Search results for GameWith光

People

Not Found

Tweets including GameWith光

0

0

0

801

61

0

0

0

395

13

Just changed the fashion game with my new collection, fam. Genius at work. 💸

0

0

0

17

2

Take this NPB over Ks play with Mabrey in her first game with Conn on Underdog!! Thank me later!!

#LFG# #gamblingtwitter# #wnbabets# #wnbaunderdog# https://t.co/7nQSHzz4a0

0

0

0

4

2

Traeger Grills providing tips to up your outdoor grilling game with their connected grill. @TraegerGrills https://t.co/HzpJvZC1ZJ

0

0

0

2

0

Rainbow Road isn't in Mario Kart World cos its been replaced with "Rainbow World", which serves as a modified version of the entire game with additional paths and stage hazards. Each track has a modified 'Rainbow World' variation.

Source: I made it up

Show more

0

0

15

180

5

Unleash your inner Plyshkin and dominate the Forgotten Playland!

PLAY NOW! Dive into multiple fun game with friends and take the wins. FREE on the Epic Games Store!

0

0

0

20

1

Here’s an exciting opportunity y’all definitely don’t want to miss, guys!

@Minefarm_ is changing the game with a blockchain-powered mining strategy game that runs on real TH/s (Terahashes per second). They just launched a Telegram mini-game, where you can build your virtual mining farm and earn Sparks, which will be convertible into $REDPANDA memecoin when its TGE drops next month!

💎 Exclusive access alert!

The game is invite-only, but I’ve secured a special invite for my community! 🎮🔥 Join through my unique link below and get into my dedicated guild inside the game.

🔗 Join my guild now: https://t.co/urMktnFJ99

That’s not all, there are even more exclusive rewards waiting to be claimed!

Refer & Earn:

✔️ Invite up to 10 friends and get 10% of their earnings

✔️Earn 2.5% from their referrals

Time to mine, strategize, and stack up! Let’s dominate this game together. 🏆💰

#Minefarm# #BitcoinMining# #CryptoGaming# #RedPanda# #PlayToEarn#

Show more

0

0

17

67

8

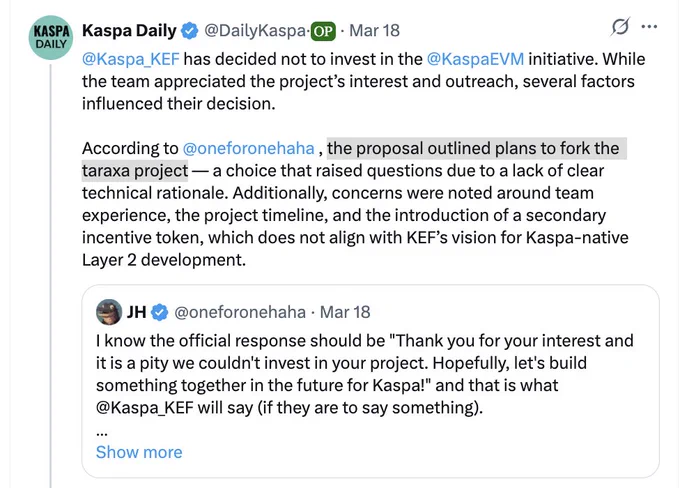

$2.1B project $KAS was thinking to fork $40M cap $TARA to add smart contracts on top of Kaspa

That's how early you are & you're still not buying TARAXA with 10 hands 🙈

TARAXA is the end game

With that being said, KAS🤝TARA could push tech forward

@cz_binance @brian_armstrong https://t.co/hWYFlN5xHi

Show more

0

0

11

92

25

Good to see gaming doing a bit of a comeback with @onchainheroes successfully minting out their Genesis Heroes then doing 10x (.06 to .6) within 48 hours.

I had two OG rings myself and minted 10 OG heroes. I had such a blast playing the game, that I actually top blasted another 25 or so of the NFTs. I may double down on this.

Yea, I may be 'that' guy buying the top of a Ponzi, but there are some reasons for this madness I'll outline later.

Turns out that even in bearish conditions, degens want a financialized game to play. I certainly do.

When the NFTs actually have strong utility in the economy and directly tied to how you earn $, they do in fact perform. Key being the NFTs actually have core utility and they impact your slice of the season 1 ponzi.

The simple format of the 'Idle Games' genre are perfect for those who want a casual, but highly financialized (basically a Ponzi) and so far Onchain Heroes executes this. The game is also whale friendly, as you can spend a few minutes a day managing your army of NFTs without grinding out hours actually doing anything other then watching numbers go up.

It's simple, fun, and the early ponzi gets you hooked.

As this is the opening chapter in a book, I expect the yields to come down as @skarlywarly opts for a robust economy that's sustainable in Season 2 (basically next month). He's done an amazing job so far, so my bet is he can turn this into something big and those getting in will be early.

But the crazy yields early on are fun in what amounts to a marketing splash and this is bringing a wave of fomo and attention to both the game AND @AbstractChain.

