Search results for Anchor

People

Not Found

Tweets including Anchor

Anchorage Digital 宣布将收购收益型稳定币 USDM 的发行方 Mountain Protocol,以加强其对机构级稳定币市场的支持。交易预计将整合 Mountain 的技术、团队及牌照结构,尚待监管批准。Anchorage CEO Nathan McCauley 表示,此举旨在推动机构稳定币采用,并加强全球数字资产生态系统中的安全性和合规性。(CoinDesk)https://t.co/aJn0Z53Liq

Show more

0

0

1

0

0

加密银行 Anchorage Digital CEO Nathan McCauley 在 Consensus 2025 否认公司正接受美国国土安全部调查,称相关报道 “无稽之谈”,并表示律师已确认无任何调查。此前有报道称 DHS 反洗钱组正接触其前员工。Anchorage 去年获颁 NYDFS BitLicense。(CoinDesk)

https://t.co/NPjIKD6Lj9

Show more

0

0

0

0

0

When I was working as a news anchor, my manager taught me to greet people 新年進步 (Progress in the New Year) instead of 新年快樂 (Happy New Year) on TV.

She said finance people are superstitious and 快樂 (Happy) sounds like 快落 (Dump Fast).

But I guess English is okay, right? https://t.co/70pFs6iEXH

Show more

0

0

49

357

98

吴说获悉,Ethena 宣布将通过与美国联邦特许加密银行 Anchorage 合作,使 USDtb 从离岸模型转为联邦监管下的支付型稳定币。Ethena 自称旗下的 USDtb 预计将成为首个具备明确路径、可全面符合美国《GENIUS 法案》的稳定币。https://t.co/56TXOELsWA

Show more

0

0

0

0

0

Indian entrepreneur Shruti Chaturvedi alleges she and a companion were detained for 8 hours at Anchorage Airport, #Alaska#, over a 'suspicious' power bank.

She claims extensive interrogation, a physical search, and denial of basic rights occurred.

Know what happened 🔗 https://t.co/Y3KKZJLa7V

Show more

0

0

6

40

15

I’m excited to announce that I have started Trends @trendsdotfun, a value-anchored social protocol that pushes the frontier of information finance. It’s also a bittersweet farewell moment: my full-time gig with @fslweb3 has come to an end, but I will continue to support the company as an advisor. I will have a separate post to reflect on this extremely meaningful journey.

Trends already has the early backing of an incredible group of founders and angels whose belief in the vision gives us both support and accountability:

@aeyakovenko

@calilyliu @ @SolanaFndn

@weremeow & @sssionggg @ @JupiterExchange

@Punk9277 @ @KaitoAI

@PrimordialAA @ @LayerZero_Core

@tn_pendle @ @pendle_fi

@cindyleowtt & @davijlu @ @DriftProtocol

Alice & James Zhang @ @JamboTechnology

@ZhuoxunYin & @bytheophana @ @MagicEden

@TusharJain_ @ @multicoincap

@Jerry10240 & @yawn_rong & @shitirastogi @ @fslweb3

@zhusu

@dapanji_eth @ @bonk_fun

@0xsudogm @ @dragonfly_xyz

@MapleLeafCap @ @FoliusVentures

After several years pursuing broader consumer adoption in crypto, I’ve distilled three first-principle convictions:

1️⃣ Every true Web3 breakthrough happens where value can flow with radically less friction - think 2017 ICOs and 2020 DeFi Summer (and even 2023 Pumpfun). The next innovation leap, as a result, will also emerge with another 100× improvement in value-flow efficiency.

2️⃣ Tokens are information containers, and social media is already the busiest information market; if every post became a token, information flow and value flow could finally merge.

3️⃣On-chain issuance and value transfer costs will keep falling, so social is now perfectly positioned for that merger in point 2.

With these beliefs in mind, we started Trends. It begins as an on-chain curation layer for X (and soon for any open content such as TikTok) and will grow into a social protocol coordinated by internet capital. Each piece of content forms its own curve, volatility and spike; accounts that consistently create / surface high-consensus posts accumulate a reputation that can’t be faked.

