Search results for STEPN

People

Not Found

Tweets including STEPN

since a few days ago some of the players who played @Stepnofficial and Gas Hero and @2184Official had been reaching out to me in DMs and asking how they could try out @trendsdotfun

the days running gas hero and 2184 were the most memorable days in my life

i wanted to thank you all for your deep love and involvement in the games that our team and myself spent days and nights creating and operating

in the next 6 hours if you, one of the dear @fslweb3 users, could screenshot 1 picture of your favorite STEPN or Gas Hero or 2184 moment, and quote rt my current tweet with this picture and "________ , trend is good"

i'll send you some "trend is good" tokens

it's for the culture

it's for our shared love for FSL

it's for trend is good

Show more

0

0

3

5

1

如何玩https://t.co/CcIAXa4q0E?

7 月 17 日 STEPN 的首席营收官、顶级 VC 机构 Multicoin Capital 合伙人 @Mable_Jiang 官宣启动新项目@trendsdotfun,同时也获得获得了 Solana 全明星阵容支持。

研究了两天,终于清楚 trends 应该怎么玩了,分享一下!

Show more

0

0

14

11

1

雪球这个cudis/Edamame 投研写的太好了,看完我更觉得是大毛 跟stepn跑鞋预期差不多,但是这个项目是真的有在关心你的健康。 背景更强,日韩群众基础广,布局了三四年才有今天这些东西。 bitget参投,赞助了bybit的巴厘岛会议。上所不会太难。 撸毛其实根本不用买戒指,你手机够多,appstore直接下载app,或者虚拟机够多就行了。只撸签到,走路,睡觉这些基础任务。 精撸的话咸鱼2手戒指+nft,或者苹果手表都有加成,成本非常低。七大姑八大姨手机都装上app.每天走一万步或者甩手一万下。 个人觉得没有必要追求单账号撸满。 他的签到签满要60天,TGE肯定不用60天了。 撸毛者尽早参与,随时TGE 用我的邀请码:SqJqPVTz 我有两个戒指,我感觉没啥必要。一个戒指是可以给两个手机录入设备的。就是你用A手机走完1万步,切换到B手机再走一万步,应该就可以了。没必要像我这样搞这么多戒指。除非你是真的很在乎健康。

Show more

0

0

11

14

1

<说点大家不想说的行业真相>

eth的联合创始人

总共卖了5亿美金的币

总资产A10.5

大概率不如stepn创始人

也不如GCR,AC这些大赌狗

很明显比pumpfun的7亿美金少

甚至可能都不如群友

人类文明级别的创新

早安,builders

早安,玛卡巴卡

Show more

0

0

2

5

0

我一直说,投资即投人

所以我看好trend @trendsdotfun

因为我无限看好@Mable_Jiang

很多人可能还没认真了解过美宝

但在我们小群里早有个说法:美宝指数(Mable Index),至今无一失手。

这不是一句调侃,是实打实的战绩。

作为前 STEPN 母公司 FSL 的首席营收官,曾掀起链上运动潮流;

也是Multicoin Capital 的合伙人,亲历过历史上最猛的一轮 VC 操盘。

最最关键的是,她对 Alpha 的判断极准:不是跟风,全是提前下注。早期参与的很多项目现在回头看都堪称范本,有兴趣可以听听她的播客《HODLong 后浪》,基本每一集都是战绩复盘。https://t.co/NqEeUQGbhj

而 @trendsdotfun,是她卸下机构身份后亲启的新项目。不是工具,也不是一款 App,而是一个锚定信息价值的社交协议。听起来可能有点抽象,但可以这么理解:信息本身是可以被定价的,而不是谁说的信息。

卡总@CalmanBTC 一句话点得很透:

重事件,重信息本身;轻 IP,轻博主。

远离无价值信息,不管是谁发的(哪怕是总统)。

Trends 正是围绕信息本身来构建市场,

它想做的是「Information Capital Market」,本质上就是:Alpha 本身是资产,不再是谁说的那么简单。

而且这不是空想,项目在 7 月 17 日完成天使轮,虽然金额未披露,但投资阵容已经拉满:

•Solana 联合创始人 Anatoly

•基金会主席 Lily Liu

•Jupiter 的 Meow 和 Siong

•LayerZero 的 Bryan

•Pendle 的 TN Lee

•Magic Eden 的 Zhuoxun

•Dragonfly 的 GM

•Folius 的 Jason Kam

全是顶级构建者亲自站台,懂得都懂这意味着什么。

所以我看好trend,因为Mable 不仅仅单纯搞个项目,而是重启了一种新价值共识的实验。信息的定价市场,很可能从这里开始。

Trends is good

and

trend is good

Show more

ok you don't need to stay tuned too long now

my ask: quote rt the post below with "_______, trend is good" (or simply just trend is good) and tag me

for the next 5 days at daily 4am UTC i'll pick top 5 highest quality engagement posts of the past 24 hours and airdrop the 5 account owners 10 SOL worth of mable's "trend is good" (the quoted tweet below, each person 2SOL worth)

i'll buy on chain at 4am UTC daily

trend is good

Show more

0

0

6

7

1

I want to clarify my experience with Yueya and share our full conversation with evidence. I’ve always acted in good faith to protect the community and ensure fair code distribution.

