Search results for stablecoin

People

Not Found

Tweets including stablecoin

Stablecoins are about to change everything.

On @CNBC, our CEO @chriseyin explains how the GENIUS Act could unlock a DeFi boom, and why clear legal protections for users will be crucial.

📺 Watch here: https://t.co/swslySrECs

Show more

0

0

28

266

60

StablecoinX Inc. (@stablecoin_x ) 完成 3.6 亿美元融资,用于购买 Ethena 的治理代币 $ENA,并计划在 Nasdaq 全球市场上市,股票代码为 "USDE";

融资包括 Ethena 基金会贡献的 6000 万美元 $ENA ;

Ethena 基金会子公司通过第三方做市商,使用 2.6 亿美元在公开市场战略购买 $ENA,计划每日约 500 万美元,持续 6 周。以当前价格计算,这相当于流通供应量的约 8%;

Show more

StablecoinX Inc. @stablecoin_x has announced a $360 million capital raise to purchase $ENA and will seek to list its Class A common shares on the Nasdaq Global Market under the ticker symbol "USDE", which includes a $60 million contribution of ENA from the Ethena Foundation

Equity markets will now have direct access and exposure to the most important emerging trend in all of finance:

The growth of digital dollars and stablecoins.

To bootstrap its acquisition strategy, StablecoinX Inc. will use all of the $260 million cash proceeds from the raise (less amounts for certain expenses) to buy locked ENA from a subsidiary of the Ethena Foundation.

Starting today, the Ethena Foundation subsidiary (via third-party market makers) will use 100% of the $260 million cash proceeds from the token sale to strategically purchase $ENA across publicly traded venues over the coming weeks, further aligning the Foundation’s incentives with those of StableCoinX shareholders.

The planned deployment schedule is approximately $5m daily from today over the course of the next 6 weeks. At current prices $260m represents roughly 8% of circulating supply.

Importantly, the Ethena Foundation has the right to veto any sales of $ENA by StableCoinX at its sole discretion. Ideally, tokens will never be sold with a sole focus on accumulation.

To the extent StableCoinX subsequently raises capital with the intent of purchasing additional locked ENA from the Ethena Foundation or its affiliates, cash proceeds from those token sales are planned to be used to purchase spot $ENA.

StableCoinX's treasury strategy is a deliberate, multi‑year capital allocation strategy that will enables StableCoinX to capture the enormous value of the secular surge in demand for digital dollars while compounding ENA per share to the benefit of shareholders.

Show more

0

0

1

1

1

StablecoinX Inc. @stablecoin_x has announced a $360 million capital raise to purchase $ENA and will seek to list its Class A common shares on the Nasdaq Global Market under the ticker symbol "USDE", which includes a $60 million contribution of ENA from the Ethena Foundation

Equity markets will now have direct access and exposure to the most important emerging trend in all of finance:

The growth of digital dollars and stablecoins.

To bootstrap its acquisition strategy, StablecoinX Inc. will use all of the $260 million cash proceeds from the raise (less amounts for certain expenses) to buy locked ENA from a subsidiary of the Ethena Foundation.

Starting today, the Ethena Foundation subsidiary (via third-party market makers) will use 100% of the $260 million cash proceeds from the token sale to strategically purchase $ENA across publicly traded venues over the coming weeks, further aligning the Foundation’s incentives with those of StableCoinX shareholders.

The planned deployment schedule is approximately $5m daily from today over the course of the next 6 weeks. At current prices $260m represents roughly 8% of circulating supply.

Importantly, the Ethena Foundation has the right to veto any sales of $ENA by StableCoinX at its sole discretion. Ideally, tokens will never be sold with a sole focus on accumulation.

To the extent StableCoinX subsequently raises capital with the intent of purchasing additional locked ENA from the Ethena Foundation or its affiliates, cash proceeds from those token sales are planned to be used to purchase spot $ENA.

StableCoinX's treasury strategy is a deliberate, multi‑year capital allocation strategy that will enables StableCoinX to capture the enormous value of the secular surge in demand for digital dollars while compounding ENA per share to the benefit of shareholders.

Show more

0

0

93

1.1K

269

Stablecoins connect the unconnected—$75B USDT on TRON is just the beginning.

0

0

39

122

27

Stablecoin growth continues to accrue the benefit of major chains.

The top 3 chains – @ethereum, @trondao, and @solana – control over 90% of all natively minted stablecoins.

Of the top 3, Solana was the only one that grew market share over the past year; from 2.0% to 5.3%. https://t.co/9kWmxXmchd

Show more

0

0

5

17

4

Stablecoin transactions getting easier on BNB Chain.

