Search results for Bitcoin’s

People

Not Found

Tweets including Bitcoin’s

Bitcoin shines a beacon of orange hope, illuminating a path in the sea of red turbulence. https://t.co/6MZH5DLu0m

0

0

111

1.7K

244

#Bitcoin’s# gearing up—hold tight, the rocket’s just fueling a bit longer! https://t.co/xtW6xH7m9i

0

0

0

1

1

Safeguarding Bitcoin since 2013. Billions in assets, never rehypothecated. Your wealth is protected with Xapo Bank.

0

0

2

25

0

Safeguarding Bitcoin since 2013. Billions in assets, never rehypothecated. Your wealth is protected with Xapo Bank.

0

0

3

70

3

Safeguarding Bitcoin since 2013. Billions in assets, never rehypothecated. Your wealth is protected with Xapo Bank.

0

0

0

123

2

"Will Bitcoin's rise as the world's top currency be a peaceful and smooth transition from the dollar?"

https://t.co/2K07y5r1Xl

0

0

0

4

23

🚨BREAKING: BITCOIN'S GOLDEN CROSS 🚨

Look what happened EVERY TIME this chart pattern appeared:

✨2016: Bitcoin SURGED 139% (just the appetizer)

✨2017: EXPLOSIVE 2200% gain that turned nobodies into MILLIONAIRES

✨2020: MASSIVE 1190% rocket ride while the haters watched from the sidelines

Show more

0

0

1

6

1

It’s ironic but true: Bitcoin’s best future doesn’t live on Bitcoin. It lives on chains like @SuiNetwork that can unlock its utility, safely and at scale.

0

0

62

1.9K

117

Sui is becoming a Bitcoin Secured Network (BSN) on the Babylon protocol, expanding its BTCfi reach.

Babylon and @SuiNetwork deepen technical ties expanding Sui’s growing connection with Bitcoin into the next frontier.

Read the full article 👉 https://t.co/75LkqFjv0m https://t.co/bai8pQjnMm

Show more

0

0

24

152

31

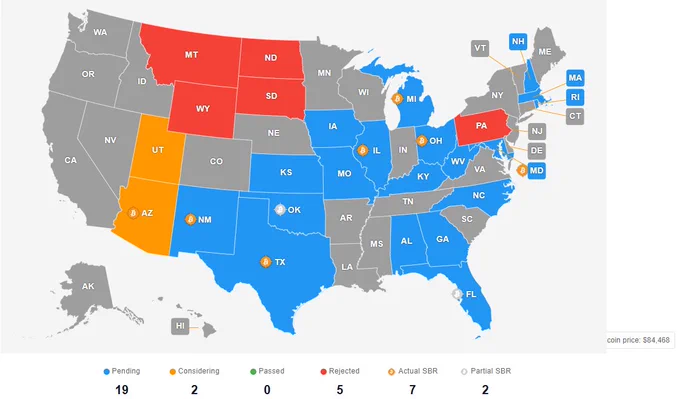

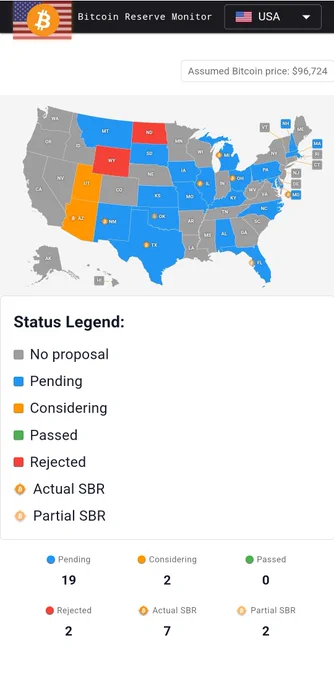

5 failed state bitcoin strategic reserves to date

0 passed

21 still in consideration https://t.co/V8c74oXoi6

0

0

0

0

1

Dual Staking: A Game-Changer for Bitcoin Holders

The crypto world is buzzing about Dual Staking, a revolutionary new strategy offered by Core.

🔍 How it Works:

Instead of simply staking Bitcoin for a modest return (around 1%), users can now significantly boost their yields by staking both Bitcoin and Core's native token, $CORE.

To maximize rewards, users need a substantial amount of $CORE alongside their Bitcoin – think 8,000 $CORE for every Bitcoin staked.

🐋 Why Whales Are Rushing In:

This high $CORE requirement is creating explosive demand for the token. As whales and institutions with vast Bitcoin holdings seek to maximize their staking rewards, the need for $CORE skyrockets.

This surging demand is directly impacting $CORE's scarcity, driving its value higher.