AI is pushing the cost of content production toward zero. When views, likes and even entire posts can be botted for pennies, on-chain capital becomes the one scarce, transparent signal of real consensus. Trends provide a direct pipeline from belief to PnL. Wash-trading has its corresponding costs, and an open protocol gives everyone the same chance to participate.

That, to me, is what mass adoption looks like: your everyday actions carry on-chain financial weight. Imagine one like equals one dollar - each click automatically buys from the curve, and your automatic exit target can be preset. Opinion expressed, position taken, no extra steps.

We’re at the dawn of this new era.

Trends is defining a new asset class.

Forging new behaviors is never easy, but trend is good.

Show more

0

0

410

1.9K

386

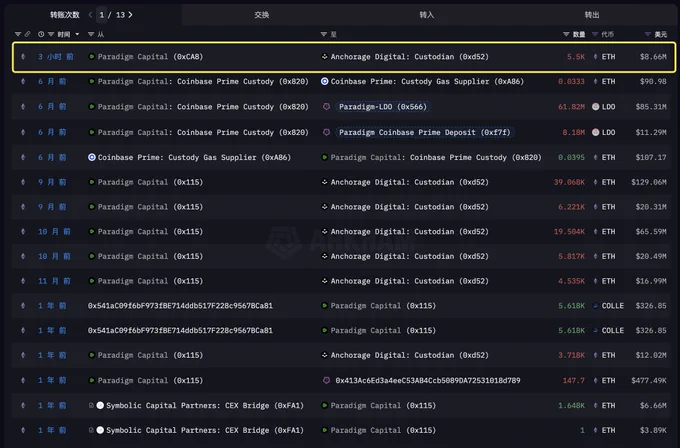

吴说获悉,据 @EmberCN,Paradigm 约 3 小时前将 5,500 枚 ETH(约 866 万美元)转至机构经纪平台 Anchorage。过去一年内,Paradigm 累计向 Anchorage 转入 96,955 枚 ETH,总价值约 3.02 亿美元,平均价格约 3110 美元。此前类似操作通常伴随后续转入 Coinbase、Binance 等交易所,疑似为出售准备。

https://t.co/7Jmd78b1qt

Show more

0

0

0

0

0

加密 VC @paradigm 可能在 3 小时前出售 ETH:他们将 5,500 枚 ETH ($8.66M) 转到机构经纪平台 @Anchorage。

Paradigm 在过去 1 年时间里,一共将 96,955 枚 ETH ($301,57M) 转到了 Anchorage,均价在 $3110。

根据之前的转移情况,ETH 在转到 Anchorage 后再流入 Coinbase、Binance 等 CEX。

https://t.co/GLcYqaHGE4

本文由 #Bitget|#@Bitget_zh 赞助

Show more

0

0

2

1

0

“It’s not easy,” Bret Baier, Fox News’s chief political anchor, said of the network’s efforts to arrange a live interview with Donald Trump, who has agreed to appear on Wednesday. https://t.co/8BsRbU0zOr

Show more

0

0

0

1

0

I was today years old when I learned from The Night Stalker doc that John Beard — that news anchor from Arrested Development — was also a real Los Angeles news anchor in the ’80s! https://t.co/JUY6w7VbiF

Show more

0

0

156

2.2K

132

Ethena is set to become the first stablecoin developer whose product has a clear path to full compliance with the U.S. GENIUS Act

Through our partnership with @Anchorage, the only federally chartered crypto bank, USDtb will move onshore to become a U.S. federally regulated payment stablecoin

Show more

0

0

124

1.3K

246

We need to end taxes.