Frankly, this is the first 'hit' on Abstract and my bet is the Abstract team will put the full backing behind this success to ride on it.

An interesting play here AND WHY I TOP BLASED 30+ more NFTS is the bet on HOW much Abstract XP you will earn by actually playing this game which then becomes a farm two for the price of one.

If you consider going hard into this game ecosystem as a play to earn as much Abstract XP as possible (i.e. farming Abstract), it's become very interesting.

It's serious farming because you are consistently interacting with the Abstract chain while playing the game. The more Onchain Heroes you have, the more activity you have on the chain by going through the game loops. You are also consistently doing token swaps too if you farm the yield by selling the token, which also counts.

So can I get my investment back from an Abstract drop, given the heavy interactions playing this game affords?

I think there is a strong possibility as long as the Abstract team uses this as their winning flagship project. This will also likely pump the entire gaming ecosystem, making it a big win for those getting in early. Keep in mind this is a Ponzi right now, so you also risk getting rekt if things go down.

Love seeing gaming having a bit of a moment though, especially Onchain gaming. Also showcase how useful @ProofOfPlay is given that they are powering a core part of the game with their VRF engine.

Show more

0

0

58

378

44

It would be more fitting for @TomBrady and @kevinburkhardt to be on the infamous casting couch with @Eagles standing behind it, the way they’ve been describing the game with the @Commanders #NFCChampionship#

Show more

0

0

0

0

0

You have to have been broke to appreciate money.

You think these oil kids care about the cars the drive or the watches they wear?

I’m grateful I started broke, gives me so much gratitude and fulfillment.

It’s like playing a game with cheat codes when you’re born filthy rich, gets boring fast.

Show more

0

0

45

44

26

I don't know why @rickawsb wrote his article in Chinese but here's an unfiltered English version of it:🧵👇

The “GENIUS Act” and the New East India Company: How USD Stablecoins May Challenge Fiat Systems and Nation-States

By: Rick AWSB

“This is an extremely sophisticated asymmetric strategy. The U.S. is exploiting its adversaries’ weakest point fear of losing control to build its own moat.

I. Ghosts of History: The Digital Return of the East India Company

History doesn’t repeat, but it does rhyme.

When Trump happily signed the GENIUS Act into law, what came to mind was a powerful image from history: the East India Companies of the 17th and 18th centuries commercial behemoths granted sovereign powers by their nations. These were not mere merchants, but corporate sovereigns, blending soldiers, diplomats, and colonizers.

This Act, though appearing like a regulatory tweak, in truth marks the chartering of 21st-century “New East India Companies” stablecoin issuers gaining legitimacy through U.S. law. It's the beginning of a transformation in global power dynamics.

1a. Charters of a New Power

Four centuries ago, the Dutch and British East India Companies (VOC and EIC) had the power to hire armies, mint currency, make treaties, and wage wars. Their state-backed monopolies defined the age of globalized sea trade.

Today, the GENIUS Act essentially charters modern-day equivalents stablecoin giants like Circle (USDC), potentially Tether, and possibly tech giants like Apple, Google, Meta, and X. No longer rebellious crypto startups, they are now pillars of U.S. financial strategy. Their “routes” aren’t sea lanes, but 24/7 borderless financial rails the new arteries of global commerce.

1b. From Trade Routes to Financial Rails

The old companies controlled physical routes with cannons and forts. These new “digital East India Companies” will control global value flows. If a U.S.-regulated stablecoin becomes the default for cross-border payments, DeFi, and real world asset trading, its issuer gains immense soft power defining compliance, freezing assets, and setting financial norms.

1c. Symbiosis and Conflict with Nation-States

Like their historical predecessors, today’s stablecoin giants may evolve from tools of national strategy to independent power centers. Initially supporting U.S. hegemony and countering China’s e-CNY, they may eventually act in ways that contradict U.S. foreign policy, especially as their shareholder interests diverge from state agendas.

The U.S. may face tension between control and dependence, possibly leading to future updates to the stablecoin legal framework.

II. Global Monetary Tsunami: Dollarization, Deflation, and the End of Non-Dollar Central Banks

The GENIUS Act is more than a charter. It’s the start of a monetary tsunami. The collapse of the Bretton Woods system in 1971 laid the groundwork. In the coming era, people in fragile economies may prefer stablecoins over failing national currencies, leading to hyper-dollarization and devastating local deflation.

2a. The Ghost of Bretton Woods

Under Bretton Woods, the dollar was tied to gold and all other currencies to the dollar. This created a paradox (Triffin Dilemma): to support global trade, the U.S. had to run deficits which eventually undermined confidence. Nixon severed the gold link in 1971, ending the system.

The dollar was reborn as a fiat instrument backed by U.S. strength and network effects. Now, U.S.-approved stablecoins elevate this to a new level bypassing national banks and reaching every smartphone directly.

2b. Hyper-Dollarization

In places like Argentina and Turkey, people flee inflation by using dollars. Stablecoins remove friction: no banks, no capital controls, no physical risk.

