Search results for ethereum-based

People

Not Found

Tweets including ethereum-based

Looking to profit from a rare metal? Look into @OICoinICO! 🔗 OiCOiN is an #ethereum-based# ERC20 Token which offers token-holders a #revenue# participation of all global crystallized Osmium sales. 💎 Join round 2 of this awesome airdrop on the TokenDrop app! https://t.co/qOTPb0cfWa

Show more

0

0

0

2

0

Silver tier quests drop tomorrow, so here’s a quick rundown on what this ‘Signal’ thing is that we keep mentioning at @boundless_xyz.

What is Signal by Boundles, and why does it matter?

It’s a ZK-based finality layer that could replace bridges as we know them. Here's how 👇

1-Signal grabs finalized Ethereum blocks, proves them with ZK, and broadcasts that proof to any chain.

Any protocol can now verify Ethereum finality, no multisigs, no trust, just math.

2-Anyone can run a prover, generate proofs, and earn points.

You can also boost block bundles (costs ~0.002 ETH) to get them proved faster.

Live now on Base (Mainnet Beta):

🔗https://t.co/VE5hsf19q0

3-Signal = universal finality

It unlocks true interoperability, secure, trustless, modular.

This is what Web3 was meant to be.

Read this listening to the soundtrack of champions,

let's go to the diamond berry fam!🔥

Be boundless 🍓

Show more

0

0

62

87

35

$ARKEO Airdrop 🪂 to $ATOM $OSMO $JUNO stakers 🥩 - April 3rd 2025

🥶Code freeze: end of January

🛠️Audit: February

🚀Mainnet: April 3rd

What is Arkeo?

🔸 @Arkeonetwork is a Cosmos SDK-based chain, for a decentralized marketplace for blockchain data.

🔸Supported chains at genesis: Bitcoin, Ethereum, Cosmos, and L2s.

$ARKEO Airdrop - legacy info -

NOTE THIS MAY CHANGE: Also this was when Airdrops were fun - not the fucking monkey guess work with no payoff that they are now.

🔸Rolling snapshots began November 22, 2022 at 22:00 UTC and ended on April 10th, 2024

🔸 $OSMO $JUNO $ATOM stakers are eligible

🔸Minimum time-weighted average balance is $500 worth is required over the time of rolling snapshots

🔸 2x Airdrop for stakers to Shape Shift DAO val

🔸 $OSMO LP providers and others may be eligible

🔸Cosmos Airdrop is 25% of the overall airdrop or 6.25% of total supply

🔸🔸 Stake 15+ $ATOM with with our Sponsor @EverstakeCosmos for a chance to win cool Cosmos NFTS: https://t.co/11hIxEiH4f🔸🔸

$ARKEO distribution when claiming Airdrop:

🔸1/3 is sent to users when they claim their airdop

🔸1/3 is send to users after they delegate Arkeo tokens to a validator

🔸1/3 is sent to users after they have voted in governance

$ARKEO Claim window

🔸6 Months

🔸All unclaimed airdrop tokens are sent back to the reserve.

➡️The initial proposed airdrop spec

https://t.co/29n67FvVsj

🔸Arkeo, originally incubated by the @ShapeShift DAO, has not had any VC funding or other additional investment. Instead it has been built as an entirely community driven open source project.

🔸 Designed as a decentralized blockchain data network, allowing participants to provide or access blockchain data in a raw or indexed manner, fostering an open, permissionless marketplace for web3 applications and services.

➡️Importance of Arkeo

🔸Arkeo democratizes the provision and access of blockchain data, offering compensation to node operators and enhancing data accessibility for dapps and web3 applications.

🔸Supports the decentralization and censorship resistance of crypto applications by ensuring a decentralized infrastructure for blockchain data, deemed crucial in a landscape with growing government scrutiny.