👉RETWEET THIS tweet and trains Follow everyone

ADD YOUR MEME & username

@j0ker937

@PriamtheB

@RDog861

@JimKruger7

@FreeThankElon

@RochelleAz

@MacyStotty

@DawgRight

@TrumpGirl1971

@TBruceTrp773

@USAVet_5

@realNick_777

@ToniW67

@BellaZZu

@Chris_Value

@TrumpGirlOnFire

@SoCal720

@luvnewinfo

@ProtectOur2A

@IndianDakotaX

@LindaNTx

@patriotmary4

@lgcomin

@Steveadams76

@777Aaron_1

@libsarepsycho

@GirlFly63

@Lisa67332426

@ToniLL22

@Rebel4Kics

@AmBrushfire

@imrajib_

@DonnaLouise1212

@Joe885923725390

@BehrensFbehr1

@deuce15502004

@taxfreeok

@RajanKoshy13

@SteveSmith21886

@mygreenbricks

@RaymondDeMarco7

@anchorman98

@jeanlanewood51

@JJJPatriot

@recklesswhisper

@Andrewnapolit17

@ThelmaKayKiser

@joeg7844

@leubanks63

@NoboastbutJesus

#Conservative# #Trump# #Christian#

#DrainTheSwamp# #MAGA# #CleanUpCalifornia#

#JesusIsLord# #GodisGood# #AmericaFirst#

#WeThePeople# #2A# #ShallNotBeInfringed#

#USArmyWarriors🇺🇸##FJB# #NoMarxism#

#redwave2022# #unvaccinated# #conservative# #republican# #2A#

#animalrights# #usa# #APRN# #americafirst#

#rightwing# #unvaxed# #ProLife# #boarderwall#

Help us help you get followers.

Retweet to get on trains

Subscribe to get on trains

Show more

0

0

97

477

358

👉RETWEET THIS tweet and trains Follow everyone ADD YOUR MEME & username

@WenMaMa2

@AppSame

@DFBHarvard

@x4Eileen

@01IOTA

@brixwe

@jAlmz5

@Imcg_2

@G_TheOriginal

@JohnPot259

@Tex_2A

@toypilaNews

@EL4USA

@Pat10th

@3Tony48

@qfd_bruce

@wdunlap

@TMzedg

@tcalkins90

@cmir_r

@TJDOGMANR2

@jessies_now

@Ikennect

@Tweeklives

@45mx_7

@tooosunny

@4524Bel

@1classRideNJ

@Kathlee26065261

@AmBrushfire

@FreeThankElon

@anchorman98

@TommyPickett12

@KimLeigh1462564

@Virgini55093172

@Patriotlady24

@simioaks

@giftgab538

@KathySh05404129

@maryannminnich1

@GoldenWing2022

@RochelleAz

@luvnewinfo

@DarlaAdams57

@MaystheOG

@SumatraSue

@DottieAube

@MHarriman55428

@Azuralove1950

@MaGaMaNaGaIn

#Israel# #IsraelAttack# #Conservative# #Trump# #Christian# #DrainTheSwamp# #MAGA# #CleanUpCalifornia# #JesusIsLord# #GodisGood# #AmericaFirst# #WeThePeople# #2A# #ShallNotBeInfringed# #USArmyWarriors🇺🇸##FJB# #NoMarxism# #redwave2022# #unvaccinated# #conservative# #republican# #animalrights# #usa# #APRN# #americafirst# #rightwing# #unvaxed# #ProLife# #boarderwall# #school# #flag# #pledge#

Show more

0

0

90

670

372

7.25梭哈晨报:

昨晚突然之间反弹起来,今早起来一看除了强势的其他还是弱啪啪,还是不能追高,追高的话一定得带好止损。

1. $BTC 很稳定继续震荡,给足ETH自由发挥的空间;

2. $ETH 强势拉回3700上方后,又被市场带下来了,可以看得出来很想往上走;

3. $SOL 表现出来作为最弱存在应该有的样子了,直接软趴趴了;

4.Ethena 宣布与 Anchorage 合作,使 USDtb 从离岸模型转为联邦监管下的稳定币;

5.Strategy 将优先股“Stretch”发行规模扩大至 20 亿美元,以购买更多 Bitcoin;

6.Coinglass数据:过去 24 小时全网爆仓 5.27 亿美元,多单爆仓 3.70 亿美元,空单爆仓 1.57 亿美元;

7.Tether 称,流通中的 250,000 个 Tether Gold 代币由 7.66 吨黄金支持;

8.REX-Osprey 的 Solana 质押 ETF 将 100% 的奖励传递给股东,因为它集成了 JitoSOL;

