Search results for OKB

People

Not Found

Tweets including OKB

cake应该走的是慢牛长牛路线

通缩路线

类似okb销毁完那次7亿后面的那段路

2-4年看20-30

但这一轮bnbchain整体冲刺加alpha加持加改经济学。预计3-6。具体是3是6。看这一波行情持续和bnb chain整体冲刺比例了。

不管怎样。

cake长期我抱定了

这几天我要遇见一个cake hodler持仓tg群。

做大做强,再创辉煌

Show more

0

0

0

0

0

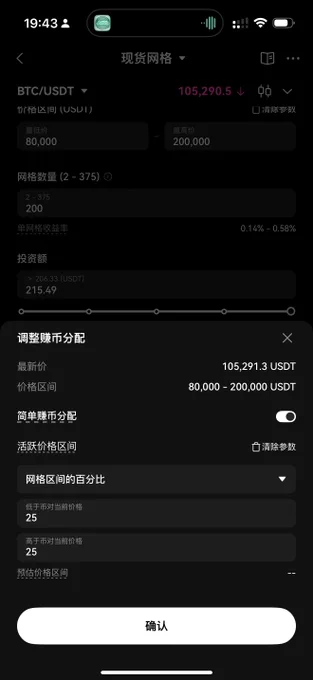

OKX 产品经理,他真的玩自己产品! @okxchinese @mia_okx

💗前提概要:#OKB#

我从比特币 35000 开始时候玩OKX的网格,那时候网格很粗糙,不能加仓,开仓时候价格都要去用小仓位测试爆仓价,然后我去反馈了海腾,然后不出一个月他们就加了策略功能!!!!

🏝️OKX产品经理真的听劝:

1️⃣为什么你们的合约网格,爆仓价、清算价格那么不明显?

OKX产品经理:改(老板,你看改版后的合约网格,一眼清晰,你再也不困扰)

2️⃣你们的现货网格真垃圾,开一个还要我去手动平仓,不能加仓,有时候我重新开,提取资金都是对我的负担,真难用!

OKX产品经理:改(老板,现在现货网格你可以随意加仓,同时增加了双币盈的功能,赚币的分配可以直接去理财,再也不用你动手去抽取资金了

3️⃣:你们未来能不能加上币本位的各种策略,我想用币去赚更多的币了

OKX产品经理:已收到,肯定在安排了!

🌊小结:

一款产品好不好用,你真的可以体会到的如果产品经理自己都不去体验,那真就没救了。 OKX的网格,是我除了派网用的最多的,最高峰的时候,我20万现货 Trump在跑网格,非常舒服,什么都不用管

如果你是一个小白,想躺着收钱,我建议你来OKX开个网格现货躺平,然后把赚币开关打开,剩下的交给天意,坐等BTC到20万美金

Show more

0

0

9

12

0

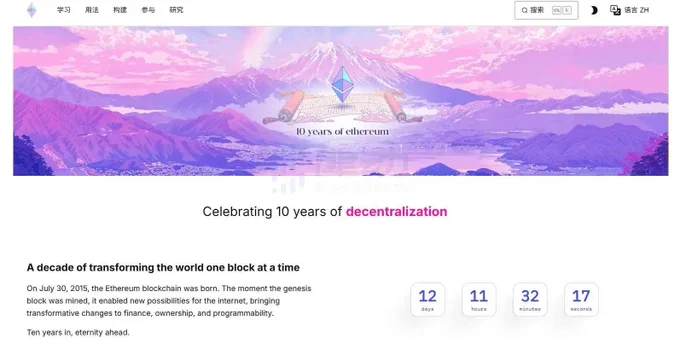

据官方公告,以太坊基金会将于 7 月 30 日,暨以太坊 10 周年纪念日当天,在中国深圳、香港等城市召开全球性社区活动。 https://t.co/OkbVZSWdJB

0

0

3

7

0

咋啦?还给我屏蔽了?真jb小心眼!@ mogpfp https://t.co/oKbHxyTSTg

0

0

0

0

0

‘Emas pun papar harga kenapa ubat tak boleh’, Armizan bidas doktor swasta #FMTNews# #FMTBerita#

https://t.co/OkBSBbq2nB

0

0

0

60

37

Overlooking the Bridgewater Canal, this beer garden has a rather unique view that'll remind you of the seaside https://t.co/oKBIjUY2D3

