全球货币 Global Money

@GlobalMoneyAI

全球货币:人工智能让金融决策更简单。

Global Money: Making Financial Decisions Easier with AI.

155 Following 114.8K Followers

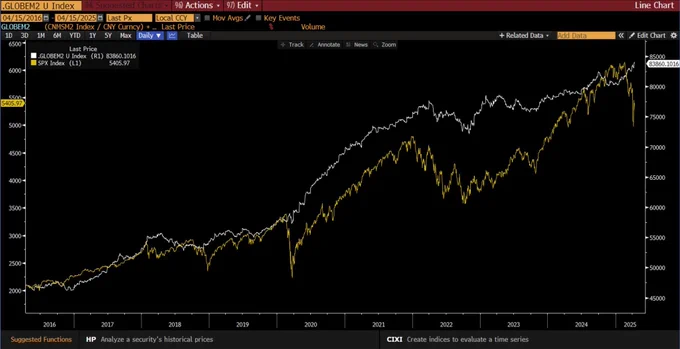

全球M2突破历史新高。贝森特说:"美国财政部有一个很大的工具包”。全球总流动性(M2)与美股(S&P500)之间的对比图,用于观察流动性与股市的关系,走势长期相关性强:从2016到2021,两者趋势大体一致。但2022年后开始背离。2025年初出现同步大幅下跌。全球M2是市场“水位线”,标普500是浮在水面上的“船”。 https://t.co/sDM8oB0ddv

Show more

0

0

0

6

3

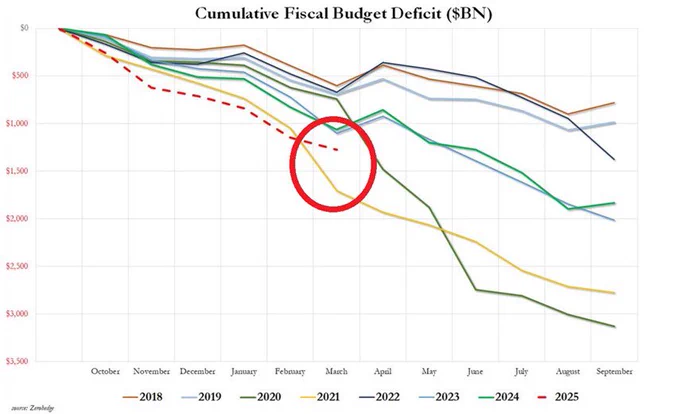

突发:美国3月份预算赤字,同比下降760亿美元,至1610亿美元,为5年来的最低水平。政府总收入增长11%至3680亿美元,而支出下降7%至5280亿美元。与2月份3070亿美元的预算缺口(历史上第二大缺口)相比,这是一个显著的改善。2025财年前6个月的总赤字目前为1.3万亿美元,为有记录以来第二高。仅2021年疫情复苏期间的6个月赤字就高达1.7万亿美元。政府支出最终会放缓吗?

Show more

0

0

2

2

0

BREAKING: Treasury Secretary Bessent says the Trump will start interviewing Fed Chair Powell’s potential successors this fall. But why have a successor at all? Market manipulation through rate-setting and bailouts is part of the problem—not the solution.

https://t.co/HxoB4aSI3l

Show more

0

0

0

8

2

大模型选股准确率,居然超过人类,AI炒股时代来了?芝加哥大学学者的论文震惊华尔街:研究者发现,由GPT4选出的股票,比人类分析师选出的表现要好!学者们向GPT4提供了标准化的匿名财务报表,并指示该模型对其进行分析。即使没有叙述性信息或特定行业信息,LLM在预测盈利的能力上也优于金融分析师。 https://t.co/hfWvXqTc3I

Show more

0

0

0

7

3

投资者购买黄金ETF的数量确实非常庞大:上周全球黄金ETF净流入52吨,为2020年金融危机以来第三高。以美元计算,投资者上周投入了47亿美元,为有史以来第三大流入量。与此同时,金价今年迄今上涨了22%。我们年初也买了黄金概念的GLD和GDXU(三倍做多),同时做空美元(ULE)和石油(SCO),最近买美债(TLT)。 https://t.co/VvkycpyA1J

