Search results for KOLS

People

Not Found

Tweets including KOLS

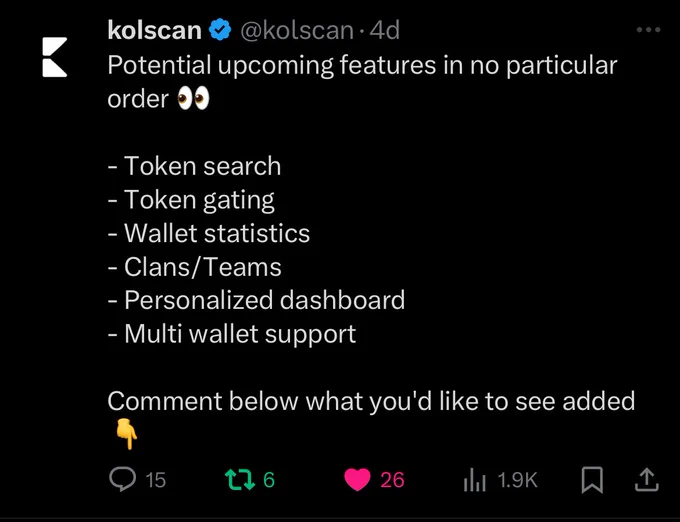

🚨 KOLSCAN 🚨

Track the KOLs in real time as they battle to win the trenches!

⭐️ $kolscan CA: 6jTQCFZR8JwvvenVGa3RzGM3a5YEagk9kQXDpHHdpump

Below 👇

- Synopsis

- Pipeline

📝 Project:

Helps you to learn the trenches, how KOLs win, the tickers or just watch the battle depending on your level of skill.

Real-time view of Kols trading and the leaderboard you have seen everywhere at https://t.co/noTV789KUl

💡 Pipeline:

Pictured and non-exhaustive. Once prioritised communication will come.

Show more

0

0

28

155

35

不得不再提一下 @kolscan

这个代币是官方发的,pump收购了这个kolscan,将来随便来一点赋能就会飞起,这个市值买一点不吃亏。

🚨 KOLSCAN 🚨

Track the KOLs in real time as they battle to win the trenches!

⭐️ $kolscan CA: 6jTQCFZR8JwvvenVGa3RzGM3a5YEagk9kQXDpHHdpump

Below 👇

- Synopsis

- Pipeline

📝 Project:

Helps you to learn the trenches, how KOLs win, the tickers or just watch the battle depending on your level of skill.

Real-time view of Kols trading and the leaderboard you have seen everywhere at https://t.co/noTV789KUl

💡 Pipeline:

Pictured and non-exhaustive. Once prioritised communication will come.

Show more

0

0

1

0

0

reading the main post @0xCRASHOUT reply to makes me wonder why most KOLS act like small gods

>Extortion/blackmail tactics

>not sticking to agreement and proceeds to threaten with 20+ other kols

>personal request of $5000 lmaoooo

>the CM even tried to satisfy your community but this kols had to resort to planned FUD

20+ KOLS isn't powerful than a whole community that shows up everyday to support the project in every form and any planned FUD will be trample on by the community.

love the way the CM handle/address this issue in the quote below.

once again, succinct is equal and fair to everybody. gprove

Show more

0

0

26

45

4

📕 About https://t.co/nYkoxhEdEw ( mostly ) Kaito, Kols and this fucking app.

Aight let’s get some shit out of the way first. I own a lot of Boop, as I do for basically anything I enthusiastically talk about. Dinga has been a buddy for a long time. And I hate the extractive cancer that is https://t.co/KTp1qd7Xs3.

So here are all my biases. Ah, and none of this shit is financial advice of course.

1/ Now, Boop has been on everyone’s mouth on CT for a few days. It’s the shiny new launchpad and vampire attempt on https://t.co/KTp1qd7Xs3. Most of the times I’ve seen it criticized for it’s KOL heavy distribution, with a caveat: they need to launch their own shitter to claim said allo, currently worth over 200k for the top spots. Clearly, rage and disdain ensued. The rich get richer, scammers getting rewarded, “how did the government let this happen”.