0

0

0

0

0

每次交易所出一点事韭菜就以为交易所凉了,交易所慌了,真的好好笑,bg几十亿储备金,你们集体骂bg,其实bg还很开心,说什么100u撸漏洞几十万美元,这样间接性给bg加了一堆新客户,一堆新客户想着以后利用漏洞赚钱,所以别意淫了,你们干不掉赌场的。什么币安okbgbybit这些交易所都不差钱,别再天真的以为他们能受什么影响,这就是这个残酷的世界,他们背后都被贝莱德,先锋集团控制,你再骂也没有用,所有交易所的ceo都是阴谋集团的话事人,傀儡

Show more

https://t.co/TESLb5lz73

0

0

63

136

9

【gx.7春闘天財• 超级 Giveaway 】R7/2/1

「史无前例,GX.7狂欢来袭 ,送送送

送 $usdt $bnb $okb $bgb $gt

串烧平台代币空投狂送,抽你爱用」

🎁 春鬪財↓(72H 开奖,按顺序揭晓) 🎁

🏆 交易所代币奖励 (💬 评论添加你喜欢)

- 1 $BGB × 7名(@bitgetglobal) 💵

- 0.3 $GT × 7名(@gate_io) 💵

- 0.1 $OKB × 7名(@okx) 💵

- 0.01 $BNB × 7名(@binance) 💵

💰 現金 & USDT 空投

- 1000 #PayPay# × 2 💴

- 7 USDT × 7 💵

🔥 春鬪獎

- $GX.7 777777 × 7 💵

💬 你主要用哪个交易所?👇

🚀 72H 倒计时,速来参与! 🚀

参与方式👇Join Now :

