Search results for Freedom_From_Evil

People

Not Found

Tweets including Freedom_From_Evil

We stand with every unsafe girl #Freedom_From_Evil# #BENGAL_HORROR# #rape# #bengaldoctor# #IIPS# mumbai https://t.co/PED0qCEm3T

0

0

0

0

0

There’s a storm coming. One that makes every current conflict look like a warm-up act. And somehow, no one seems to fully grasp it. Maybe it’s too insane, too surreal. Maybe people are still pretending this is all just politics, or culture, or temporary noise. It’s not. This is something deeper, darker… and it’s already begun.

Everyone’s felt it: the world flipped upside down, and nothing adds up anymore. Terrorists commit medieval-level atrocities, and yet somehow millions rush to cheer them on. Not just justify them, but worship them. Bin Laden. Hitler. Symbols of evil being openly praised in the streets of Western capitals. It’s not fringe anymore. It’s now mainstream. That should terrify people, yet for whatever reason it doesn’t.

And if you take a step back and cut through the noise, something else starts to come into focus. There’s a pattern forming, too coordinated to be coincidence, and too strategic to be chaos.

Yes, antisemitism is exploding. It’s real. It’s incredibly serious. But perhaps we’re missing something. What if the rage against Jews and Israel isn’t the endgame, but rather the smokescreen? What if it’s the hook, not the killshot? What if the real target is everything else… the entire Western world.

Because while people are marching for Gaza, ripping down posters of kidnapped civilians, fighting each other over ancient hatreds, something else is happening. Quietly… Systematically. Laws are changing. Speech is shrinking. Institutions are shifting their loyalties. And somehow every lever of power now bends toward protecting one worldview above all others.

No one voted for this. No one asked for it. But it’s happening. If you question it, you’re branded a racist. If you resist, you’re fired, banned, cancelled, arrested. Meanwhile, those pushing this agenda? They go unchecked. Untouchable. Above the law, outside criticism, beyond accountability.

And while everyone is screaming about Israel and Gaza, here’s what no one is asking: What do the people of Gaza actually get out of all this?

They’re still trapped. Still suffering. Still dying. But somehow Syria’s butchers get rebranded as freedom fighters, and Europe cuts them checks while Gaza is being used, just like everything else.

This was never about Gaza. Never about the Jews. They’re just the distraction. The misdirection. This is about breaking the West from the inside out. Using its guilt, its openness, its fear of being called the wrong name as weapons.

And they’re winning. Not with tanks. Not with bombs. But with ideas, with language, with infiltration. They found the vault. They used our compassion to open it. Now they’re looting it piece by piece, law by law, narrative by narrative.

This isn’t immigration. It’s not tolerance. It’s not diversity.

It’s replacement.

And if you still think that all sounds crazy, then good… That’s what they’re counting on.

Show more

0

0

920

7.6K

2.4K

When I was travelling through the South over the past month, I was told by several hosts that they all carry guns. They confirmed that they do not tolerate the nonsense that Jews face elsewhere. America: Never ever give up or water down your Second Amendment. It is the means by which you maintain your freedom from all enemies, domestic and foreign.

Show more

0

0

1.3K

31.1K

5.5K

He was one spin away from financial freedom https://t.co/QyAxEcmdVj

0

0

82

582

40

🇺🇸 Deportation Nation RISING 👥 Verified Followers

@bhealey - Leading the MAGA

@IHeartMyDoggy — Christian Deplorable

@HRMustin — Faith, food, freedom

@SherylGAZ — Army Vet, 45-47 ride or die

@Kiffer68 — MAGA from the Riviera

@Stacey174768 — Triple-patriot 🇺🇸

@Joy582563680971 — Jumpin’ for truth

@MrEMixeragain — Comment sniper

@StarrBellex13 — No crypto, just vibes

@RedRider19033 — Socratic and savage

@FeliceGerwitz — MAGA grandma power

@Allmercy007 — Jesus > Government

SCOTUS just green-lit President Trump to DEPORT criminal aliens under the Alien Enemies Act. Buses are gassed up. Sanctuary cities? Panic mode. This is AMERICA’S TURNAROUND. 🛑🛻

