Nick Timiraos

@NickTimiraos

Chief economics correspondent, The Wall Street Journal • Author, "Trillion Dollar Triage”

124 Following 429.4K Followers

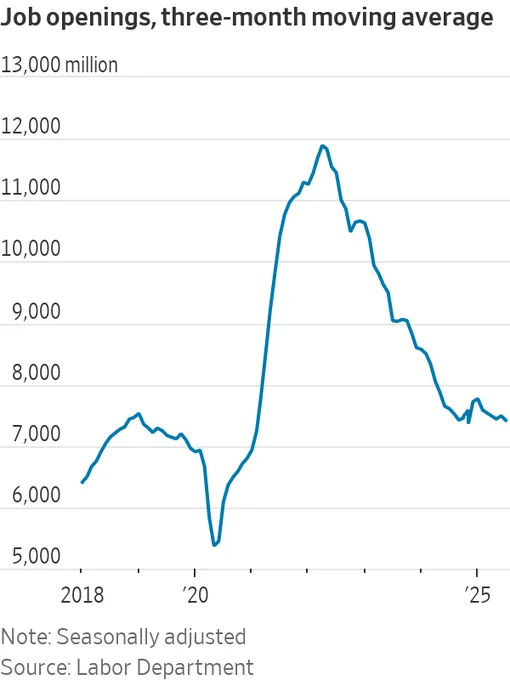

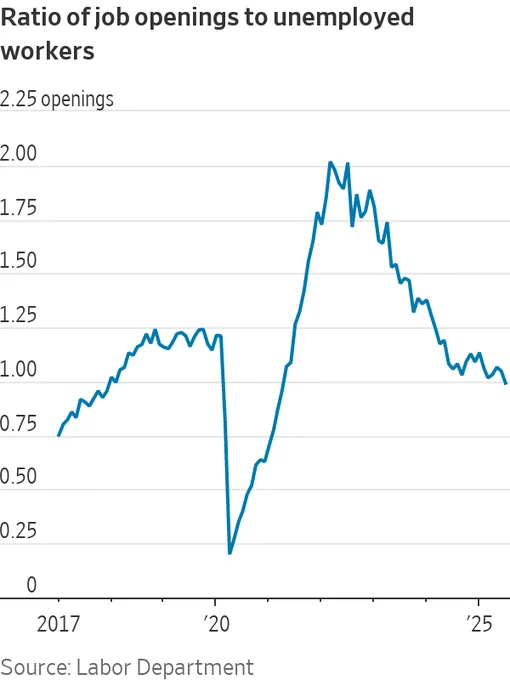

Job openings fell in July to the lowest level since September 2024, holding the 3-month average close to 7.4 million openings.

The ratio of job vacancies to unemployed workers edged just below 1 for the first time since early 2021. https://t.co/9CghdR9hZ1

Show more

0

0

9

137

32

Powell cautiously tees up a cut: “The balance of risks appears to be shifting.”

While labor markets remain in balance, “it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers.”

“This unusual situation suggests that downside risks to employment are rising. And if those risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment.”

Show more

0

0

47

1.1K

384

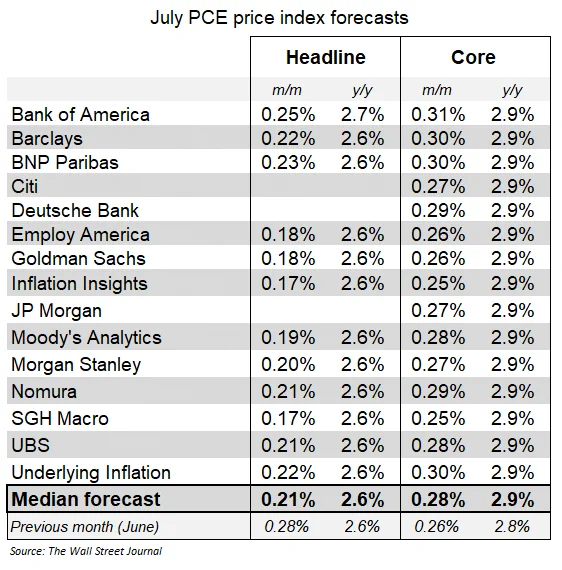

Economists who translate the CPI and PPI into the PCE expect monthly core inflation was 0.28% in July (3.4% annualized), which would raise the year-over-year measure to 2.9%

Headline PCE is expected to be milder at 0.21%, holding the year-over-year measure at 2.6%. https://t.co/WrU4k1fC0m

Show more

0

0

8

145

39

Bessent: I didn't tell the Fed what to do. What I said was that to get to a neutral rate on interest that that would be approximately 150 basis point cut. I did not call for them to get there.

0

0

36

250

36

Kansas City Fed President Jeff Schmid, an FOMC voter this year, prefers keeping rates where they are:

"I see no possibility that we will know the effect of the tariffs on prices, either as a one-off shock to the price level or a persistent inflation impetus, over the next few months. Also, I promise that you will not hear me talking about inflation excluding tariffs, which I think is neither a meaningful nor a measurable concept."

"I am anticipating a relatively muted effect of tariffs on inflation, but I view that as a sign that policy is appropriately calibrated rather than a sign that the policy rate should be cut."

