been reflecting on this a lot recently - both as an observer and as an operator

i do agree with @ajwarner90 here

i think the obsession with buybacks probably comes from 1/ historically widespread poor alignment and governance, and 2/ a general focus on token price management above everything else

but i do think the industry may have swung too far in the other direction

even if you look at nasdaq

- earnings matter, but the future / growth always matters way more (market is forever forward-looking)

- many companies don’t do buybacks at all, and the market agrees

an excessive focus on buybacks pushes every new builder toward trading-related use cases

and a culture that only celebrates buybacks risks pushing builders to prematurely invest proceeds into their own tokens - which is inherently risky

as the industry matures, the right balance imo should be:

- demonstrate alignment between teams and token holders

- choose the path that’s best for the long term

- communicate openly with the market about the rationale and future catalysts for change

so my bottom line is -

while we should absolutely celebrate the success of hyperliquid, pump, and many others

we should also give new builders enough room to pursue their long-term visions

the right ask from the market is alignment

from there, for builders, it should be an obsessive focus on real adoption with a long-term horizon - with or without immediate value distribution

Show more

0

0

72

109

2

what might seem on paper a relatively simple update to some, has actually been very complex - hence the time it’s taken

we’re in a fortunate position as a team to work with so many projects, and to have a wide spanning audience and user-base across the globe

with this comes a tricky balancing act: ensuring sustainability, intention, and subjective quality on both sides, plus a wider social responsibility for the space

we feel that today’s first update, as part of an iterative process, is key to ensuring that real creators are able to continue being recognized by more and more projects for their efforts

this is especially true in the age of AI dominance

undoubtedly, as Kaito leaderboards became more prevalent, there was an influx of malicious actors and - more unique to monetized social platforms - AI slop

from the start, our intention has been to be as inclusive as possible, but as we’ve seen - over time this has, in some cases, led to bad actor involvement and increased spamming overall

therefore with reference to how other social platforms manage their monetization for creators, we’re rolling out updates to both increase the necessary threshold for participation, and for preventing and cutting out spam, malicious actors and slop

there will never be a one-and-done solution for this, so do expect it to have imperfections -

there will inevitably be real, high quality emerging creators or community members who are left out of the leaderboard (for now!)

and there will also be some folks still on it that people feel are unjustified (again, for now!)

and this is why we’ll treat this as an iterative process of improvements with this just being the first step.

during the process we want assure three things:

- changes are essential here for sustainability of the product in terms of its quality and utility to both participants and projects

- we will be constantly looking at and adapting to issues, and missteps, so know we’re very focused on this as a task

- thresholds are there to be met, and as we’ve seen with so many accounts who have grown in the 9 months through consistent quality content and intersections, they are more than achievable

another key element here is that each project has different focuses in the communities they want to foster and highlight, so expect variance, and we’ll work closely with the projects to make sure they are able to recognize the creators they want

it’s a big change, and a complex one, but ultimately it’s hugely important as we continue to push our strategy, so I’m excited to see the progress from here

the next steps of gKAITO, onchain integration, multi platform integrations and others mentioned in the tweet below will really tie this all together - so stay tuned for that!

Show more

0

0

674

1K

58

we are entering one of the best times for individuals to grow social presence and capitalize brand value - and the goal of Yaps has always been to reward such valuable voices.

finding the balance between the aim of intended monetization and incidental farming is the trickiest part, and currently Yapper Leaderboard has swayed too far into allowing noise and farming - amplified by the proliferation of AI tools and X’s monetization push altogether, regardless of the existence of Kaito.

so improvements and iterations will be a constant part of our roadmap, and I’m excited to announce the introduction of two major things, updates to Yapper Leaderboards, and gKAITO - both live in the coming weeks.