Yueya initially contacted me about a 20-code giveaway, saying she and @naive_bnb (Chinese community helper) had agreed to give away 20 codes in the following manner:

- 5 codes to her community

- 10 codes to the Defiapp team

- 5 codes to her BD team

I agreed to do the 20 code giveaway. However, when I checked with @naive_bnb, he informed me that he only agreed to 8 codes:

- 5 to her community

- 3 to the Defiapp team

This raised concerns about a possible miscommunication at the start of the discussion.

Later, Yueya sent me a list of 20 recipients, but the list did not include 10 members of the Defiapp team as she had stated. Some accounts on the list appeared inactive, such as @StepN_Alpha, and the overall list seemed to consist mostly of her personal KOL network rather than the agreed recipients.

When I questioned why there were 20 recipients instead of the 8 that Naive confirmed, Yueya's response was, “If you don’t keep your word, all 20 of our top kaito KOLs will come together to FUD.”

I asked her to clarify and avoid threats, but she repeated that we had agreed from the beginning and added, “If you want to play tricks, then there is no need for us to communicate.”

She later demanded a $5,000 USDT marketing fee per post, saying I didn’t fulfill my part of the deal. I had not agreed to any such fee beforehand.

To move forward, I suggested a revised proposal: we could run a giveaway of 20 codes directly to her community.

She declined and said “send the code directly. 20. If you want to express sincerity, send it directly, and I will make the code public to all community members… I can help you save face just now.”

To ensure fairness, Succinct does not directly send the giveaway host the codes used in the giveaway. We personally message each giveaway winner their code via DMs.

After consulting the Succinct team, we decided to honor our original agreement:

- 10 codes to the Defiapp team

- 5 codes to her community

- 5 codes to her BD team

Yueya did not respond after that and began a campaign to discredit me, saying I used PUA tactics.

I want to make it absolutely clear: I did not behave maliciously or manipulatively.

My concerns and initial questions were based on the miscommunication between Yueya's 20-code request and Naive's confirmation of an 8-code agreement. However, we decided to honor the 20-code giveaway that Yueya originally proposed and to which I had agreed with her.

I work for the community and my priority is protecting the interests of the community. In web3, it’s common for KOLs to receive special treatment because of their follower count. Some KOLs take advantage of their status to receive more rewards that wouldn’t be offered to ordinary community members. If they feel dissatisfied with the rewards received, some may resort to posting negative or misleading tweets in an effort to pressure the project and receive additional rewards. To ensure fairness to the community, code distributions are carefully handled to ensure codes are delivered to real contributors following the agreed terms. Any attempts to use influence or intimidation to secure additional codes for personal use or to distribute them outside the agreed terms are not permitted. This principle also applies to Discord roles, stars, and the Stage 2 whitelist.

Everyone is welcome to review the evidence and come to their own conclusion.

Here is evidence of our conversation: https://t.co/l5kgYbSiL3

Also, it should be noted that the Succinct Chinese community has the highest member count for L1 and L2 roles than any other region. The most active community member in Succinct, @lizuca25evelyn, has 39,856+ messages and holds the Proofer role (L2). @Frio424910 (10,208+ msgs) is a very talented artist from the Chinese community and holds the Prover role (L2). These are two examples, but Succinct has many more incredible Chinese contributors, too many to name. I also want to give praise to our Chinese moderator, @lovecity0088, who works tirelessly to ensure active community members have codes and passionate community members are promoted. If you enter the Succinct China Discord chat, you will see that most of the community members chatting have roles and codes already. If you have any questions, you can always directly contact @lovecity0088. If you are actively building the Succinct community, @lovecity0088 will see you and ensure you have a testnet code. We also host 6+ Chinese community events every week, where we play online games like Kirka, rocketbotroyale, poker, and deduction games, and sing together in Karaoke events. The Succinct Chinese community is a group of friends passionately building the community together and we welcome anyone to join us.

The Kaito voting campaign is over, but if any individuals who followed the voting rules did not receive a code, please contact me to receive one. Unfortunately, I cannot provide a code if you voted under the minimum voting requirement for a code.