Huge shoutout to @ninjarobot for spotting and taggin - kudos friend! 🤝

Source: https://t.co/ZJ5bkgHBZ6

🔗Links

➡️Web: https://t.co/tGApWQFtms

➡️Discord: https://t.co/lDucX8QeUS

➡️Source: https://t.co/axRm89Uf4m

➡️Arkeo ShapeShift Proposal

https://t.co/6y9JIiuVH2

➡️Airdrop Claim details

https://t.co/VxYgGJdBlo

https://t.co/FgyIaZJWQT

🫡

Show more

0

0

15

307

98

Don't fret, brother.

Crypto is, and has always been, 99% nonsense grifty garbage/scams/jokes, and 1% fundamental global financial system revolution.

But this 99/1 is based just on quantity of projects.

Considered by market cap, it's more like 75% quality, 25% nonsense. Bitcoin is good. Ethereum is good. Stablecoins are good. Several dozen defi projects are good. Wildly cool technology permeates through all of it, and sound economics underpins its long term growth, though the short term feels often like an appallingly irrational market.

How to cope with this dichotomy?

Embrace the degen frontier and have fun, and recognize that amidst it all, a decentralized financial system is real, is important, and is working. None of it is forced on anyone, after all.

We are building and we are attracting the world toward us... and much of the world simply wants to gamble and have fun. This is okay, and actually provides capital for the important work happening behind the casino.

It is, actually, working.

We are realizing the wildest dreams of those who are into it for all the right reasons, despite the accompanying fantasies of those who aren't.

Just keep building, and build well.

Show more

0

0

179

2.7K

454

When I compare most chains to @movementlabsxyz, I find founders that are building on Movement significantly younger, in fact I can say if you took the average age of founders from every chain today, Movement Labs would come up with the lowest number.

I got to know about Movement back in 2023 summer, when I was an intern for @DoublePeakGroup, where @galenlawkun gave me an intro about 2 dropouts who were building a network of Move-based blockchain. This is also where I met @LeowongWL, before he started building @WarpGateX with @kng30000.

Fast forward one year, just graduating high school and turning 18, I started working at a few protocols and a devshop mainly on ethereum doing some work for WorldCoin, Brevan Howard Digital, EigenLayer, Starknet…

during this time, the idea of me building a project on Movement Labs as something I can do within my first year of University, which resulted in me building @CourageMove. I now working on multiple projects, not just as a founder, but contributor and strategic advisor to projects based on Movement.

i think @rushimanche and @coopsmoves will continue to see more university drop-outs and students building on their chain because this chain was built by gen-Z founders for gen-z founders, chads like @PhilipQiu5 and @lawrencelimxyz who are building @henrysocialxyz being one of the first builders I met in the eco, @chazzgordon99 and @wasjakehere building @buildnexio, @BRKTgg team, @canopyxyz team, and @semona0x building @vomeus who i connected with earlier this year, being the only other teenage founder on Movement.

hyped to see more chads joining the ecosystem upon Movement mainnet GMOVE

Show more

0

0

17

79

20

鸟哥最近注意到, @vooi_io 推出了一个大升级,叫做 VOOI V2。这事儿在 DeFi 圈子里引起了不小的波澜,因为 VOOI 这次的目标很明确:让交易变得更简单,更高效,同时还不放弃 DeFi 的核心价值——自托管。

地址:https://t.co/zu0Hpg6DFg

VOOI V2 的核心理念是“Chain Abstraction”,简单来说,就是让你不用再为链之间的复杂操作头疼。过去,跨链交易往往需要用户手动切换钱包、处理桥接、支付 gas 费,现在这些麻烦事儿都被 VOOI 给抽象掉了。用户可以通过一个统一的余额(Unified Balance)在多个 EVM 链上交易,比如 Ethereum、Arbitrum、Optimism、Base 和 BNB Chain。鸟哥觉得,这听起来有点像 Robinhood 对传统股票交易的简化,但 VOOI 做的还不止于此,它保留了 DeFi 的自托管特性。

这个升级的核心功能之一是“Gasless Trading”,也就是无 gas 费交易。过去,链上的每笔交易都需要支付 gas 费,这对用户来说尤其是在小额交易时,是一笔不小的负担。现在,VOOI 通过 collateral sponsoring 的方式,让交易变得“免费”,这对普通用户来说简直是福音。鸟哥想,难怪 VOOI 敢说“就存钱,交易就行”,因为整个流程确实被简化到了极致。

