This Forbes article concluded by citing my perspective on ETF inflows and institutional influence on Bitcoin pricing. I'd like to delve deeper into what this institutional dominance and Wall Street pricing power truly signifies.

The core point is that Bitcoin's price is now primarily driven by liquidity within the United States—not capital from Europe, the Middle East, or Asia. Capital from these regions tends to flow more toward gold and equities—which I believe also explains why commodities like gold, AI-related U.S. stocks, and even China's equity index have seen solid gains this year.)

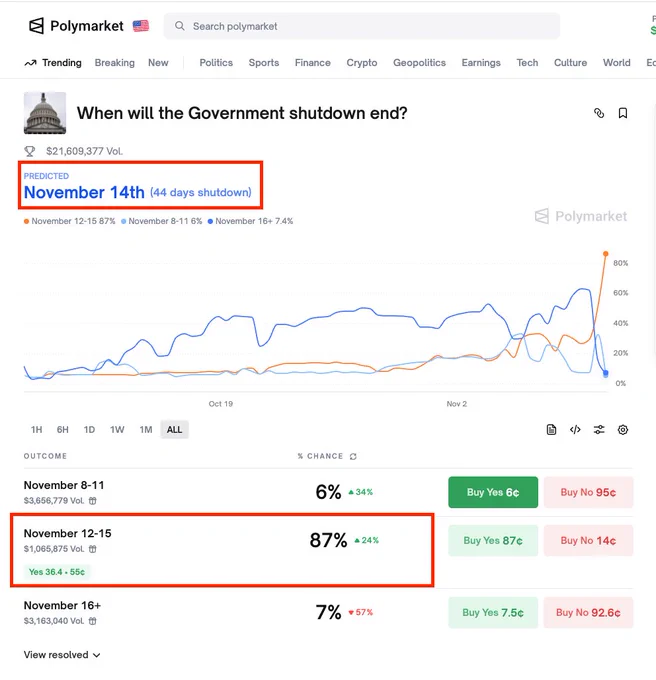

Moving forward, once the U.S. government ends its shutdown in November (Polymarket's current prediction suggests the record-breaking 44-day shutdown may conclude on the 14th), fiscal spending and easing market liquidity will resume. If the Fed then in Dec, halts its balance sheet reduction and initiates a rate-cutting cycle, a new Bitcoin bull run could truly begin. After all, Bitcoin is the purest and most liquidity-sensitive asset class, poised to benefit first.

Back in January, I made a bold prediction: “BTC could easily surpass $130K this year and potentially surge to $150K-$200K.” While that hasn't materialized yet, once the two conditions mentioned above are triggered—gov shutdown ends and the Fed shifts to easing—hitting $150K will merely be a matter of time, whether in Q4 this year or Q1 next year.

My personal crypto positions are fully loaded again, but NFA.

I look forward to witnessing a new BTC all-time high with everyone. Let's meet at the top.

Forbes article link: https://t.co/QmjYGXYBJs

Show more

0

0

0

1

0