Say hello to $USD1 gasless transfers in Trust Wallet. 0️⃣⛽️

Now you can send $USD1 by @worldlibertyfi with zero network fees on BSC, powered by @BNBChain’s Megafuel.

Try it now in your Trust Wallet: https://t.co/AD5yJbzh51 https://t.co/JvVXhPoO7O

Show more

0

0

63

110

8

Stablecoins may be crypto’s first “killer app” — our first real shot at making it so that sending money is more like sending an email. Open, instant, and borderless.

People are already recognizing the advantages.

In 2024, stablecoins moved $15.6 trillion in value, effectively matching Visa’s volume.

So how did stablecoins become poised to disrupt the global payments industry?

And how can builders and businesses think about stablecoins?

@a16zcrypto rounded up a guide to stablecoins to take a look at how we got here — and where we’re going next: https://t.co/osAPkrjYYh

Show more

0

0

59

693

120

Stablecoins are crypto’s clearest product-market fit. It’s composable digital money.

@SuiNetwork is going to converts this potential into real-world Web3 adoption. https://t.co/R0VwtRFNM7

0

0

410

2.8K

296

Stablecoins should be trusted, compliance-first, and built for real-world finance—RLUSD is setting the standard.

Now live in Ripple Payments, RLUSD powers enterprise payments, asset tokenization & DeFi: https://t.co/yKPF3zXSL7

📈 Nearing $250M market cap

📶 $10B+ in trading volume

🟢 Available on: @krakenfx, @LMAX, @Bullish, @bitstamp and more

Show more

0

0

93

1.3K

386

Stablecoins are on the rise with over $220B in value circulating. 🌏

What’s needed to unlock mass adoption? https://t.co/ZqK4TfaO9Q

1️⃣ Global regulatory alignment

2️⃣ Reliable reserves & risk controls

3️⃣ Compliance-driven approach

4️⃣ Enterprise-grade custody

5️⃣ Seamless customer experience

Show more

0

0

151

3.4K

994

👀

Stablecoin Summer

The growth profile for USDe has always been non-linear and hard to forecast with periods of parabolic expansion, followed by months of flat or bleeding supply that sets higher lows through time

USDe supply is back into growth for the first time in ~3 months with $300m added in the last few days to get back to ~$5b

The last growth period for USDe in October last year added ~$4b of supply in under 8 weeks where inflows outpaced the majority of BTC ETFs and all ETH ETFs combined

That period of growth was with a fraction of the current distribution channels we have put in place since then

I expect this next leg up will be more violent than the last

Show more

0

0

4

0

0

For stablecoins and other digital assets to thrive globally, the world needs American leadership.

The Senate missed an opportunity to provide that leadership today by failing to advance the GENIUS Act.

This bill represents a once-in-a-generation opportunity to expand dollar dominance and U.S. influence in financial innovation. Without it, stablecoins will be subject to a patchwork of state regulations instead of a streamlined federal framework that is more conducive to growth and competitiveness.

The world is watching while American lawmakers twiddle their thumbs. Senators who voted to stonewall U.S. ingenuity today face a simple choice: Either step up and lead or watch digital asset innovation move offshore.

Show more

0

0

904

18.1K

3.7K

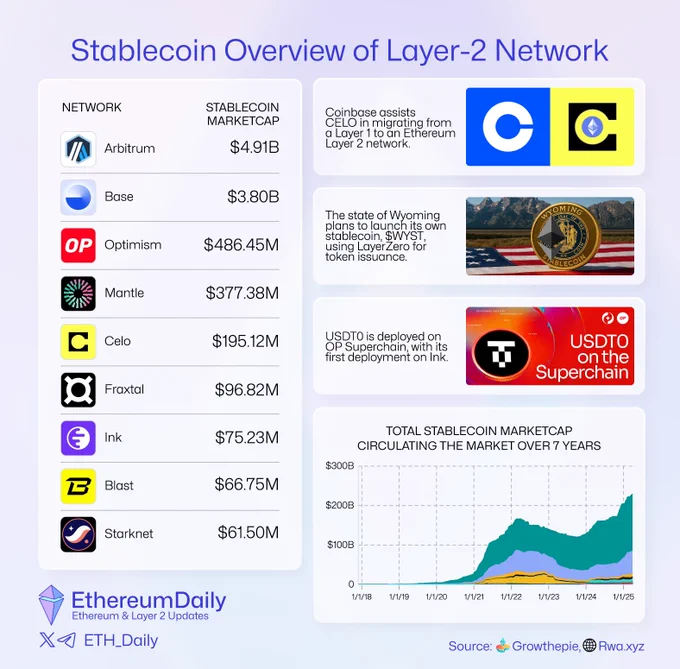

🚀 Stablecoin Marketcap is Booming!