Yapper Leaderboards have served as a valuable alternative to the historically opaque and performance-agnostic KOL distribution model. however, over time, certain negative externalities have emerged - namely noise, low-effort content, and an overemphasis on rewards (which is also on us). these dynamics have discouraged some genuinely strong accounts from participating and attracted lower-quality engagement.

with all of these in mind, we are introducing a series of changes to the network, including a reputation threshold to all yapper leaderboards - coming live in a few weeks

it’s a mechanism we’ve put a lot of consideration into, and it’s very much based on addressing the feedback we see across the timeline, both from Kaito community members and the wider crypto audience (very grateful for both negative and positive constructive feedback and flags).

every single creator platform has a minimum threshold for creators to monetize

- X requires 5 million impressions over last 3 months

- TikTok is 10,000 followers and 100,000 video views

- for Youtube it’s 4000 valid watch hours

creators need to prove influence and impact prior to monetization, and a large part of this is to ensure equitable distribution, as well as to prevent low effort, low quality content from being able to participate which overall makes the network more attractive to all involved.

you’ll be able to see the various elements we’re going to implement based on this in the tweet below.

supplementing this, we wanted a way to involve the crypto community more widely in the Kaito ecosystem even if they aren’t more actively able to be involved - and this is through gKAITO.

gKAITO represents the five core pillars of a project-community relationship: Thought Leadership, Attention, Participation, Ownership, and Culture.

for us, the significance of the gKAITO mechanism is it brings together everyone, both in our ecosystem and the broader crypto space in a unified way. gKAITO then becomes the unified proof of contribution that allows all participants - of different degree - to benefit from the platform’s success in terms of fee sharing, priority access to deals, and more.

overall, as we’ve always said in the past - improvements and iterations will be a constant part of our roadmap, especially for something brand new. the reality is, the incentive structure that worked yesterday may no longer work today, and the technology landscape is always changing.

but this is exactly how we move the space forward - together.

build. iterate. and keep moving.

Show more

0

0

731

1.1K

92

simple math -

there's only 18M KAITO staked today = $15m (NFT another $5m)

BOOP drop = 50bps * 30M = $1.5m

that's ~10% return right there

from 1 drop

we're in talks with so many teams on all kinds of collabs

attention is the real scarcity

Show more

0

0

394

832

53

if cabal becomes so big

cabal becomes the network itself

and if such network is

- permissionless to join

- composable to build upon

- and computationally scalable

a whole new economy is born with unstoppable flywheel

that is Kaito

few today

Show more

0

0

344

673

42

most of the CT don't know this yet

@Sidekick_Labs is absolutely dominating in Chinese CT in our regional mindshare heatmap

tiktok first blew up in China (douyin) before going viral globally

there might be a whole different world outside of our own echo chamber

that's the power of data-driven insights

Kaito

Show more

0

0

159

292

20

About the definition of mindshare and sentiment -

seeing people unclear about what mindshare is defined and feeling strongly about having critical voices in the space

let me be clear -

1/ mindshare is NOT sentiment dependent - it represents share of voice in a particular topic

this applies to Kaito Yaps (tokenized influence), CT leaderboard, pre-tge arena, VC arena etc

so when you trade on @noise_xyz, you are trading unfilter-ed mindshare - regardless if it's bullish or bearish

2/ what is senitment-weighted mindshare currently?

it's ONLY the project-specific yapper leaderboard.

those leaderboards are designed to highlight and reward the biggest evangelists in each of the community

3/ what about critical voices in the space?

my view is Yaps (and X) actually disproportionally incentivizes controversial takes given virality

lots of people have said since Yaps there’s been a significant increase in the number of public call outs

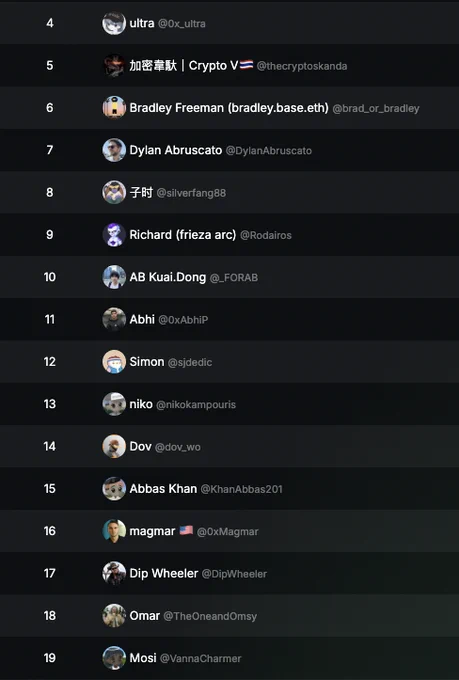

looking at Kaito Yaps emerging accounts L30D leaderboard - you notice many of the accounts here that've been critical

including

@0x_ultra no 4

@VannaCharmer no 19

@silverfang88 no 8

@_FORAB no 10

===

happy to answer any questions below -

Show more

0

0

35

52

6