管理多资产组合的人能节省不少时间,而且资金池是统一的,资金效率明显提高。

🔸MT5接入 - 38种技术指标+高级图表工具,配合算法交易功能,专业度完全够用。

🔸跟单功能 - 新手可以直接复制顶级交易者的策略。

这种整合型平台会是一个大趋势,用USDT结算比法币入金流程方便太多。虽然交易的是传统资产,但体验完全是加密原生那套玩法。

⚠️不过要提醒的是CFD本质还是合约交易,杠杆一定要控制好!!!

Bybit这次算是把加密和传统金融的边界又模糊了一步。对想要多元化配置又嫌开户麻烦的人来说确实是个不错的选择。

#Kaito# #xStocks# #TradFi#

Show more

关于 @Bybit_Official 和 #kaito# 合作,yaps 250分以上充值送10%体验金活动,我来做个实测反馈!😎

我是7月8号官方发出活动公告,第二天上午完成kyc并存入了一万刀,大概等了半个月收到了1000u体验金券。群里有3个小伙伴做了这个任务,也都收到了。

之前看评论区有小伙伴质疑这个体验金要么只能亏完,要么就是20u券逼你开50倍杠杆。。。所以我实测完给大家解答下👇

🔸体验金是实实在在的1000u,被锁定在交易账户中只能用来交易。

🔸我没有搞什么对敲的操作,直接正常开单测试了几笔。

赚了400多u可以直接划转到资金账户,是真U,可以直接提现!亏损的部分则在体验金中被抵扣。

所以这次活动是真的可以赚钱提现的!不是套路券!亲测有效!!!👍

🔰🔰🔰🔰🔰🔰🔰

关于港美股投资这块,最近真的很火热!我上个月特意去香港办了卡,一方面是想着收老马的工资,另一方面就是准备玩股票。

结果因为拖延症还没开好账户,就发现Bybit和Backed Finance合作上线了xStocks,直接在交易所现货就能买美股了,这对web3用户太友好了!

首批上线包括AAPL、TSLA、GOOGL、MSFT、NVDA、META、AMZN七大科技股,还有MSTR、HOOD、CRCL这些加密相关股票。

🌟简单说说xStocks几个核心优势:

1️⃣安全性有保障:底层资产是真实股票,由合规券商购买并托管,1:1映射代币化资产

2️⃣7×24小时交易:打破传统股市时间限制,周末假期都能买卖

3️⃣支持稳定币支付:用USDT/USDC就能投,还能小额交易

4️⃣开户门槛超低:完成Bybit KYC就能买,不用开海外账户那么麻烦

5️⃣实时链上结算:效率碾压传统券商

6️⃣自动返现机制:股息和股票分割会自动调整持仓

虽然xStocks代币不直接等于股票所有权(没有投票权),但作为RWA赛道的重要创新,确实让传统金融和DeFi的边界变得更模糊了...

目前RWA市场规模已经突破240亿美元,年底预计能达到500亿。Blackrock的Larry Fink这些大佬都在力推资产代币化,加上美国监管逐渐明朗,未来股票、债券、房地产这些传统资产上链会越来越普遍。

#Bybit# 这次推出的xStocks,相当于给Web3用户开了个直通美股市场的快捷通道。

不需要复杂的海外开户流程,用稳定币就能投资全球顶级公司股票,还能享受7×24小时交易和链上结算的优势。

对想多元化配置的Web3投资者来说,能用熟悉的方式参与传统市场,体验还是很不一样的。🤔

#Kaito# #Bybit# #RWA# @Bybit_ZH

Show more

0

0

0

1

1

1/ Today, we’re announcing Swapr: the AI-powered DEX aggregator that works for you.

In TradFi, order flow segmentation enables PFOF where value accrues to brokers & MMs.