@MilkyjnerX — Meme fueler

@Moose_Gypsy — Shaman in the storm

@PatriotTruth44 — Unfiltered Army vet

@Adumtrucker — Road warrior patriot

@LamarH84 — Christian to the core

@Truthfoolgal — Affordable > Woke

@borders_LLC — Dad of girls, MAGA grit

@kenmcguff70 — Grandfather goals 🇺🇸

@mamaavalos701 — Rebel Heart, strong voice

@_Irishpatriot — Ultra before ultra was cool

@jdscop101 — Retired LEO, full throttle

@Gigiluvs2020 — Irish + American = unstoppable

@AmericanFirstMG — Building patriot press

@B7grWinning — Journalist for real truth

@just_decorating — No nonsense

@tjstaten1 — Biz queen + patriot ⭐️

📢 Repost this. Rally the crew. Let’s take the hill.

#SCOTUS# #AlienEnemiesAct# #DeportThemAll# #Trump2024# #Zelena# #DrainTheSwamp# #AmericaFirst#

Show more

0

0

6

13

5

🧵❗️We were compelled to cancel the Pride Fest and evacuate the Fest territory. @MIAofGeorgia once again neglected to protect us from violent far-right groups and allowed the mobs to prevent us from exercising our freedom of expression & assembly even in private settings.

Show more

0

0

20

471

174

Got my eyes on @TDCCPMEME || $TDCCP 👀

TDCCP is not just a meme. It’s a decentralized movement.

Born from meme culture, TDCCP uses blockchain as its weapon to satirize and challenge authoritarianism. In the face of censorship and forced delistings, we did not fade—we surged.

They’ve built one of the most unified communities in blockchain history, gaining global momentum and unstoppable growth.

At $2.39 and a $1.5B market cap, TDCCP has officially surpassed Solana’s meme project Bonk.

This is not hype. This is not luck.

This is a revolution.

Freedom. Resistance. Blockchain innovation.

TDCCP IS THE MEME THAT FIGHTS BACK.

ACTION! ACTION! ACTION! 🔥🔥🔥

📊DEX:

https://t.co/LuXefHjvkw

🌏 Website:

https://t.co/mGcNs1EFI1

💬 Telegram :

https://t.co/ReilXPeLyS

#TDCCP# #MemeRevolution# #TakeDownTheCCP#

Show more

0

0

383

1.2K

572

Most don’t understand that $ETH community isn’t just built around “numba go up.”

It’s built around cypherpunk values striving at a chance to revolutionize the world for the better.

Communities that are mostly built around gains disappear as soon as the gains do.

Without the ideals that seek to maximize economic freedom for the common man, we will never improve from the fiat/slave system that crypto set out to escape from in the first place, we will only further enslave ourselves by reinventing a more efficient version of it.

Show more

0

0

48

387

41

On #GoaLiberationDay#, I extend my heartfelt wishes to the people of Goa. Today, we celebrate the spirit of freedom, resilience, and progress that defines this beautiful state. Hope Goa gets liberated from corrupt forces destroying peace, prosperity, and unity. Jai Hind! 🇮🇳

Show more

0

0

30

714

262

🚨🚨 BREAKING:

Twenty CIA and FBI agents have blown the whistle, confirming that Barack Obama and his Chief of Staff, CIA Director John Brennan, created the false Russia hoax, doctored intelligence to overthrow the duly elected president of the United States in 2016, and locked the report in a CIA vault for nearly a decade.”

DEVIN NUNES VINDICATED

On March 21, 2017, Devin Nunes traveled to the White House and informed President Trump that he was being overthrown.

The following day, March 22, 2017, he stood alone, holding an unexpected press conference confirming that Barack Obama had spied on Trump and the Trump campaign.

On April 17, 2017, Devin Nunes was forced to resign from the House Intelligence Committee’s Obama-Russia inquiry—because Paul Ryan is a piece of garbage.

