Search results for market

People

Not Found

Tweets including market

Market’s acting drunk — r u ok?

Last week’s EP1 pulled 10k viewers on Binance Square! Big love to everyone who showed up 💚

EP2 drops tomorrow (July 25), and it’s gonna be even messier:

- Are $BTC and $ETH gonna break out again next week?

- Are we about to pump, dump, or just die sideways?

- Plus some spicy surprise topics 👀

Hosted by the chaos crew:

@suwanyu7777 @Lsssss1106 @off_thetarget @joakja

Come for the alpha, stay for the roast.

Show more

0

0

8

28

0

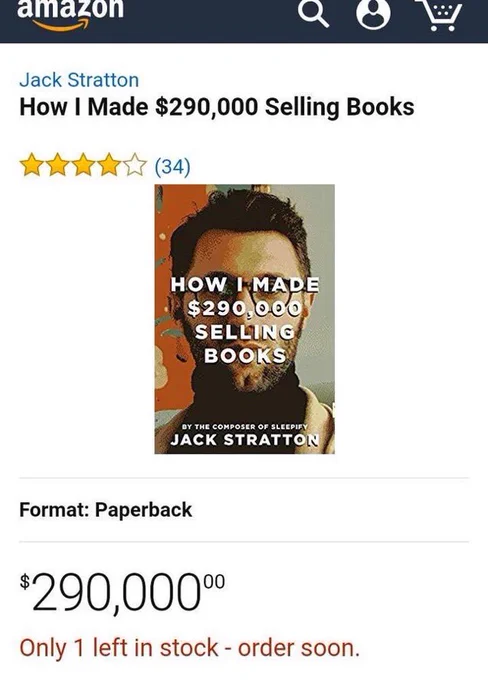

Marketing at its finest https://t.co/RsfmLde1To

0

0

8

52

4

Markets may be doing well, but @MeteoraAG's market share has dropped.

TGE Soju has locked in, with frontend work kicked off (points, <redacted>), and a strong team of people to keep it up.

Time to lock in to grow market share.

Show more

0

0

8

30

1

Market headwinds have mostly settled. Still standing by my $BTC call for this year, because the macro and market structure still back it up. 💪

#HSCLifeRules# by Gracy Chen (@GracyBitget), CEO at @bitgetglobal

"Everyone's asking for a BTC prediction — so here’s mine:

This year? Maybe $120K.

10 years? I truly believe $1M is possible. Just keep doing the right thing — results will come."

NFA, DYOR

#HackSeasonsConference# #HSC25# #HSCLifeRulesByGracyChen#

Show more

0

0

1

3

1

Market attention for @Muxy_AI has been skyrocketing ever since leading exchange @bitgetglobal announced the news of the upcoming $MAI listing! 🔥

Latest data shows $MAI has surged over +30%! 📈

This reflects the growing market recognition of @Muxy_AI 's vision to build the essential economic infrastructure for the future of AI Agents on @MorphLayer . Real value discovery is happening!

Still on the sidelines? 🚀

➡️ $MAI: 0xe4635e9cd1f719c37523a80c0fb0b95a445a788a

➡️ TG:https://t.co/jo0DOzhIHK

Follow @Muxy_AI for the latest!

#MuxyAI# #Bitget# #PriceAlert# #Crypto# #AI# #Web3# #FOMO# $MAI #Morph# #Trending#

Show more

0

0

7

10

0

"marketing experts" these days https://t.co/rLAxWhg69Z

0

0

3

18

2

Marketing Manager | Crypto Asset Management

@3commas_io

↯ Rare Opportunity ↯

Apply ↓ or send a friend

https://t.co/2H1pB6V8CB

0

0

0

3

1

Markets down, heart rate up

GM - time to lock in https://t.co/s0KjMmCtzz

0

0

9

17

0

Market lessons have taught us one thing—projects without cash flow are a ticking time bomb.

From now on, I’m only investing in or buying projects that generate real cash flow. 💰

0

0

4

5

2

Marketing campaigns can be hard to get right. Here's how AI helps!

https://t.co/bHoGKXwngk

0

0

0

2

0

Market sentiment is shifting! Our AI-driven analysis detects a surge in bullish sentiment for $AAPL & $TSLA. Will the rally continue? Stay ahead with real-time sentiment insights. Download our app now! #StockMarket# #Trading# #Investing# #AI#

Show more

0

0

0

2

0

Market not moving and I’ve managed to set aside some funds from my IRL businesses

ready to buy my final, definitive #ENS# domain, preferably top-tier grails, no budget limit

Show me what you have in the comments along with your price in USD

Show more

0

0

121

106

57

Internet Market Offering (I.M.O.) is LIVE!