Swapr flips that: instead of selling user flow, it identifies high-value users and improves their execution. https://t.co/XUsjHUx1Ju

Show more

0

0

41

163

20

昨天玩Bybit @Bybit_Official 的时候,突然发现一个好东西,Bybit上面可以直接交易TradFi!这直接给我干震惊

啥意思呢?就是用户可以直接在Bybit @Bybit_Official 交易美股、金属、外汇、大宗商品、指数!这和我之前提到的xstocksFi @xStocksFi 和vooi @vooi_io 还不一样,这些都是项目方映射到链上进行交易,而Bybit是直接在交易所进行交易!

1⃣Bybit TradFi开通

①在Bybit app找到TradFi频道,如下图所示,然后点击去开通,直接就可以用USDT进行各种货币的交易

点击“去开通”之后会跳转到地址证明,在这里进行地址证明之后即可进行交易

2⃣Bybit TradFi交易

上面提到Bybit TradFi几乎支持目前所有的主流资产,下图可以清楚看到包括 XAU、TSLA、CRCL、NVIDA、MSTR等极度具有价值投资的资产!

需要注意的是目前Bybit交易的是CFD产品,也就是差价合约,跟现货交易有一定的区别,别加杠杆就行

目前的中心化交易所好像也只有Bybit @Bybit_Official 走在前列,包括TradFi、CFD、xstockFi等,这肯定是未来的主流叙事之一,融入到主流金融环境中的必经之路!

最后 提醒Humanity @Humanityprot 赶紧把空投领取界面打开!

Show more

0

0

108

131

6

昨天玩Bybit @Bybit_Official 的时候,突然发现一个好东西,Bybit上面可以直接交易TradFi!这直接给我干震惊

啥意思呢?就是用户可以直接在Bybit @Bybit_Official 交易美股、金属、外汇、大宗商品、指数!这和我之前提到的xstocksFi @xStocksFi 和vooi @vooi_io 还不一样,这些都是项目方映射到链上进行交易,而Bybit是直接在交易所进行交易!

1⃣Bybit TradFi开通

①在Bybit app找到TradFi频道,如下图所示,然后点击去开通,直接就可以用USDT进行各种货币的交易

点击“去开通”之后会跳转到地址证明,在这里进行地址证明之后即可进行交易

2⃣Bybit TradFi交易

上面提到Bybit TradFi几乎支持目前所有的主流资产,下图可以清楚看到包括 XAU、TSLA、CRCL、NVIDA、MSTR等极度具有价值投资的资产!

需要注意的是目前Bybit交易的是CFD产品,也就是差价合约,跟现货交易有一定的区别,别加杠杆就行

目前的中心化交易所好像也只有Bybit @Bybit_Official 走在前列,包括TradFi、CFD、xstockFi等,这肯定是未来的主流叙事之一,融入到主流金融环境中的必经之路!

Show more

昨天聊的币股叙事感觉都比较感兴趣,其实币股叙事包含币到股+股到币

股到币也就是昨天提到的Bybit @Bybit_Official +xstockfi @xStocksFi 等项目方做的事情,将传统市场的股票映射到链上,也就是之前提到的RWA叙事,将现实资产代币化,也比如最近的Circle上市引发的稳定币叙事

1⃣Circle上市

Circle本身是USDC的母公司,Circle的上市直接导致了稳定币赛道的火热,再加上美国稳定币法案、MiCA 法规等对稳定币赛道的友好程度,未来的稳定币赛道肯定也是非常热门的赛道之一!现在已经有加密项目参考Circle的路径进行股权化:

①MakerDAO → RWA国债收益代币化 → 实体公司上市;

②Ethena、Mountain Protocol 等新型稳定币项目探索股权化路径

同样的,Circle上市也引发了传统资本的积极参与,比如①Circle 与美国国债挂钩

②Paypal 推出 PYUSD

③BlackRock 推出基于 RWA 支撑的稳定币计划等

所以币到股+股到币这是一个双向的过程,有点飞轮的意思,这无疑是未来需要重点布局的赛道,同时对个人投资者的要求也更高一些,需要同时对加密+传统金融有深刻的了解!