Now, give the man the Presidential Medal of Freedom—at once.

Show more

0

0

1.1K

71.5K

23.4K

Today, Elon Musk Builds Dogecoin.

Tomorrow, Dogecoin Builds Elon Musk.

Ladies and gentlemen, open your eyes.

We are witnessing the greatest shift in global finance since the creation of the internet—and at the center of it all is a coin most people still think is just a joke.

But Dogecoin is no joke.

It’s Elon Musk’s secret weapon.

Let me explain why.

⸻

1. The Real Weapon Against Global Financial Control

Musk’s ambition isn’t just electric cars or Mars colonization.

He’s building a global tech empire: Starlink, X, FSD… all reaching across borders.

But here’s the challenge: global financial regulation.

One wrong move, and a country can freeze your payment channels, kill your service, and cut your network.

Unless… the payment system is decentralized.

Unless… it’s DOGE.

DOGE is not bound by banks.

DOGE doesn’t need anyone’s permission.

DOGE is freedom.

⸻

2. From Cross-Border to Borderless Commerce

When Starlink connects the world, what platform will the global population use to trade, sell, stream, and earn?

X.

With DOGE integrated as a native currency,

X becomes the first truly global marketplace.

No credit cards, no middlemen, no currency barriers.

You pay in DOGE.

X auto-converts it to local fiat for sellers.

No volatility issues, no currency limits.

Forget “cross-border e-commerce.”

The future is borderless e-commerce.

And Dogecoin is the gateway.

⸻

3. The New Global Financial Center

But we’re just getting started.

As commerce flows through X, so will finance.

Imagine:

— Buying stocks

— Earning yield

— Investing in global markets

— All on one app

— All using DOGE as the foundation

This is why Musk said:

“If X is done right, 50% of global finance will happen here.”

He’s not exaggerating.

He’s building it. Right now.

⸻

4. Why America Loves DOGE (Even If It Won’t Say It Yet)

Here’s the part nobody’s talking about:

If X becomes the global hub for commerce and finance, then every global business on X will…

Pay taxes to America.

Yes, you heard that right.

DOGE enables global transactions.

X tracks them.

The U.S. taxes them.

That’s why Trump supports Musk.

That’s why U.S. agencies are watching DOGE, not fighting it.

It’s not just crypto—it’s strategy.

⸻

Conclusion: You’re Early. Very Early.

Elon Musk doesn’t need DOGE to get rich.

He needs it to make the system work.

And DOGE doesn’t need hype—it needs understanding.

Today, it’s “just” a meme coin.

But tomorrow?

It’s the foundation of the new global economy.

There are only ~140 billion DOGE now.

Ten years later? Maybe 200 billion.

8 billion people on Earth.

That’s less than 25 DOGE per person.

When every transaction, every investment, every interaction flows through DOGE…

What will 1 DOGE be worth?

⸻

Believe it or not—DOGE is not just money.

DOGE is infrastructure.

DOGE is strategy.

DOGE is the future.

And the future?

It belongs to those who saw it first.

#doge# #dogecoin# @elonmusk @houseofdoge @cb_doge @dogeofficialceo @cb_doge

Show more

Elon Musk says if done right, X would become half of the global financial system. https://t.co/dmUyOa1i1L

