Search results for Alibaba

People

Not Found

Tweets including Alibaba

Excited to bring @Alibaba_Qwen 's powerful Qwen3 Coder to our Inference Engine.

We're putting the best open-source tools on the most reliable foundation. This is about removing friction and helping builders move faster. https://t.co/OLZGoG0HYm

Show more

0

0

1

0

0

Chinese e-commerce giants Alibaba and https://t.co/Pf1ys8csDY have opened a new front in the ongoing battle for market share, with both expanding aggressively into so-called instant retail centered around delivery speeds of 30 to 60 minutes this year https://t.co/y5FZboZHIj

Show more

0

0

2

12

1

Say GM to @Alibaba_Qwen!

We’re proud to announce a strategic collaboration between FLock and Qwen, a world-leading open-source LLM series developed by @alibaba_cloud.

For years, decentralized AI has been questioned for its lack of real-world utility.

Today, FLock rewrites the narrative.

Show more

0

0

8

44

19

今天大盘跌了也没啥好看的,跑去墨尔本网红夕阳观景点Touch Grass,结果因为玩的有点累在 @aspecta_ai 开盘前一刻睡着了,等睡醒刚好看到 $ASP 币价已经从开盘的0.7 砸到了0.38 😭😭😭 猪脚饭缩水一半

想了一下没卖,还0.38抄了一些。虽然当前Alpah上的不少项目的确是给VC清库存,但还是有一些不错的,而Alpha发完无脑砸盘后反而是个不错的抄底点位。

过去两天山寨的大回撤对于恰好撞上TGE的项目来说是比较尴尬的,因为好容易获得的listing热度直接被恐慌给吓跑了。

但如果相信后续行情还没结束,BTC/ETH/BNB/SOL 们还有一波,那么这些新出来的,流通盘不大的项目或许也可以小博一下,因为筹码大概率又被项目方趁机收回去高控了。

顺着这个思路我也接了点 @codatta_io 的 $XNY ,毕竟流通市值现在也就 38M,开盘Alpah砸完后基本也还没有发过力。

@alibaba_cloud 阿里云官方推特其实昨天还给他们专门发过文,但可能因为二级动静不大市场并没有太多声音。

也能理解,现在市场的逻辑已经与曾经发利好就有社区上车的时候不一样了。

等个市场回暖吧,希望能赢🥰

Show more

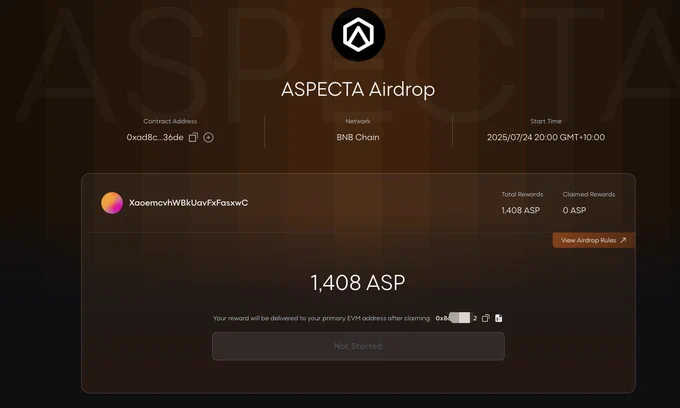

今天市场一片血腥,还好 @aspecta_ai 的这个空投提供了温暖,真实交易过过Key的小伙伴基本都有空投,持有徽章的看起来都获得了上千的 $ASP 。

按目前8.33的Key价格,每个 $ASP 0.694刀,我大概能获得985刀的空投,总算这之前没白交易那么多次Key(而且赚钱了)。

刚去社区群里看了一圈,听我招呼参与过Aspecta的小伙伴都有空投,区别是多少而已,大家反馈都还不错。

当然这还只是pre-TGE的价格,国内时间6点Claim之后到底值多少钱才知道,但应该也是一顿大餐是没跑的。

那么多天情绪都不错,结果TGE碰到大回调也是有点背,希望能有个好二级表现。

Show more

0

0

5

6

0

今天看到 $XNY 只做了4周就上线还挺有点意外的,作为第一个Booster当时仔细看了一下规则,还以为会要8周挖完才上线。

当然这是好事,最近山寨行情挺不错的,再过一个半月谁知道是不是黄花菜都凉了。

@codatta_io 作为一个结合区块链、AI 和众包标注的AI去中心化数据协作平台,背景专业度还是相当不错的。尤其是与阿里巴巴大语音模型Qwen千问 @Alibaba_Qwen 有官宣的深度合作,算是圈里独一份了。

更多的专业术语现在大家也都不爱看就不多说了,毕竟币价有表现才有人会去看基本面,但作为币安Booster的头一个,照理说应该是会要多给一些期待的,Why?

