Search results for Bitcoin-backed

People

Not Found

Tweets including Bitcoin-backed

💥JUST IN: 🇺🇸 Cantor Fitzgerald launches Bitcoin-backed lending for institutions.

0

0

149

4.4K

506

I've just started running my light #node# on #LayerEdge# 's Incentivised #Testnet# #Dashboard# and earning points. Contribute now towards a #Bitcoin-backed# internet while earning rewards by simply using my referral code that you'll need to access the dashboard: GXljslWH

#LayerEdge#

Show more

0

0

0

22

34

🚨 BREAKING: HUT 8 launches American #Bitcoin# mining firm backed by Eric Trump and Donald Trump Jr. https://t.co/S7CHvlKXhK

0

0

177

1.1K

225

🚨 JUST IN: JPMorgan considers offering loans backed by crypto such as Bitcoin and Ethereum holdings, potentially starting next year per FT. https://t.co/mwso6JEi8q

0

0

123

995

190

NEW: Pro-Bitcoin Republicans Jimmy Patronis and Randy Fine won special congressional elections in 🇺🇸 Florida's 1st and 6th Districts, backed by the Fairshake political action committee. https://t.co/IXlChZplCJ

Show more

0

0

6

53

15

New Airdrop 🪂

✅ Project Backed by Top Tier VCs Complete tasks to win a share of 400,000 $KOS!

@Kontosio x ByBit WEB3 Wallet

🔗 Join airdrop here: https://t.co/nHVcGfmD4W

✅ Deposit 10 $MNT on Bybit wallet to be eligible

You have missed 5 fig airdrops

Do not miss @Kontosio again!

#crypto# #airdrop# #giveaway# #airdrops# #bitcoin#

Show more

0

0

12

159

176

RWA DePIN Protocol Registrations are now Live!

@rwadepin is a government-backed launchpad and wealth management platform for RWA.

Established in 2021, the project operates hydro power and Bitcoin mining plants, giving users on-chain exposure to industries like energy production and Bitcoin mining.

🟠 Platform Raise: $300,000

🟠 IDO Ticket Size: $250

Registrations are now LIVE.

Opt in NOW:

https://t.co/vvWkr0Jr2N

Show more

0

0

80

811

262

ICYMI: 🚀 @SemlerSci adds 211 #BTC# at $101,890 each, now holding 2,084 BTC. Backed by $21.5M from cash flow & ATM sales, their Bitcoin strategy shows a 92.8% yield. 🚀

https://t.co/1zwIFCPYjr

0

0

7

53

14

Winners Announced: The Buidl Battle Competition 🟧

Over the past few weeks, @StacksOrg hosted the Buidl Battle—an open competition for Bitcoin builders to ship powerful new tools, protocols, and apps across the Bitcoin ecosystem.

With nearly a hundred submissions, two intense judging rounds, and a finale judged by top-tier VCs, Buidl Battle proved that the next wave of Bitcoin apps is already being built.

Round 1: Themed Innovation

Round 1 of the Buidl Battle was organized around four major themes: DeFi, the Digital Economy, Real World NFTs, and Developer Tooling. Each theme surfaced winners who demonstrated strong technical execution and potential for real impact on Bitcoin and Stacks.

DeFi

🏆 BigMarket – A Bitcoin-native, AI-powered prediction market

🥈 BitForward – NFT-backed forward contracts using Bitcoin as collateral

Digital Economy

🏆 KultureFun – Token-gated wallet chat and ad channel with DAO governance

🥈 StacksTube – AI-driven memecoin launchpad and entertainment platform

Real World NFTs

🏆 Offers & Counter Offers – A seamless marketplace for BNS name trading

🥈 Truth-Chain – Onchain verification for digital content authenticity

Tooling / Infrastructure

🏆 Blaze – A scaling protocol for fast off-chain transfers with secure onchain settlement

🥈 PoX Agents – Conversational interface for blockchain operations

Partner Challenges

To expand the playing field, partners held Challenges, incentivizing builders with more prizes for building innovative solutions with cutting-edge technology on the Internet Computer Protocol, AWS Bedrock platform, and AIBTC’s Agent-governed DAO platform.