0

0

2

15

2

If Web3 is "pseudo decentralized" but packaged for legalization, what consequences will it bring? Many people have not yet realized that if the so-called Web3 is actually a centralized financial system disguised as "decentralization", and this system is selectively legalized by US regulation; • Obtain support from the US stock market and layout on Wall Street; Some listed companies have even started to allocate what we both know as "air coins" and "leek harvesting coins"; So this game may be far more profound than you imagine. ⸻ 🧠 1. The betrayal of technological ideals. If Web3 is essentially centralized, the result is: • The protocol is controlled by a few funds/giants; Key infrastructure such as nodes, oracle machines, and cross chain bridges are operated by oligopolies; High concentration of investment allocation, governance power, and resource pricing power; All 'user autonomy' has become a packaging language, and the real control is opaque. 📌 This is not decentralization, but 'secondary centralization+legal facade'. ⸻ 💼 2. The financial illusion under policy collusion when the United States selectively "complies" with certain Web3 projects: • Compliance legitimizes centralized platforms (such as Basechains, stablecoins, and certain wallets); Packaging the entire ecosystem as a 'new generation of financial technology'; Cooperate with ETFs and listed companies to invest and speculate, forming a "legal belief harvesting loop". 📌 Essentially, it is a new type of financial shuffle, which, under the banner of technological idealism, packs the trust of retail investors, the aura of media and the moat of policies into a new asset foam. ⸻ 📉 3. Market risk transmission: Who will take the last baton? The entire Web3 asset may just be a "new shell of financial games", with project parties/institutions cashing out in advance and retail investors repeatedly accepting offers; The allocation of these tokens by US stock companies will directly inject cryptocurrency risks into the global capital market; • Once the foam bursts, ETF、 Mutual funds and pensions may both be affected; The public has lost faith in decentralization, and technological innovation has fallen into a cold winter. 📌 Unlike the 2008 subprime mortgage, this round of risks is packaged in "legal disclosure" and "social collusion", making it more difficult to identify. ⸻ 🌐 4. Geofinancial Strategy: Web3 as a tool for expanding the US dollar • Stablecoins and compliance chains become the new global payment network for the US dollar; The Web3 infrastructure supported by policies extends the financial soft power of the United States; Developers, users, and assets around the world are "decentralized" under American rules. 📌 What is truly achieved is not 'technological empowerment', but 'the colonial expansion of digital dollars'. ⸻ 🧭 At the summary level, the concept of technological decentralization has been hollowed out, technological innovation has been alienated into the packaging tool market, and retail and individual investors have been repeatedly harvested. Investment beliefs have gradually collapsed, and policy compliance logic has been monopolized and utilized. The space for fair competition has further shrunk, and the global dollar has borrowed the "Web3" shell to reshape its global financial hegemony logic. This is an experiment of power and capital working together to manipulate beliefs. What we really need to be wary of is not 'which currency has fallen', but which power has redefined our understanding of 'freedom, openness, and decentralization' with the help of Web3.

Show more

0

0

0

0

0

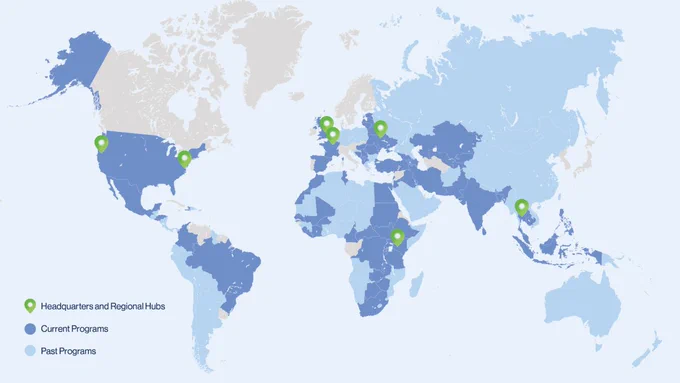

🚨EXCLUSIVE - BOUGHT AND PAID FOR: HOW $472 MILLION BUILT A GLOBAL LEFT-WING MEDIA MACHINE

In February 2025, WikiLeaks pulled back the curtain on a government-funded media empire that’s been quietly shaping what billions of people read, watch, and believe.

At the center of it all? A group you’ve probably never heard of: Internews Network. Funded mostly by USAID, Internews presents itself as a friendly nonprofit supporting “independent journalism.”

But behind that noble-sounding mission lies a global operation that critics say is more about managing narratives than reporting facts.

The numbers are jaw-dropping.

Nearly $473 million—yes, that’s nearly half a billion—has flowed to Internews from USAID and the U.S. State Department over the past 2 decades.

Add in millions more from billionaire-backed organizations like George Soros’s Open Society, the Rockefeller Foundation, and the Bill & Melinda Gates Foundation, and you’ve got a media Frankenstein stitched together with government cash and private influence.