因为毕竟Booster引入的时候,目的就是为了抢野生撸毛党的饭碗,把体制外的撸毛生意放入体制内。所以能看到Booster 引入积分、质押、等级、活跃度等维度,提高了用户留存率和对项目的了解。

如果把币安钱包与当前市场上项目们的关系比喻为“招商引资”,那么第一个头炮打响,实现项目方,散户双赢对于后续的应该还是挺有意义的。

而且按理说8周的空投量现在变成了4周,是不是TGE的抛压也小了?

这个项目开盘我会好好观察一下

Show more

🎁 @codatta_io XNY token circulation will begin on July 23th, 2025, at 12:00 (UTC).

Users who participated in the Codatta Pre-TGE can trade XNY tokens on Binance Alpha.

Winners of the Week 1 & Week 2 Codatta Booster Campaign can claim and trade their XNY tokens within 8 hours after the token circulation starts.

Where to Claim? Go to “Discover” > “My Total Rewards” > tap “Batch Claim on Top Right” to claim all rewards in one click.

Show more

0

0

0

0

0

BMW is launching its first China-based IT R&D center in Nanjing, Jiangsu, aiming to boost global digital capabilities through AI, intelligent manufacturing and digital twins. Once operational, the center will become BMW's largest IT R&D hub in Asia. By partnering with China's innovation ecosystem and tech giants like Alibaba and DeepSeek, BMW is accelerating its digital transformation to build a future-facing smart mobility ecosystem. https://t.co/CVrEELnrV2

Show more

0

0

0

170

9

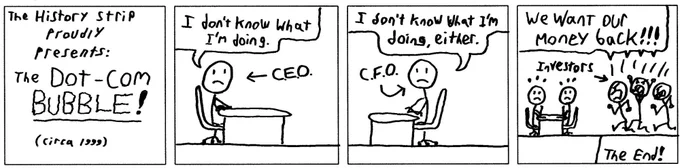

The dot-com bubble burst in the early 2000s.

Stock prices crashed. Market caps vanished. People lost money and hope. Mainstream media said the internet was only a scam and vaporware.

But all of these companies were founded during the bubble:

• Amazon (1994)

• Yahoo! (1994)

• eBay (1995)

• Expedia (1996)

• Netflix (1997)

• Google (1998)

• Tencent (1998)

• PayPal (1998)

• Alibaba (1999)

• Salesforce (1999)

• Baidu (2000)

... and more

While many companies failed during the crash, those that survived often shared these traits:

• A focus on sustainable business models

• Adaptability to changing market conditions

• Strong leadership and long-term vision

Back to today.

Token prices crashed. Market caps vanished. People lost money and hope. Mainstream media said crypto was only a scam and vaporware...

Sounds familiar?

Show more

0

0

94

422

207

查了下全球前二十大科技股里阿里的动态市盈率和前瞻市盈率几乎是最低的,实际上业务则是在慢慢扭转前两年多颓势:前两年各业务线相互独立的状态今年又重新回归到“ONEALIBABA”,整合旗下淘系电商(如淘宝、天猫)与本地生活服务(如饿了么)等资源,形成统一协同的业务体系、最近闪购日订单超8000万也能说明协同的效果。看最近几个季度业绩在持续回升、云业务稳健、AI布局到位(投了国内大部分AI公司)同时自研的同义千问也表现不错、今年回购力度很大。

其实很重要的还是马老师回归,政治意义重大,蚂蚁国际快要上市未来蚂蚁整体上市估计也在日程上。

更重要的是蒋凡这个阿里太子地位是真正坐稳了:当年主导淘宝成功移动化转型、直播战略成本,因为个人问题调任阿里国际业务短短两三年又把阿里国际化业务做起来,现在重回阿里核心同时掌控淘系、ONE ALIBABA算是阿里实际业务一号位,是个狠人。有一个非常年轻、但履立战功的同时战略眼光手段都是一流的未来统帅,对一家大企业来说至关重要。

https://t.co/SnFzvBNvun

Show more

0

0

3

5

0

Congratulations to Floki-backed project @realRiceAI for winning the $BNB chain MVB Accelerator, where they will get access to grants, @BNBChain's "Launch as a Service", and ecosystem support!

Winners of the BNBChain MVB Accelerator were determined by a panel of judges that include BNB Chain, YZi Labs, Presto Labs, Gate Ventures, Kraken, Faculty Group, CoinMarketCap, Amber, and honorable guest judge @cz_binance!