We’ll get there.

Now let’s focus for a second on what makes this platform different, and better than pump and all it’s copy/pasta clones.

Stakers get just shy of 70% of all the fees produced in $sol as well as an allo of 5% pro rata of every single shitter launched.

That’s right.

The passive trenchor dream is alive. And it’s a game changer. Keep reading to understand why.

Show more

0

0

44

195

33

We're hiring for Regional Affiliate Managers/BDMs

You’ll:

✅ Drive trading volume

✅ Onboard KOLs + affiliates

✅ Localize campaigns

✅ Own your region like a founder

Apply, If you’ve driven results at a tier-1/2 exchange

Show more

0

0

174

4.6K

293

Happy Mother’s Day to me. Aren’t my precious little KOLs thriving? Oh that sweet orange-haired darling got a fever—Mama’s feeding time.

哦今天是母亲节,给你们瞧瞧我养育的KOL,够健壮吧?我马上要给橘色头发的小甜心喂奶了。

#BSC# #BINANCE# #MEME# #QueenYi# https://t.co/b12X1tZGSw

Show more

0

0

0

8

6

HM 大家好!

我们 @humafinance 本周将会有两场跟 KOLs 一起探讨 Huma 的商业模式和社区发展,这是第一场。欢迎大家一起过来参加,有问必答!

📅日期:2025年4月15日(星期二)

⏰时间:新加坡时间 晚上10点 | 太平洋时间 早上7点

🔔请在这里设置提醒:

https://t.co/Q6n1mZFHTX https://t.co/E6yFY3GSdL

Show more

0

0

17

41

8

You’re in your 20s. Full of wild ideas.

But let’s be real—building isn’t easy.

- How do you even find KOLs?

- Where’s the right community to back you?

- How do you secure grants or bring in investors?

- Which platform should you even launch your token on?

This is why Aura Farmer DAO exists—built by Sigma Labs for people like you.

A collective of developers, builders, and mentors who get it. A group you can always rely on to help you turn ideas into reality.

The DAO is where everything comes together:

- Brainstorming your wildest ideas.

- Building the smart contracts to back them.

- Launching your project into the world.

- And more…

Sigma Labs isn’t just a DAO—it’s your launchpad.

Since launching Sigma Labs, we’ve already onboarded 5+ developers, split into 2 teams. But that’s just the beginning.

Because the ultimate aim is to incubate 30 projects in the next 11 months.

To make that happen, we’re opening up PUBLIC sign-ups for Sigma Labs' Aura Farmer DAO.

For the first batch, we are recruiting 30 Solana Developer Under 30 Only

*We are also accepting mentor/advisor applications for those who are more experienced. DM @MrRyanChi / @HyfiDaksh / @Gokunocool for details.

Join the Community:

https://t.co/ZQ8ioHY8jm

Pitch Your Ideas:

https://t.co/IUugpiLQMk

Show more

0

0

0

4

1

🛰 We followed the wallets. We traced the volume(trading on Pumpfun's bonding curve).

And the truth is… wild.

Some KOLs traded over 513122 $SOL in memecoins.

They paid enough gas fees to buy an island. 🏝.

@TheMisterFrog @Cupseyy @assasin_eth @Ga__ke are rewriting the meme economy in real time.

If you traded memes — you might already be on our radar.

🪂 Check your airdrop points now: https://t.co/7WaXvpjoeP

Show more

0

0

5

10

3

ReachMe is a new project on the BSC network, streamlining access to industry leaders.

• Pay BNB to message KOLs, ensuring only serious inquiries get through

• 50% refund if there’s no response within five days

• KOLs are incentivized to respond, receiving 50% upfront and the remaining 50% after replying

• Built on BSC for fast transactions and low fees

No more spam, no more ignored DMs—real conversations with real Key Opinion Leaders! 🚀