I. 关注 @kyou198611 / Follow / フォロー

II. 点赞 & 转推 / Like & RT / いいね&RT

Ⅲ. @3 位好友 & 评论 #春鬪Giveaway# / Tag 3 & Comment

Ⅳ. https://t.co/Wd9FK50QK8

👆评论祝福㊗️/ RT 👆

春天战斗的胜利,豪礼大放送

最高の春の勝利祭り

Join Now

#春鬪# #超级Giveaway# #NFT# #Airdrop# #Web3# #Crypto#

Show more

0

0

587

177

141

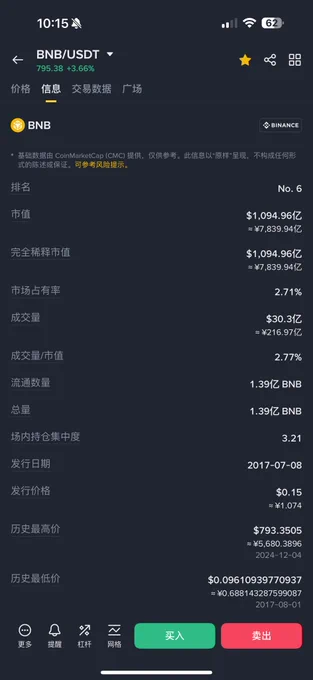

《 BNB 开启曲线救国?》

今天 $BNB ATH 后我看一堆人在讨论怎么之前一直跟稳定币一样的BNB突然这几天爆发了。

很久没有写长文了,我也来猜测一下,顺便把近期一些思路捋一捋,没有得到过官方的验证,全是我根据蛛丝马迹推的,大家当一乐看。但这些思路是我最近能拿稳BNB吃到大肉的重要原因。

~~~~~~~~~~~~

首先最近有动作大概率还是跟最近币股的爆发有关,或许就是从SBET,Tron等获得了灵感,不再刻意追求OKX的那条合规上市之路。

其实从过去一段时间不少迹象可以看出币安应该是对上市/合规有想法的,Why? @binancezh 虽然没明说,但一直在降低明面上给 $BNB 的赋能。

继Launchpad名存实亡很久之后(狮兄应该是全网第一个说Pad不会再有),Launchpool的节奏也越来越慢,上一个Pool还是5 月 6 日的 $SXT ,距今已经2个多月。

如果有心人去币安App看看,会发现不但 Launchpad已经搜索不到(只能去网站查看往期),连Launchpool功能的界面都改了,Holders Airdrop也归入进去。现在我严重怀疑未来还会不会有往期用BNB挖份额的 Launchpool 出来,虽然收益本来就缩水了很多。

Why?

之前狮兄分析OKx上市之路的时候针对老徐对 $OKB 长时间冷处理不赋能的原因做过分析。如果要上市,那么平台币是否属于证券,能否通过豪威测试(Howey Test)非常关键。

过去SEC曾经也明确认定 $BNB 涉嫌证券,而这是Pad消失的最直接原因,Pool虽然好很多但依然算是“打新特权”,所以逐步被弱化,并被Holders Airdrop取代,从而更容易通过Howey Test也是能理解的。

虽然我之前对币安US上市持积极态度,但OKx筹谋数年都还没结果,币安上市之路还很漫长,这一点得认。

话说回来,筹备合规和上市,打新收益降低可能是 $BNB 在很长一段时间内表现平平,随大流的原因。

上面狮兄列出来的表象都指向一个非常明确的趋势:BNB 正在被“去证券化”处理,这是为了应对豪威测试(Howey Test)潜在风险。如果未来有 IPO 或大型合规合作,BNB 是否是证券将是致命敏感点。

像 FTT、KCS、HT、LEO 等平台币也在“合规转型阶段”一度失去上涨动能,体现出这种模式下平台币天然的估值抑制。

~~~~~~~~~~~~

那怎么突然跟吃了伟哥一样硬了?

要知道,谁是最大的 $BNB holder? 大表哥怎么可能不关心BNB的价格,不希望BNB涨呢?

所以当这波币股浪潮来袭,有心人会发现,原来币安要上市,不见得只有走Okx那一条路啊,哈哈😂😂

看看孙哥的 $Tron, 不就是套了一个美股的壳曲线救国了吗?这是绕开SEC的另类路径,且已经被先行者证实可行。

那现在如此火爆的币股微策略,如果多几个正儿八经的BNB微策略公司,不就类似币安上市,而且还不止一个壳?

币安可能意识到,“做币股+微策略叙事”+BNB控盘拉升 = 变相市值重估 + 群体共识重建。这是更“Web3 native”的玩法,也能避开 SEC 的致命路径依赖。

所以 $BNB 脱离了合规转型束缚后,在微策略买入的刺激下,终于开始回归本我。

在我看来,没有合规的束缚, $BNB 早就应该1000以上了

~~~~~~~~~~~~

✅ 总结一句话:

币安可能正在从“合规上市”转向“多壳并进、变相市值重估”的战略转型期,BNB 的行情就是这种转型的直接产物。

不论这一波拉升是否有“实操派”控盘,它反映出来的 narrative 已经正在成型:BNB 可以“以虚促实”,不用非得走正道上市,也能达成市值跃迁。

一旦我这个推论被证实,那么除了拿稳 $BNB 吃够这波补偿,还要好好盯一下 BNB的微策略公司。

其中虽然可能有浑水摸鱼的,但大概率会跑出来一家类似 BMNR 或SBET 这样的龙头。

让时间来验证我的观点是否正确。

#BNB# #BNB微策略#

~~~~~~~~~~~~~~~~~~

【Is BNB Launching a Curved Path to National Salvation?】

After BNB hit a new all-time high (ATH) today, many people have been discussing how BNB, which had been behaving almost like a stablecoin, suddenly exploded in the past few days.

I’ll take a stab at explaining it and organize some recent thoughts. None of this is officially confirmed—just speculation pieced together from fragments of information. Take it as an entertaining theory.