Show more

0

0

1

6

1

专业投资者,在近期美股下跌前减持仓位的做法是正确的。融资利差(用于衡量期货、期权和掉期交易的长期需求)仍接近2024年5月以来的最低水平。该指标目前表明,标普500指数近期的反弹可能只是昙花一现。Professional investors were right to reduce their positioning ahead of the recent drop in U.S. stocks. Funding spreads—used to gauge long demand via futures, options, and swaps—remain near their lowest levels since May 2024. This indicator now suggests that the S&P 500’s recent bounce may be short-lived.

Show more

0

0

0

2

1

有钱人如何偷渡出境?加密大亨孙宇晨的同事回忆:2018年7月,孙宇晨租赁商务车,将自己打包成货物,放在后备箱,通过广西边境偷渡,入境越南。有美女演示了孙宇晨偷渡的可行性:行李箱用的是28寸,脚先迈进行李箱里,然后依次放置好屁股和头。成功出境后,再持小国护照,从东南亚进一步国际出行。协助孙宇晨偷渡的几个同事,现羁押于北京市海淀看守所:王冰宇、张莹、余达菲、杨凯山等,都成了孙宇晨筹谋已久的替罪羊。

Show more

0

0

29

158

28

交易信号:对冲基金连续两周以史上最快速度抛售欧洲股票。这恰恰标志着所谓“追赶性交易”的终结。几十年来,欧洲一直不是长期资本的理想投资目的地。二流科技、过度监管以及持续的政策瘫痪,使其在结构上缺乏竞争力。与此同时,欧洲继续敲响对俄罗斯的战鼓,进一步加剧了该地区的不稳定。此外,资本百科(@Capitalpedia)的消息,自特朗普发起关税战以来,对冲基金7周来首次买入美股。

Hedge funds have been selling European stocks at the fastest pace on record for two consecutive weeks. This simply signals the end of the so-called "catch-up trade." Europe hasn’t been a favorable destination for long-term capital in decades. With second-rate tech, excessive regulation, and persistent policy paralysis, it remains structurally uncompetitive.Meanwhile, Europe continues to beat the drums of war against Russia, further adding to the region’s instability. According to Capitalpedia, since Trump launched the tariff war, hedge funds have bought U.S. stocks for the first time in 7 weeks.

Show more

0

0

1

7

1

民意调查:本周末的走势,对未来两周美国股市是利好还是利空?

请在下方发表你的理由和看法。

POLL: Are this weekend’s developments bullish or bearish for U.S. stocks over the next two weeks?

Comment your reasoning below.

Show more

0

0

6

15

6

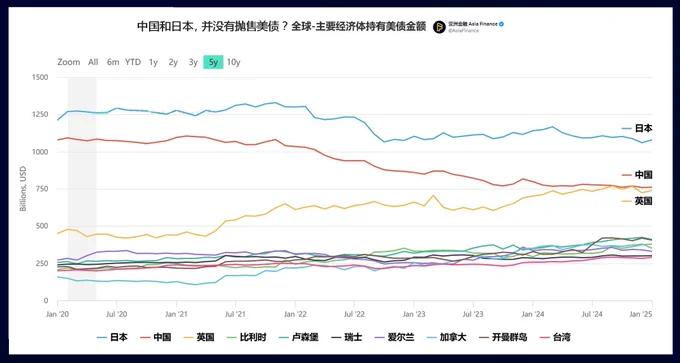

中国和日本,并没抛售美债?正如昨天分析,中国不会轻易抛售美债。美债的下跌,是华尔街害怕特朗普发疯,而其仓位是杠杆放大。风险平价基金,吓得抛售8150亿元的美债,譬如桥水基金。目前还是混合信号。我们坚持波动策略,不单边做多或做空。短线继续大盘做多,同时做多黄金(GLD)和做空美元(ULE)对冲。 https://t.co/crWutNBaYJ

Show more

0

0

2

24

5