9.埃隆·马斯克的 Grok AI 与 Kalshi 集成,Kalshi 是 Paradigm 支持的预测市场;

10.Injective 上链 SharpLink 股票,推出首个以太坊金库代币化资产;

11.摩根大通表示,在监管推动下,今年迄今为止,加密货币流入量已飙升至 600.00 亿美元;

12.Cyvers Alerts:WOO X 遭攻击,损失逾 1200.00 万美元;

最可怕的是被盗没任何人说;

13.根据 Letsbonk .Fun 平台产生的费用,昨晚有 5000 亿枚 BONK(1862.00 万美元)被销毁;

14.美银:GENIUS 法案通过后稳定币供应量或将在近期增长 250 亿 - 750 亿美元;

美银:美联储独立性存疑施压美元,市场担忧加剧宽松倾向;

15. Circle 推出的计息型稳定币 USYC 将在 BNB Chain 原生发行;

---------

这个市场有点看不明白了,其实挺难赚钱的,但是看赚钱的人真觉得这个钱好赚啊,确实是想不明白了,菜还是需要多练。

一定不能扛单,尤其是追高的,不然真的分分钟亏的干干净净。

#Bitcoin# #Ethereum# #Solana# #Crypto#

Show more

0

0

3

5

1

7.25梭哈晨报:

昨晚突然之间反弹起来,今早起来一看除了强势的其他还是弱啪啪,还是不能追高,追高的话一定得带好止损。

1. $BTC 很稳定继续震荡,给足ETH自由发挥的空间;

2. $ETH 强势拉回3700上方后,又被市场带下来了,可以看得出来很想往上走;

3. $SOL 表现出来作为最弱存在应该有的样子了,直接软趴趴了;

4.Ethena 宣布与 Anchorage 合作,使 USDtb 从离岸模型转为联邦监管下的稳定币;

5.Strategy 将优先股“Stretch”发行规模扩大至 20 亿美元,以购买更多 Bitcoin;

6.Coinglass数据:过去 24 小时全网爆仓 5.27 亿美元,多单爆仓 3.70 亿美元,空单爆仓 1.57 亿美元;

7.Tether 称,流通中的 250,000 个 Tether Gold 代币由 7.66 吨黄金支持;

8.REX-Osprey 的 Solana 质押 ETF 将 100% 的奖励传递给股东,因为它集成了 JitoSOL;

9.埃隆·马斯克的 Grok AI 与 Kalshi 集成,Kalshi 是 Paradigm 支持的预测市场;

10.Injective 上链 SharpLink 股票,推出首个以太坊金库代币化资产;

11.摩根大通表示,在监管推动下,今年迄今为止,加密货币流入量已飙升至 600.00 亿美元;

12.Cyvers Alerts:WOO X 遭攻击,损失逾 1200.00 万美元;

最可怕的是被盗没任何人说;

13.根据 Letsbonk .Fun 平台产生的费用,昨晚有 5000 亿枚 BONK(1862.00 万美元)被销毁;

14.美银:GENIUS 法案通过后稳定币供应量或将在近期增长 250 亿 - 750 亿美元;

美银:美联储独立性存疑施压美元,市场担忧加剧宽松倾向;

15. Circle 推出的计息型稳定币 USYC 将在 BNB Chain 原生发行;

---------

这个市场有点看不明白了,其实挺难赚钱的,但是看赚钱的人真觉得这个钱好赚啊,确实是想不明白了,菜还是需要多练。

一定不能扛单,尤其是追高的,不然真的分分钟亏的干干净净。

#Bitcoin# #Ethereum# #Solana# #Crypto#

Show more

0

0

0

0

0

吴说获悉,区块链与数字资产行业协会 The Digital Chamber 宣布任命 Binance 首席执行官 Richard Teng 为顾问委员会成员。The Digital Chamber 表示其丰富的监管与金融经验将助力行业推动平衡且具有增长导向的监管框架;Teng 强调将与各方合作推动创新政策,并维护投资者利益,顾问委员会其他成员还包括 WisdomTree CEO Jonathan Steinberg、Chainlink 联合创始人 Sergey Nazarov 与 Anchorage Digital 的 Rachel Anderika 等人。