ICP Challenge

🏆 ckBoost — Reduce confirmation times to 15 minutes while rewarding liquidity providers

🥈 CounterParty ICP — API for retrieving asset information related to the Counterparty

AWS Bedrock Challenge

🏆 StacksAI – AI-powered Clarity contract generator leveraging AWS Bedrock.

Honorable Mentions

Alongside these winners, a number of strong entries earned Honorable Mentions, including AutoStacks, Claride, Stacks Brain, Creator’s Web3 Economy, Bitcoin Loan Bank, TipCloud, Bolt Protocol, Kraxel, and Skullcoin.

Wildcard Finalists

To keep the competition dynamic and inclusive, four teams were nominated as Wildcard Finalists based on creativity, execution, and promise:

TipCloud

Bolt Protocol

Kraxel

Skullcoin

After a final vote, Bolt Protocol—which enables users to pay transaction fees with sBTC and supports instant transfers between Bolt Wallets—earned its spot in the finals as the Wildcard Winner.

From Builders to Finalists

Round 1 was judged by a panel of experienced developers and startup operators who selected the top projects from each theme. These winners advanced to Round 2, where venture capitalists judged the finalists based on the problem their product solves, their vision, and team execution.

Round 2: The Final Showdown

In Round 2, twelve finalists—eight selected from the four themes, three teams from the partner challenge categories, and one wildcard—competed for the top prize. After pitches, demos, and a lot of deliberation, the judges awarded:

🏅 4th Place: ckBoost (ICP Challenge)

🥉 3rd Place: BitForward (Bitcoin DeFi Theme)

🥈 2nd Place: BigMarket (Bitcoin DeFi Theme)

🥇 1st Place: Blaze Protocol (Infra & Tooling Theme)

Blaze Protocol by @lordrozar stood out as the most well-executed and visionary project, offering a new scaling layer for Bitcoin and Stacks apps with responsive, invisible blockchain interactions. The team impressed with both technical execution and long-term potential.

What’s Next?

The Buidl Battle was more than just a hackathon—it was a showcase of what’s possible when Bitcoin builders are given the right tools, support, and platform to build. These teams now have a launchpad to take their prototypes into production, and the Stacks community will be watching—and supporting—every step of the way.

To all the builders: You showed up. You shipped. And you’re building the future of Bitcoin.

Show more

0

0

10

86

28

🌍 Tariff wars heat up. USD assets no longer feel “safe.”

In uncertain times, owning hard assets like gold—physically and directly—is more critical than ever.

🔔 Introducing Leveraged Spot Gold Strategy with $XAUm

Long more gold with less capital.

For example, you could get up to $50K in gold exposure with just $10K.

With $XAUm, you can amplify your position up to 5x, fully backed by LBMA-accredited physical gold.

This strategy allows you to gain enhanced exposure to gold's price movements by using leverage against actual gold holdings—not futures, not options, not perpetual contracts. You're investing in real LBMA gold stored securely, while using tools to multiply your exposure.

✅ Available on @Matrixport_EN App (CeFi)

✅ Live on @PancakeSwap + @kinzafinance (DeFi)

Smarter gold. On-chain.

⚠️ Leverage magnifies both gains and losses. Use responsibly and assess your risk appetite.

Learn more here→ https://t.co/tAukgpObBc

#GoldOnChain# #XAUm# #Matrixdock# #RWA# #DeFi# #CeFi# #Gold# #crypto# #bitcoin# #stablecoin#

Show more

0

0

7

32

11

I don't know why @rickawsb wrote his article in Chinese but here's an unfiltered English version of it:🧵👇

The “GENIUS Act” and the New East India Company: How USD Stablecoins May Challenge Fiat Systems and Nation-States

By: Rick AWSB

“This is an extremely sophisticated asymmetric strategy. The U.S. is exploiting its adversaries’ weakest point fear of losing control to build its own moat.

