Search results for LookUp

People

Not Found

Tweets including LookUp

Here is a concept newbies to automation struggle with related to webhooks...

Webhooks often contain minimal info to keep the data payload size small.

That can mean providing an object ID instead of the object details. (e.g. Contact ID instead of Contact Name, Email, etc.)

That requires another step in the automation to lookup the object by ID in order to get the full info about the object.

So it becomes a webhook + API request in order to get the object info.

Show more

0

0

0

0

0

This would be an awesome feature in @Zapier!

The ability to convert a mapped variable to be an AI variable in a Zap step field that is a dropdown.

The idea being the user could add a prompt to instruct the AI about which dropdown option to pick.

Example: Map a variable that has a State abbreviation (e.g. CA) to a dropdown field that has a list of States (e.g. California), where each State in the dropdown list has an internal ID (e.g. 12345).

So the AI is able to select the correct dropdown option, instead of the user having to translate CA to 12345.

It would replace the need for certain lookup tables and paths.

Show more

0

0

0

1

0

Let’s see your “Look Up” photographs https://t.co/XKjmlOQfiU

0

0

122

179

6

BEST WAY TO SPREAD LIGHT IS TO BE AN EXAMPLE ESPECIALLY IF YOU HAVE INFLUENCE IF NIGGAS LOOK UP TO YOU MAKE SURE THEY SEE YOU DOING THE RIGHT THING IT STARTS WITH YOU AND THEN IT SPREADS

0

0

1

3

0

🚀 $ECHO Token Sale is LIVE — Only on EchoX

Earn daily USDC yield from 50% of all trading fees.

🔥 10% burned daily.

🗳 1 Token = 1 Vote. Real utility. Real governance.

No lockups. No inflation. No empty promises.

👉 Join the Revolution — Own the Revenue.

Buy now → [https://t.co/JDMYouUS9k]

#ECHO# #TokenSale# #CryptoYield# #EchoExchange# #RealYield#

Show more

0

0

21

49

41

Good morning, friends.

Have a beautiful and blessed day.🙏🇺🇸☀️

“My voice shalt thou hear in the morning, O LORD; in the morning will I direct my prayer unto thee, and will look up.”

Psalms 5:3 (KJV) 🩷 https://t.co/fR2TOdhhp0

Show more

0

0

16

41

27

杯咖啡来灵感了,开启码字+撸毛模式:

今天再特别讲一下,我现在用不到5w刀,同时交互6530w刀的Infinex+4630w的Huma的心得!我发现还能同时撸Jupiter的交易空投+Wormhole的后期空投。

我的路径:

1.把炒钱多多的篮球NFT赚的差不多1000 $SOL 的一部分通过 @JupiterExchange 刷交易量换成 $USDC ,另外用交易所提了2w多个USDC到 Arbitrum链上(注:上面讲的金额都有吹牛逼成分,别信)。

2.用Infinex @infinex_app 的deposit把钱打进去到抽象账户,然后用Swidge,把这些USDC倒腾一下不同的链,最后都汇聚到Solana链的USDC(注:慎用这个,手续费和磨损很高,至少每千刀要3-5u起,土豪忽略);

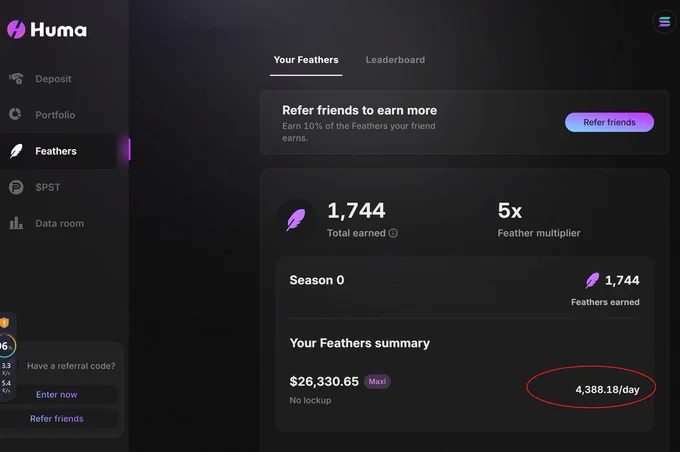

3.在Huma @humafinance 选择Maxi模式 no lockup零锁仓存进去,我现在每天能有3000-5000分吧(昨天开始的,目前26000在赚羽毛中,还有14000不到卡在Infinex刷量中,晚点一起搞到Huma,预计到时候每天能到5000-7000分)。