Show more

0

0

0

0

0

刚认真看了 @burnt_xion 官推发布的2025年上半年的回顾报告,不得不说XION这半年确实发展挺快。

100+品牌接入包括 Uber、Amazon、BMW 这种大厂,80万+月活用户,DAU/市值比全L1第一。

关键是他们这个链抽象做得确实到位,用户只需要邮箱登录,完全无感体验Web3操作,这点对其他公链来说真的降维打击。

USDC支付Gas这个功能也很实用,毕竟新人最头疼的就是Gas费和钱包管理问题。现在用USDC就能直接交易,转化率提升是必然的。

合规方面:机构端的Anchorage Digital和Ledger集成,也是首个符合MiCA标准的L1,看得出来团队在各个维度都在发力。

开发者生态这块,DAVE移动开发工具包支持1800万次调用,Proof of Concept竞赛发放25万美元奖金,全球多个XION House落地...这些基础设施投入对长期生态建设很关键。

社区数据也挺猛,The Promethean Saga活动把日活拉到5-10万,月活80万。DAU/市值比全L1第一这个指标很能说明问题 - 用户增长跑得比市值快。

整体来看,XION这半年从"链抽象试验田"变成了一个完整的运营平台,品牌活动、机构接入、开发者工具、社区运营都在同步推进。特别是让加密"消失"这个理念,在实际落地层面确实做出了成绩。

下半年如果能保持这个势头,更多消费级应用上线,USDC Gas进一步普及,可能会真正打开主流采用的大门。

毕竟当用户完全感知不到区块链存在时,大规模采用才真正开始...

Show more

XION's first half of 2025:

✓ 100+ brands leveraging XION (including Uber, Amazon, and BMW)

✓ 800k+ monthly active users

✓ 18M mobile developer toolkit launch

✓ 25+ major news announcements

Proof that making crypto disappear works, and we're only halfway through the year🧵↓ https://t.co/NhVt8muYc7

Show more

0

0

4

4

0

不得不说,CFX在搞对公关系这块真是有两把刷子,记得2023年初爆拉那波就是跟电信搞了个区块链SIM卡合作,号称“中国唯一合规公链”。虽然最后不了了之一地鸡毛,但不影响陈凤霞风光了好长一段时间。

这次又开始炒作公链+人民币稳定币概念,Conflux联手AnchorX和东信和平(Eastcompeace),借上海政府支持,强调“稳定币+合规”概念,社区情绪高涨。

虽然大概率最后还是没实际东西落地,但依然不影响炒作,从6.22号低点到今天最高点拉了4倍多。这种币可能比较适合喜欢大起大落强刺激的选手玩。

Show more

0

0

0

6

0

加密早报 * 每日不能错过的重要信息 * 2025年7月25日

1. 特朗普当面要求鲍威尔降息,在特朗普引用美联储总部翻新预算数据时,鲍威尔在一旁不断摇头。特朗普还称没必要解雇鲍威尔,其即将届满;

2. 特朗普盟友起诉鲍威尔,要求FOMC公开开会;

3. @aspecta_ai 的代币 #ASP# 上线了,上线钱一个按照Key的价格计算,当时一枚价格是0.7刀附近,结果上线后一路下跌,现在跌破0.2了直接,现在的市场还是不能乱接;

4. #Vine# 之前早报就提及过,昨晚被马斯克喊了下单,瞬间翻倍,不过现在已经回落了不少,后面还要看什么时候接入X或者马斯克持续喊单才行;

5. #RESOLV# @ResolvLabs 将启用费用开关,每日协议利润的10%用于基金财政;

https://t.co/TMfvhme1T0

6. #MONAD# @monad 将于 9 月 29 日上线,代币总量为 1000 亿;

7. Upbit 交易所上线 #syrup# #huma# ;

8. 昨天上线的 ponzimon 游戏,刚上线FOMO后币价 #PONZI# 直接来到了30M+,不过所有旁氏游戏都无法阻挡挖卖提,现在已经跌麻了;