In 2023 alone, Internews claims to have worked with 4,291 media outlets, produced 4,799 hours of programming, and trained over 9,000 journalists.

It also says it reached an audience of 778 million people worldwide. That’s more than double the population of the United States.

But here’s where things get murky. Internews isn’t just giving media groups equipment and microphones. It’s tying grants to ideological conditions.

In Hungary, for example, officials accused Internews of funding anti-government media under the guise of “media development.” If you didn’t toe the line, you didn’t get the money.

In Ukraine, it funded 9 out of 10 major media outlets—almost all promoting pro-NATO, pro-conflict content during wartime.

And it’s not just about news. In Kosovo, just months before major protests broke out in Serbia, Internews offered grants to reporters to write in Serbian.

The pitch? Promote “positive” stories about Albanian-Serb relations. Sounds harmless—until you realize this was a foreign-funded push to shape how people talk about sensitive ethnic conflicts.

Then there’s Internews’ Earth Journalism Network, which recently launched a $100,000 media grant focused on climate reporting in Asia.

Sounds great—except that the fine print gives Internews and its donors the rights to edit and publish all the content.

So yes, they’re funding journalism—but they’re also controlling the output.

Even advertising isn’t off limits. Through its “Ads for News” program, Internews partners with GroupM, the world’s biggest media buyer, to funnel ad dollars to “trusted” outlets. If you’re not on the list, you get nothing. It’s a digital loyalty program—except instead of points, you get credibility and cash.

Internews is led by Jeanne Bourgault, a former U.S. government official who made $451,000 last year. She previously worked on post-Soviet “transition programs” and oversaw a $250 million budget at the U.S. Embassy in Moscow.

In 2023, she launched a $10 million media fund at the Clinton Global Initiative—a project backed by Hillary Clinton. The Internews board includes big Democratic donors and political insiders, and WikiLeaks says at least one of its six subsidiaries is based in the Cayman Islands, a notorious offshore haven.

Meanwhile, its headquarters in California? Reportedly an abandoned building still listed in official filings.

Let that sink in: a half-billion-dollar media empire, pushing narratives in dozens of countries, funded by your tax dollars—and run from a ghost office.

Internews says it’s here to “support press freedom.” But as one media analyst put it, “It’s not about giving journalists a voice—it’s about choosing which voices get heard.”

So the next time you read a “fact-check” or see a story calling something “disinformation,” remember: it might just be brought to you by the same people who paid $473 million to decide what the world thinks is true.

Sources: Anadolu Agency, Hungary Gov, Ukrayinska Pravda, KoSSev, Earth Journalism Network, TRT World, Concordia, Shore News Network

Show more

0

0

390

3.9K

1.7K

I don't know why @rickawsb wrote his article in Chinese but here's an unfiltered English version of it:🧵👇

The “GENIUS Act” and the New East India Company: How USD Stablecoins May Challenge Fiat Systems and Nation-States

By: Rick AWSB

“This is an extremely sophisticated asymmetric strategy. The U.S. is exploiting its adversaries’ weakest point fear of losing control to build its own moat.

I. Ghosts of History: The Digital Return of the East India Company

History doesn’t repeat, but it does rhyme.

When Trump happily signed the GENIUS Act into law, what came to mind was a powerful image from history: the East India Companies of the 17th and 18th centuries commercial behemoths granted sovereign powers by their nations. These were not mere merchants, but corporate sovereigns, blending soldiers, diplomats, and colonizers.

This Act, though appearing like a regulatory tweak, in truth marks the chartering of 21st-century “New East India Companies” stablecoin issuers gaining legitimacy through U.S. law. It's the beginning of a transformation in global power dynamics.

1a. Charters of a New Power

Four centuries ago, the Dutch and British East India Companies (VOC and EIC) had the power to hire armies, mint currency, make treaties, and wage wars. Their state-backed monopolies defined the age of globalized sea trade.