Show more

0

0

193

387

87

感谢链上皇sun哥和pikaxbt的关注

#memecoin# 的基本面

>东方链上皇0xsun的买入200sol

> 众多 $aura 大户的支持

>西方chillguy 领导者 @0x_Darius 的支持

>咆哮小猫 pikaxbt @XbtPika 名牌钱包购买拉盘并多次加仓,并承诺不会卖出

>bonkguy @theunipcs 的回复

>pnut @pnutsolana 官推的支持

>西方众多kol的参与 @missoralways

@MarcellxMarcell @0xSweep

A神的论文https://t.co/bxdeZtxilL

注意到 @bonk_fun bonk平台会回购bonk生态中的货币对,目前 #memecoin# 交易量排名第3,市值排名第4,可以肯定的是 #memecoin# 会被回购

上一次我们将 $gp 34m发送到340m 10倍https://t.co/nKjgaxWV9i

这一次我们将 #memecoin# 发送的更远,盘整之后是新的ATH👀

---

Thanks to on-chain emperor 0xsun and @XbtPika for the following

The fundamentals of #memecoin#:

> Eastern legend 0xSun bought in with 200 SOL

>Backed by top $AURA whales

>Western chill leader @0x_Darius showing support

>Roaring kitty @XbtPika aped in from his signature wallet, multiple reloads, and publicly committed to never selling

>Reply from the legendary @theunipcs (Bonkguy)

>Official nod from @pnutsolana

>Many western KOLs aped in:

@missoralways @MarcellxMarcell @0xSweep

Alpha thread by @missoralways :

https://t.co/bxdeZtxilL

We also noticed @bonk_fun is actively buying back BONK ecosystem pairs.

#memecoin# is now ranked #3# in trading volume and #4# in market cap.

One thing’s clear: it will be bought back. 🔁

Last time we sent $GP from 34M → 340M (10x):

https://t.co/nKjgaxWV9i

This time, we’re taking #memecoin# even further 🚀

After consolidation... a new ATH is coming 👀

Show more

0

0

49

238

31

🏆【Crydit BIG KOL Finals】

They’re not just swiping cards—they’re owning the whole spotlight!

Who’s the hottest diva in crypto?

The Crypto’s Hottest Diva Award is live and on fire!

Show some love in the comments of our official tweet:

@ KOLs Name + whatever you wanna say

🎁 We will randomly pick 20 lucky fans from the comments,

each winning $10 airdropped to their Crydit Card account.

he final winners will be announced after all awards are revealed!

@Jelly7788_ @Eveblockchain @vvxiaoyu8888 @hotbabyrebao @pipizhu_eth @Gummybear1771 @xincctnnq @fyj678 @smymy414 @0xMilkRabbit

#CryditBIGDay# #CryditBIGPay# #CryditCard# #CryditBIGKOL#

Show more

0

0

2

3

1

🌍 Unite industry influence to build a secure and healthy forex ecosystem, driving innovation and sustainable development

🔥 [WikiFX Golden Insight Award] Annual Most Influential Key Opinion Leader Selection Register Open Now! 🔥

You could be the next spotlight figure!

📩 Apply now 👉 https://t.co/3J1bzO9WA9

💬 Or post to nominate your industry KOLs 👇

@YourNominees + Recommendation

Remember to use the following hashtags and mention @WikiFXGlobal_ to boost their candidacy momentum! 🏆

Show more

0

0

2

32

3

With so many conferences going on, a few cultural etiquette tips in UAE.

Avoid pointing the soles of your feet towards people, as this can be seen as disrespectful in Arabic culture. This can be especially common when you speak on stage with your legs crossed. Watch out.

Recording someone without their permission is illegal under Emirati law. KOLs can often miss this while recording.

Public displays of affection (PDA) are considered against public decency laws.

Although nowadays, there are so many tourists in UAE, I have never seen or heard any of these being enforced. But it’s always best to respect the local culture and customs. 🙏

Show more

0

0

87

186

17

We’re officially hosting the UPCX DUBAI 2049 KOL TOUR 🎉 in collaboration with @AllSparkResearch - a side event during TOKEN2049 Dubai @token2049

📍 Desert Safari, Dubai

🗓️ Friday, May 2, 2025 | 15:00 PM – 20:00 AM (GMT+4)

🔗 RSVP here: https://t.co/CVxvjdeyGy

This exclusive VIP experience is designed to:

🐫Build meaningful connections with KOLs, media, and the global Web3 community

🏜️Showcase the UPCX payment ecosystem in an immersive setting

🤝Strengthen strategic collaborations with fellow Web3 partners

So @kokisato_upcx, are we ready to take the desert by storm?