I also want to sincerely apologize to the KOLs who were labeled as "FAKE KOL" in the Truth Lens image. Creating and sharing that image was inappropriate and unproductive. Regardless of any misunderstandings or disagreements, it was wrong to respond in that way. I take full responsibility and will be more thoughtful moving forward.

I don’t appreciate how I was treated by Yueya, but I hold no hard feelings towards her or her KOL friends. I wish them all the best of luck in the future.

Show more

0

0

151

283

38

TimeSoul全球首个"冥想修行×Web3激励"数字平台正式上线

核心价值:

- 开创性Meditate-to-Earn模式

- 区块链技术确权修行数据资产

- 融合全球6240亿美元冥想市场与Web3经济

产品架构:

1. 智能冥想辅助系统(AppStore冥想类应用畅销产品)

2. 可进化式Karma NFT体系

3. 经CertiK审计的TSS双代币经济模型

专业背书:

· 由维基脑力创始人领衔产品设计

· 前STEPN经济架构师打造代币体系

· 获得Venom基金会生态发展基金支持

限时活动(倒计时3天):

- 每日冥想可获得TTS代币奖励(新用户3倍系数)

- 组队参与排名赛,TOP50团队共享10万美元奖池

- 开放"正念NFT"限量铸造

参与方式:

官网注册:https://t.co/uD9ClMkhIx

Telegram活动:https://t.co/XgxIjdca4a

Show more

🚀 TimeSoul:全球首个「冥想觉醒×Web3激励」元宇宙修行平台——静心即挖矿,禅定生财富!

▌颠覆性赛道卡位

🔥 双万亿风口聚合:

- 撬动全球6240亿美元冥想健康产业红利

- 首创"Meditate-to-Earn"通证经济模型

- 链上修行数据永久确权,打造数字舍利资产

▌三大护城河体系

⚡️ 产品铁三角:

✔ 冥想AI助手(已上架AppStore畅销榜)

✔ 可进化式Karma NFT(附带链上功德值)

✔ 经CertiK审计的$TSS双代币矩阵

🦅 超豪华智囊团:

- 维基脑力创始人(800万用户产品教父)

- 前STEPN经济架构师亲自操盘

- 获Venom基金会千万级生态Grant

🎯 暴击级财富活动(倒计时3天)

💎 冥想暴富三重奏:

❶ 每日禅修15分钟=躺赚$TTS(空投系数×3)

❷ 组建战队冲榜,TOP50斩获$100,000奖池

❸ 限时铸造「正念NFT」

🪔 新晋专属通道:

✨ 官网注册立享特权:

https://t.co/uD9ClMkhIx

✨ TG抽奖:

https://t.co/XgxIjdca4a

#Web3禅宗# #Meditate2Earn# #链上修行#

[法讯] 5月7日质押池开光,早课APY高达888%!

Show more

0

0

52

110

52

🚀 TimeSoul:全球首个「冥想觉醒×Web3激励」元宇宙修行平台——静心即挖矿,禅定生财富!

▌颠覆性赛道卡位

🔥 双万亿风口聚合:

- 撬动全球6240亿美元冥想健康产业红利

- 首创"Meditate-to-Earn"通证经济模型

- 链上修行数据永久确权,打造数字舍利资产

▌三大护城河体系

⚡️ 产品铁三角:

✔ 冥想AI助手(已上架AppStore畅销榜)

✔ 可进化式Karma NFT(附带链上功德值)

✔ 经CertiK审计的$TSS双代币矩阵

🦅 超豪华智囊团:

- 维基脑力创始人(800万用户产品教父)

- 前STEPN经济架构师亲自操盘

- 获Venom基金会千万级生态Grant

🎯 暴击级财富活动(倒计时3天)

💎 冥想暴富三重奏:

❶ 每日禅修15分钟=躺赚$TTS(空投系数×3)

❷ 组建战队冲榜,TOP50斩获$100,000奖池

❸ 限时铸造「正念NFT」

🪔 新晋专属通道:

✨ 官网注册立享特权:

https://t.co/uD9ClMkhIx

✨ TG抽奖:

https://t.co/XgxIjdca4a

#Web3禅宗# #Meditate2Earn# #链上修行#

[法讯] 5月7日质押池开光,早课APY高达888%!

Show more

0

0

110

99

52

🚀一个超棒的项目:TimeSoul——正念+Web3,边成长边赚取奖励!

💡为什么值得关注?

- 6000亿美元市场:心理健康和正念需求激增,TimeSoul 结合 EdTech 和 Web3,打造沉浸式成长生态。

- 真实产品+奖励:已有 App(iOS/Android)、NFT、质押、任务挑战,代币 $TTS 即将上线!

- 强大背景:由 800 万用户的 Wikium 创始人打造,合作 STEPN、Rarible、Venom 等顶级项目。

🎁现在参与,赢取空投 & NFT!