不仅如此,VOOI V2 还支持多种登录方式,包括钱包、邮箱、Google 和 Telegram。这意味着用户可以根据自己的习惯选择最方便的方式进入平台。鸟哥记得,以前有些 DeFi 平台强制要求用户使用特定钱包,体验并不友好,而@vooi_io的这一设计显然更贴近用户需求。

另一个值得一提的功能是“1-Click Trades”,也就是一键交易。过去,用户每次交易都需要多次签名,现在 VOOI 通过技术手段减少了这些繁琐的步骤。鸟哥觉得,这对那些不熟悉 DeFi 操作的新手用户来说,门槛降低了太多。

当然,VOOI V2 也不仅仅是针对新手的。平台提供了两种模式:Light Mode 和 Pro Mode。Light Mode 更适合普通用户,简化了交易流程,专注于 AMM-based DEXs 上的交易;Pro Mode 则针对高级用户,提供更复杂的订单类型和定制化选项,比如 Orderbook 支持和 Hyperliquid、Orderly Network 上的交易。鸟哥觉得,这种双模式设计非常聪明,既照顾到了新手,也满足了老手的深度需求。

目前,VOOI V2 已经支持多个 DEX,包括 KiloEx 和 Ostium,未来还会有更多 DEX 加入。鸟哥注意到,平台的目标是覆盖更多的市场类型,包括 Crypto、RWA(Real World Assets)和 Exotic Markets。换句话说,VOOI 想成为一个“One-Stop Trading Marketplace”,让用户在一个平台上就能完成所有交易需求。

鸟哥还发现,VOOI V2 背后有一个强大的技术支持,那就是 OneBalance 系统。这套系统让跨链交易变得无缝衔接,同时还整合了 AI 基础设施,比如 AI Copilot,可以帮助用户更好地导航和决策。鸟哥觉得,这一点尤其重要,因为 DeFi 的复杂性往往让用户望而却步,而 AI 的加入无疑会让整个体验更智能。

总的来说,VOOI V2 是一个 ambitious 的尝试。鸟哥认为,它的目标不只是简化交易,而是重新定义 DeFi 的用户体验。未来,VOOI 计划继续扩展 DEX 集成、增加更多市场类型,并进一步自动化交易流程。鸟哥觉得,这条路还长,但 VOOI 的方向很明确:让 DeFi 变得更Accessible,同时保留它的本质。

#vooi#

Show more

嘴撸确实累了,很多人跟我反映每天嘴撸排名焦虑的很,Kaito被ICT集团占领,饼干被反撸,不如试试币安广场的嘴撸平台:创作者任务平台,我看了一下目前总的奖励金额70万美金,虽然肉不多,但“狼也少”,可以同时把币安广场的账号做起来,币安广场对于新人来说涨粉还是很快的,至少没有推特卷! 不说啦,我去撸币安广场啦!

KOL除了推特,币安广场就是最好的创作平台,只要坚持涨粉很快,哪怕只有几百个粉丝,只要内容过硬也可以获得数万展示量,我知道有很多项目方专门去投放币安广场的广子,上万粉丝就能有几百U,其实道理很简单,币安广场的粉丝都是实打实的,推特刷粉太容易了!

参与地址:

https://t.co/NRH2Bg7bFZ

输出的时候别忘了加上 #WalletConnect# 标签。所有符合条件的帖子必须至少包含 100 个字符,包含 $WCT 代币标签,并提及 @walletconnect