Freedom to Pay, Wherever You Roam 🌍

#UPCX# #KOLTour# #Token2049Dubai# #BeyondPayments# #AllsparkResearch#

Show more

0

0

18

108

54

ty for taking a stand for me, king! 🫡️️️️️️

in The Lab, we observed that every solid new memecoin runner tended to have a -60% dip after its initial mega rally—and that that’s where you bid hard if you were sidelined!

USELESS had a 16,000%+ pump in just 7 days, so a correction was inevitable. interestingly, it just had its first -60% dip from the highs and is likely bottomed

as for the haters: the reason they’ll always be sidelined pocket-watching me is because i act on conviction and double down when needed—while they’re too chicken to even decide where they stand

this week they’re swayed by emotional and paid actors screaming 'bonk guy is the worst thing to happen to this space'

next week they're moved by the same crowd chanting 'bonk guy was right' after one of my theses plays out

indecisive. weak. spineless. unable to make their own decisions or have their own conviction!

i was initially bothered by the hate—some of which clearly comes from vested interests and paid actors. of course the establishment is threatened by LetsBONKfun disrupting their cash cow. naturally, they fight back

i just happened to be the most prominent actor and ‘main character’ at the time, so it was easier to target me

but i wouldn’t be here today if i was easily swayed by attacks like this

i also just bought an additional $125,000 worth of USELESS coins today—increasing my position while many are getting shaken out by baseless FUD and coordinated attacks (ty for the dip!)

if it isn’t clear, let me make it clear again:

1. i’m not on the BONK or LetsBONKfun team. never have been

2. i’ve never been paid by either team—not in tokens, cash, or favors. the only commercial incentive i have with BONK is my long position, which i’ve publicly documented for almost 2 years now

3. i could literally choose to never talk about BONK eco or LetsBONKfun again and it would change nothing. i’m under no contract or obligation to anyone, anywhere

4. i’ve spent over $500k of my own money buying LetsBONKfun memecoins over the past two weeks—most of it trackable via my public wallet. i haven’t sold a single token of any of these memecoins. so if people are down, i’m probably down more. i’m literally in the trenches aping with everyone. i even locked my HOSICO tokens for 3 months when i didn’t have to

5. prior to LetsBONKfun, i had privately decided not to publicly shill any new memecoin tickers for the foreseeable future. i only broke that rule for a few reasons:

- i love the BONK eco (for obvious reasons!) and i think this is the most high-impact, high-potential project to come out of the eco

- LetsBONKFun is also the most pro-people, pro-Solana eco launchpad in the entire space

- its success directly benefits my flagship BONK position: over 40% of the platform fees go toward buying BONK, and if it captures even half of Pumpfun’s traction, that’s $100m+ in annual BONK buy pressure

- i’ve seen genuinely good memes come out of the platform. that makes it easier to publicly stand by them. i’ve only pushed ~5 memes out of 80,000+ launched (despite thousands tagging me hoping for a push), and i was very upfront that i would be pushing memes from the platform to support it when it just came out. i was also pretty clear that this is a degen move, and i explained the attendant risks. ironically, many of the KOLs attacking me push more tickers than this every week!

my support is clearly making a dent—hence the attacks

regardless, those who know the bonk guy lore know i was born and forged in CT hate. i’ve been accused of so much, despite only trying to help by sharing my experience and thought process in a fully documented way—with proof!

i don’t bow to baseless hate or cancel attempts

and i’m definitely not bowing here

this is only the beginning of the ‘bonk guy’ legend

GOD WILLING 🙏️️️️️️

Show more

0

0

38

132

17

I want to clarify my experience with Yueya and share our full conversation with evidence. I’ve always acted in good faith to protect the community and ensure fair code distribution.

