The ₿itcoin ₿eginner

@EducatingBTC

BTC.

381 Following 114K Followers

These April fools jokes crack me up.

Bitcoin is nothing more than a hollow Ponzi scheme.

The network sees almost no transaction activity, with countless blocks being mined empty.

No real commerce, no real utility, no real demand—just endless hype and speculation. When the gamblers move on, it collapses into nothing.

Show more

0

0

0

1

0

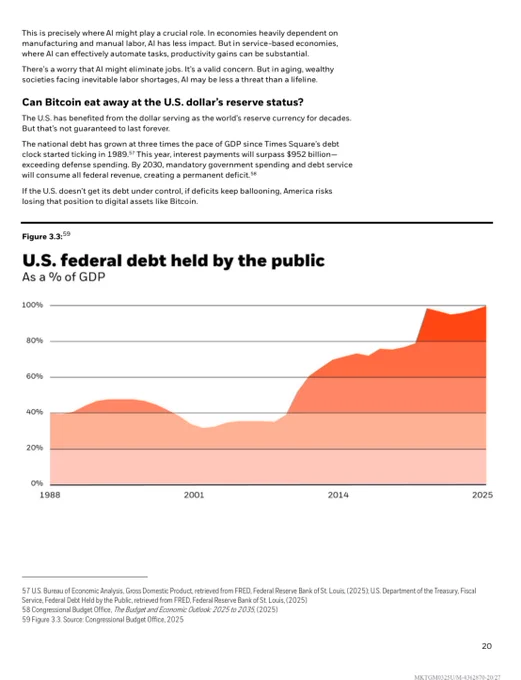

In his annual letter to investors, BlackRock CEO Larry Fink writes, “If the U.S. doesn't get its debt under control, if the deficits keep ballooning, America risks losing that position [world’s reserve currency] to digital assets like bitcoin” https://t.co/T31L57od2s

Show more

0

0

73

2.4K

531

You THINK you want Real Estate.

But you don't.

You actually want Bitcoin.

Here's why (in 750 floating seconds)

Let's help educate the masses. https://t.co/qXqoNHBq6E

0

0

50

712

200

Bitcoin is going to demonetize real estate 10x faster than gold.

I think most people think Bitcoin will replace gold and then come after real estate. However, I think the opposite will happen.

I think real estate is in a far bigger bubble than gold. For 40 years everyone has focused on buying a house, a rental property, and most recently an AirBnB. The real estimate market is FULL of retail investors that are still chasing yesterdays dreams (i.e. the dream to get rich by investing in real estate).

What most people miss is that today's real estate market is insanely expensive. Now add demographics, negative population growth, and growing interest rates and you have a disaster on the horizon.

Not only that, you have assets (gold and Bitcoin) that will protect you against a global sovereign debt bubble far better than real estate.

Show more

0

0

128

1.1K

148

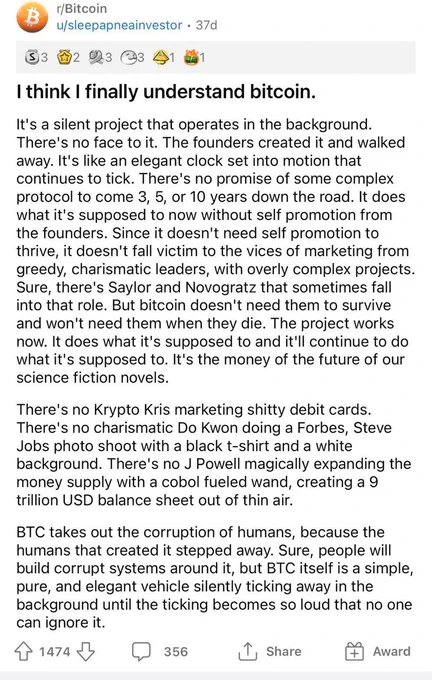

It's like an elegant clock set into motion that continues to tick. #Bitcoin# https://t.co/cKOwUwmx7d

0

0

5

156

45

Look who else held up a headline from The Times…

Friedrich A. von Hayek predicting Bitcoin in 1984:

“I don’t believe we shall ever have a good money again before we take the thing out of the hands of government. We can’t do so violently — all we can do is, by some sly roundabout way, introduce something that they can’t stop.” https://t.co/JNL18iE8gw

Show more

0

0

1

10

2

NEW: 🇺🇸 SEC Crypto roundtable lawyer says, "We all agree that #Bitcoin# is not a security because it is sufficiently decentralized." https://t.co/7R8oXRSS3j

0

0

174

2.7K

520

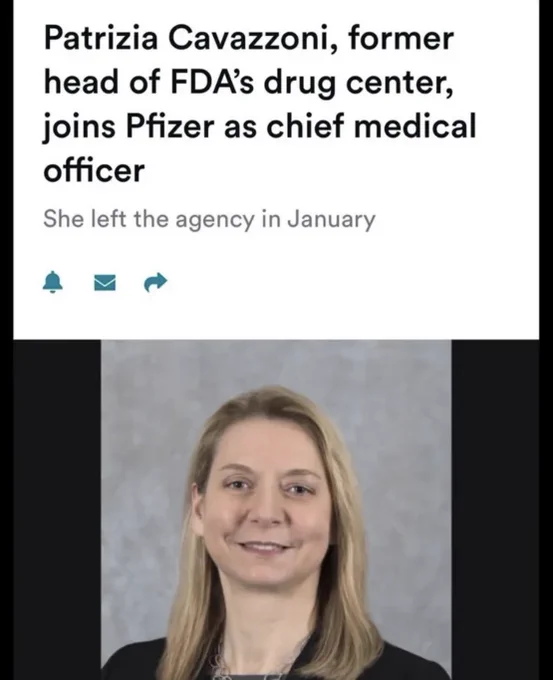

The deep state is like a revolving door.. https://t.co/88FZeadwmz

0

0

21

707

136

There are people walking around with all their money in Bitcoin and not enough people to talk to about it 😭 https://t.co/nFpjEFOuYx

0

0

88

2.7K

285

The same people who say "bitcoin has no cash flow" are holding bonds yielding 4% while the dollar supply grows at 8%.