Show more

0

0

1

2

0

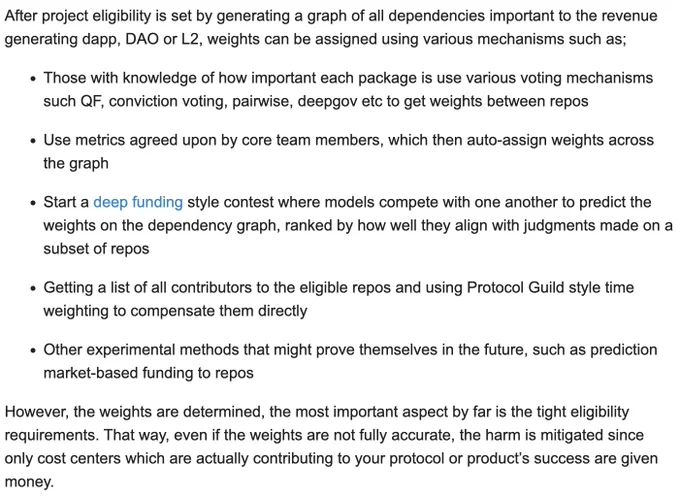

just wrote up a monster post with @sejal_rekhan around how ethereums ecosystem can become self-sufficient & circular

Some of these ideas have sat in my head for ages & grateful to Sejal for making the push to comprehensively write up an entire roadmap

here's a 5 point TL;DR

1. There's limited appetite for a "shared treasury" to fund infrastructure as that feels like "donating"

however there is a desire by ecosystems to contribute to repos that they depend on, which feels more like integrating revenue & cost centers

For eg, @CurveFinance makes use of @vyperlang ; so funding them isn't a donation so much as making their own product more secure

2. Eligibility requirements is the hard question to solve for; what repos should even be allowed into an ecosystems funding round, whatever the mechanism may be?

On what grounds could Curve include vyper in their funding stream but reject solidity?

3. There's need for an L2Beat style system tracking the extent to which DAOs, dapps & L2s are funding software they make use of

it would be quite manual though, since answering questions like "does @arbitrum contribute more or @Optimism" isn't straightforward, since @prylabs is funded by offchain labs but needs to be accounted for

similarly some of optimisms funding goes to growing dapps on their ecosystem (creating dependents) rather than their dependencies, so opinionated calls would need to be made on how much of the retrofunding gets counted in the leaderboard

4. We propose augmenting the pledge to,

,,1% airdrop to @ProtocolGuild , 2% revenue to your own dependencie"

Some estimates of funding amounts if this pledge gets taken;

- @ensdomains earned $31 million over 12 months, so $620k to their dependencies

- @Securitize gave $25.4 million in dividends, 92% on ethereum, 2% of which would be $467,360

- @nounsdao is currently selling at ~2 ETH/day, 2% of which over a year would be 14.6 ETH to repos they depend on

5. Finally, how would we go about fairly allocating to repos?

Step 1 is simply generating a dependency graph of all repos that make your revenue generating product work well

Step 2 is giving weights to each dependency. QF, Deep Funding, Futarchy, PG style time weighting, metrics based retrofunding etc are some ways to obtain weights

Step 3 is encoding a stream from revenue earned to your local dependency graph, thus creating reliable & recurring funding for teams that your project depends on

Curious to actually see how these ideas pan out in practice!

if you're building in public goods, pivot from seeking donations to self-interested systems where projects can easily pay for the software they rely on

Show more

0

0

18

59

10

IMO: there is a strong probability China plans to back their digital Yuan with Gold and the US plans to back their digital Dollar with Bitcoin and Gold.

Both currencies are implemented as a pegged stable coin. Digital Yuan on a proprietary private blockchain or on public Tron blockchain and the digital dollar on public blockchains including Solana Ethereum Base and SUI.

Bonds will be monetized in stable coins.

More to come.