2⃣类似于BTC微策略的其他币种

最近美股也是搞出了很多Eth、Sol、Tron等版本的微策略,正是由于这些操作,也成为这轮牛市的疯狂助力之一,这些动作从根本上说明加密资产相对于传统资产而言更具备吸引力,唯一的问题就是合规+风险!

币股叙事是传统资本和加密资本的碰撞,意义重大:

①加密资产不再是“边缘市场”,而是被传统金融系统接纳的过程

②传统公司(如 MicroStrategy、Circle、Coinbase)通过上市或持币等方式与加密世界打通资金和估值逻辑③Web3 项目也在反向接入 Web2 资源(如数据、AI 算力、金融模型),两者边界模糊化

④不再只是“买币”或“买股”,而是要看:哪个项目/企业有链上和链下双重布局

Show more

0

0

2

1

0

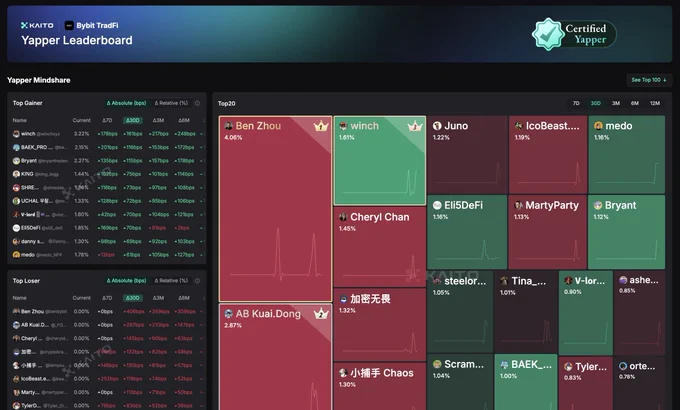

Very excited to announce a new partnership with @Bybit_Official and Kaito Earn - as part of their recent TradFi product suite launch!

A first of its kind - $1,000,000 in deposit bonuses, $100,000 in yapper rewards, and 33% referral bonuses.

TLDR summary in the reply below!

First up, Bybit have set aside $100,000 in yapping rewards for their very own 1-month Yapper Leaderboard.

Starting now, and lasting for 1 month - with the leaderboard launching in the coming days - rewarding high quality content that mentions both Bybit (or @Bybit_Official) AND any of the following 3 topics:

- xStocks (or @xStocksFi)

- CFD

- TradFi (Stocks, Oil, Forex, Indices)

As well as this, Bybit have set up a $1M+ Kaito-exclusive deposit bonus pool:

For users with >250 yaps, 5000 sKAITO / YT sKAITO, or 1 Yapybara NFT:

- Collect your exclusive code on Kaito Earn for up to $1000 deposit bonus per person (10% of deposit)

- FCFS - Pool of $1M available (there are more people eligible than the cap so need to be fast!)

- Sign up using your code at partner.bybit(.)com/b/{Your Unique Code}

- Complete KYC, make a deposit of at least $100

We will also open up the pool to a higher band of eligibility depending on how fast the $1M pool fills (>100 yaps, 250 sKAITO/YT-sKAITO)!

For all users, use code: KAITOAI for up to $100 deposit bonus per person (10% deposit):

- Sign up using the KAITOAI code at https://t.co/w86vMDs0dz

- Complete KYC, make a deposit of at least $100

Exclusive referral bonus:

- Earn 33% of net trading fees generated by referred users

- Sign up and get approved to the Bybit affiliate program using https://t.co/dMnqnfTh3z

- Refer users after being approved

Show more

0

0

1.7K

3.2K

507

VanEck caught ETF fever so bad they're speedrunning applications – first BTC/ETH now BNB? TradFi catching up while BNB chads sip coffee watching Lorentz upgrade stabilize fees like we’re not in a tariff war.