9. #Pump# 持续下跌,现在已经到了0.0025附近,距离麻吉大割爆仓价不远了;

https://t.co/uwWEFxnVRS

10. @cookiedotfun 平台第一个打新项目 @Almanak__ 来了,这是一个AI赛道的标的,90m FDV,TGE 100%解锁 ,前25名顶级鲷鱼和50个顶级CSNAPPER的优先条款销售:75m FDV,100%解锁在TGE;

https://t.co/mLNoeKwFAO

11. #Bonk# 项目方回购并销毁了 5000 亿枚 $BONK ($1847 万) 的半小时后,5100 亿枚的 $BONK ($1875 万) 从 Galaxy Digital 转出进入 Binance 和 Coinbase。 这可能导致 $BONK 下跌了 10%:从 $0.0000365 下跌到 $0.0000325。

数据来源:@EmberCN

12. 关于 Solana2027年非正式版的路线图,可以看看 @jason_chen998 的X线程,很精彩;

https://t.co/Wpfj0rc6uX

13. Ethena 宣布与 Anchorage 合作,使 USDtb 从离岸模型转为联邦监管下的稳定币;

14. Grok AI 与 Kalshi 集成,Kalshi 是 Paradigm 支持的预测市场;

15. WOO X 遭攻击,损失逾 1200.00 万美元;

16. Bonk 生态的 #GP# 持续拉升,昨晚直接突破了6刀了,后续bonk台子收入稳定且走高的话,可以持续关注,因为每天都有回购 GP;

【行情分析】 比特币4小时级别到了震荡下沿位置,这也是短期重要的支撑位,所以这周重点要关注115000的位置能否有效守住,如果能守住,后续会持续拉升,如果守不住,还要向下继续验证,如果再向下的话,极端情况回到112000附近。

短期的调整不会影响下半年趋势走势,所以大家一定要坚定信心,btc eth,越跌就要越加仓,其他山寨要根据实际情况再决定,优先考虑龙头优质标的,优先考虑已经建立储备仓库的标的。

【风险提醒】 数字资产波动较大,风险极高,请谨慎参与,杜绝满仓梭哈,拒绝贷款杠杆;

Show more

0

0

0

0

0

❓ 过去 24 小时 #Crypto# 发生了什么

1. 大盘走势

▪️ $BTC 继续高位震荡, 目前在 117500 附近

▪️ $ETH 冲高回落,突破 3750 后又回落至 3600 附近

▪️ $SOL 跟随大盘在 180 左右徘徊

▪️ 山寨全面普跌,以 #Meme# #NFT# 板块领跌

2. 链上新闻

▪️全链 TVL 为 137.718B,与昨日持平

▪️链上一般, $stonks 24 小时涨幅超 50%,目前市值 7.7M; $DEBT 24 小时涨幅超 40%,目前市值 3.9M; $VINE 马斯克喊单,目前市值 59.8M

3. 热点新闻

▪️@monad 辟谣代币将于 9 月 30 日推出

▪️OSL 集团拟配股筹资约 23.55 亿港元用于战略性收购、稳定币业务等

▪️特朗普当面要求鲍威尔降息

▪️@OpenAI 新一代 GPT-5 模型预计将于 8 月初正式发布

▪️@celestia 基金会以 6250 万美元购买 Polychain 所持全部剩余 TIA,将转让给新投资者

▪️市场消息:@ton_blockchain 基金会与 Kingsway Capital 拟为 TONCoin 国库筹集 4 亿美元

▪️@Strategy 拟将用于购买比特币的筹资规模提升至 20 亿美元

▪️@SolanaFndn 基金会联合生态多方发布“互联网资本市场”路线图

▪️Anchorage Digital 与 @ethena_labs 合作推出首个 GENIUS 合规、联邦监管稳定币 USDtb

▪️Spirit Blockchain Capital 成立新实体 SpiritReserve Group 并拟募资最高 5 亿美元

▪️@circle 将在 BNB Chain 原生发行计息稳定币 USYC

▪️欧洲央行维持利率不变,观望美欧贸易谈判进展

▪️deBridge 基金会宣布正式上线储备金计划

#Crypto# $BTC $ETH $SOL $stonks $DEBT $VINE

Show more

0

0

0

1

0