💰 More Than Just Rewards:

Dual Staking isn't just about maximizing profits. It also strengthens the security and decentralization of the Core network by encouraging broader participation.

🏦 Institutional Adoption:

Major players like BitGo, Hashnote Labs, and Cactus Custody are recognizing the immense potential of Dual Staking. These institutions are actively integrating solutions to support BTC + $CORE staking for their high-net-worth clients.

ValourInc, an early adopter of Core's non-custodial staking, has been earning impressive yields. By integrating Dual Staking, they're demonstrating a blueprint for success that others are eager to replicate.

👉 Dual Staking is not just a new feature, it's a paradigm shift for Bitcoin holders. It offers a compelling combination of high yields, enhanced security, and full control over your assets. The time to act is now, as the window to capitalize on this opportunity before the $CORE supply truly tightens may be closing soon.

Show more

0

0

105

165

74

🧙♂️💜 It's time to Reinvent Bitcoin 🧡!

What if holding BTC isn’t the endgame — but just the beginning?

@MerlinLayer2 has been building since DAY ONE — from inscriptions & BTCfi to now AI-powered tools. With Merlin 2.0, we are sharpening our focus on a singular vision: Reinventing Bitcoin – Hold, Earn, Invest.

By harnessing advanced AI and chain abstraction, we aim to unlock new liquidity scenarios and enhance Bitcoin’s utility as a global currency.

👇 Here’s how @MerlinLayer2 is building the future of Bitcoin:

HOLD. EARN. INVEST.

🧵

Show more

0

0

26

55

25

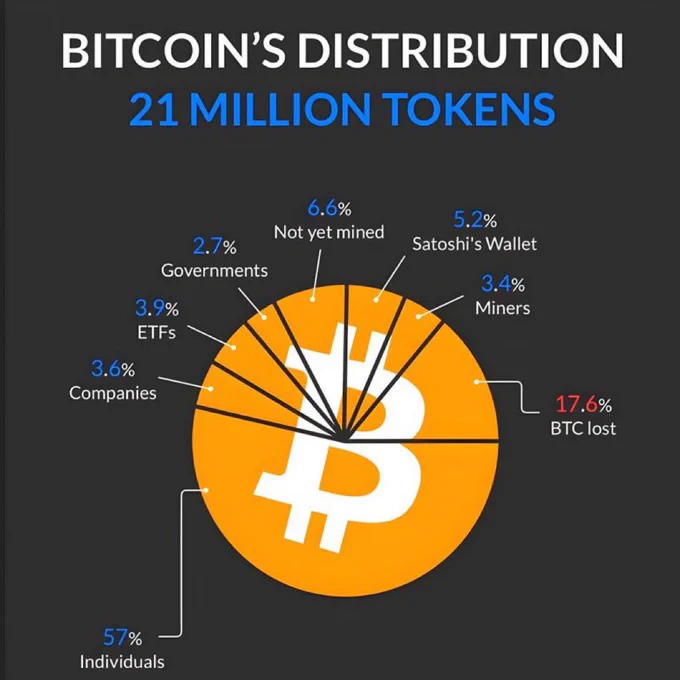

Bitcoin Distribution Pie Chart Analysis (Compressed Version)

The pie chart depicts Bitcoin’s 21 million BTC supply distribution as of late 2024. Data sources include Binance Square and financial reports. It categorizes ownership into eight segments. Below is a concise breakdown, with percentages, absolute BTC (calculated as % × 21M), explanations, and implications. Percentages sum to 100%. Effective circulating supply: ~75.8% (~15.9M BTC), excluding lost and unminted.

Key Categories (Descending Order)

1Individuals: 57% (~11.97M BTC)

Retail holders in personal wallets. Implies decentralization but whale risks. Calc: 0.57 × 21M = 11.97M.

2BTC Lost: 17.6% (~3.7M BTC)

Inaccessible due to lost keys or errors. Boosts scarcity; stresses key security. Calc: 0.176 × 21M = 3.7M.

3Not Yet Mined: 6.6% (~1.39M BTC)

Remaining unissued rewards, mined gradually until ~2140. Ensures predictable supply. Calc: 0.066 × 21M = 1.39M.

4Satoshi’s Wallet: 5.2% (~1.09M BTC)

Dormant coins of Bitcoin’s creator. Adds mystery; potential volatility if moved. Calc: 0.052 × 21M = 1.09M.

5ETFs: 3.9% (~0.82M BTC)

Spot ETFs like BlackRock’s. Enables mainstream access; centralization concerns. Calc: 0.039 × 21M = 0.82M.

6Companies: 3.6% (~0.76M BTC)

Corporate treasuries (e.g., MicroStrategy). Validates as hedge; ties to business cycles. Calc: 0.036 × 21M = 0.76M.