具体大家走我链接,一起来Huma存钱一起玩!

https://t.co/r2YvwR8d76

我再强调一下,为啥我看上了Infinex和Huma

1.首先肯定是融资,大融资意味着大流量、多用户、重资金,以及可能的大空投。

2. Infinex同时做了好几件事,简单讲就是把AA钱包/抽象账户+全链桥+DEX+质押借贷(Vault、Earn)等所有离钱最近的事儿。人家做钱包,他直接跳过钱包了,用Swidge搞定了上面说的一切,同时拿到了用户量、TVL、收益率、过桥费、手续费等;。

3.Huma据说是目前最屌的PayFi之一,看了TVL应该是够搞高,而且质押模式友好,要APY+Feather(羽毛积分)或者光要Feather羽毛都可以,而且是否lockup锁仓,随便选。还有一个很好玩的。Classic模式的 $PST 可以直接去交易换钱;Maxi模式的直接就能取现(48小时到账)。

而且PayFi的叙事,我是看到Ning总 @0xNing0x 在小群分析了他的真实世界操作的分享,就是从境外真的把钱瞬间转到账户了。速度是即时的,其中的十几刀手续费,就是Huma作为PayFi的真实盈利模式。

这年头,真正能挣钱的,才是牛逼好项目!

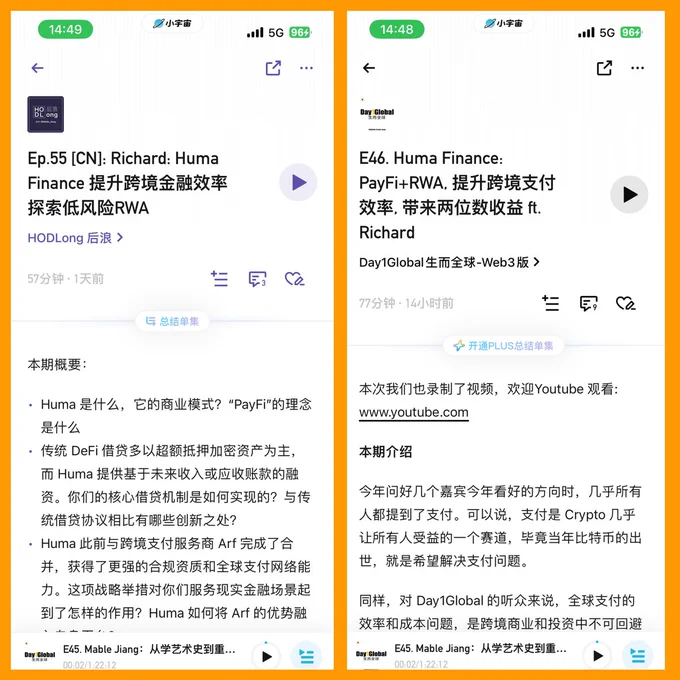

4.还有一个重要的原因,就是我很喜欢的投资人/创业者朋友Mable煤宝 @mable 的最新一期《后浪》播客就是专访Huma联创 RichardLiu(没有慧根,就要会跟!)。《生而全球》/Day1Global @day1globalpod (这名字真的不错,很天生骄傲的感觉!) 我看今天也推出Huma专访了。你懂的,他们大毛命中率超级高的。对了,两个访谈前后两天同时播出来了专访,好事将近已经很明显。看到的老铁们都是缘分(访谈自己去小宇宙搜索,生而全球在推特可以直接看油管专访)。

声明:以上都是我的个人猜测和看法,与我提到的人和节目没有任何关系!!!

5.Huma现在不卷,几十万分都能排名前十,没人弄。现在质押大家都不玩了,那我就要玩,另辟蹊径,走在大佬和大家对立面,我感觉才有机会成为傻逼或牛逼。冒着成为傻逼的风险,努力成为牛逼的人(这是我们十几年前上研的时候在新浪博客写的一句话,感觉现在想想都经典,哈哈)

6.撸毛要么多号、要么多金,或者二者结合。我干不了多号,有资金门槛的就成为了我的首选,这样就可以不那么卷了。主要现在超级有钱的大哥大姐们,现在都不怎么玩质押了,你懂的,巴比龙上了很多人,还好,我没上。大哥们节哀!

7.我喜欢的Kaito @KaitoAI (煤宝在访谈里说,这是当前趋势下,和当年银河一样的范式的的项目,我坚定跟随。对了,A10的宝爷也是这么认为的,哈哈)这几个项目都可以写写,还能赚yap,很爽,一举多得!