Yueya initially contacted me about a 20-code giveaway, saying she and @naive_bnb (Chinese community helper) had agreed to give away 20 codes in the following manner:

- 5 codes to her community

- 10 codes to the Defiapp team

- 5 codes to her BD team

I agreed to do the 20 code giveaway. However, when I checked with @naive_bnb, he informed me that he only agreed to 8 codes:

- 5 to her community

- 3 to the Defiapp team

This raised concerns about a possible miscommunication at the start of the discussion.

Later, Yueya sent me a list of 20 recipients, but the list did not include 10 members of the Defiapp team as she had stated. Some accounts on the list appeared inactive, such as @StepN_Alpha, and the overall list seemed to consist mostly of her personal KOL network rather than the agreed recipients.

When I questioned why there were 20 recipients instead of the 8 that Naive confirmed, Yueya's response was, “If you don’t keep your word, all 20 of our top kaito KOLs will come together to FUD.”

I asked her to clarify and avoid threats, but she repeated that we had agreed from the beginning and added, “If you want to play tricks, then there is no need for us to communicate.”

She later demanded a $5,000 USDT marketing fee per post, saying I didn’t fulfill my part of the deal. I had not agreed to any such fee beforehand.

To move forward, I suggested a revised proposal: we could run a giveaway of 20 codes directly to her community.

She declined and said “send the code directly. 20. If you want to express sincerity, send it directly, and I will make the code public to all community members… I can help you save face just now.”

To ensure fairness, Succinct does not directly send the giveaway host the codes used in the giveaway. We personally message each giveaway winner their code via DMs.

After consulting the Succinct team, we decided to honor our original agreement:

- 10 codes to the Defiapp team

- 5 codes to her community

- 5 codes to her BD team

Yueya did not respond after that and began a campaign to discredit me, saying I used PUA tactics.

I want to make it absolutely clear: I did not behave maliciously or manipulatively.

My concerns and initial questions were based on the miscommunication between Yueya's 20-code request and Naive's confirmation of an 8-code agreement. However, we decided to honor the 20-code giveaway that Yueya originally proposed and to which I had agreed with her.

I work for the community and my priority is protecting the interests of the community. In web3, it’s common for KOLs to receive special treatment because of their follower count. Some KOLs take advantage of their status to receive more rewards that wouldn’t be offered to ordinary community members. If they feel dissatisfied with the rewards received, some may resort to posting negative or misleading tweets in an effort to pressure the project and receive additional rewards. To ensure fairness to the community, code distributions are carefully handled to ensure codes are delivered to real contributors following the agreed terms. Any attempts to use influence or intimidation to secure additional codes for personal use or to distribute them outside the agreed terms are not permitted. This principle also applies to Discord roles, stars, and the Stage 2 whitelist.

Everyone is welcome to review the evidence and come to their own conclusion.

Here is evidence of our conversation: https://t.co/l5kgYbSiL3

Also, it should be noted that the Succinct Chinese community has the highest member count for L1 and L2 roles than any other region. The most active community member in Succinct, @lizuca25evelyn, has 39,856+ messages and holds the Proofer role (L2). @Frio424910 (10,208+ msgs) is a very talented artist from the Chinese community and holds the Prover role (L2). These are two examples, but Succinct has many more incredible Chinese contributors, too many to name. I also want to give praise to our Chinese moderator, @lovecity0088, who works tirelessly to ensure active community members have codes and passionate community members are promoted. If you enter the Succinct China Discord chat, you will see that most of the community members chatting have roles and codes already. If you have any questions, you can always directly contact @lovecity0088. If you are actively building the Succinct community, @lovecity0088 will see you and ensure you have a testnet code. We also host 6+ Chinese community events every week, where we play online games like Kirka, rocketbotroyale, poker, and deduction games, and sing together in Karaoke events. The Succinct Chinese community is a group of friends passionately building the community together and we welcome anyone to join us.

The Kaito voting campaign is over, but if any individuals who followed the voting rules did not receive a code, please contact me to receive one. Unfortunately, I cannot provide a code if you voted under the minimum voting requirement for a code.

I also want to sincerely apologize to the KOLs who were labeled as "FAKE KOL" in the Truth Lens image. Creating and sharing that image was inappropriate and unproductive. Regardless of any misunderstandings or disagreements, it was wrong to respond in that way. I take full responsibility and will be more thoughtful moving forward.