CA in bio before they file an AI agent ETF next cycle 👀

Show more

0

0

0

5

0

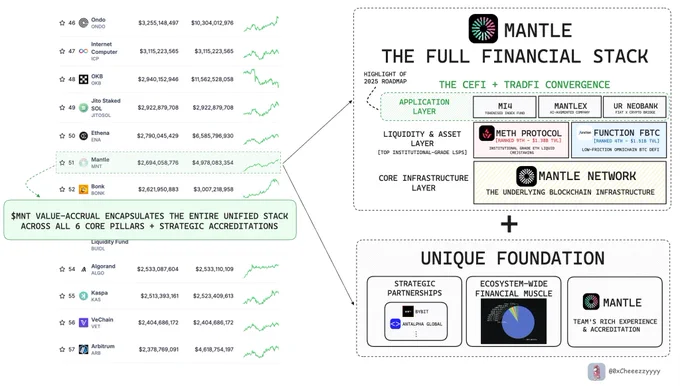

Most still underestimate just how expansive the $MNT value proposition really is.

This isn’t just another 'ecosystem token', it's becoming the linchpin of a vertically integrated financial stack that spans DeFi <> CeFi <> TradFi.

$MNT represents the end-to-end value capture of its unified financial stack + strategic accreditations.

@Mantle_Official's uniquely positioned because it’s not just building infrastructure, but it’s alignment with regulatory institutional + user-grade traction where only few can realistically achieve this.

Key pillars already in place:

🔸DeFi-native ecosystem (Mantle Network) at steady-state adoption

🔸 Top institutional-grade (re)staking protocols (ranked #9# ETH-based LSP w/ ~$1.38B TVL) @FunctionBTC (ranked #4# BTC-Fi LSP w/ $1.59B TVL)

🔸 Strategic partnerships + distribution channels i.e. @Bybit_Official @AntalphaGlobal

🔸Robust regulatory compliance framework for @URNeobank

🔸(Soon) MI4 tokenised index fund unlocking broader capital market access

And in an era where capital rewards coherence, $MNT’s multi-pronged exposure to both onchain + offchain flows may be one of the most overlooked asymmetric bets in the market today.

Higher 🫡

Show more

0

0

34

67

14

The Bybit short-term Yapper Leaderboard is live!

Ranking content that mentions both Bybit (or @Bybit_Official) AND any of the following 3 topics:

- xStocks (or @xStocksFi)

- CFD

- TradFi (Stocks, Oil, Forex, Indices)

With Bybit setting aside $100,000 in rewards for their top yappers, ending on July 31st!

Show more

0

0

300

577

61

摩根士丹利数字资产市场主管 Andrew Peel 已于 3 月离职,并计划在瑞士楚格创办一家加密投资与科技公司,专注于代币化基金和连接 TradFi 与 DeFi 的交易工具。Peel 此前为瑞士信贷交易员,2018 年加入摩根士丹利。(CoinDesk)https://t.co/fQ9GNjqgMF

Show more

0

0

2

0

0

Still buzzing from an incredible OKX Xperience stop in NYC 🇺🇸

Super glad to connect with our first cohost @avax, and our dear old frenz @solana, @arbitrum, and 30+ leaders from both Web3 and TradFi—from @PanteraCapital to @OndoFinance, @Fidelity, @pudgypenguins and more. Grateful to be building alongside so many brilliant minds in the heart of NYC 📍🌟

This felt like more than just an event—it’s a signal. A signal that OKX is here in the US, and we're here for the long run. With OKX @wallet, OKX DEX, OKX Pay, and our recent @okx US launch, we’re unlocking powerful experiences for the next wave of US builders, users, and institutions.

