Search results for utilities

People

Not Found

Tweets including utilities

Utilities fumigated

https://t.co/MwWYVMCL3b

0

0

15

48

8

Utilities always win.

You need to be a believer for heavy gains it never been easy to make money, you need to survive many stages before reaching the top.

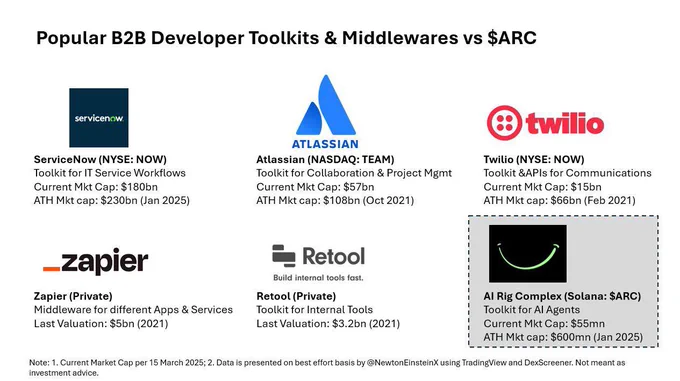

My bets on $sol and $arc @arcdotfun

Buying the red comes with a lot of stress

But eventually it will pay off.

See you in few months.@kanyewest

Show more

0

0

0

6

0

Mihama may become Japan’s first new reactor since Fukushima as utilities race to power the AI future. https://t.co/voCYyCrT6x https://t.co/QXoTY63auP

0

0

0

0

0

BNB has huge upside potential and a ton of utilities.

Just waiting for it to break ATH.

#DYOR# #NFA# #MyOpinion# https://t.co/zzkC8QpnlJ

0

0

18

31

7

Horizontal directional drilling (HDD), a trenchless method used to install underground utilities like pipes and cables with minimal surface disruption,

https://t.co/MvxbOe4mVH

0

0

28

648

101

The Cisco team is live at DISTRIBUTECH! Stop by booth 1223 to learn how Cisco is helping power utilities defend, optimize and scale the modern grid.

Discover Cisco's utility network solutions: https://t.co/nPI95a2ENA

#DISTRIBUTECH25# #SmartGrid# https://t.co/Iyfpsq5Ft2

Show more

0

0

0

12

9

Free Live Webinar | Wednesday March 26 | 1100 EST / 1500 GMT

Securing Remote Facilities: Cost-Effective Video Monitoring

Traditional security measures can’t keep up with the rising threats to energy, utilities, heavy industry and transportation sites. With 82% of respondents in our latest survey saying critical infrastructure organizations aren’t investing enough in security, it’s time for a smarter approach.

Join Ground Control and Videosoft for a 25 minute live webinar where we reveal how satellite-enabled video surveillance delivers real time, low cost monitoring anywhere on Earth - no cellular needed. Secure your infrastructure, cut costs, and stay ahead of threats.

Reserve your seat

https://t.co/qEGeFbXZBy

Show more

0

0

0

1

0

Download our technical paper ➡ https://t.co/rllFUE8yRs

to learn all about a new earth-fault protection method for compensated distribution networks, IFPTOC.

#ABB# #utilities# #DSO# https://t.co/19LOP7T7AC

Show more

0

0

0

10

3

It’s here: PYBOBO Major Update is live!

New Water Park Event:

Collect Park Coins and draw for a shot at the exclusive

SSSR-tier Sharkoko skin, mount, weapon and more.

Special Event Pack on sale, up to 1000% value!

🗓️: July 21–25 23:59 UTC

Join now - https://t.co/sob9pLj94z

Get skin = airdrop boosted forever — Skin Bonus Now Live:

All Rare Skins now boost your $CAPY AIRDROP at TGE this Q3!

All SR Skin: +1% Airdrop

SSR Suit & Weapon: +1.5% Airdrop

SSR Mount: +3% Airdrop

SSSR Suit & Weapon: +3% Airdrop

SSSR Mount: +5% Airdrop

Once you get a skin, the bonus always works. No need to wear it.

Your entire wardrobe just became more valuable

And remember: full SSSR sets (suit + weapon + mount) are strictly time-limited — Sharkoko is no exception.

PYBOBO’s Skin System is evolving — unique looks, battle buffs, and airdrop boosts.

More upgrades and utilities in progress — a collectible IP in motion!

Show more

0

0

85

1.2K

898

A new era begins for $SD 🚀

With VC emissions now fully completed, $SD stands stronger than ever, battle-tested through both bull and bear markets.

As we turn the page, $SD becomes the backbone for two powerful ecosystems:

@staderlabs — pioneering LSTs

@cabbagedotapp — leading the edge in AI led token discovery + trading

With Cabbage gaining momentum, war tested LSTs and new utilities on the horizon.

The future is sustainable. The future is $SD.