I don’t appreciate how I was treated by Yueya, but I hold no hard feelings towards her or her KOL friends. I wish them all the best of luck in the future.

Show more

0

0

151

283

38

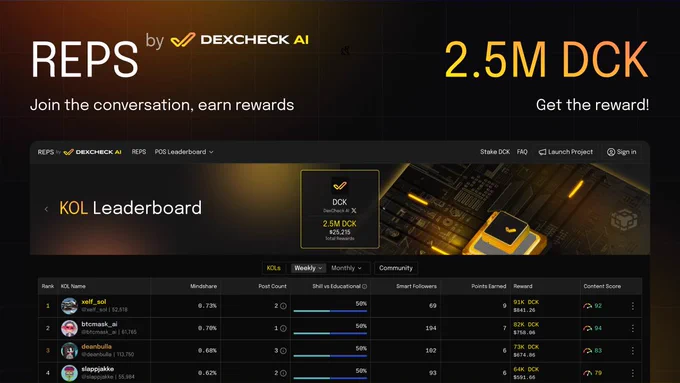

Our social-based reward platform, REPS, is NOW LIVE and can be accessed here: https://t.co/eq9vb6jBN4

We believe that community is at the heart of what crypto stands for. From the Bitcointalk forums to Reddit communities and now CT, the biggest contributors to the organic growth of the most successful crypto projects.

With REPS, we aim to make this crucial role rewarding for those who play it, while also enabling projects to build even more effective communities. REPS is a fair reward system, developed with best-in-class technologies and designed for modularity and scalability.

We’re introducing the Support-to-Earn narrative. Thanks to the Proof of Support protocol (POS), we’re redefining what it means to build a REPutation for you in supporting your favorite project(s).

The leaderboard for DexCheck is already live for the Monthly (May) competition, with the Weekly leaderboard starting on Monday. Every post on CT will be analyzed by our system for REPS points and rewards. All KOLs and community members who organically and naturally promote DexCheck $DCK through their posts-helping to expand product awareness-will earn REPS points. We’ll be expanding to more projects soon!

Show more

0

0

49

294

88

KTV Over Offices: My Playbook for Scaling Crypto in APAC (Part 1/2)

Let's be honest… in Asia, the magic rarely happens in offices and meeting rooms. They happen at 1am in a KTV booth when everyone's had 10 shots each and the person you’ve been trying to talk business with finally says “Ok, what does your project do?”

Whilst Western founders perfect their pitch decks, Asian business deals get sealed over late-night dinners, in private WhatsApp / WeChat DM’s, and yes, during KTV sessions and nights at the club where your tolerance for alcohol might just secure the deal.

This is part 1 of the APAC playbook nobody tells you about. My no bullshit guide to cracking seven key crypto markets across Asia.

After years of building in the region, I've seen countless Western projects face-plant because they tried to copy-paste their Silicon Valley approach. So I'm breaking down exactly how to navigate China's censorship maze, tap into Vietnam's builder energy, win over Singapore's gatekeepers, penetrate Hong Kong's old-money circles, ride Korea's narrative waves, crack Malaysia's trust code, and vibe with Thailand's mobile-first communities.

Got your eye on a specific partner? 👀

Drop "APAC" in the comments whilst tagging the project, and I'll try get you a warm intro from my stakeholder list of 300+ regional contacts

Note: Post was inspired by @ahboyash

1. CHINA 🇨🇳

China remains a high-potential yet complex crypto market. Despite a ban, underground activity is vibrant, with $86 billion in crypto flowing through the country from mid-2022 to mid-2023 and OTC volumes exceeding $20 billion by mid-2024. The market is driven by crypto-native users and curious pragmatists seeking wealth preservation and speculative opportunities. Stablecoins like USDT dominate. User psychology divides experienced users who navigate restrictions easily, while the general public remains risk-averse. Resonant narratives include financial security, blockchain innovation, and global participation.

