ً

@defi_isaac

prev @infinex_app · currently helping crypto projects scale into APAC

Joined June 2020

622 Following 7.9K Followers

KTV Over Offices: My Playbook for Scaling Crypto in APAC (Part 1/2)

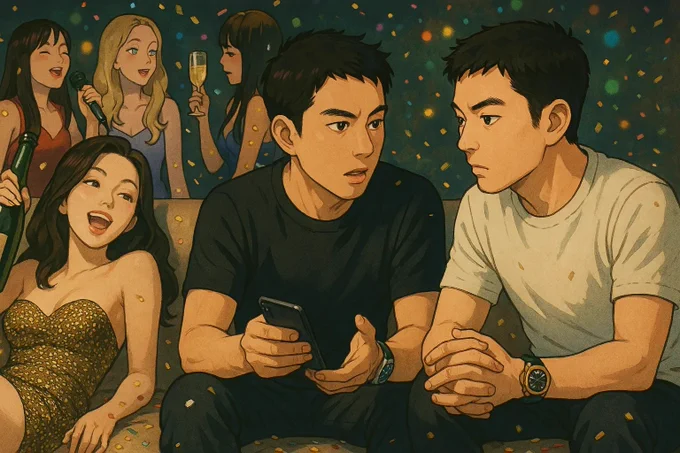

Let's be honest… in Asia, the magic rarely happens in offices and meeting rooms. They happen at 1am in a KTV booth when everyone's had 10 shots each and the person you’ve been trying to talk business with finally says “Ok, what does your project do?”

Whilst Western founders perfect their pitch decks, Asian business deals get sealed over late-night dinners, in private WhatsApp / WeChat DM’s, and yes, during KTV sessions and nights at the club where your tolerance for alcohol might just secure the deal.

This is part 1 of the APAC playbook nobody tells you about. My no bullshit guide to cracking seven key crypto markets across Asia.

After years of building in the region, I've seen countless Western projects face-plant because they tried to copy-paste their Silicon Valley approach. So I'm breaking down exactly how to navigate China's censorship maze, tap into Vietnam's builder energy, win over Singapore's gatekeepers, penetrate Hong Kong's old-money circles, ride Korea's narrative waves, crack Malaysia's trust code, and vibe with Thailand's mobile-first communities.

Got your eye on a specific partner? 👀

Drop "APAC" in the comments whilst tagging the project, and I'll try get you a warm intro from my stakeholder list of 300+ regional contacts

Note: Post was inspired by @ahboyash

1. CHINA 🇨🇳

China remains a high-potential yet complex crypto market. Despite a ban, underground activity is vibrant, with $86 billion in crypto flowing through the country from mid-2022 to mid-2023 and OTC volumes exceeding $20 billion by mid-2024. The market is driven by crypto-native users and curious pragmatists seeking wealth preservation and speculative opportunities. Stablecoins like USDT dominate. User psychology divides experienced users who navigate restrictions easily, while the general public remains risk-averse. Resonant narratives include financial security, blockchain innovation, and global participation.

To capture Chinese users, you must go underground but stay loud where it counts. Build stealth micro-communities on WeChat and QQ, wrap your product in "blockchain innovation" narratives, and flood early adopters with gamified rewards like airdrops, quests, and collectible NFTs. Move fast, speak their language, and make every action feel like a VIP invitation into the next big opportunity

Adoption

• Approx. 4.2% of population holding crypto

• Top exchanges: Binance (~20% of volume is from Chinese users), OKX, HTX

• Predominantly retail adoption

• DeFi shows strong growth

• NFTs see traction when framed as "digital collectibles"

• Memecoins see speculative hype cycles

• Infra protocols have limited but strategic growth

Regulation

• Fully illegal

• No formal tax framework for crypto

• Foreign crypto marketing restricted

Trends

• Dominant chains: Tron, Ethereum, BSC, L2s

• Top use cases: Stablecoin transfers, DeFi, OTC swaps

• Popular wallets: MetaMask, imToken, TokenPocket

• High-frequency behaviours: CNY → USDT OTC → DeFi, and airdrop farming

• Fiat on/off ramps rely on OTC desks and private brokers

• Popular narratives: Yield farming, airdrop farming

• Most active users: Retail traders, degens, airdrop hunters

• Sentiment: Primarily yield-maxi, secondarily anti-establishment and pro-privacy

Exchanges

@binance, @OKX, @HTX_Global (Huobi), @gate_io, @Bybit_Official

VC / Funds

@fenbushi, @CsquaredVC, @SevenXVentures, @DFG__official

KOLs / Agencies

@Cipher_Dance, @iamyourchaos, @snow949494, @Elabs_crypto, @EnHeng456

Community Groups

@ETHPanda_Org, @see_dao

Events

@EthereumSH

Media

@PANewsCN, @JinseFinance, @bwenews, @TechFlowPost, @ChainCatcher_, @Foresight_News, @OdailyChina, @BlockBeatsAsia, @BiteyeCN

Show more

0

0

43

359

39