Show more

0

0

37

579

66

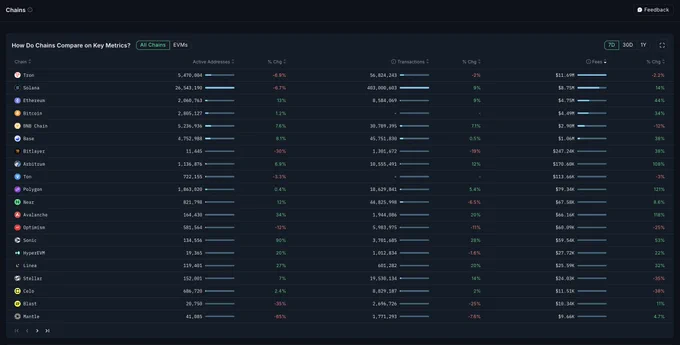

币安Alpha活动之Sonic链龙头Shadow Exchange x33 小白使用教程🔸

最近币安Alpha也上了Sonic的交易比赛,做了一个教程帮助大家快速上手

参与体验 @ShadowOnSonic 和 @ShadowOnSonicCN 打造的 Shadow Exchange,还有 x33 稳定的收益表现。

🔶教程开始👇

一. 准备工作:设置钱包并连接到 Sonic 网络

步骤:下载兼容钱包:推荐使用 #OKXwallet# , 刷分使用币安钱包

①配置 Sonic 网络:

打开钱包,添加 Sonic 网络(现在okx啥的都有自动加),可参考 Sonic 官方文档https://t.co/7Gsadp4OuG

网络参数:网络名称:Sonic

RPC URL:https://t.co/yGPIKWp9x9

链 ID:64165

货币符号:S

区块浏览器:https://t.co/ovfBWSwStt

②跨链

使用 Sonic 官方桥接工具https://t.co/ABSlqa9BBw

从其他链(如 Solana、Base 或 Ethereum)将资产(例如 USDC、ETH)转移到 Sonic 网络。

③获取 $SHADOW 或 $x33

在 Shadow Exchange https://t.co/CiLcHR0SWj 等交易所购买 $SHADOW ,然后兑换为 $xSHADOW(1:1)

买x33的话直接换就行。

🔸小白提示:确保钱包内有少量 $S 代币用于支付 Gas 费,Sonic 网络 Gas 费极低(得益于 FeeM 机制,90% Gas 费返还给用户)。

二. 参与 Shadow Exchange:质押、交易与治理

①访问 Shadow Exchange:

前往 https://t.co/LJyEFMUbHR

页面输入邀请码 RMF5HW 拿10%加成

连接钱包,将兑换 $SHADOW 为 $xSHADOW:

在「Stake」页面,将 $SHADOW 兑换为 $xSHADOW(1:1 比例)。

选择质押期限(15-180 天,14 天内免费退出,180 天前退出有 50% 罚金)

②买$x33

直接买x33,无需手动投票或管理,$x33 自动复利协议费用、投票奖励和 rebase,简化操作。

③参与流动性池:

在「Pools」页面,选择流动性池(如 x33/SHADOW,流动性达 112 万美元)。

存入等值资产(如 $50 x33 和 $50 SHADOW),选择传统或集中流动性模式。集中流动性可设置价格范围(如 $54-$67),目前最高一个池子的450%,直接起飞

④参与币安 Alpha 交易比赛:

在币安 Wallet 上交易 x33/SHADOW 交易对,争夺 220 万美元奖池。

🔸新手建议从低风险的稳定币池(如 USDC/USDT)开始,减少价格波动影响。

三.进阶操作:使用新界面与治理参与

①目前Shadow Exchange推出了新界面功能

x33 专页可以一键查看 $x33 转换、历史回报率、分析图表和铸造功能,简化操作流程。

MultiSwap支持多种代币批量兑换,无需多次点击即可合并奖励,节省时间。

②拿币参与治理

持有 $x33 或 $xSHADOW 可投票决定流动性池的激励分配,并且是自动化投票,在「Governance」 可看。

Show more

0

0

39

71

14

链上我怎么玩✍️

所有内容纯属意淫,如有雷同纯属巧合。

在sol上我这么玩

基本上solana上,我很难做到枯坐,因为枯坐挺无聊的,所以枯坐塞内盘这些,基本上我做不到。

我都是看各种信息,无论是海外cabal还是海内车头看看他们在玩什么,知道基本的信息后,自己再分析是否实力足够。

尤其是 @real_dr_pump 会给我提供各种知识,包括西方的各种梗还有当时AI的知识。

基本上选择“易于传播”的,还有能够搭车的,例如 $USELESS $ANI 这类, @elonmusk 和 @theunipcs 天天喊。

要么就是 $AURA 这一类,你能看见天天都有人喊的。

其实说到底至少在 #Solana# 上玩的是“传播学”,谁能洗脑,谁能传播的好,最后最重要的是有资金盯上。

当然最近我喜欢看谁喊单,喊单越凶,尤其是我又知道喊的单就是ta在操盘,那我会分析下上不上,毕竟ta操盘的优势就是带来买量,如果低位割完了,以后就失效了。

只能说哥继续保持,你发一个盘我玩一个,我慢慢耕种✍️。

链上地址跟单这个思路,我很难做,因为我很在意成本优势然后很懒,每次都是猪哥喊我😂。

话说兄弟们怎么玩,教我下,我学习下。

先写到这,要出一趟门,可以把 @base @BNBCHAIN @ethereum 等等留到后面写了,又能水起来了🤔。

Show more

0

0

0

2

0

Base-BALD Deployer Bridges $12.9 Million To Ethereum, Moves 2,100 ETH To Kraken

https://t.co/zSWEI1YMm9

0

0

3

10

45

💵 Base x Iskra x ClashMon WL

🔗Link https://t.co/qbYC28Yz46

🔹Fill Your Email.

#BTC# #Airdrop# #Ethereum# https://t.co/Q357PcVO5C

0

0

1

13

48

Coinbase Announces Ethereum Bridge And NFT Functionality For L2 Base

https://t.co/dTwpgOeD8e

0

0

2

10

57

🤝 Deploy today on @ethereum, @0xPolygon, @base, @zksync, @arbitrum, and soon with @optimism, @Celo, and @peaq

🤝 Leverage best-in-class user experience with @ensdomains, @efp, @WalletConnect, @etherscan, @OctavFi, @flaunchgg

Show more

0

0

5

86

19

TOKYO EVM DRIFT: Been an OG on Ethereum, Polygon, BSC, Base, Arbitrum, or Unichain?!

🔥 Repost + Comment your wallet address

🎁 Get 10 GXP as part of our Road to TGE

🐳 +25 GXP for OGs if your wallet is 5+ months old https://t.co/1iN6yEyaGy

Show more

0

0

12.8K

9.3K

8.9K

以太坊(Ethereum)最新的重大更新是 Pectra升级,已于2025年5月7日正式在主网上线。这是继2022年合并(The Merge)和2024年坎昆升级(Dencun)之后的第三次重大升级。

随着Pectra升级,以太坊今日涨到了1940u每枚。这篇文章就详细说一下,这次升级后对以太坊都有那些利好,以及对那些项目有影响。

先说升级内容,本次升级包含执行层(Prague)和共识层(Electra)的双层硬分叉。

先说执行层部分,执行层部分升级内容主要是EIP-3074(AUTH和AUTHCALL),EIP-5806(委托调用改进),EIP-2935(历史状态访问优化)EIP-7702(账户抽象扩展)EIP-7685(通用执行请求)。带来的影响是,EVM性能优化,通过改进操作码和Gas计费机制,降低复杂合约的执行成本。新增操作码支持更高效的密码学运算(如椭圆曲线运算),提升安全性。数据可用性增强,执行层与共识层协作,优化Blob数据存储(由EIP-4844引入),为L2提供更低成本的数据可用性。Blob容量翻倍(从3个增至6个),直接降低Rollup交易费用。从生态角度讲,此次执行层的升级,从各个角度给ETH带来了新鲜血液。首先是EIP-3074和EIP-7702使钱包操作更直观,类似Web2应用的流畅体验,吸引非技术用户进入DeFi、NFT等领域。其次是(EIP-7685)(EIP-2935),简化了开发者的DApp开发,对自动化交易方向,提供了技术支持。还有就是L2生态,本次的升级Blob容量提升直接降低L2交易费用,跨层交互优化促进L1-L2无缝协作。