"With the economy still showing momentum, growing business optimism, and inflation still stuck above our objective, retaining a modestly restrictive monetary policy stance remains appropriate for the time being."

"While monetary policy might currently be restrictive, it is not very restrictive."

"Given recent price pressures, a modestly restrictive stance is exactly where we want to be."

"With stock prices near record highs and bond spreads near record lows, I see little evidence of a highly restrictive monetary policy."

https://t.co/mO04Sp085X

Show more

0

0

26

223

40

Marc Sumerlin: Inflation isn't a serious problem right now. Tariffs are a tax hike. Tax increases lower inflation because they lower after-tax income.

If the Fed had known the May & June jobs reports were as weak as they were, they could have cut rates by 25 bps in June & July

Show more

0

0

56

605

98

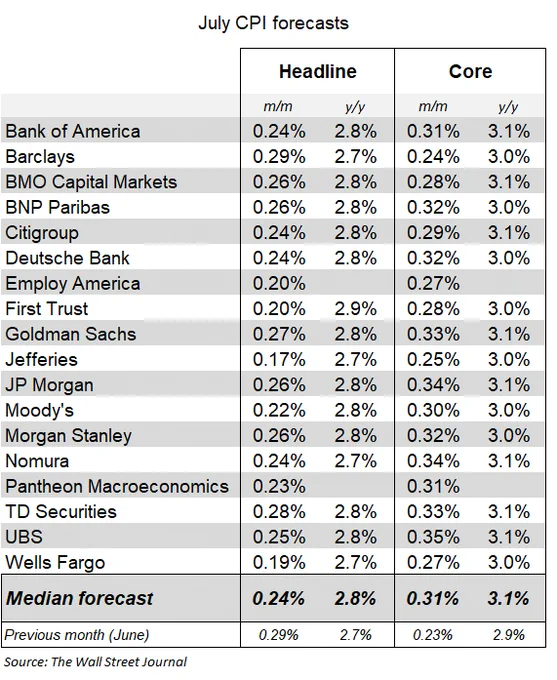

July CPI is the big release this week.

Core prices are expected to have risen 0.31%, which would bring the 12-month increase to 3.1% (from 2.9% in June and 2.8% in May).

Headline prices are expected to have risen 0.24%, which would lift the 12-month measure to 2.8%. https://t.co/OKxVQ5Y1MQ

Show more

0

0

17

178

69

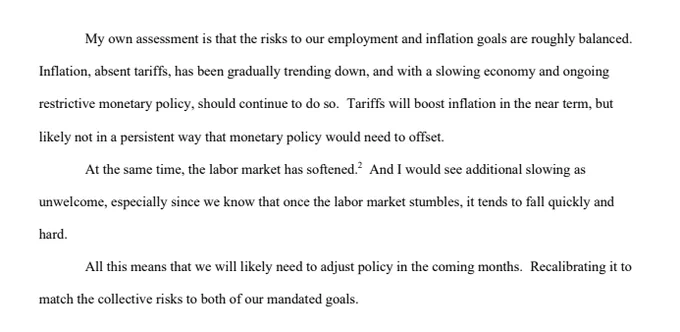

SF Fed President Mary Daly: "We will likely need to adjust policy in the coming months." https://t.co/e7HNxJuJwt

0

0

30

246

54

Trump to CNBC on the jobs numbers before the election: "The numbers were rigged."

He's getting his dates wrong. He's saying the jobs numbers looked good before the election but were revised down after the election. The big downward revision in August, before the election.

Show more

0

0

20

81

21

Kugler's decision to leave the board about six months early gives Trump a sooner-than-expected opportunity to put someone on the Fed board, including the person who could succeed Powell as chair when his term ends.

Show more

0

0

12

291

50

This week's Fed meeting could feature two dissents from governors, which hasn't happened in more than 30 years—or 259 consecutive policy meetings

“Trump has an influence over every institution sooner or later, and maybe the Fed’s ability to resist it has come to an end" @TimDuy

Show more

0

0

25

158

32

Bessent on the Fed: "Based on the way they cut rates last fall, they should be cutting rates now."

0

0

3

37

6

NY Fed President John Williams says you can take the summer off: "It's not going to be that in June, we're going to understand what's happening, or July."

"It's going to be a process of collecting data, getting a better picture, and watching those things develop."

Show more

0

0

10

202

38

The Fed adopted changes to its policy setting framework in 2020 because the very low rate world of the previous decade had introduced a meaningful asymmetry to their inflation target.

The world had other plans. Freed from that regime, the Fed is now seeking to retool.

Show more

0

0

15

136

29

CPI was in line with expectations

Core CPI was +0.24% in April, keeping the YoY rate at 2.8%

Headline CPI was +0.22% in April, lowering the YoY rate to 2.3% from 2.4%, a new four-year low https://t.co/Zpot9ZZwyY

Show more

0

0

15

186

63

Fed officials agree that rate cuts aren't appropriate until they see concrete signs of slower spending and higher joblessness.

But differences are flaring over how confident officials can be that price increases from tariffs and shortages will be temporary.

Show more

0

0

73

1.3K

269

"This idea that you can break trade, and not break the capital flow side, is a fantasy."

The dollar has weakened while longer-dated Treasurys have been under pressure since President Trump's April 2 trade announcement https://t.co/MIILwPEJfs

Show more

0

0

5

47

13