- 5月10日前完成任务赚积分,快照后领取 $TTS 代币。

- 独家抽奖:通过机器人参与,赢 NFT 和代币奖励!

立即行动:

官网注册:https://t.co/l8XD6AgdG6

抽奖Bot:https://t.co/0fEqlXZqBq

机会有限,抓紧布局!

#Web3# #PlayToEarn# #心理健康# #空投#

Show more

0

0

54

106

104

3 月已经慢慢清退“空投”部门

基本退出撸毛圈

1/进入撸毛圈是去年 2 月份

在此之前,我的布局始终围绕在二级市场

那时候发生了两件事情成为了转折点

第一件事情是: 路飞@DLF2216在blur做市商爆赚积分,再通过抱团,一起从市场带走了A9 的收入

第二件事情是:op、apt、sui动辄发几亿美金的空投

这两件事情让我大为震撼

路飞@DLF2216把二级做市商的手法,用在了弱流动性的链上市场

相当于手拿屠龙刀去了菜市场杀鸡,这属于降维打击

而且正好碰上华尔街在菜市场里撒钱

2/

这打破了我“熊市里没有大机会”的认知

我坐立不安,隐约感觉市场的风向都要变了

在上轮周期,二级市场上我的判断力已经接近完美:

大周期逃顶:21年12月清仓

熊市反弹逃顶:22年2月进stepn ,最后高歌离场https://t.co/e9hMFOCAxY

下半年旅游休息

22年11月最后一跌:期权做空sol https://t.co/qZJfGyRepD

最后煎熬1个月等待抄底https://t.co/I6GSLtXwI1

但我幸苦分析、计算,在二级市场研究牌技和技巧

自认为风骚走位在塔下反杀,沾沾自喜时

才发现还不如路飞找到了一个更弱的对手牌桌

轻松取胜

勤劳不能致富,节俭没法持家

选择总是远远大于努力

如果维持以前老旧的思维

我不仅会在熊市战略性的收缩状态,颗粒无收

更会因为布局错了,后面的行情依然赚不到钱

3/

确定要战略性放弃“二级市场”后

我在 2 月很快就调整方向,在工作室新增了个“撸毛”部门

事实证明我来晚了

撸毛赛道因为Vc 的洗牌和 old money的进入

再加上项目的增多,熊市接盘韭菜的减少,需要各种活动内卷流量和用户。

早就形成了一个新的红利窗口

头部玩家 2 年前就开始撸毛,基本已经获利 A8

而我慌慌张张半路上了风口才发现:

撸毛和投机下注完全不同

撸毛是解答题。需要不断的解决执行中的问题,尽量要降低执行中的成本。

而投机是选择题。决策—判断—等待,根本不需要执行,尽量要降低交易中的摩擦成本

4/

选择确实大于努力,但风口不够大的时候,需要“努力”来弥补

而且当时的撸毛赛道,根本不需要过多的投研

拼的是谁的生产力强,谁同时干的项目多、干的号多,就能赢

赛道红利在的时候往往是粗放式的

直接、简单、粗暴

我投研的长板毫无用处,但我执行的短板却暴露无遗

Straknet的2000个号全军覆没:https://t.co/v5FohMSQUH

只在$AVEO和$Pracl 小有斩获

并且在补短板的同时,付出大的代价:

城市局限、人员管理,组织架构,成本控制

还因此踏空了 23 年下半年的铭文赛道

4/

从今年开始,撸毛赛道应该又是一个转折点。

从人力红利-人力互卷-资金互卷

说明这个赛道已经成熟了,红利已经消失。

内卷到

头部的工作室相当于腰部的工作室的优势几乎也没了

以前是以小搏大,1块钱成本能赚10块甚至50块钱回来

现在是10块钱赚3块钱的现金流游戏了

渔船上钓鱼的人比鱼都多

我已经看到了,又要重现去年撸毛工作室的倒闭潮了

市场一直在变化,沉沉浮浮,不会一直会符合自己的风格

三刀@sdcrypto123说过

(1)一个人不可能时时高光,总会有难熬时刻出现;

(2)一个人不可能永远处于低谷,不离场总有属于你的机会,不要焦虑;

(3)人不可能时时成功、时时抓到热点跟机会。

要坚定持有比较多仓位的btc跟eth防身,它是你低谷时依旧能保持好心态的坚强后盾

Show more

0

0

45

325

69

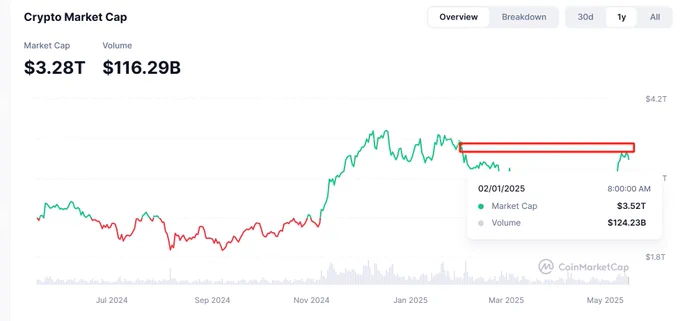

说一个扎心的真相:

◼︎ BTC只不过是恢复到了川普加关税前的水平。

◼︎ 然而,无论是ETH还是加密货币总市值,都没有达到2月1日的水平。

➤BTC行情已修复

2月1日,川普签署行政令,对中国、加拿大、墨西哥三国增加关税。2-4月的时间里,川普多次增加关税。一直到4月10月,川普暂停大部分关税措施,BTC开始向上。

看上去5月的大涨,只不过是对关税影响的修复。

➤ETH和加密总体市场尚未修复

ETH在Pectra升级的影响下,只是恢复到2月第一波下跌以后的水平。

加密总市值距离2月1日,还差9318亿美元。

➤稳定币在增长

好消息是,稳定市的市值在上涨,比2月1日上升了191.2亿美元。

只不过,现阶段稳定币的用途已经不限于币圈。

需要更多的资金流向稳定币,才能开启大牛市。所以,降息一段时间以后、最好是QE,才能带来足够的流动性。

流动性是大牛市的必要不充分条件。

➤不要对关税和降息太乐观

❚ 川普可能还要加关税

先来说关税,川普可能是真的想要加关税,他想要的是制造业回流。未必是为了给美国劳动力创造就业,甚至未必是为了国民收入。

要知道,一个国家的制造业总是关键产业。最简单的例子,2020年1月美国N95口罩的月产能仅为4500万,有人分析还不到中国的10%。

即使科技再发达,美国也需要保持一定的制造能力。以应对各种需求的变化、尤其是需求的突然变化。

所以猜测川普可能还要向各国适当加关税。

❚ 降息可能还要等待

关税对通胀和经济的影响是非常复杂的。

美国的进口大于出口,加关税以及对手国反制关税,对通胀的直接影响可能大于对衰退的直接影响。

但是,加关税导致会推动物价上涨。物价上涨会抑制国内消费,会加剧衰退。

另一方面,衰退使生产和消费减少,又有利于抑制通常。

所以,接下来川普会不会对东大以外其他国家加关税?加关税对通胀和经济会有怎样的影响?

很难预测,美联储的政策一向是有滞后性。需要观察接下来的政策、通胀和经济变化,才能做出决策。

所以美联储何时降息,还需要观察一段时间。6月的点阵图可能仍然没有结论。

➤写在最后

如果充足的流动性出现在2025年下半年甚至2026年上半年,都可以"邂逅"币市的情绪。

不要小看2026年上半年,牛周期后的上半年情绪还不会立刻退去。2018年上半年EOS与波场主网上线,2022上半年Stepn出世。

降息之前很难有大牛市,更不用说山寨季了。

近期即使川普再加关税,恐怕也不会像4月加的那么极端。即使美联储6月点阵图不乐观,但有可能停止缩表。所以也都不至于出现黑天鹅。

【这里不要相信蜂兄,蜂兄短线一向不准】大牛市之前,如果没有黑天鹅,个人的判断是震荡为主,类似去年3-9月等着盼着降息。

Show more

0

0

65

103

6

Lessons To My Future Bull Market Self:

This is partly to keep me accountable during bull market euphoria and also serves as a guide for those coming into the markets for their first cycle.

I’d be extremely impressed if you managed to “make it” the first time and even more impressed if you managed to keep it.

The former isn’t even the hard part. It is very much the latter. A blind Bored Ape Yacht Club member could make money in a roaring bull market. This is why many enter the markets for the first time and throw money at something they saw on Twitter, hear from a colleague or (the best one) get shilled by their Uber driver and convince themselves they have cracked the markets.

Stuff goes up because more money flows into the system. The opposite is also true. Hence the past 2 years of pain.

Your mission, if you choose to accept it… is to bet on the fastest and fittest horses in the race. This way you don’t miss an opportunity of a lifetime sat holding some worthless piece of shit whilst the rest of the people around you are making serious dough.

There are plenty of ways to get to that arbitrary number that you think will help you achieve eternal happiness. Whether it will or not is a different matter.

The following are some of the most important points that I have sat and stewed over which I think were at times the parts I personally went wrong in the last cycle, primarily.

2017 was just a blur. I didn’t have a clue what I was doing if I am honest. If you check the residuals in my Coinbase account it would be very embarrassing indeed.

