Search results for reels

People

Not Found

Tweets including reels

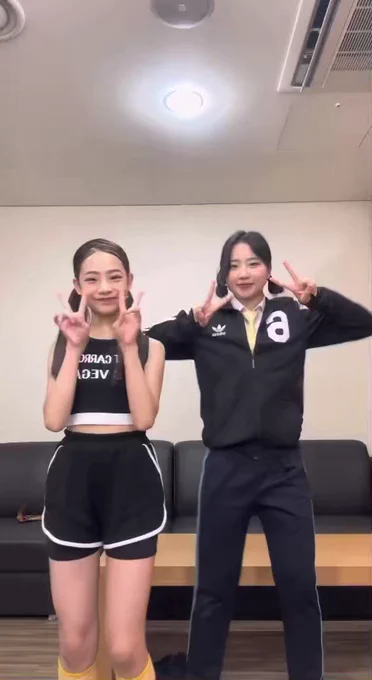

(🎥) — REELS :: 17.07.23

⤷ LIM SEOWON participantes de <UNIVERSE TICKET> à réaliser le Super Shy challenge des NewJeans (@NewJeans_France ) !

#유니버스티# #UNIVERSETICKET#

#걸그룹오디션# #글로벌오디션# https://t.co/6C2Jgv1TQH

Show more

0

0

0

23

4

Literally just opened IG reels. Instantly struck Gold!!! https://t.co/H2FGn03HQZ

0

0

48

29.4K

3.1K

In a world of reels and dreams, women are the directors of their destiny.

The Red Sea x Vanity Fair "Women in Cinema" ✨

#WomenStories# https://t.co/76518RmmA5

0

0

151

2.1K

142

0

0

1

23

2

0

0

2

19

0

0

0

0

12

1