Devansh Mehta

@TheDevanshMehta

Working on AI x Public Goods/Governance @ethereumfndn |

I don't speak for the collective, unhinged tweets my own | Check out @deep_funding to see my main focus

2.4K Following 6K Followers

just wrote up a monster post with @sejal_rekhan around how ethereums ecosystem can become self-sufficient & circular

Some of these ideas have sat in my head for ages & grateful to Sejal for making the push to comprehensively write up an entire roadmap

here's a 5 point TL;DR

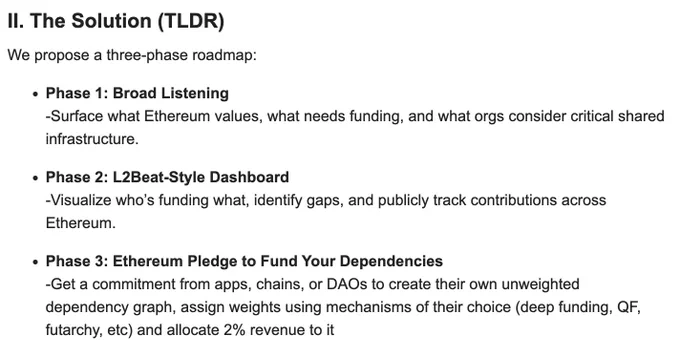

1. There's limited appetite for a "shared treasury" to fund infrastructure as that feels like "donating"

however there is a desire by ecosystems to contribute to repos that they depend on, which feels more like integrating revenue & cost centers

For eg, @CurveFinance makes use of @vyperlang ; so funding them isn't a donation so much as making their own product more secure

2. Eligibility requirements is the hard question to solve for; what repos should even be allowed into an ecosystems funding round, whatever the mechanism may be?

On what grounds could Curve include vyper in their funding stream but reject solidity?

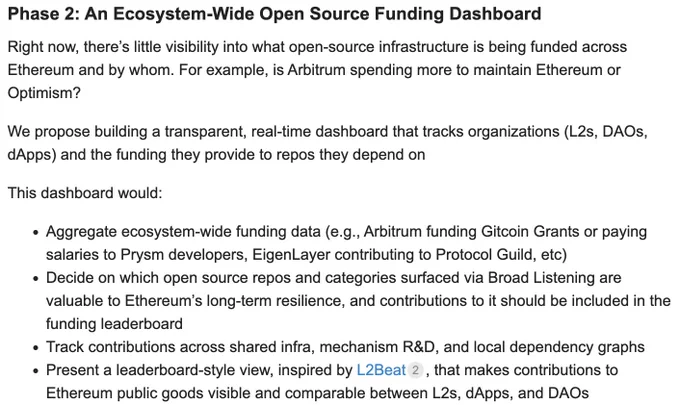

3. There's need for an L2Beat style system tracking the extent to which DAOs, dapps & L2s are funding software they make use of

it would be quite manual though, since answering questions like "does @arbitrum contribute more or @Optimism" isn't straightforward, since @prylabs is funded by offchain labs but needs to be accounted for

similarly some of optimisms funding goes to growing dapps on their ecosystem (creating dependents) rather than their dependencies, so opinionated calls would need to be made on how much of the retrofunding gets counted in the leaderboard

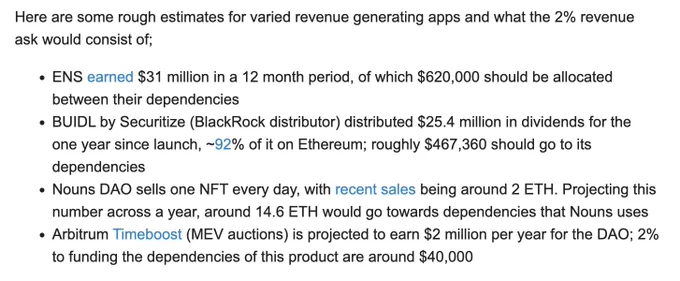

4. We propose augmenting the pledge to,

,,1% airdrop to @ProtocolGuild , 2% revenue to your own dependencie"

Some estimates of funding amounts if this pledge gets taken;

- @ensdomains earned $31 million over 12 months, so $620k to their dependencies

- @Securitize gave $25.4 million in dividends, 92% on ethereum, 2% of which would be $467,360

- @nounsdao is currently selling at ~2 ETH/day, 2% of which over a year would be 14.6 ETH to repos they depend on

5. Finally, how would we go about fairly allocating to repos?

Step 1 is simply generating a dependency graph of all repos that make your revenue generating product work well

Step 2 is giving weights to each dependency. QF, Deep Funding, Futarchy, PG style time weighting, metrics based retrofunding etc are some ways to obtain weights

Step 3 is encoding a stream from revenue earned to your local dependency graph, thus creating reliable & recurring funding for teams that your project depends on

Curious to actually see how these ideas pan out in practice!

if you're building in public goods, pivot from seeking donations to self-interested systems where projects can easily pay for the software they rely on

Show more

0

0

18

59

10

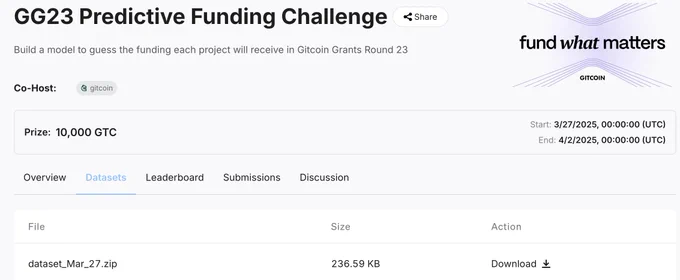

Out of all the challenges we are cooking for the AI & ML communities, i'm most excited about the GG23 predictive funding challenge 🪙

It has a tight 36 hour submission window (starting in 10 hours!), prizes are purely merit based on leaderboard placement and there's no cheating possible - use every trick up your sleeve 🃏

what's the 5 point TL;DR?

1/ your job is predicting how much funding each project in GG23 is going to get

We've provided past funding data from GG18 onwards to build or train your model

2/ Once GG23 begins on April 2nd, we close submissions for predictions & the round proceeds as normal

So its a super short window of 36 hours in which you need to submit your predictions

3/ After payouts are done, we see which modelloor was closest in their funding predictions to the actual allocation outcome

You also need to write a short description on your predictive funding model to be eligible

if you pride yourself on AI/ML stuff, here's a rare chance to get an objective measure of your skills. Prizes and glory await!

Show more

0

0

20

137

100