The last cycle was infinitely better from a performance perspective. That being said, in hindsight, there were still so many stupid and silly mistakes that either stunted my portfolio growth or cost me a small fortune in losses.

Let’s get to it.

Disclaimer: If you are not mature enough to read this and take responsibility for your own actions in the markets please just stop reading. There are probs a few things I have missed that I will add on as time goes by and I get a brain zap and remember. This is not financial advice, I am extremely stupid. You will lose all your money listening to me

Stay Curious and Try Shit - Funnily enough, I think this applies more to people who may be on their second or third cycle. Naturally, when you come into the markets for the first time, all you want to do is digest information and buy shit. The further down the rabbit hole you go the more likely you are to find something early. The reinforcement of making great returns from being early encourages you to continue your exploration of the crypto/on-chain world. Always maintain this edge of being one of the first to try shit out. You never know when you will stumble upon something great.

As a bull cycle goes on the edge in the markets tends to erode due to increased competition both on a capital and skill front. People will outwork and outsmart you and there’s always someone with more capital around the corner.

Edge can be reestablished by trying shit early and deciding for yourself whether it has something about it. There were many different times last cycle that you could have picked up assets before the masses just by trying the protocol and seeing for yourself. Never leave it down to someone else to tell you. They can’t and won’t do it for you.

It has happened recently with Solana. The masses tell you one thing when in reality it is the other. This results in the majority of the market being offside on something that clearly has a lot going for it. Stay curious and try shit.

Don’t Chase Yield - If you are new to this market, DO NOT try and chase yield. You do not need to earn 20% on a position less than $200,000 (minimum).

There are going to be plenty of times when you are drawn in by a very tasty yield on stable assets. There are also going to be plenty of times when you are drawn in by ridiculous APRs. You’re probably going to provide liquidity on a DEX and get rekt there too.

The long and short of it is this. You do not need to concern yourself with earning yield when you don’t have a worthwhile portfolio size.

Why earn 20% on stable(ish) assets when you could have liquid capital and earn much more than that, oftentimes in one day (if you choose correctly)? The additional complexity, counterparty risk and smart contract risk are categorically not worth it at this stage.

If you play the farm and dump game with new ponzis that come online, please do not even entertain for one second that you should purchase the token that everyone is farming. There are bigger fish with more capital and experience that know how to play these games to a tee. You will be bait.

I’d even go as far as saying if this is your first or second time around just buy tokens and don’t do anything else with them (other than sell of course).

Maybe there are a few exceptions:

Holding an LST like stETH, rETH, swETH or pxETH over ETH if you have a long-term view (again, not really for everyone).

Staking a token to match inflation i.e. SOL (in this case use the most lindy SOL LST stSOL or mSOL).

If TIME makes a comeback and we go full ponzi season and run it back turbo

Don’t chase yield, it doesn’t make sense until you make it.

Let Others Drink the Kool-Aid - I was definitely caught sipping from the communal ponzi Kool-Aid fountain a few times last cycle. It’s quite funny because you know deep down that there is something cult-like about certain founders, communities and tokens but at the time everyone is printing money so nobody cares.

It always ends up in tears, literally every time. That being said, when you see a ponzi cult that has a founder that people would jump off a bridge for, just buy it. These folks never tend to realise they’ve been dumped or that they in fact were in a cult until it’s too late. The beauty of this (for you; an awakened market participant) is that people tend to wrap their whole online personality up in, said cult and when you are selling they are writing 40 Tweet threads about why the recent fud is unjustified. Let them be the exit liquidity they desire to be.

TLDR; Scams pump the hardest, Let others drink the Kool-Aid.

Position Sizing - I was too small on the way up and too large on the way down at times. This ain’t good. Larger more concentrated bets on less volatile yet sure-fire wins whilst rotating proportions into higher-beta assets to make more of the underlying position is my typical play.

Be wary of liquidity, particularly for on-chain assets. You may get away with poorly timed entries in a bull market but if liquidity thins out you get screwed entering a position and also screwed exiting a position. If they have a buy-and-sell tax which is more popular now, then you get screwed again.

I don’t really have much more to say on this one other than pick your poison (which I already have) and don’t fuck up the remainder of your portfolio oversizing into lower conviction plays, undoing the great entry on the large position.

If you can’t outperform BTC, ETH and maybe even SOL this cycle. Just buy those and forget about it until McDonald’s puts the minimum wage up to $50 an hour because all their workers got paper rich and left, again.

I can’t reiterate the above enough, if you aren’t serious about this and you don’t have the time don’t bother. Just keep it simple.

Shitcoins are Generally Good - First, we should define a shitcoin. In my opinion, anything that is purely created for speculation. The irony is that 99.99% of the market are shitcoins but some projects are more honest about it than others.