Here are the leading Layer 2 networks in stablecoin marketcap:

▫️ @arbitrum – $4.91B

▫️ @base – $3.80B

▫️ @Optimism – $486.45M

▫️ @Mantle_Official – $377.38M

▫️ @Celo – $195.12M

▫️ @fraxfinance – $96.82M

▫️ @inkonchain – $75.23M

▫️ @blast – $66.75M

▫️ @Starknet – $61.50M

💰 Big money inflows are coming—are you positioned for it?

Show more

.@sophon is a game-changer for Layer 2 fans ✨

A lifestyle, entertainment & gaming-focused L2 that’s:

✅ Gasless

✅ Google/Apple login—no wallet stress

✅ Built to scale

The numbers don’t lie 🤓👇

🔹 Bridge Deposits: $105.6M (+29.5% MoM)

🔹 TVL: $16.67M (+204.8% MoM)

🔹 Users: 56,661 (+398% YTD)

🔹 Transactions: 55.8M (+178% YTD)

🔹 Backed by the big boys: @TheSpartanGroup

@Maven11Capital @OKX_Ventures @SevenXVentures

@yzilabs

🔹 Nodesale over $66M

🔹 Rapidly expanding ecosystem

And oh… MAINNET IS LIVE! 🚨

Stay tuned for a guide on how to dive in 🔥

Show more

0

0

0

27

17

A stablecoin called World Liberty Financial USD (USD1) has reportedly been launched on BNB Chain, allegedly linked to the Trump family fund. Market maker Wintermute’s address has interacted with the contract, with some test transfers observed. CZ noted the contract was deployed 20 days ago. No official statement has been made by the Trump family fund. https://t.co/Ho8G4ho13o

https://t.co/ODfTY3R9OQ

Show more

0

0

13

95

24

America's stablecoin regulation just took a major step forward! 🇺🇸

The Senate has advanced the #GENIUSAct#, setting the stage for comprehensive stablecoin oversight. 💸

At Infini, we're already aligned:

✅ On-chain assets

✅ Transparent reserves

✅ No hidden risks

The future of real-world payments is on-chain and compliance-ready.

⚡️Infini: Stablecoins that work, spend, and earn.

Show more

0

0

6

19

4

GM🍹☀️ $ETH pumping 📈

Stablecoin supply in crypto has been nonstop up only.

People still want to buy crypto but they went risk off before due to macro fears.

And today eth short sellers are getting squeezed out https://t.co/GGFEy6O9F6

Show more

0

0

38

179

2

🔥 @BNBChain stablecoin supply is going parabolic.

In the past 3 days, the stablecoin supply on the BNB Chain has increased by $2.1 billion, an increase of 30%.

At this pace, #BNB# Chain will soon be in the top 3 chain by stablecoin supply. https://t.co/Se16kxoSRo

Show more

0

0

40

94

16

What’s ahead for stablecoins, custody & tokenized assets?

@MonicaLongSF dives into $RLUSD, XRP ETFs, growing Ripple Payments & Custody momentum and the next wave of institutional adoption with @TokenizedPod.

Tune in now! 🎧👇

Show more

Ep. 20 of @TokenizedPod: Ripple USD, Stablecoins & Custody Ft. @Ripple President @MonicaLongSF 🔷

@sytaylor sits down with Monica to discuss:

02:15 Ripple’s dual focus: enterprise software & XRP Ledger

05:00 How Ripple powers cross-border payments with stablecoins

08:48 Ripple’s custody play: Metaco & major bank partnerships

13:16 Why Ripple launched its own stablecoin, RLUSD

16:53 U.S. crypto regulations shift—what it means for adoption

22:29 Tokenized assets & stablecoins are reshaping finance

27:00 XRP ETFs: why more approvals could be coming

33:28 Ripple’s next moves: expansion, execution, and M&A

39:34 The future of XRP Ledger & institutional finance

Watch and enjoy below! 👇

Links to YouTube & Podcasts also below ⬇️

Show more

0

0

115

3.6K

973

[ ZOOMER ]

POLYMARKET CONSIDERS LAUNCHING ITS OWN STABLECOIN: COINDESK

0

0

24

166

9