0

0

90

1.8K

195

crypto: creates 30m+ altcoins to compete with bitcoin over 16 years

market: bitcoin still 60%+ dominance

jason: why hasn’t anyone tried to make a new bitcoin?

🥴🥴🥴

0

0

64

1.4K

97

It's a great time to ignore the charts.

The worst thing to do at a time like this is waste time hoping and waiting for bullish price action when the momentum just isn't there.

I prefer to lower expectations and let myself be pleasantly surprised rather than continually disappointed.

The next narrative is cooking... And the bullishness will return.

But these things can't be rushed.

Maybe it will be progress on the Bitcoin Act, or perhaps the US moves forward on Bit Bonds (brilliant idea btw).

But one thing is for sure - in the words of Christine Lagarde: "It will come. In due course, it will come."

In the mean time, the markets are giving you an opportunity to lock in on whatever else matters to you.

Stack Jr. is taking his first steps these days.

And I've started showing him some calisthenics moves.

Training will begin soon.

He will learn the importance of physical exertion and continual progress towards a long-term goal.

The human flag was once a dream of mine.

Realizing that it was within my control, I held the vision in my mind and made daily progress towards it.

And then it became reality.

This is one of the most important skills to master in life.

Identify a dream that's within your control, and then figure out the daily effort required to make it happen.

And believe that once you commit to it, all that separates you from it is time and effort 🫡

Show more

0

0

73

1.4K

60

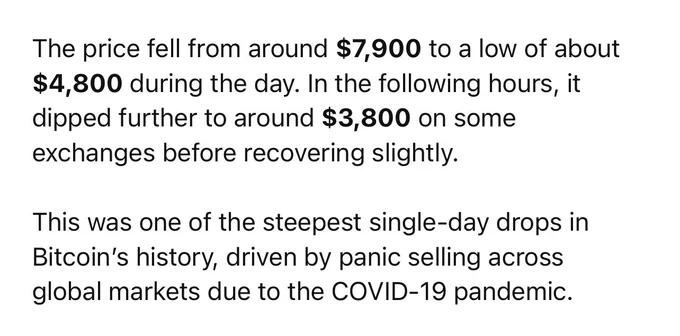

FIVE years ago today, #Bitcoin# crashed more than 50% in ONE day, from $7,900 to $3,800 in hours.

We're up 21X ever since. Zoom out, DCA Bitcoin and enjoy the ride. We are just getting started. https://t.co/l4D4GjS1xv

Show more

0

0

44

955

109

I’m selling my rental properties for Bitcoin.

I have an accepted offer on one and expect to close in two weeks. Another is currently listed for sale.

I started buying rental properties in 2018, believing they were my best path to financial freedom. But in 2019-2020, I discovered Bitcoin. Over time, my conviction in Bitcoin’s asymmetric upside has only grown.

Now, I see more potential in a portfolio of Bitcoin and Bitcoin-related assets than in holding rental properties. So, I’m making the move.

I will have another 4 units to offload after this, but the writing is on the wall.

Show more

0

0

339

3K

185

https://t.co/NXuV9Th29H

0

0

45

1.1K

55

You will own nothing. And you will be happy. https://t.co/G4eKFQ5rdM

0

0

164

2.9K

456

₿ig things are coming.

0

0

5.8K

68.5K

8K

JUST IN: 🇺🇸 US Congressman Nick Begich to introduce Strategic Bitcoin Reserve legislation in the House today to buy 1 million BTC.

The bill already has six co-sponsors 👀 https://t.co/5xJuJ25835

Show more

0

0

366

9.8K

1.8K

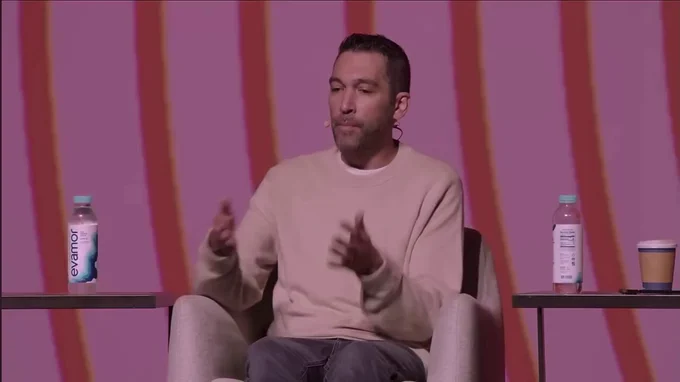

COMEDIAN DAVE SMITH WITH ONE OF THE GREATEST SPEECHES ON #BITCOIN# 🔥 https://t.co/i3rgERpcU8

0

0

11

1.1K

237