Introducing #1# OpenAI LP Token —

⛓️ Trade 24/7 onChain

📈 Real-World AI meets DeFi

🫴 Economic yield mapped to OpenAI’s long-term potential

Welcome to the new era of internet tokenized markets.

#DeFi# #Ethereum# #RWAs# #IMO# #openAI#

Portal: https://t.co/C7dmYaNoSr

Show more

0

0

2

10

6

🚨 Market Minds - 7/22/25 | LIVE Trading Show ft. Mike Shorr | Vertical Spreads🚨 https://t.co/YFtvlD0aRo

0

0

0

52

1

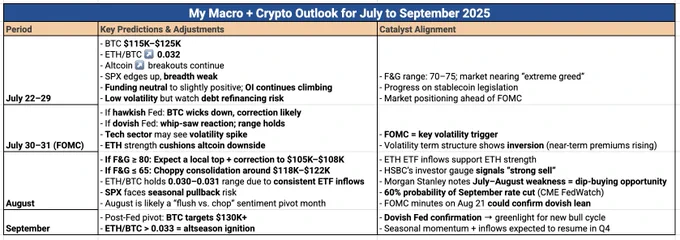

The market’s rising in a weird, almost artificial way…

Crazy ETF inflows. FOMC just a week away.

Is altseason finally here? Will $BTC break above $130K next month — or is it setting up for a 10% correction?

🔍 Here’s my macro + crypto outlook for July to September 2025:

1. Pre-FOMC Drift (July 22–30)

• Market sentiment rising: Fear & Greed (F&G) Index ~70–75 (Greed increases).

• 📈$BTC ranges between 115k–125k → Cooling near ATH, no major breakdown yet.

• ETH/BTC bouncing at 0.032 → ETF inflows buffering ETH pair.

• Altcoins waking up → Traders rotating profits into higher-risk plays.

• 📉SPX edges up but weak breadth → Still tech-led, not broad-based.

• Derivatives: Open Interest is climbing and funding rates are neutral → Leverage is building, but there’s no visible froth yet.

• Key risk: low volatility + debt refinancing overhang → Debt-heavy firms might crack soon; small/mid caps vulnerable.

No major catalysts, just positioning for FOMC.

2. 📅FOMC Knee-Jerk (July 30–31)

This is the first real macro trigger in a while. Two possible outcomes:

• 🟥 If Fed sounds hawkish (not cutting rates) → $BTC wicks down.

• 🟢 If Fed sounds dovish (hinting at cuts) → Markets stay in range or bounce.

Other notes:

• Tech stocks might finally get volatile again.

• ETH likely outperforms altcoins if markets get shaky.

• Options markets show stress → short-term premiums rising.

3. 🪓 August = Chop Zone or Flush

• 🟥 If F&G ≥ 80: Expect a local BTC top, then correction to $105K–$108K.

• 🟢 If F&G ≤ 65: Likely choppy consolidation between $118K–$122K; Mirrors mid-2024 when sentiment dipped before a year-end rally.

• ETH/BTC likely holds 0.030–0.031 due to strong ETF inflows.

• SPX faces seasonal pullback risk.

Key risks and signals:

• ETH ETFs inflows pulling strong

• HSBC says investors are getting way too bullish (a contrarian sell signal). 20–30% of their internal signals are urging institutional de-risking.

• Morgan Stanley sees July–August weakness as a dip-buying opportunity.

• 60% chance of September rate cut (CME FedWatch).

• Fed minutes on August 21 may confirm dovish shift.

4. 🚀 September = Next Bull Leg?

• If Fed confirms dovish stance or a rate cut → BTC likely targets $130K+

• ETH/BTC > 0.033 could reignite an altseason wave

Why this matters:

• Dovish Fed = liquidity return

• Seasonal patterns favor strong moves starting Q4

• If August dip happens, September may be the restart of the uptrend

That’s how I’m seeing things based on the data I’ve been tracking — not financial advice.

I’ve summarized the key points in the table below.

Curious how others are looking at this.

Are you leaning more breakout or correction?

Always down to learn from different perspectives.

Show more

0

0

15

43

3

所有marketing人谨记,公关第一步:不要陷入自证陷阱。

当面对黑子的时候,最聪明的做法就是不要回复互动,不要喂给任何流量,不要自证。

让这些人像下水道里的老鼠,只能吱吱乱叫。但却无法伤人分毫。

infini的kol伙伴也不要跟心理阴暗的黑子互动,流量是宝贵的。

将军赶路,不追小兔。 https://t.co/WpR2UcfrOv

Show more

3

0

2

10

0

taking marketing to the next level https://t.co/PiyGYDezVC

0

0

36

328

21

Crypto market explained in 15 seconds https://t.co/1SegbeDHH6

0

0

258

49.7K

2.9K