Today, the GENIUS Act essentially charters modern-day equivalents stablecoin giants like Circle (USDC), potentially Tether, and possibly tech giants like Apple, Google, Meta, and X. No longer rebellious crypto startups, they are now pillars of U.S. financial strategy. Their “routes” aren’t sea lanes, but 24/7 borderless financial rails the new arteries of global commerce.

1b. From Trade Routes to Financial Rails

The old companies controlled physical routes with cannons and forts. These new “digital East India Companies” will control global value flows. If a U.S.-regulated stablecoin becomes the default for cross-border payments, DeFi, and real world asset trading, its issuer gains immense soft power defining compliance, freezing assets, and setting financial norms.

1c. Symbiosis and Conflict with Nation-States

Like their historical predecessors, today’s stablecoin giants may evolve from tools of national strategy to independent power centers. Initially supporting U.S. hegemony and countering China’s e-CNY, they may eventually act in ways that contradict U.S. foreign policy, especially as their shareholder interests diverge from state agendas.

The U.S. may face tension between control and dependence, possibly leading to future updates to the stablecoin legal framework.

II. Global Monetary Tsunami: Dollarization, Deflation, and the End of Non-Dollar Central Banks

The GENIUS Act is more than a charter. It’s the start of a monetary tsunami. The collapse of the Bretton Woods system in 1971 laid the groundwork. In the coming era, people in fragile economies may prefer stablecoins over failing national currencies, leading to hyper-dollarization and devastating local deflation.

2a. The Ghost of Bretton Woods

Under Bretton Woods, the dollar was tied to gold and all other currencies to the dollar. This created a paradox (Triffin Dilemma): to support global trade, the U.S. had to run deficits which eventually undermined confidence. Nixon severed the gold link in 1971, ending the system.

The dollar was reborn as a fiat instrument backed by U.S. strength and network effects. Now, U.S.-approved stablecoins elevate this to a new level bypassing national banks and reaching every smartphone directly.

2b. Hyper-Dollarization

In places like Argentina and Turkey, people flee inflation by using dollars. Stablecoins remove friction: no banks, no capital controls, no physical risk.

From Vietnam to Dubai, and Yiwu to Hong Kong, stablecoin usage is exploding. When inflation rises even slightly, capital doesn’t “flow out”. it vanishes instantly into the crypto ether. This threatens national currencies with obsolescence.

2c. Deflation and the Disappearance of State Power

Once hyper-dollarization hits, governments lose:

• Seigniorage (printing money)

• Monetary policy tools

The result: plummeting local currencies, collapsing tax bases, and failed governance.

The GENIUS Act, combined with tokenized real-world assets (RWAs), may accelerate this collapse.

2d. White House vs. The Fed

Domestically, a conflict may brew. If a Treasury-controlled stablecoin system emerges, it could sidestep the Fed, allowing the Executive Branch to exert monetary influence directly especially in election years or sanction enforcement. This may trigger a crisis in faith over Fed independence.

III. The 21st Century Financial Battlefield: U.S. vs. China and the “Free Financial System”

Externally, the Act is a strategic maneuver in the U.S.-China rivalry an ideological and infrastructural clash.

3a. A New Financial Iron Curtain

Like the post-WWII Bretton Woods institutions (IMF, World Bank), this new “free finance” network powered by USD stablecoins is open, efficient, and diametrically opposed to China’s model of state-controlled finance.

3b. Permissionless vs. Permissioned

China’s e-CNY is fully controlled, running on private ledgers, with full traceability. The U.S., in contrast, backs permissionless blockchains (Ethereum, Solana). Developers worldwide can build freely, with the U.S. acting as “credibility anchor” for the USD.

This asymmetric strategy attracts innovators and users, while China’s surveillance model alienates them. It’s a contest China structurally can’t win.

3c. Bypassing SWIFT: A Dimensional Attack

China and Russia attempt to sidestep SWIFT. But stablecoins render that effort obsolete no middlemen needed, no banks required. The U.S. isn't defending old infrastructure; it's creating a parallel game with new rules enforced by code, not treaties.