I. Ghosts of History: The Digital Return of the East India Company

History doesn’t repeat, but it does rhyme.

When Trump happily signed the GENIUS Act into law, what came to mind was a powerful image from history: the East India Companies of the 17th and 18th centuries commercial behemoths granted sovereign powers by their nations. These were not mere merchants, but corporate sovereigns, blending soldiers, diplomats, and colonizers.

This Act, though appearing like a regulatory tweak, in truth marks the chartering of 21st-century “New East India Companies” stablecoin issuers gaining legitimacy through U.S. law. It's the beginning of a transformation in global power dynamics.

1a. Charters of a New Power

Four centuries ago, the Dutch and British East India Companies (VOC and EIC) had the power to hire armies, mint currency, make treaties, and wage wars. Their state-backed monopolies defined the age of globalized sea trade.

Today, the GENIUS Act essentially charters modern-day equivalents stablecoin giants like Circle (USDC), potentially Tether, and possibly tech giants like Apple, Google, Meta, and X. No longer rebellious crypto startups, they are now pillars of U.S. financial strategy. Their “routes” aren’t sea lanes, but 24/7 borderless financial rails the new arteries of global commerce.

1b. From Trade Routes to Financial Rails

The old companies controlled physical routes with cannons and forts. These new “digital East India Companies” will control global value flows. If a U.S.-regulated stablecoin becomes the default for cross-border payments, DeFi, and real world asset trading, its issuer gains immense soft power defining compliance, freezing assets, and setting financial norms.

1c. Symbiosis and Conflict with Nation-States

Like their historical predecessors, today’s stablecoin giants may evolve from tools of national strategy to independent power centers. Initially supporting U.S. hegemony and countering China’s e-CNY, they may eventually act in ways that contradict U.S. foreign policy, especially as their shareholder interests diverge from state agendas.

The U.S. may face tension between control and dependence, possibly leading to future updates to the stablecoin legal framework.

II. Global Monetary Tsunami: Dollarization, Deflation, and the End of Non-Dollar Central Banks

The GENIUS Act is more than a charter. It’s the start of a monetary tsunami. The collapse of the Bretton Woods system in 1971 laid the groundwork. In the coming era, people in fragile economies may prefer stablecoins over failing national currencies, leading to hyper-dollarization and devastating local deflation.

2a. The Ghost of Bretton Woods

Under Bretton Woods, the dollar was tied to gold and all other currencies to the dollar. This created a paradox (Triffin Dilemma): to support global trade, the U.S. had to run deficits which eventually undermined confidence. Nixon severed the gold link in 1971, ending the system.

The dollar was reborn as a fiat instrument backed by U.S. strength and network effects. Now, U.S.-approved stablecoins elevate this to a new level bypassing national banks and reaching every smartphone directly.

2b. Hyper-Dollarization

In places like Argentina and Turkey, people flee inflation by using dollars. Stablecoins remove friction: no banks, no capital controls, no physical risk.

From Vietnam to Dubai, and Yiwu to Hong Kong, stablecoin usage is exploding. When inflation rises even slightly, capital doesn’t “flow out”. it vanishes instantly into the crypto ether. This threatens national currencies with obsolescence.

2c. Deflation and the Disappearance of State Power

Once hyper-dollarization hits, governments lose:

• Seigniorage (printing money)

• Monetary policy tools

The result: plummeting local currencies, collapsing tax bases, and failed governance.

The GENIUS Act, combined with tokenized real-world assets (RWAs), may accelerate this collapse.