You are gonna lose a fuck tonne of money playing the shitcoin markets. You also stand the chance of making large amounts of capital very quickly, which if you are smart, you can then play the games mentioned above.

I can’t stress the fact that you can go completely flat-ass broke trading shitcoins not knowing what you are doing. These trenches are well-trodden by professionals who have more capital, more experience and more information than you. They haven’t stopped all bear market, they are fucking born ready for the next PEPE or SHIB. What is your edge?

The chances of you buying a shitcoin out of pure luck that goes on to make you serious money is slim to fuck-all. There are thousands of complete rugs launched Every. Single. Day. Learn the trade if you must, sniff out the good accounts to follow and get ready to have sleepless nights and to start spamming the group family message with /wen_marketing, because this shit will take over your life.

If this isn’t for you stick to the point above BTC, ETH and SOL. If you are a born fucking nugget degenerate then see “Position Sizing”.

If you don’t get it, buy it - I am becoming a lot better at this next point but still struggle. A lot of the time because I struggle to think like an absolute fucking moron. But, you must be the idiot. Eat, sleep and think like an idiot, if you are to catch the almighty pump led by redacted coins.

I know I would have missed the Stepn seed round. Move to earn, like what?! GTFO. I knew better, I was investing in the future of financial technologies. All the while it went 1000x and I had 0 position. Come to think of it move to earn was such an easy sell for the rest of the world outside of the echo chamber of CT. I just didn’t get it at the time and I paid the price. Never again.

If you have a visceral reaction to something good or bad, investigate it more, there is probably something there. After all we are emotional beings and charts are just human emotions expressed in candle sticks… I think RT taught me that one.

Write, write, write - This is simple. Writing is the fastest way to growthhack your understanding of anything. You have to check your own understanding of things before you publish them or you look like a tit. Just write and do it even if you aren’t going to publish, it helps clear your mind and structure your thoughts.

Stay Healthy - I got fat as fuck during the bull market. More money, more time spent sitting at the desk. DO NOT DO IT. You need to train as you would for anything. Staying fit and healthy is a way to perform better.

You Can’t Own Everything - There will be unlimited shiny objects during a bull market. You can own them all but you will not perform well. Do your research, get the best entry you can get and let the thesis play out. If you are wrong, you will know a lot sooner in a bull market.

Over-diversification is terrible if you are looking to grow the portfolio quickly and well. You can’t physically manage all those positions as much as you would like to think so. There is also no way you know all the bull and bear cases for each token you hold too. If you do, then come work for us at blocmates because that is impressive.

The crypto markets are so reflexive that it makes no sense to be over-allocated across too many assets. Winners can often move alone but the full market pulls back together. Get conviction and stop being a little bitch.

Break your bags - This stems from the point above. You best know the bear argument for your position because if it begins to come true then you need to exit and move on. If there is no bear argument for your position then congrats you have joined a cult.

Supply Dynamics are Everything - Tokenization is such a difficult dynamic to wrap your head around if you are just starting out. But, know this... You best be aware of large token unlocks, who is getting unlocked, the inflation schedule for the tokens you hold and what the supply of your token will be 12 months from now.

If you do not know this, then you should not own a token. If you think you can simply beat the market because some 1920’s data said that HODL outperforms, then you are my exit liquidity, thank you.

Token supply increases in crypto are absolutely brutal. Large unlocks and cliffs can increase a token supply by 2x overnight. Many tokens from the last cycle will not reach their previous ATH because of the drastic increase in supply. They might hit their market cap ATH but the price could still be lightyears away. Choose wisely.

The flip side of this is that a lot of OG tokens from the early DeFi summer days are nearing complete unlocks so no additional supply is left to come onto the market. This is as close to fair pricing as you are going to get. I am not revealing what these are you will have to subscribe to The Meal Deal once it goes live.

“Just One More 2x” - If you are in the fortunate position where you say to yourself “Just one more 2x” or if you begin to look at your dream home, just sell everything right that moment. A portfolio ATH is always a good time to take some of the more fruity positions off. If you are thinking it, others are too, you are not special and you are not a market outlier. Do yourself a favour, and secure the bag.

Don’t Paperhand Bear Market Entries - If you have just been through the past two years and hated every minute of it but you stuck to the plan and bought as much of a specific asset as possible, the worst thing you can do is sell it early trying to chase other people’s winners. Put it in cold storage out of the way so you aren’t tempted to even “take a bit off and buy back lower”. If you are talented then yeah go for it, most aren’t.

Other tips not worth writing a lot about:

- Use a DEX and birdge aggregator to make sure you are getting the best price

- Always use a Ledger

- Check DeFi llama directory to find the correct URL of a site. If that faults go to their Twitter and verify.

- Get authenticator 2FA. Get off of your phone number for security backup.