3d. Winning the Network Effects War

The fusion of the dollar with crypto’s innovation creates an exponential network. Developers and users will flock to where liquidity and freedom are highest.

Compared to the closed, RMB-centric e-CNY, the open USD ecosystem will dominate globally beyond China’s limited spheres of influence.

IV. The De-Nationalization of Everything: RWA, DeFi, and the Collapse of State Control

Stablecoins are the Trojan Horse. Once users hold stablecoins, the next step is tokenizing all assets, stocks, bonds, real estate, IP into on-chain digital instruments, detaching them from national jurisdiction.

4a. Stablecoins as the Trojan Horse

Governments welcome regulated stablecoins as safe crypto. But in doing so, they unintentionally onboard users into crypto ecosystems one tap away from Bitcoin, ETH, DeFi, and privacy coins.

Platforms like Coinbase become one-stop crypto supermarkets. USDC is the gateway drug leading users toward more freedom, higher yield, and greater autonomy.

4b. RWA: Assets Escape National Jurisdiction

Imagine:

• A Chinese team tokenizes app ownership

• Traded on a permissionless DeFi protocol

• An Argentinian buys it with stablecoins

No bank, no SWIFT, no borders.

This isn’t just new payment rails it’s a parallel universe outside the Westphalian order. When capital de-nationalizes, so do capitalists.

4c. The End of Traditional Finance

Banks, brokers, and payment systems exist to mediate trust. Blockchain replaces this with public, tamper-proof records and smart contracts.

Functions replaced:

• Lending → DeFi protocols

•Trading → AMMs

• Payments → Stablecoin transfers

• Securitization → RWA tokenization

V. The Rise of Sovereign Individuals & The Twilight of the Nation-State

When capital flows freely, assets ignore borders, and power shifts to networks and private giants, we enter a post-national age where the individual becomes sovereign.

5a. The Prophecy of The Sovereign Individual

In 1997, Davidson and Rees-Mogg predicted that the Information Age would make power more mobile than ever. The state would be unable to tax knowledge and capital that exists online.

Stablecoins, DeFi, and RWA make this real. A person can now:

• Hold global assets

•Move capital instantly

• Stay outside any one jurisdiction

States lose grip. And their ability to tax or control fades.

5b. The End of the Westphalian System

Since 1648, the world has been ruled by nation-states. But if productive individuals live in cyberspace, state borders become meaningless.

States may resort to coercion predatory taxes, surveillance accelerating elite exit. Eventually, they may become "nanny states" serving only immobile, less wealthy citizens.

5c. The Final Frontier: Privacy vs. Taxation

Today’s chains are transparent. But zero-knowledge tech (ZKPs) will bring complete anonymity.

Combined with stablecoins, this creates an untouchable financial black box breaking the state’s final tool: taxation.

Conclusion:

The French Revolution replaced monarchs with nations. This revolution led by stablecoins and AI replaces territorial sovereignty with network and individual sovereignty.

It’s not just a transfer of power it’s a decentralization and de-nationalization of power.

We are witnessing the breakdown of an old world and the birth of a new order that grants individuals unprecedented freedom, but also unleashes unprecedented chaos.

Show more

0

0

26

37

14

How To Survive Crypto - Financially and Mentally

⬝ not overinvest more than what you are ok with losing

⬝ always have separate income stream(s) and treat this as a hobby and fun social experimentation

⬝ never go fulltime into this unless you absolutely feel a calling (i am still doing this part time, to this day, 7 years in)

⬝ at the same time, do not be afraid to go in headfirst into something and learn by doing, there is no other way

⬝ in a post-GPT AI dominated internet, having a voice is a must and having a personal brand is preferable.

⬝ curiosity in exploring new things on-chain and new apps fails 70% of the time and results in loss of time and money but the 30% more than make up for it

⬝ FOMO comes in different sizes, on a macro and a micro level.

Example:

Micro - omg i missed X runner of the day

Macro - i am 39 years old and i will never have a million its over for me

Don't fall prey to either of these, your life is your life.