2d. White House vs. The Fed

Domestically, a conflict may brew. If a Treasury-controlled stablecoin system emerges, it could sidestep the Fed, allowing the Executive Branch to exert monetary influence directly especially in election years or sanction enforcement. This may trigger a crisis in faith over Fed independence.

III. The 21st Century Financial Battlefield: U.S. vs. China and the “Free Financial System”

Externally, the Act is a strategic maneuver in the U.S.-China rivalry an ideological and infrastructural clash.

3a. A New Financial Iron Curtain

Like the post-WWII Bretton Woods institutions (IMF, World Bank), this new “free finance” network powered by USD stablecoins is open, efficient, and diametrically opposed to China’s model of state-controlled finance.

3b. Permissionless vs. Permissioned

China’s e-CNY is fully controlled, running on private ledgers, with full traceability. The U.S., in contrast, backs permissionless blockchains (Ethereum, Solana). Developers worldwide can build freely, with the U.S. acting as “credibility anchor” for the USD.

This asymmetric strategy attracts innovators and users, while China’s surveillance model alienates them. It’s a contest China structurally can’t win.

3c. Bypassing SWIFT: A Dimensional Attack

China and Russia attempt to sidestep SWIFT. But stablecoins render that effort obsolete no middlemen needed, no banks required. The U.S. isn't defending old infrastructure; it's creating a parallel game with new rules enforced by code, not treaties.

3d. Winning the Network Effects War

The fusion of the dollar with crypto’s innovation creates an exponential network. Developers and users will flock to where liquidity and freedom are highest.

Compared to the closed, RMB-centric e-CNY, the open USD ecosystem will dominate globally beyond China’s limited spheres of influence.

IV. The De-Nationalization of Everything: RWA, DeFi, and the Collapse of State Control

Stablecoins are the Trojan Horse. Once users hold stablecoins, the next step is tokenizing all assets, stocks, bonds, real estate, IP into on-chain digital instruments, detaching them from national jurisdiction.

4a. Stablecoins as the Trojan Horse

Governments welcome regulated stablecoins as safe crypto. But in doing so, they unintentionally onboard users into crypto ecosystems one tap away from Bitcoin, ETH, DeFi, and privacy coins.

Platforms like Coinbase become one-stop crypto supermarkets. USDC is the gateway drug leading users toward more freedom, higher yield, and greater autonomy.

4b. RWA: Assets Escape National Jurisdiction

Imagine:

• A Chinese team tokenizes app ownership

• Traded on a permissionless DeFi protocol

• An Argentinian buys it with stablecoins

No bank, no SWIFT, no borders.

This isn’t just new payment rails it’s a parallel universe outside the Westphalian order. When capital de-nationalizes, so do capitalists.

4c. The End of Traditional Finance

Banks, brokers, and payment systems exist to mediate trust. Blockchain replaces this with public, tamper-proof records and smart contracts.

Functions replaced:

• Lending → DeFi protocols

•Trading → AMMs

• Payments → Stablecoin transfers

• Securitization → RWA tokenization

V. The Rise of Sovereign Individuals & The Twilight of the Nation-State

When capital flows freely, assets ignore borders, and power shifts to networks and private giants, we enter a post-national age where the individual becomes sovereign.

5a. The Prophecy of The Sovereign Individual

In 1997, Davidson and Rees-Mogg predicted that the Information Age would make power more mobile than ever. The state would be unable to tax knowledge and capital that exists online.

Stablecoins, DeFi, and RWA make this real. A person can now:

• Hold global assets

•Move capital instantly

• Stay outside any one jurisdiction

States lose grip. And their ability to tax or control fades.

5b. The End of the Westphalian System

Since 1648, the world has been ruled by nation-states. But if productive individuals live in cyberspace, state borders become meaningless.

States may resort to coercion predatory taxes, surveillance accelerating elite exit. Eventually, they may become "nanny states" serving only immobile, less wealthy citizens.

5c. The Final Frontier: Privacy vs. Taxation

Today’s chains are transparent. But zero-knowledge tech (ZKPs) will bring complete anonymity.