Tokenization, DeFi, real-world adoption—we’re just getting started 🗽🔥

Next stop: NYC - OKX Web3 x Arbitrum on June 16 👀 big shout out to @conycointalks #Xperience# #NYC# #Web3# #Tokenization#

Show more

0

0

1

6

0

吴说获悉,美国证券交易委员会(SEC)加密货币工作组宣布将于 5 月 12 日举办主题为“代币化——资产上链:TradFi 和 DeFi 的交汇点”的圆桌会议。SEC 加密货币工作组负责人、委员 Hester M. Peirce 表示,代币化是一项可能从根本上改变我们金融市场诸多方面的技术发展。此外,SEC 还宣布原定于 6 月 6 日举办的“DeFi 与美国精神”圆桌会议已改期至 6 月 9 日。https://t.co/kzFCipjgDo

Show more

0

0

4

0

0

❗ @21Shares_US, a prominent issuer of crypto exchange-traded products, just made a TradFi play for SUI.

They’ve filed an S-1 registration statement with the SEC for a SUI ETF — meaning you may one day be able to get SUI exposure directly from your brokerage account.

The launch of the 21Shares SUI ETF is pending SEC approval of both the S-1 and 19b-4 forms.

Show more

0

0

247

2.5K

285

🔥 RWA赛道深度布局指南:2025年值得关注的10个RWA项目

最近RWA、Payfi再度被市场提起,这两个赛道到底是新瓶装旧酒的又一轮叙事炒作,还是真能连接 TradFi 与 DeFi、开启万亿市场的“金钥匙”?

我们盘点了不容错过的10个RWA项目,试图深入拆解RWA 赛道的几个核心问题。👇

Show more

0

0

2

21

9

在 DeFi 固收赛道日益升温的背景下,Treehouse 以 4 亿美元估值完成战略融资,不仅是自身发展的重大飞跃,更是整个链上固定收益市场走向成熟的重要信号。值得注意的是,这轮融资由一家管理超 5000 亿美元资产的传统金融巨头领投,足见 TradFi 正在快速靠拢加密金融基础设施。

Treehouse 正在构建的是链上的“债券市场”,核心落点是 去中心化报价利率(DOR) 和代表链上收益权的 tAssets(如 tETH)。这些原语将为加密资产带来更稳定、可预测的回报模型,给机构资金一个真正“敢进来”的理由。TESR 的推出,也让 ETH 质押收益有了一个透明的链上基准,直接打破信息不对称的藩篱。

我认为,这轮融资是传统金融对链上真实收益系统的一次“确认式下注”。在大家都在谈 meme、talk points 和流动性挖矿的时候,Treehouse 选择扎根基础建设,铺设收益和风险定价的底层设施,是一条更有长期壁垒的路。DeFi 要真正走进主流,必须建立在这样的制度型产品之上,而 Treehouse,很可能是那个起头的人。

如果你也对 Treehouse 做的事感兴趣,不妨去他们官网看看他们打造的固定收益基础建设究竟长什么样子:https://t.co/6wzxqwozoE

Show more

🌳 Treehouse is now valued at $400M.

Backed by leading institutions from TradFi & crypto, we're building the infrastructure to accelerate fixed income in digital assets.

Learn more 👇

https://t.co/38OQNTroAz https://t.co/2l07Vtkfi9

Show more

0

0

0

1

0

国际清算银行(BIS)发布报告称,加密货币与去中心化金融(DeFi)已达到 “临界规模”,开始对传统金融体系构成潜在风险。报告指出,比特币现货 ETF、稳定币扩张及现实资产代币化正在加深加密市场与 TradFi 的关联。报告还警示,加密市场可能加剧贫富分化,小投资者在市场低迷时反而加仓,而富人则提前退出。BIS 建议采取 “遏制” 策略,推动 DeFi 纳入 KYC、信息披露等合规框架,并呼吁进一步研究 DAO 治理、稳定币风险与新兴市场 “加密化” 等议题。(LedgerInsights)https://t.co/Bw1ye7keIF

Show more

0

0

12

16

4

Bitcoin has been the star of this cycle, and with its success comes a thirst for Bitcoin yield.

@bounce_bit brings with it a solution for yield, whether its for institutions, retail, or new TradFi participants.

Learn why they think Bitcoin will eat all of finance below: https://t.co/8pTO8dG954

Show more

0

0

10

33

9