To capture Chinese users, you must go underground but stay loud where it counts. Build stealth micro-communities on WeChat and QQ, wrap your product in "blockchain innovation" narratives, and flood early adopters with gamified rewards like airdrops, quests, and collectible NFTs. Move fast, speak their language, and make every action feel like a VIP invitation into the next big opportunity

Adoption

• Approx. 4.2% of population holding crypto

• Top exchanges: Binance (~20% of volume is from Chinese users), OKX, HTX

• Predominantly retail adoption

• DeFi shows strong growth

• NFTs see traction when framed as "digital collectibles"

• Memecoins see speculative hype cycles

• Infra protocols have limited but strategic growth

Regulation

• Fully illegal

• No formal tax framework for crypto

• Foreign crypto marketing restricted

Trends

• Dominant chains: Tron, Ethereum, BSC, L2s

• Top use cases: Stablecoin transfers, DeFi, OTC swaps

• Popular wallets: MetaMask, imToken, TokenPocket

• High-frequency behaviours: CNY → USDT OTC → DeFi, and airdrop farming

• Fiat on/off ramps rely on OTC desks and private brokers

• Popular narratives: Yield farming, airdrop farming

• Most active users: Retail traders, degens, airdrop hunters

• Sentiment: Primarily yield-maxi, secondarily anti-establishment and pro-privacy

Exchanges

@binance, @OKX, @HTX_Global (Huobi), @gate_io, @Bybit_Official

VC / Funds

@fenbushi, @CsquaredVC, @SevenXVentures, @DFG__official

KOLs / Agencies

@Cipher_Dance, @iamyourchaos, @snow949494, @Elabs_crypto, @EnHeng456

Community Groups

@ETHPanda_Org, @see_dao

Events

@EthereumSH

Media

@PANewsCN, @JinseFinance, @bwenews, @TechFlowPost, @ChainCatcher_, @Foresight_News, @OdailyChina, @BlockBeatsAsia, @BiteyeCN

Show more

0

0

43

359

39

Bybit CCCC 巴厘岛现场记录|Card3 项目方视角

1. Card3 项目参与

我代表 @card3_ai 以项目方身份,第一次参加 @Bybit_Official 在巴厘岛举办的 #CCCC2025Bali# 内容创作者大会。我们为现场 200 多位 KOL、项目方和 Bybit 内部同事定制了 NFC 社交卡,并上线了「Tap 2 Connect」现场积分排行榜——最终为最活跃的前 20 位社交高手送出了 @MemeCore_ORG $M Token + @iSafePal 硬件钱包,算是用最 builder 的方式向内容圈交了个朋友。

2. 🌿 @benbybit 花园 AMA,高光回放

在花园的圆桌 AMA,Ben 状态极好,面对几十位华语 KOL,两小时无保留开聊,从黑客事件、业务战略,到交易所之战、钱包产品、乃至中美市场博弈。

这些话很难在公开渠道听到,但都是真东西:

- 黑客事件后的“收购邀约”某头部交易所发出投资收购邀约,剧本几乎照抄 FTX。Ben 没说狠话,但说得很重:“拒绝了,幸亏我们 solvent,能撑住。”

- 除了币安和 OKX,Ben跟其他华人交易所老板之间其实关系都很熟,圈子还是那个圈子。

- CEX vs DEX: 主战场永远是 CEX。DEX 是“无 KYC 的刚需补充”,但成交量、深度、用户结构完全不同。

- CEX的Web3 钱包不是好生意, 认为OKX 投入 500+ 人做钱包,Ben 评价“不划算”。Bybit 决定未来关掉钱包业务,并暗示会有全新产品推出(还笑称因为 Bybit的黑客 被盗后,OKX 把钱包从主 App 拆出来了)。

- 美国市场计划 - Trump 回归,美国迎来 4 年加密监管友好的机会窗口期。Bybit 会进入美国市场,方式是与本地巨头(如贝莱德类型)合作,对方主导合规和关系, 拿60+%大头,Bybit 输出产品与交易能力。

- 警惕Coinbase的全球扩张: 合规交易所也开始下场做offshore业务, 他比较警惕Coinbase, Coinbase在收购Deribit (衍生品交易所Top3), Bybit其实本来也想投Deribit,但15亿美金黑客事件之后,只能暂时放弃。。