~~~~~~~~~~~~

First, this recent surge is very likely related to the recent crypto-equity explosion. Perhaps Binance got inspired by SBET, Tron, and others, and decided to stop following OKX’s rigid compliant listing path.

In fact, there have been several signs over the past months suggesting Binance has been considering IPOs or compliance moves. Why? Although @binancezh has never said it outright, they’ve been steadily reducing explicit utility for $BNB.

After Launchpad became a mere shell (I may have been the first to publicly say Launchpad was done), Launchpool has also slowed down. The last pool was $SXT on May 6th, more than two months ago.

If you take a look at the Binance App, not only is Launchpad no longer searchable (you can only view past events on the website), even the Launchpool interface has been redesigned, and Holders Airdrop is now included in it. I’m seriously doubting whether we’ll see any more Launchpools using BNB to farm allocations again—even though the returns had already been greatly diluted.

Why?

Back when I analyzed OKX’s listing path, I explained why Xu (OKX founder) has long “cold-treated” $OKB and reduced its utility. If an exchange plans to go public, whether their native token qualifies as a security becomes a key issue. Passing the Howey Test is crucial.

Previously, the SEC had explicitly flagged $BNB as potentially being a security, which directly caused the death of Launchpad. Launchpool is somewhat better, but still counts as a “launch privilege,” so it’s also being phased out and replaced by Holders Airdrop. This makes it easier to pass the Howey Test—which is understandable.

Although I was previously optimistic about Binance US going public, given that OKX has been preparing for years with no results, Binance’s IPO journey will likely be very long. That’s just reality.

So preparing for compliance and IPOs, and reducing “launch-related” benefits, is probably why $BNB had been underperforming for a long time—just drifting with the market.

Everything listed above points clearly in one direction: BNB is being de-securitized, in order to reduce Howey Test risks. If Binance ever pursues an IPO or major compliance initiative, BNB’s status as a non-security will be a dealbreaker.

We’ve seen this story before. Tokens like FTT, KCS, HT, and LEO also lost momentum during their respective “compliance transformation” phases. That’s the price platform tokens often pay in exchange for legitimacy.