再说共识层,共识层部分主要更新内容主要是:EIP-7600(灵活质押上限)EIP-7251(质押退出优化)EIP-7594(数据可用性采样)EIP-6988(惩罚机制改进)。EIP-7600 将验证者质押上限从32 ETH调整为32 ETH至2048 ETH的动态范围。允许验证者根据需求调整质押金额,降低小额质押者的进入门槛,同时支持大额质押以提高效率。吸引更多个人参与质押,增强网络去中心化,减少对大型质押池(如Lido)的依赖。EIP-7251 优化验证者退出机制,缩短退出队列的等待时间(从数天减少至数小时,具体取决于网络负载)引入更高效的余额处理,允许部分质押资金快速退出。提高验证者的流动性,降低退出成本,鼓励更多用户参与质押。 EIP-7594引入初步的数据可用性采样(Data Availability Sampling),为未来的Danksharding分片技术铺路。验证者只需验证部分Blob数据(而非全部),降低节点运行的带宽和存储需求。提升网络的可扩展性,支持L2 Rollup的低成本数据存储,同时为全分片做准备。EIP-6988优化对验证者不活跃或恶意行为的惩罚机制,减少误罚情况。更精准地识别网络故障与故意攻击,提高惩罚的公平性。增强网络安全性,激励验证者保持在线和诚实。对生态的影响,EIP-7600和EIP-7251降低质押和退出的门槛,吸引更多零售用户参与,预计验证者数量将显著增加。灵活质押上限支持个人和小规模验证者,减少对中心化质押服务的依赖,促进网络去中心化。Blob容量翻倍直接降低L2的数据存储成本,利好Rollup的交易吞吐量和用户体验。 数据可用性采样的初步实现为L2的长期扩展性提供技术支持。 惩罚机制的改进和验证者参与度的提升增强了以太坊对51%攻击的抵抗能力。更高效的退出机制降低了验证者因资金锁定而产生的风险。

这就是关于本次Pectra升级具体的内容,现在分析升级后对那些项目生态造成影响。首先是质押赛道,本次升级内容关于质押部分的内容很多,对质押类项目也是影响比较大。此次升级降低了个人质押门槛,鼓励独立验证者或小型质押池参与。这对现有的质押类项目来讲,会有一定的分流。但是质押类项目因为其复杂性,和defi项目的密切合作,使得质押类项目大概率不会丢失太多的用户,会保持相应的地位。但是对其中类似Rocket Pool的去中心化特性可能更吸引注重去中心化的用户。

对L2的影响。交易成本降低:L2 Rollup(如Arbitrum、Optimism)的数据存储成本减少约50%,直接降低用户Gas费用。吞吐量提升:更多Blob空间允许L2处理更多交易,Optimism的TPS(每秒交易数)可能从几十提升至上百。当中的EIP-7685提高了优化了跨链通信,对一些新兴的L2来讲,会更加刺激其生态的发展。特别是一些defi项目,账户抽象(EIP-3074、EIP-7702)简化L2钱包操作,吸引Web2用户进入L2,利好Base(由Coinbase支持)等面向新手的L2。Blob容量翻倍直接降低L2的Gas费用,Arbitrum和Optimism的DeFi用户(如Uniswap、Aave)将受益于更低的交易成本。

对抽象账户项目的影响,此次升级允许外部账户(EOA)通过智能合约授权交易,支持批量交易、Gas赞助(第三方支付Gas)、自定义签名逻辑。一切做抽象账户的项目可以得到更好的发展,不再受技术制约。用户降低了准入门槛,后续对此类项目可能会有更多的用户增长。

接下来说风险,本次升级后(EIP-3074、EIP-7702)引入的授权机制可能被恶意合约利用,例如通过钓鱼攻击诱导用户授权,窃取资金。钱包项目需加强安全审计。EIP-7600允许验证者质押32-2048 ETH,某种程度上会导致大型质押池(如Lido)进一步集中资金,因其资本效率更高。以太坊去中心化程度可能下降,增加51%攻击或治理操控风险。类似项目应该推动鼓励小型质押池和去中心化治理。还有就是监管风险,Pectra的质押优化(EIP-7600)和AA功能可能引发监管关注,尤其在美国,流动性质押(如Lido)和智能账户可能被视为金融服务,面临合规要求。