Combined with stablecoins, this creates an untouchable financial black box breaking the state’s final tool: taxation.

Conclusion:

The French Revolution replaced monarchs with nations. This revolution led by stablecoins and AI replaces territorial sovereignty with network and individual sovereignty.

It’s not just a transfer of power it’s a decentralization and de-nationalization of power.

We are witnessing the breakdown of an old world and the birth of a new order that grants individuals unprecedented freedom, but also unleashes unprecedented chaos.

Show more

0

0

26

37

14

⚡️🇺🇸 ERIC TRUMP:

I FELL IN LOVE WITH BITCOIN BECAUSE OUR FAMILY WAS DE-BANKED by CAPITAL ONE and CHASE.

- I truly believe Bitcoin is one of the greatest stores of value, immediately liquid, an unbelievable hedge.

- Bitcoin is cheaper, faster, more transparent, you can't be cancelled, and it's global.

- Financial Institutions cancel people and businesses they don't like.

- Not a single thing banks do that can't be done better on the blockchain.

-

Show more

0

0

150

3.3K

551

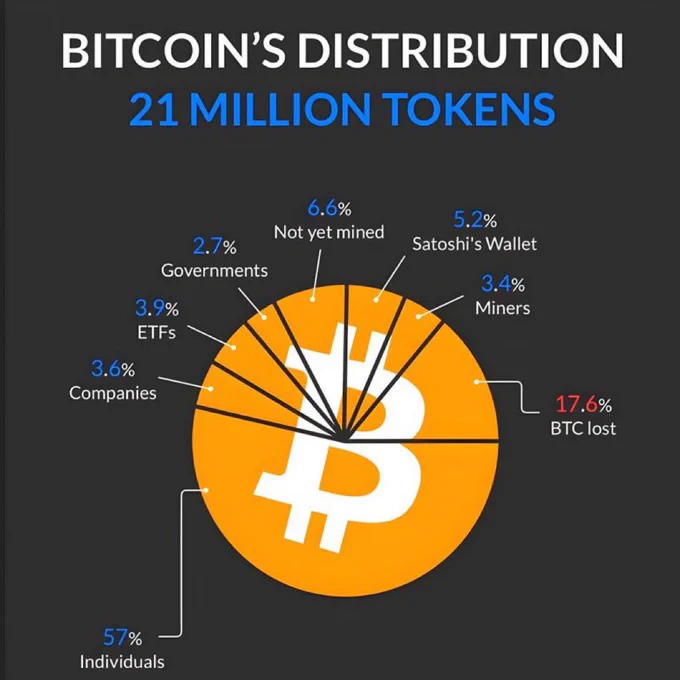

Bitcoin Distribution Pie Chart Analysis (Compressed Version)

The pie chart depicts Bitcoin’s 21 million BTC supply distribution as of late 2024. Data sources include Binance Square and financial reports. It categorizes ownership into eight segments. Below is a concise breakdown, with percentages, absolute BTC (calculated as % × 21M), explanations, and implications. Percentages sum to 100%. Effective circulating supply: ~75.8% (~15.9M BTC), excluding lost and unminted.

Key Categories (Descending Order)

1Individuals: 57% (~11.97M BTC)

Retail holders in personal wallets. Implies decentralization but whale risks. Calc: 0.57 × 21M = 11.97M.

2BTC Lost: 17.6% (~3.7M BTC)

Inaccessible due to lost keys or errors. Boosts scarcity; stresses key security. Calc: 0.176 × 21M = 3.7M.

3Not Yet Mined: 6.6% (~1.39M BTC)

Remaining unissued rewards, mined gradually until ~2140. Ensures predictable supply. Calc: 0.066 × 21M = 1.39M.

4Satoshi’s Wallet: 5.2% (~1.09M BTC)

Dormant coins of Bitcoin’s creator. Adds mystery; potential volatility if moved. Calc: 0.052 × 21M = 1.09M.