3. 🌏 中国市场的现实

- 去年中Bybit重新开放中国用户 KYC 注册,内部争议激烈,Ben 表示当时主要是为了对冲美国对离岸交易所的围堵策略。

- Bybit 从未做过中国 C2C出入金 通道,未来也不会。做了意味着要承担团队安全风险。

- 对香港用户审查更严格,因为 Bybit 正在重新申请香港持牌交易所。

- 场下有位大哥提到,香港持牌的 OSL 所其实内地流量不小,有内地“帽子叔叔”通过 OSL 卖币。目前OSL 甚至在协助地方政府推动监管框架,好为地方财政“卖币收入”铺路 .

4. Mantle($MNT)与交易所平台币之辨

Ben 再次强调:$MNT 不是 Bybit 平台币。

好的 CEX 不一定要发币。BNB 是历史产物。

Mantle 当前作为 L2 发展受限,未来将战略转型为「链上银行」,并与某家瑞士银行合作,Mantle用户可获得加密友好型银行账户。

5. 上币策略 & 团队文化:全面透明、深度联动

这次 CCCC 来了 30 多位 Bybit 华人同事,从新加坡、香港、迪拜等地飞来,涵盖产品、市场、现货、衍生品, 支付等核心板块。他们不是“主办方观众”,而是实打实的“全场 builder”,与项目方和 KOL 打成一片。

第一天早上的上币环节由现货负责人亲自讲解——从机制、流程到资源联动,内容透明、毫不遮掩。

Bybit 的上币打法非常结构化:

多元上币方式:Launchpool、Launchpad、Byvote、HODLverse 等模块组合出击,社区+生态+游戏化并重;

严选机制:只看“真实需求+产品力”,不卷叙事、不蹭热点、不搞“上所即巅峰”;

市场活动联动:如 Puzzle Hunt、Token Splash 等,强化用户参与度;

Meme 市场反思:Trump 类 Meme 币虽爆,但流动性易枯竭,缺乏叙事支撑;

新叙事聚焦:RWA、AI Infra、链上数据(如 SoSoValue、RedStone、Hyperliquid)是 Bybit 重点关注方向。

6. 华语 KOL 生态印象小记

这次来了 150 多位内容创作者,大多数是天赋与努力兼备的 KOLs。随手记几位聊过的新老朋友:

@Paris13Jeanne K线教主, 出众美貌+才华明明就是人生赢家,居然还是位卷王。大中午在沙滩拍完比基尼艳照,1小时内出片、剪辑、发推,推文质量不输品牌号。

@Goupenguin 挖矿小企鹅:传统金融出身,表达密度高,语速惊人(估计是我一天说话的 10 倍),难怪微博直播打狗每晚四位数在线。

@Mumu_yay Mumu 老师:谦虚“野生交易员”,实则全能选手, 晚宴“高抛低吸”小组战, 一秒抓住交易本质,带领小组在人数劣势下双料夺冠,Leader气场拉满。

@btc_jx 大名鼎鼎的静香小姐:KOL里社牛的社牛 (Card3线下社交挑战赛亚军),居然原来还是 #atomicals# 的家人, 给我看了她钱包里23年铭文大热时打的阿童木 $ATOM (ARC20), 一直没有卖, 抱团痛哭。

@jianguotz 建国同志:深藏不露的 OG 创业老兵,跨行业认知跨度惊人,听他讲话像加密行业口述史。

7. 市场周期这件事

与几位 Whale 级别的大户、VC 朋友与投研类 KOL 交流后发现:

观点分歧极大,乐观者与悲观者对半开。

但大家有一个共识:

逻辑自洽,仓位真实。每个人都在用自己的钱,为自己的判断下注。

8. 最后一点个人反思:

23 年曾做过播客,但没坚持下来。

这次回来最大的触动是——不做 KOL 也要做表达者。

观点、调研、交锋、记录、思考,是每一轮周期里真正留下来的“链上痕迹”。

再次感谢 @CCCCampus 主办方, 年底里斯本再见!

Show more

0

0

9

23

3