~~~~~~~~~~~~

So why did BNB suddenly get “Viagra-level” strong?

Let’s not forget: Who’s the biggest $BNB holder? Would Big Bro CZ not care about BNB’s price or want it to pump?

When this wave of crypto-equities exploded, someone sharp probably realized:

Binance doesn’t have to follow OKX’s path to go public 😂😂

Look at Sun Yuchen’s $TRON—it essentially backdoored its way into U.S. markets via a shell company. It’s an alternative, SEC-free listing path, and it’s been proven to work.

Now, with the crypto stock narrative on fire, if multiple “MicroStrategy-style BNB companies” appear, isn’t that basically equivalent to Binance going public—except with more than one shell?

Binance may have realized that:

“Crypto equities + microstrategy narrative” + BNB supply control + pump

= Repricing via new narratives + restored collective conviction.

This is a more Web3-native play. And it also avoids the SEC’s regulatory bottleneck.

So $BNB, once freed from compliance shackles, finally reverted to its true form amid the MicroStrategy-style buying frenzy.

In my view, without compliance overhang, $BNB should have been above $1000 long ago.

~~~~~~~~~~~~

✅ One-sentence summary:

Binance may be transitioning from a “compliance-first IPO” strategy to a “multi-shell, narrative-led repricing” strategy—and BNB’s recent pump is a direct result of that shift.

Regardless of whether this pump is backed by “hands-on controllers,” the narrative is clearly forming:

BNB can “fake it till it makes it”—it doesn’t need to follow the traditional IPO path to achieve a market cap leap.

If my theory proves true, then holding onto $BNB to enjoy this compensation rally is just the beginning. We’ll also need to watch BNB-themed microstrategy companies closely.

While some might be opportunistic, chances are a real leader will emerge, just like BMNR or SBET.

Let time tell whether I was right.

#BNBATH#

Show more

796了! $BNB 打破了2024年12月4日创下的793.35,实现历史新高!

全体起立,鼓掌

👏🏻👏🏻👏🏻👏🏻👏🏻

恭喜🎉 坚守BNB的金手子们,恭喜 @cz_binance @heyibinance 和 @binancezh @BNBCHAINZH ,信的人又一次获得了奖励,Bravo https://t.co/CxyFN19KBY

Show more

0

0

3

11

0

💰💰💰100U*🔟位老铁均分,你以为的10U不仅仅是10U!

📈CEEX交易所X鸿儒战队,注册就送1W算力,直接会空投到交易所的挖矿账户。

算力可以直接用于挖CEEX的平台币CMC,目前知道的人很少,建议搞起。

👉三连+评论区留下CEEX个人页面截图,4️⃣8️⃣小时开奖,中奖粉丝送矿机~

💪CMC采用POW+POC双重机制算力挖矿,避免了因矿机迭代、电力损耗、场地费用等引起的币值外溢。其逆向价值锚定的持续通缩模型是CMC价格长期增长的底层逻辑。“极致通缩"意味着CMC代币通过销毁来提升稀缺性和价值。用户可以销毁CMC代币以换取算力,并用这些算力挖矿。

🔗友情提醒:每个手机、每个账户,仅限领取一次矿机(要多号搞得记得自己分号)

注册和下载地址:

https://t.co/nF9JLtJ6as

🔒算力领取步骤为:注册-KYC-购买10u矿机-点击领取1W算力。

具体教程如下:

https://t.co/aqttfyXSg7

🔥几个值得关注的重点:

1. CEEX目前报道的不多,但是背后大佬和金主很多。私下和各位老板们聊过,应该是要搞很大的事情。

2. 平台币永远是值得关注的,比如BNB/OKB/GT/BGB等,这个比喻基本都懂。

3. CMC平台币的通缩机制:挖矿需要将CMC销毁兑换为算力,持续通缩;市场上所有的CMC都是挖矿所产生,没有任何其他获得方式。

4. CEEX老板的代币全靠自己挖,作为一个BTC的信仰者做到了去中心化挖矿!

交易所平台币市值有兴趣的可以去算一下,估计会有很多灵感。具体大家可以10u体验一波搞起来。

Show more

0

0

25

23

8

之前聊过几次数据标注,没想到第一次真的当“数据标注民工”居然是在 Sahara 😂

今天才上线的功能,选了一个音乐板块做尝试。Ber 不是,这活儿是真·苦力活儿啊。

一上来就要先回答 5 道测试题,这还算简单,给你播放几分钟的音乐,然后问你这些音乐是爵士、R&B 还是电子乐,以及男声女声之类的。

答到了 100 分,然后才能正式开始干活儿。

没想到第一首就开始上难度,碰到一首致幻剂风格的音乐。说实话,没那么大把握,因为其他选项是:前卫派、工业风等等。

然后听完音乐还要给出评价,比如说这个音乐是不是包含能量感,有没有情绪表达之类的。

和之前想象中的不太一样啊,说好的选择小猫小狗图片呢?以为小学难度,这个至少得高中难度了😂。

另外,偶尔还会穿插一些钓鱼问题,防止标注者乱选的。例如这个题目:

(歌手唱什么?A.卡拉OK B.数独 C.俳句 D.高原)

幸好它不给迷惑性选项,正常来说只要懂英文,这题就不会错。

里面估计还有金标任务(以前分享过,金标就是专家已经写好答案的钓鱼题),只不过看不出来,这种金标问题必须答对,否则会被警告甚至拒绝入场。

当然这些任务报酬也不低,一首音乐如果批准了可以拿 1.33 Sahara,考虑到 $Sahara 刚刚新高,大概是 0.15 美金,另外还有一些其他代币,例如 Solo 之类,估计也在 0.1-0.3 美金左右。

传统的数据标注行业的话,之前做过调研——复杂任务,熟手一个小时能赚 30 美金;垃圾任务,一个小时赚 10 美金也不是难事。

Sahara 这个看起来比传统平台还能高一些。

前几天看个帖子,说宝妈想赚钱,结果借钱开合约负债累累,其实还真不如去这种数据平台上打打零工,一个小时赚个 10-20 美金,别嫌少,对于三四线城市真的足够用了。

而且现在翻译软件这么多,而且 AI 都是包月的,一些文本型的任务做起来也不难。

挺有意思。

Show more

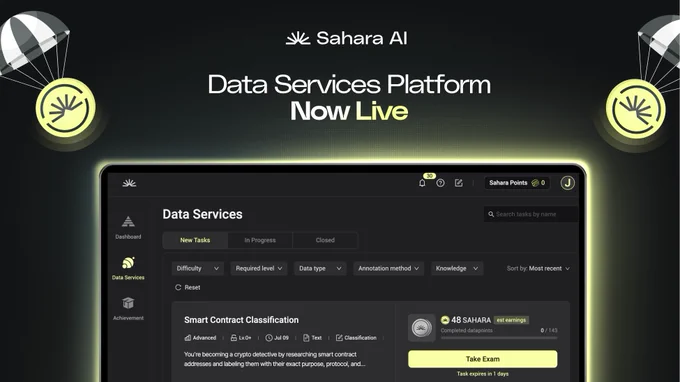

Data Services Platform (DSP) is LIVE!

🔆 Now anyone, anywhere in the world, can contribute to AI development and earn real rewards for their work.

🔆 $450K+ in $SAHARA + partner rewards available day one!

Get started today → https://t.co/mklUe0bfTF

#AIforALL# https://t.co/AFcvu19Zf9

Show more

0

0

0

4

0