Show more

0

0

21

109

41

🚨BINANCE REVEALS #XRP# PRICE PREDICTION, FORECASTING A REMARKABLE $600 PER XRP!! THE XRPL IS SET TO SOAR TO UNPRECEDENTED LEVELS!! THE TOP DEFI TOKEN ON THE XRP LEDGER IS PRIMED TO CREATE MILLIONAIRES!!

THE MUCH-ANTICIPATED CTF TOKEN, A LEADING DEFI PROJECT ON THE XRP LEDGER, WILL LAUNCH FOR INSTITUTIONS ON APRIL 3!!! THE SUPPLY RESTRICTIONS ON CTF TOKEN WILL BE TRULY EXTRAORDINARY!!

HERE'S THE FACT: CTF TOKEN HAS A TOTAL SUPPLY OF ONLY 120 MILLION COINS!! A $20 BILLION MARKET CAP COULD SEE CTF'S VALUE SKYROCKET FROM $0.70 TO A REMARKABLE $748.50 PER TOKEN!!

IF YOU'RE LOOKING FOR A PROJECT WITH MASSIVE UPSIDE, CTF TOKEN HAS IT ALL – STRONG UTILITIES, LIMITED SUPPLY, AND ENORMOUS DEMAND!!

THIS IS A TRUE OPPORTUNITY!! BE SURE TO DO YOUR OWN RESEARCH!

CTF TOKEN TRADING LINK: https://t.co/rxGnTIze8q

CTF TOKEN ON MEXC: https://t.co/pFWpwg4qRg

Official Website: https://t.co/7fjMUxWEcV

Show more

0

0

67

1K

304

Announcing some big upcoming improvements to Yapper Leaderboards and the introduction of the gKAITO mechanism.

These are built based on feedback we've seen across CT and our community to ensure sustainability, less noise, and improved quality for both users and projects.

We’ll be rolling out both the updates, and the gKAITO mechanism over the next few weeks.

Updates coming to Yapper Leaderboards:

Introducing a reputation threshold across all YLs, measured in Yaps/Smart Followers/CT mindshare to ensure real accounts rank, to prevent AI bots, and to focus more on signal over grinding.

- There will still be a dedicated section to highlight consistent, loyal, high-quality contributions across all accounts

- More focus will be on growing a genuine audience and presence first as we’ve seen with various initially small accounts, which have grown significantly over time utilizing Kaito

- Emphasizing interests and alignment instead of rewards to help both farmers and genuine community members

- Restructuring leaderboards from a pre-/post-TGE format into category-based groupings

- Building a culture of retroactive, milestone-based, and ROI-driven rewards for better provable results and more focus on genuine interest

- Adding public topic leaderboards (eg stablecoin, RWA, ZK, AI) to recognize thought leaders - no direct rewards - just recognition and perks

- Implementing an improved global slashing mechanism to combat misinformation, engagement farming, group farming, and low-effort AI slops

Introducing the gKAITO mechanism.

gKAITO as a mechanism will be built around five core pillars: Thought Leadership, Attention, Participation, Ownership, and Culture.

It's designed to recognize meaningful contributions from a diverse set of stakeholders - both the Kaito ecosystem and the broader crypto space.

- Thought Leadership: For those who contribute meaningfully to broader crypto conversations (Yaps) and the emerging field of InfoFi.

- Attention: For those who bring new audiences to Kaito and actively evangelize the ecosystem.

- Participation: For those engaged in the Kaito ecosystem - ecosystem yappers, Capital Launchpad participants, and more.

- Ownership: For holders of sKAITO and certain related derivatives

- Culture: For Yapybara holders and pfp users, Kaito culture builders, and active community participants

gKAITO Utilities

- Earn a share of platform fees

- Get priority access to deals

- Signal alignment with partner projects within the Kaito ecosystem

- Access priority features on Kaito

We’ll be sharing more details on the gKAITO mechanism as we get closer to its launch - including involvement of onchain alignment too.

Show more

0

0

3.1K

4.1K

509

Discover the power of Dynamic Sharding.

Venom utilises this innovative approach to enhance its scalability, improve performance, and optimise resources of the blockchain.

Watch the video to get a clear understanding how our dynamic sharding works https://t.co/591aj1n0Vu

Show more

0

0

154

1.5K

619

As most of you know, we have been VERY intentional about how @PlayWildcard utilizes blockchain features. We have been insanely lucky to partner with teams like @paradigm who have supported our decisions. There a several chains that we have considered over the last year...

Show more

0

0

1

14

7

Valentyn Frechka, a 23-year-old Ukrainian inventor, has developed a method to convert fallen leaves into biodegradable paper, eliminating the need for tree-based pulp. His startup, Releaf Paper, utilizes urban leaf waste to produce eco-friendly packaging, offering a sustainable alternative to traditional paper and contributing to forest conservation.