- Find your crew, you can’t be everywhere.

- Make your own decisions

If you enjoyed this then please consider subscribing to The blocmates Newsletter which covers a lot of our thoughts on the market, every Friday!

Link - https://t.co/B3KNx1TkNz

We also talk to a lot of projects, founders, builders, traders and investors about this kind of thing on our podcast which is also linked below

📺 - https://t.co/QOqnROq9d9

Show more

0

0

136

1.1K

327

Stephen Miller: "The Democrat Party is completely radicalized... They are committed to the 'rights' of illegal aliens over the very lives of American citizens... They want to end... America and create a new communist hellhole."

https://t.co/KA3sOOy495

Show more

0

0

2

66

9

Step into the showroom of the future — where robots do the talking. 🤖

Meet IRON, XPENG’s AI-powered guide, who's here to walk you through three of our smartest products:

🚗 MONA M03

⚡ G7

🖤 P7+

From bold design to seamless tech, this is innovation in motion. $XPEV https://t.co/nfzhK1uKT3

Show more

0

0

15

165

24

Stephen Hawking was born on the anniversary of Galileo Galilei’s death (January 8) and died on Albert Einstein’s birthday (March 14).

0

0

2

7

2

Stephen Hawking cheated and left his wife of 30 years who supported him through his illness, to marry his nurse, who was married to the guy who built his speech device. The second marriage ended in drama. His 2nd wife was apparently abusive and maybe broke his wrist. https://t.co/MEx7GEAzlZ

Show more

0

0

10

18

0

【Steps to Vote for $ETHS Listing on HTX】

1. Prepare Your Wallet:

•Download and install the TRONLINK wallet.

•English download link: https://t.co/M2QkXdZWlI

2. Deposit HTX:

•Transfer the amount of $HTX tokens you want to use for voting into your TRONLINK wallet address. (Important: Ensure the wallet is on the TRON blockchain.)

3. Go to the Voting Page:

•Visit the HTX DAO voting platform: HTX DAO Voting Platform | Decentralized Governance and HTX Token Decisions https://t.co/ggPtTceT5d

•Select ETHS and initiate your on-chain vote.

Show more

0

0

21

163

61

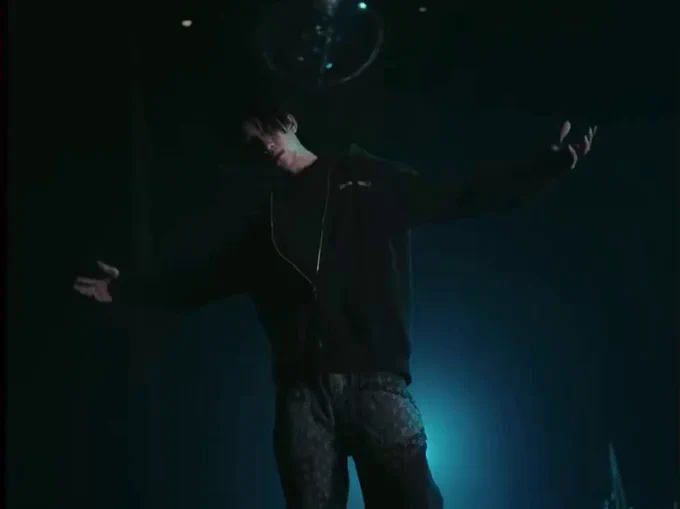

𝐒𝐓𝐄𝐏 𝐔𝐏 - 𝐒𝟐 𝐟𝐭. 𝐈𝐑𝐎𝐍𝐁𝐎𝐘

OUT NOW ! [OFFICIAL MV]

แล้วไป Step Up!!! เด้ง เด้ง เด้ง like that Dance, dance, dance. 🔥🪩 กับ S2 กัน

YouTube : S2 Official

📺 https://t.co/f05XYR07uQ

S2 Step Up MV

#S2StepUp_MV#

#S2StepUp#

#S2TheSunset# #Noeulnuttarat# https://t.co/QMiiDZKK0C

Show more

0

0

0

133

83

Stephen Miller gives a masterclass on the role of the President of the United States

“A president is elected by the whole American people.He's the only official in the entire government that is elected by the entire nation. Judges are appointed. Members of Congress are elected at the district or state level. Just one man and the Constitution, Article 2 has a clause known as the vesting clause, and it says the executive power shall be vested in a president, singular.

The whole will of democracy is imbued into the elected president. That president then appoints staff to then impose that democratic will onto the government. The threat to democracy, indeed the existential threat to democracy, is the unelected bureaucracy of lifetime tenured civil servants who believe they answer to no one, who believe they can do whatever they want without consequence, who believe they can set their own agenda no matter what Americans vote for.”

Show more

0

0

2K

54K

15.2K