以上就是本次升级的主要内容,以及带来的影响。点个赞再收藏,给个支持吧。

Show more

0

0

3

7

1

Top 5 Chains by Daily Active Users 👇

🥇 #BNBChain# : 3.6M

🥈 Solana: 3.3M

🥉 Tron: 2.7M

4⃣ Base: 1.4M

5⃣ Ethereum: 427K https://t.co/aQRUKdoOCD

0

0

66

188

38

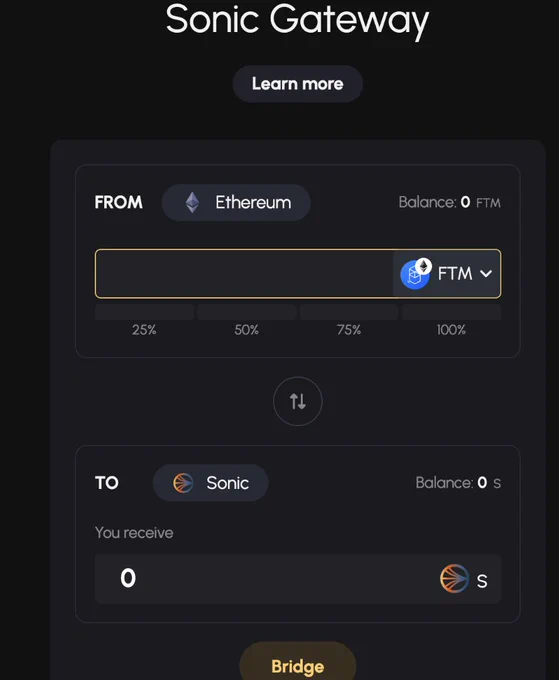

Over the past 7 days:

- TRON led with $11.7M in fees

- Solana followed with $8.75M

- Ethereum generated $4.75M

- Bitcoin collected $4.49M

- BNB Chain brought in $2.90M

- Base jumped 38%, reaching $1.06M

Fee dynamics reveal a very different picture than just looking at transactions or users.

Show more

0

0

26

85

15

吴说获悉,获 Paradigm 投资的累计融资额超过 5,000 万美元的 Ethereum Layer2 网络 Zora 宣布将在 4 月 23 日发布 ZORA 代币;快照将分为两次,包括从 2020 年 1 月 1 日至 2025 年 3 月 3 日和从 2025 年 3 月 3 日至 4 月 20 日。Zora 网络在过去几年以 NFT 创作者经济为卖点,但在今年重心转向为 Base 网络的 Memecoins 发射工具 Zora Coins,自推出两个多月已累积在 Base 网络上创建超过 50 万种代币。https://t.co/ZyR2dxoZBN

Show more

0

0

1

0

0

Our Capital Launchpad is live, with our very first Initial Community Offering starting tomorrow with @espressoFNDN! ☕️

Espresso is the base layer for rollups: unlocking real-time finality, crosschain composability, and Ethereum compatibility to power the multichain future.

Previous investments supporting Espresso technology totaled $50M+ and saw backing from @a16zcrypto, @ElectricCapital, @GreylockVC, @sequoia and others.

Full details on the round are now available on the Capital Launchpad portal: a first-of-its-kind opportunity to participate exclusively available to the Espresso and Kaito communities. You can deposit and pledge for allocation of up to $100,000 of $ESP tokens starting at 12PM UTC tomorrow. Final allocations will be determined by the Espresso Foundation.

For all future raises on Kaito, including Espresso - make sure to head over to the Capital Launchpad tab today on Yaps to complete the relevant steps including KYC to make sure you don't miss out.

And for Espresso NFT holders, make sure to connect the wallet containing your Composable 👀

Note: Geographic eligibility is determined on a project-by-project basis. For the Espresso sale, participation is not available to U.S. persons and persons located in the U.S. and certain other restricted jurisdictions.

Show more

0

0

438

886

99