Anna Wong

@AnnaEconomist

Chief US Economist, Bloomberg LP @economics. Former Fed/CEA/US Treasury, @uchi_economics @UCberkeley. All opinions are my own.

280 Following 60.7K Followers

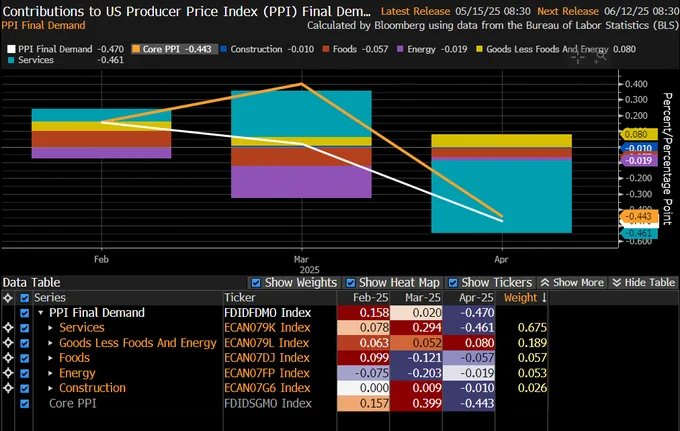

Normally on PPI release we just focus on the categories that's important for calculating core PCE deflator. But April's release is interesting in its own right, as it broadly reinforce the story we saw in the CPI release earlier today:

-There is increased pass-through of tariffs in goods prices

-Deflation in services is offsetting those tariffs increase

-The net impact is disinflation.

On services, final demand prices for transportation and warehousing, and construction are very soft.

Show more

0

0

22

530

126

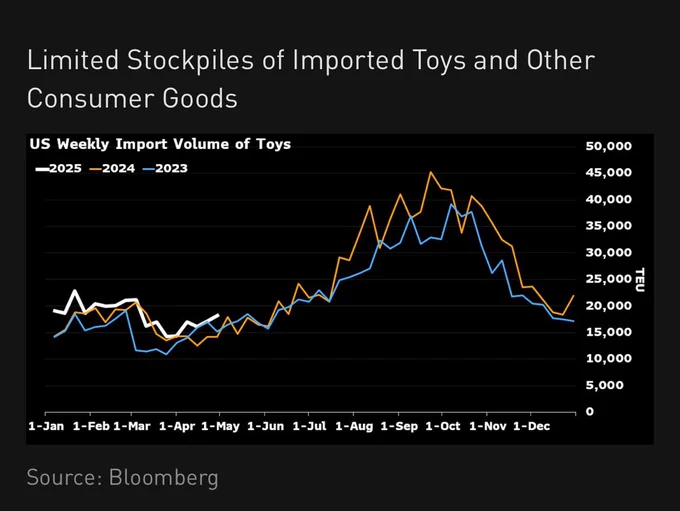

Why 90-day us-china tariffs rachet down? To save Christmas. This “seize fure” just covers the peak holiday shipping period.

May and June nfp bloodbath are likely averted.

The contour and timing of this “deal” can be foretold by shipping data. https://t.co/ZIo5JYvWLd

Show more

0

0

47

883

200