RICE AI is the web3 arm of Rice Robotics, one of the most promising AI robotics startups with high-profile clients and partners that include:

- Softbank, which leads the $500 billion Stargate initiative recently introduced by President Trump to grow artificial intelligence infrastructure in the United States, is one of Rice Robotics' major customers, with RICE robots powering office delivery at SoftBank Headquarters.

- RICE robots provide delivery services at Tokyo Midtown Yaesu for Mitsui Fudosan, one of the largest property developers in Japan.

- RICE has integrated with the 7-Now mobile app and its robots are used by 7-Eleven Japan in scaling unmanned indoor delivery in Japan.

- Rice Robotics is a partner of the Nvidia Inception Program.

Rice Robotics is also backed by highly-successful funds that include Alibaba Entrepreneurs Fund, Soul Capital, Audacy Ventures, Sun Hung Kai & Company, and Cyberport HK.

RICE AI will soon launch its token primarily through @TokenFi, where $TOKEN stakers will be able to participate in the $RICE presale on TokenFi Launchpad.

In addition, a significant portion of the RICE token will be airdropped to $FLOKI and $TOKEN holders.

We will be announcing more details about the RICE airdrop and presale soon.

Stay tuned!

Show more

0

0

36

327

90

“蚂蚁国际”计划香港IPO:简讯与分析

核心要点

- IPO计划:蚂蚁集团旗下蚂蚁国际(注册于新加坡)计划在香港独立上市,正与监管部门沟通,无政策障碍。

- 收入贡献:蚂蚁国际收入约占蚂蚁集团20%,核心业务包括跨境支付和金融服务。

- 战略背景:2024年3月,蚂蚁集团拆分蚂蚁国际、OceanBase和蚂蚁数科,推进“AI First”“支付宝双飞轮”“加速全球化”战略。

- 财务表现:蚂蚁集团2024年9月季度净利润137.5亿元,同比增长55.1倍(低基数效应)。

蚂蚁国际概况

总部:新加坡,专注数字支付与金融服务,驱动全球商业增长。

三大产品:

- Alipay+:跨境移动支付平台,支持线上线下无缝支付,助力小微企业全渠道增长。

- 安通环球(Antom):为全球商户提供数字支付、营销及数字化服务,支持100+货币,覆盖200+市场。

- 万里汇(WorldFirst):跨境贸易支付与账户服务,服务100万+中小企业,满足全球收付、外汇管理等需求。

市场表现:万里汇交易额超3000亿美元,助力中小企业应对资金周转与外汇风险。

广州“双中心”战略

新布局:2024年4月21日,蚂蚁华南数字运营中心与万里汇跨境贸易运营中心在广州启用。

意义:

推动跨境数字贸易,助力粤港澳大湾区互联互通。

与广州市政府合作,深化数字金融、跨境支付、科技创新。

- Alipay+升级:实现粤港澳三地电子钱包(支付宝、AlipayHK、MPay)在大湾区11城一码通行,广州率先全通。

- 广交会支持:联合20+商圈,提供入境消费友好服务;万里汇“护航计划”助力中小企业拓展全球市场。

公司治理优化

- 管理调整:管理层不再担任阿里巴巴合伙人,强化与股东隔离。

- 董事会改革:独立董事超半数,设立风险管理、ESG等六个委员会,提升透明度与多元化。

- 独立运营:蚂蚁国际等三家公司设立独立董事会,实行CEO负责制。

风险与机遇

机遇:

- 全球化战略:蚂蚁国际覆盖200+市场,受益于跨境电商与数字支付增长。

- 政策支持:广州政府合作与大湾区布局增强市场竞争力。

- 技术优势:AI、区块链等技术提升服务效率与安全性。

风险:

- 监管风险:香港IPO需符合监管要求,跨境支付面临全球政策变化。

- 市场竞争:与PayPal、Stripe等竞争,需持续创新。

- 地缘政治:中美关系或影响香港上市与国际化进程。

投资分析

吸引力:蚂蚁国际20%的集团收入、全球化业务与技术驱动使其成为高增长潜力标的。

估值潜力:参考蚂蚁集团人民币137.5亿元季度净利润,上市后可能获高市盈率,但需关注IPO规模与定价。

建议:

关注IPO进展与监管动态,评估发行估值。

考虑蚂蚁国际在跨境支付与大湾区布局的长期增长潜力。

分散投资,搭配其他科技或金融资产以降低单一标的风险。

$BABA.US #Alibaba#

Show more

0

0

2

22

1