7Miners: 3.4% (~0.71M BTC)

Held by mining firms. Supports network; sales impact supply. Calc: 0.034 × 21M = 0.71M.

8Governments: 2.7% (~0.57M BTC)

Seized assets (e.g., U.S. from busts). Adds legitimacy; regulatory risks. Calc: 0.027 × 21M = 0.57M.

Implications

•Decentralization: Individuals dominate (57%), but institutions (~13.6%) grow, risking centralization.

•Scarcity: ~24.2% out of play drives value.

•Trends: Captures 2024 institutional surge post-ETF approvals.

•Data Notes: Based on on-chain estimates; lost/Satoshi figures approximate.

July 2025 Updates

Chart from 2024; shifts include:

•Unmined: ~5.3% (~1.11M BTC).

•Lost: 11-18% (2.3-3.7M).

•Satoshi: ~5.2% (~1.1M).

•ETFs: ~6.2% (~1.3M, $158B).

•Companies: ~4.1% (~0.86M); MicroStrategy leads (0.6M).

•Miners: ~0.5% public (~0.11M), total higher.

•Governments: ~2.2% (~0.46M); U.S. ~0.2M.

•Individuals: ~52-53%.

Institutions rising; overall aligns with chart. (Word count: ~450)

Show more

0

0

2

3

0

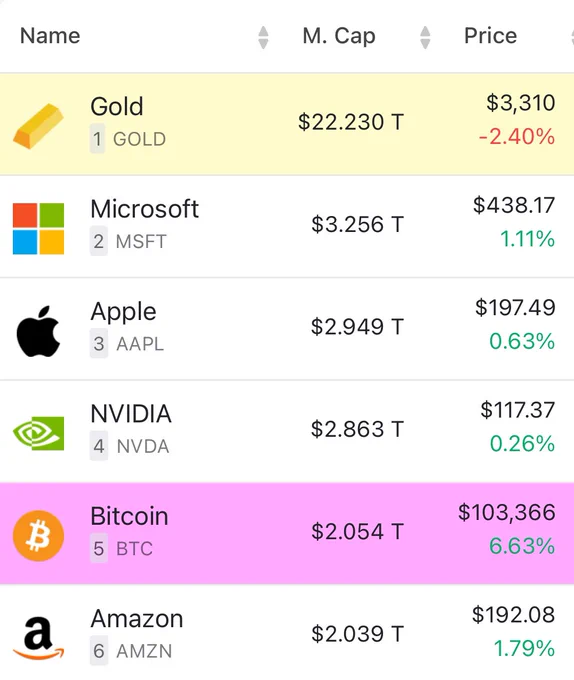

JUST IN: #Bitcoin# surpassed Amazon to become the 5the largest asset in the world 🚀 https://t.co/9j2XCLyQvC

0

0

202

6.3K

1.4K

Jack Mallers explains how Bitcoin’s history is marked by powerful phase shifts, with each one leveling up its credibility. https://t.co/Y2BB9Ni97T

0

0

1

21

1

I’m selling my rental properties for Bitcoin.

I have an accepted offer on one and expect to close in two weeks. Another is currently listed for sale.

I started buying rental properties in 2018, believing they were my best path to financial freedom. But in 2019-2020, I discovered Bitcoin. Over time, my conviction in Bitcoin’s asymmetric upside has only grown.

Now, I see more potential in a portfolio of Bitcoin and Bitcoin-related assets than in holding rental properties. So, I’m making the move.

I will have another 4 units to offload after this, but the writing is on the wall.

Show more

0

0

339

3K

185

🚨Breaking: Check out the bitcoin state reserve monitor

https://t.co/GNWin7Z0H7 https://t.co/9a4RZa2puU

0

0

0

2

3

Babylon Genesis is Live: Secured by Bitcoin to Unite the Decentralized World

Babylon Genesis, the world’s first L1 blockchain secured by Bitcoin, officially launches today.

This launch cements the Babylon Bitcoin staking protocol as the foundational infrastructure layer for Bitcoin and the most impactful staking solution in the web3 ecosystem, transforming idle Bitcoin into the backbone of the decentralized economy and unlocking its full utility.

Show more

0

0

312

1.2K

380

Reduce potential risks by storing your #Bitcoin# securely instead of leaving it on exchanges. #SelfCustody# is simple to set up and provides strong protection for your assets.

0

0

0

0

5

it's important not to forget what we've achieved: stacks is scaling the bitcoin economy with transactions as irreversible as bitcoin's.

goal this year: grow the amount of apps and users using stacks. https://t.co/Djpdugbfr7

Show more

0

0

15

151

43