别的不说了,具体项目具体介绍,我之前写过了,可以参考我前几天写的文章

1. Infinex的详细介绍,可以看这里:

https://t.co/JtyjJCMtui

2. Huma的详细介绍,可以看这里

https://t.co/PubH3ihiXP

强调一下,老板们,Huma必须走我链接

https://t.co/r2YvwR8d76

Show more

0

0

63

138

27

High Gain by @kernel_dao

Institutional-Grade ETH Yield — One Click Away

High Gain makes professional ETH optimization simple, accessible, and liquid. With just one deposit, users tap into advanced strategies previously reserved for institutional investors.

---

Why Choose High Gain?

Democratized Yield Access

Since launching in November 2024, High Gain has reached nearly $30M TVL by bringing sophisticated ETH yield strategies to everyday users.

~15%+ Targeted Returns

Earn competitive yields through diversified strategies across Aave, Compound, Morpho, and Pendle—designed for efficiency and performance.

No Lockups. Full Liquidity.

Withdraw anytime. Rewards are earned in real time, with no staking periods or withdrawal delays.

hgETH: Liquid & Reward-Bearing

Your vault position is represented by hgETH—a fully liquid token that accrues rewards and can be used across DeFi, now including Pendle LP integrations.

Advanced Strategy Stack

Powered by capital-efficient loops (e.g., rsETH on Aave), strategic Pendle deployments, and automated compounding—all working behind the scenes.

Proven Backing

Developed by UltraYield ($2.15B+ AUM) and Upshift, an institutional-grade infrastructure provider. Strategies are actively optimized based on real-time market data.

Built for All Users

DeFi pros benefit from multi-protocol optimization without manual overhead

Newcomers access professional-grade yield and risk management—no complexity required

Show more

0

0

6

17

14

Announcement Regarding The Current $JAGER Trading Failures On PancakeSwap And Resolution

This was an unforeseen event. From the very beginning of $JAGER's launch on May 1st, the team renounced ownership of the token contract and made no code modifications. While "community-first" and a true on-chain spirit might not matter to other memecoins, it is everything to $JAGER.

Phase 1 and Phase 2 of $JAGER have achieved remarkable success. Phase 1 activated 1.4 million active and dormant BSC addresses. In Phase 2, we redistributed all unclaimed $JAGER airdrops over a 7-day period as rewards for liquidity providers in the $JAGER-BNB pool.

However, the success of Phase 2's liquidity incentives also introduced an unexpected issue: At present, $JAGER's FDV stands at $4.9M, with $3.6M of that locked in LP. PancakeSwap v2 imposes a hard cap—no single LP can hold more than 35% of a token’s total supply. The $JAGER-BNB v2 pool has now exceeded this limit, which may trigger transaction failures for large sell orders.

Upon identifying this issue yesterday, the $JAGER team immediately engaged in close coordination with @PancakeSwap devs. We sincerely appreciate their support and guidance in resolving this matter.

$JAGER Team’s Recommendations & Future Plans

1⃣️LP Unlock Timeline

- The majority of $JAGER-BNB LP tokens in PancakeSwap v2 were deposited on May 8th with a 14-day lockup period.

- Starting May 22nd at 10:00 UTC, these staked LP tokens will begin unlocking and can be withdrawn.

- Once this occurs, the current large-sale failures will be resolved as the LP ratio naturally rebalances below the 35% threshold.

2⃣️Strategic Tax Design for Long-Term Liquidity

- Prior to launch, the $JAGER team deliberately structured liquidity pools with foresight:

- PancakeSwap v4 (0.01% fee pool): No taxes were applied to ensure a low-slippage trading environment, enabling future organic liquidity growth.

- Automatic routing: Users executing trades will default to the pool with the best price and depth.

- Even after the v2 LP unlocks, the pool will continue to be reinforced by 20% of every transaction’s tax, which is automatically converted into LP tokens and sent to a dead address.

- This dead address has already accumulated $200K worth of $JAGER-BNB LP, ensuring that the v2 pool maintains sustainable depth and rewards long-term holders of 146B $JAGER.

3⃣️$JAGER’s Long-Term Vision

While expanding to more CEXs and growing the user base remains a priority, the team is committed to preserving 50% of tax rewards for holders—because even Hunters deserve some downtime.

Do you enjoy Hunter Time? Do you love $JAGERBNB?

Show more

0

0

54

125

41