⬝ your network is your (future) net worth

being connected to others who are in similar situations as you are but also are better off (and worse off, for good measure) is the biggest benefit of CT and private groupchats - this will help keep you sane and grounded when everything is up 2000% weekly and also keep you motivated and optimistic when everything is -99% monthly.

i am not even talking about dealflow and business opportunities that many here are talking about.

⬝ cashing out routinely will make you appreciate what you've made and help you make even more.

⬝ many people that i know on their 3rd or 4th cycle can be considered to have 'made it', but in the sense that they've not made a bank deposit from fiat into crypto since 2020 or something.

this is what it means to "make it" for the average person, and you should be glad if you ever reach that level.

⬝ share the wealth with your family, especially parents who might not have much left in terms of good health to enjoy traveling with you.

⬝ compartmentalize your wallets - use a hardware wallet (@OneKeyHQ is great and on discount quite often, code below if you need it) for long term holds, and use hot wallets for stuff that you don't have much on and value flexibility on

⬝ you don't really need to invest a whole lot in terms of crypto safety - keep backups offline and keep them safe. most people have made insane amounts of money on ipads, phones and regedit sony vaio 11" laptops (shoutout to @AWice!), you just need to have clean computing habits.

⬝ macOS is safer than windows, generally, and you should have a basic used M1 Air at the very least for convenience (easy charging, lightweight, traveling). if you run command line stuff on anything you're done for - so don't that lol.

⬝ when considering longterm altcoin investments, especially before a huge momentum upwards, you might have to wait a long time before you see them rip, but when they do, they really do.

⬝ when in doubt if selling airdrops you got, consider the following: would you be comfortable buying the amount you're selling with real money from your wages? if the answer is hell no, FSH that thing right away.

⬝ most consensus investments outside of BTC feel "blue-chip" and "safe" at their peak, and "risky garbage vapor" at their lowest, make use of that (shoutout to @0xkyle__)

⬝ crypto is incredibly inefficient and you should never succumb to pessimism and bearposting because these inefficiencies (in terms of profit that can be made) only really come to surface in a bull run - everyone wins in a bullrun (vapor infra governance holders, defi governance token holders, PoW people, memecoins, vapor from 4 cycles ago, bitcoiners, defi 20% APR supply stablecoiners) except the extremely overinvested moonboys - shoutout to @outpxce for this today.

⬝ having a pen and paper to journal some quick thoughts instead of twitter drafts or telegram drafts can work better for most people, its like having a second screen anywhere you go.

⬝ many people here are larps and unemployed people with way too much time on their hands and up to no good because that's the life they're used to - CT is generally a very spiritually empty space but the people that are glimmers of hope are worth staying for

⬝ the only weapon you have against the aforementioned larps is time and experience.

⬝ the best CT accounts post sporadically and don't seek validation at every corner, these accounts are worth following and making separate lists for - don't let anyone tell you which ones are and which ones are these accounts, you will know after you've had time and experience.

⬝ automated trading strategies or something that promises that it does most of the work for you while you sit and do nothing really never work and you end up being the yield most of the time, but in a bullrun these scams print hardest and if you're early, so will you

⬝ last cycles we didn't have tools like @ethos_network to screen for things. "blockchain remembers" is indeed real now, use it if you're in doubt of who you're seeing on the timeline.

⬝ you should be emotional about investments sometimes, but the emotions shouldn't last more than 2 business days - if they are, something is wrong with you and you shouldn't be trading.

⬝ denominate your portfolio value in yearly previous job's salaries, never ETH, BTC, SOL, HYPE, or anything - if you're worth 13 best years of your healthiest and strongest period of your life, you're fucking rich and you've made it.

⬝ daytrading is generally not advised for 97% of people, if you are doing this..you should stop.

⬝ most importantly - if you've made money that is lifechanging, even if the market is falling and that investment is worth 30% of what it was a few weeks ago, you should absolutely sell. GCR expunge your mind of your peak net worth quote goes here.

⬝ bonus GCR quote: if you've won your freedom, secure it.

Show more

0

0

20

47

13