For more content like this, please visit: https://t.co/iRLsxjax1z

#EcoInnovation# #SustainableMaterials# #GreenTech# #ReleafPaper# #ClimateAction#

Show more

0

0

0

0

0

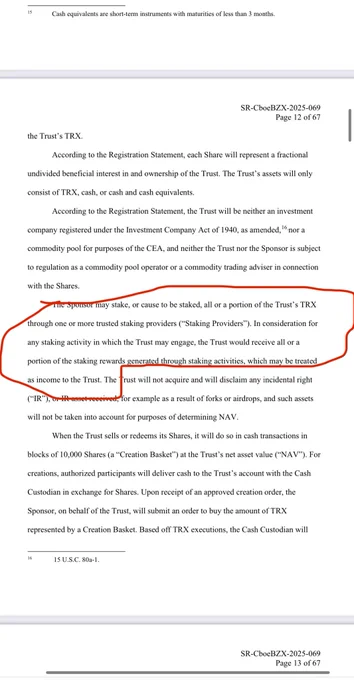

我这次翻译了下整个专案,想和大家聊聊TRX ETF这件事

我一开始看到Canary Staked TRX ETF这几个字其实是懵的。

但我想,既然这是Cboe BZX正式递给SEC的提案,而且是关于TRX的,那就得看看这背后到底是啥意思。

我把整份19b-4提案文件翻译了,查了不懂的术语,想用我能理解的方式,说一说这份ETF文件里,TRX到底被怎么写的。

段落在后方图中标注:

1. TRX不只是个币,它是个运行中的网络工具

“TRX is the native cryptographic token of the Tron Network, a permissionless and decentralized blockchain platform launched in 2017. The Tron Network is designed to facilitate high-speed, low-cost transactions and support the creation of decentralized applications, with a particular emphasis on content sharing and entertainment services. TRX serves multiple functions within the Tron Network, including securing the network through staking, enabling governance participation, and facilitating the payment of transaction fees.”

看起来很基础,但这段话让我意识到一个点:TRX不是一个讲故事的币。它就是TRON链上做任何事都要用它。

这跟那些还在画饼、靠社交媒体维持热度的项目不一样,TRX真的在链上“工作”,不是空的。

2. 这只ETF不是买币,而是拿去质押赚钱

“The Sponsor may stake, or cause to be staked, all or a portion of the Trust’s TRX through one or more trusted staking providers (“Staking Providers”). In consideration for any staking activity in which the Trust may engage, the Trust would receive all or a portion of the staking rewards generated through staking activities, which may be treated as income to the Trust.”

ETF不是买币挂着等涨,而是真的拿去链上质押。

这让我想起之前看Solana质押收益那些玩法,但这次是ETF的形式来做,也就是说,传统金融那边也要开始来“吃网络红利”了。

3. TRON用的是DPoS,不是那种“谁有钱谁说了算”的链

“The Tron Network utilizes a delegated proof-of-stake consensus mechanism in which TRX token holders vote to elect 27 ‘super representatives’ who are responsible for validating transactions and producing blocks. These super representatives are elected every six hours, and TRX holders can vote by staking their tokens, thereby participating in the Tron Network’s governance.”

这句我看了两遍才明白大概意思。简单说,TRON的出块不是你自己节点多就能包场,而是社区选出来的“超级代表”去负责。

规则明确、流程清晰,也不像某些链那样“社区治理”到最后就变成大户说了算。

4. TRX是有真实价格的,不靠协议操控

“The geographically diverse and continuous nature of TRX trading makes it difficult and prohibitively costly to manipulate the price of TRX… TRX’s 24/7/365 nature provides constant arbitrage opportunities across all trading venues”

这句很好。因为它非常明确地说了,TRX的价格是靠市场决定的,现货市场说了算。

就是真正的市场供需。这才是一个适合做成ETF的资产,不容易被怀疑造假。

5. ETF不仅买TRX,还会找服务商去跑验证节点

“The Sponsor may stake, or cause to be staked, all or a portion of the Trust’s TRX through one or more trusted staking providers (‘Staking Providers’).”

它不只是把TRX锁在冷钱包,而是会找专业机构跑节点、做验证、领奖励。这种结构,已经不再是传统那种“复制价格”的ETF,而是真的参与到TRON这个网络里了。

写在最后再说两句吧

我知道,大家现在都在看别的某ETF,觉得那是大新闻。但TRX这边悄悄地、没有造势,就递上了一个技术完整、结构清晰、还真能赚钱的ETF。

它没有靠炒概念,也不依赖社交情绪,而是拿出了一套真实参与区块链经济体的方式。有质押、有参与、有市场、有规则。

如果这个ETF获批,那TRX真的就从链上走到金融面前。这会是TRON整个生态最重要的一次转身。

@justinsuntron 孙哥你觉得呢

@trondao #TRONEcoStar#

Show more

0

0

33

41

3