5ETFs: 3.9% (~0.82M BTC)

Spot ETFs like BlackRock’s. Enables mainstream access; centralization concerns. Calc: 0.039 × 21M = 0.82M.

6Companies: 3.6% (~0.76M BTC)

Corporate treasuries (e.g., MicroStrategy). Validates as hedge; ties to business cycles. Calc: 0.036 × 21M = 0.76M.

7Miners: 3.4% (~0.71M BTC)

Held by mining firms. Supports network; sales impact supply. Calc: 0.034 × 21M = 0.71M.

8Governments: 2.7% (~0.57M BTC)

Seized assets (e.g., U.S. from busts). Adds legitimacy; regulatory risks. Calc: 0.027 × 21M = 0.57M.

Implications

•Decentralization: Individuals dominate (57%), but institutions (~13.6%) grow, risking centralization.

•Scarcity: ~24.2% out of play drives value.

•Trends: Captures 2024 institutional surge post-ETF approvals.

•Data Notes: Based on on-chain estimates; lost/Satoshi figures approximate.

July 2025 Updates

Chart from 2024; shifts include:

•Unmined: ~5.3% (~1.11M BTC).

•Lost: 11-18% (2.3-3.7M).

•Satoshi: ~5.2% (~1.1M).

•ETFs: ~6.2% (~1.3M, $158B).

•Companies: ~4.1% (~0.86M); MicroStrategy leads (0.6M).

•Miners: ~0.5% public (~0.11M), total higher.

•Governments: ~2.2% (~0.46M); U.S. ~0.2M.

•Individuals: ~52-53%.

Institutions rising; overall aligns with chart. (Word count: ~450)

Show more

0

0

2

3

0

Bitcoin now secures Nexus.

Through our partnership with @babylonlabs_io, we're adding 44,660+ BTC worth of economic security to protect your apps, assets, and data without relying on token inflation or complex bridges. https://t.co/N6y1dPSnCr

Show more

0

0

440

753

436

Bitcoin liquidity is coming to Solana

Yala is bringing its Bitcoin-native infrastructure to Solana, enabling BTC holders to unlock real yield across Solana DeFi.

Here’s what’s happening ↓

0

0

59

650

245

#Bitcoin# 两次假突破之后,从最高点107137美金砸到102105美金,跌幅 4.7%个点~

如果,空军再不发力,这也许就是最后逃跑的机会了,下半年涨到头皮发麻~

0

0

1

14

0

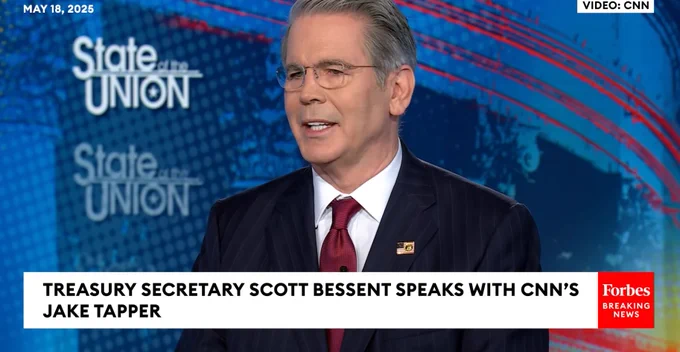

Bitcoin 今天几乎突破到了 106,000 美元,但没有任何的理由显示为什么 $BTC 能涨的这么开心,看了下 tradingview 的细节数据,BTC 的上涨是从北京时间晚上21点37分开始的。

而这个时间正好是 美国第79任财政部长 贝森特 讲话的时间,当然可能有些小伙伴说这是硬找角度,没关系,起码这是我找到可能是最接近上涨的原因。

那么 贝森特 讲了什么会带动 Bitcoin 的上涨呢?

最主要的就是讲的就是美国债务和 GDP 的信息,众所周知,在周五闭盘后穆迪下调了美国的信用评级,这一下三大评级公司都把美国从 Aaa 级别下调到了 Aa1 级别,这对于美债的信心是一种打击,而三大下调的主要原因也正是因为“美债”。

所以 贝森特 才必须要在假日出来给市场打气,毕竟周一美股和美债市场就要开盘了,所以首先 贝森特 先讲的是 GDP 的问题,认为美国的经济发展非常的好,而且随着关税问题的处理,GDP 增长速度将快于债务增长速度,说人话就是美国并不会陷入债务危机中。

关键处在于 贝森特 阐述美股的目标不是与中国脱钩,而是开放市场、恢复平衡。美国将继续与中国进行贸易,特别是非战略商品的贸易,并且以较低的关税水平进行。 与此同时,将致力于将医药、半导体和钢铁等关键行业回流,以保护美国的国家安全利益。

并且再次强调了川普的大美丽方案能够减轻工薪家庭和企业的负担,推动经济增长。而且还认为减税会导致通货紧缩,从而能够抗击通胀,恢复美国的能源主导地位。

还公布了川普去中东获得了2万亿美元的投资承诺,这笔资金将会推动美国的就业、创新和长期增长。当然后边还有非法入境等事件,但是和经济的关系已经不大了,讲到这里的时候应该就是 $BTC 上涨的高点,因为市场确实希望相信川普能把美国治理的更好。

如果我没有估计错,这就是 Bitcoin 能够上涨的主要原因,几乎就是来自于投资者对于川普政府的信任,而并不是来自于 BTC 本身的叙事,更主要的是因为美股现在在停盘,流动性并不是很好,成交量相比传统的周末并没有明显的放大。

当然我并不是说 BTC 接下来就会跌,但 BTC 的涨跌还是会和美国的经济,政治,关税,货币政策等高度一致,目前的上涨很可能无法代表真的就能在短期有一个非常好的结果,当然,我很有可能是错的,这不是开单的理由。

目前的 BTC 仍然是处于事件型驱动。

本推文由 @ApeXProtocolCN 赞助|Dex With ApeX

Show more

0

0

28

44

3

Bitcoin meets Sui DeFi.

@BitlayerLabs is bringing Peg-BTC (YBTC) — a trust-minimized BTC asset powered by BitVM — to life on Sui, giving hodlers yet another choice for utilizing their BTC.

YBTC lets BTC holders tap into staking, lending, trading, and more on Sui.

BTCfi on Sui continues to grow! 👇

Show more

0

0

28

117

23

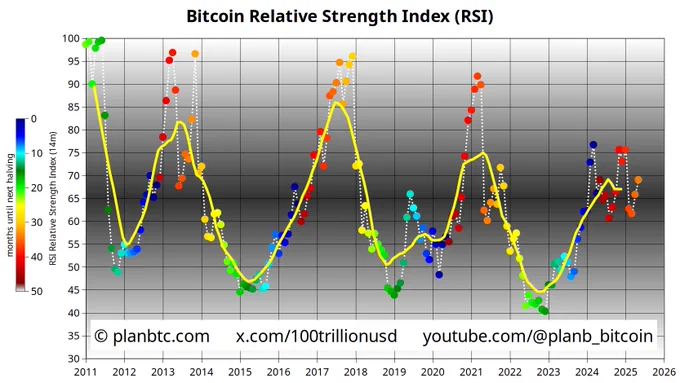

Bitcoin RSI = 69. I expect at least 4 months with RSI 80+, just like in previous bull markets (2021, 2017, 2013). RSI 80+ is associated with monthly returns of 40%+. 4 months of 40%+ return bring BTC from $104k to $400k ...

More analysis: https://t.co/9ACtqkNFBv https://t.co/Lkc2ljDAh1

Show more

0

0

110

1.8K

311