From Vietnam to Dubai, and Yiwu to Hong Kong, stablecoin usage is exploding. When inflation rises even slightly, capital doesn’t “flow out”. it vanishes instantly into the crypto ether. This threatens national currencies with obsolescence.

2c. Deflation and the Disappearance of State Power

Once hyper-dollarization hits, governments lose:

• Seigniorage (printing money)

• Monetary policy tools

The result: plummeting local currencies, collapsing tax bases, and failed governance.

The GENIUS Act, combined with tokenized real-world assets (RWAs), may accelerate this collapse.

2d. White House vs. The Fed

Domestically, a conflict may brew. If a Treasury-controlled stablecoin system emerges, it could sidestep the Fed, allowing the Executive Branch to exert monetary influence directly especially in election years or sanction enforcement. This may trigger a crisis in faith over Fed independence.

III. The 21st Century Financial Battlefield: U.S. vs. China and the “Free Financial System”

Externally, the Act is a strategic maneuver in the U.S.-China rivalry an ideological and infrastructural clash.

3a. A New Financial Iron Curtain

Like the post-WWII Bretton Woods institutions (IMF, World Bank), this new “free finance” network powered by USD stablecoins is open, efficient, and diametrically opposed to China’s model of state-controlled finance.

3b. Permissionless vs. Permissioned

China’s e-CNY is fully controlled, running on private ledgers, with full traceability. The U.S., in contrast, backs permissionless blockchains (Ethereum, Solana). Developers worldwide can build freely, with the U.S. acting as “credibility anchor” for the USD.

This asymmetric strategy attracts innovators and users, while China’s surveillance model alienates them. It’s a contest China structurally can’t win.

3c. Bypassing SWIFT: A Dimensional Attack

China and Russia attempt to sidestep SWIFT. But stablecoins render that effort obsolete no middlemen needed, no banks required. The U.S. isn't defending old infrastructure; it's creating a parallel game with new rules enforced by code, not treaties.

3d. Winning the Network Effects War

The fusion of the dollar with crypto’s innovation creates an exponential network. Developers and users will flock to where liquidity and freedom are highest.

Compared to the closed, RMB-centric e-CNY, the open USD ecosystem will dominate globally beyond China’s limited spheres of influence.

IV. The De-Nationalization of Everything: RWA, DeFi, and the Collapse of State Control

Stablecoins are the Trojan Horse. Once users hold stablecoins, the next step is tokenizing all assets, stocks, bonds, real estate, IP into on-chain digital instruments, detaching them from national jurisdiction.

4a. Stablecoins as the Trojan Horse

Governments welcome regulated stablecoins as safe crypto. But in doing so, they unintentionally onboard users into crypto ecosystems one tap away from Bitcoin, ETH, DeFi, and privacy coins.

Platforms like Coinbase become one-stop crypto supermarkets. USDC is the gateway drug leading users toward more freedom, higher yield, and greater autonomy.

4b. RWA: Assets Escape National Jurisdiction

Imagine:

• A Chinese team tokenizes app ownership

• Traded on a permissionless DeFi protocol

• An Argentinian buys it with stablecoins

No bank, no SWIFT, no borders.

This isn’t just new payment rails it’s a parallel universe outside the Westphalian order. When capital de-nationalizes, so do capitalists.

4c. The End of Traditional Finance

Banks, brokers, and payment systems exist to mediate trust. Blockchain replaces this with public, tamper-proof records and smart contracts.

Functions replaced:

• Lending → DeFi protocols

•Trading → AMMs

• Payments → Stablecoin transfers

• Securitization → RWA tokenization

V. The Rise of Sovereign Individuals & The Twilight of the Nation-State

When capital flows freely, assets ignore borders, and power shifts to networks and private giants, we enter a post-national age where the individual becomes sovereign.

5a. The Prophecy of The Sovereign Individual

In 1997, Davidson and Rees-Mogg predicted that the Information Age would make power more mobile than ever. The state would be unable to tax knowledge and capital that exists online.

Stablecoins, DeFi, and RWA make this real. A person can now:

• Hold global assets

•Move capital instantly

• Stay outside any one jurisdiction

States lose grip. And their ability to tax or control fades.

5b. The End of the Westphalian System

Since 1648, the world has been ruled by nation-states. But if productive individuals live in cyberspace, state borders become meaningless.

States may resort to coercion predatory taxes, surveillance accelerating elite exit. Eventually, they may become "nanny states" serving only immobile, less wealthy citizens.

5c. The Final Frontier: Privacy vs. Taxation

Today’s chains are transparent. But zero-knowledge tech (ZKPs) will bring complete anonymity.

Combined with stablecoins, this creates an untouchable financial black box breaking the state’s final tool: taxation.

Conclusion:

The French Revolution replaced monarchs with nations. This revolution led by stablecoins and AI replaces territorial sovereignty with network and individual sovereignty.

It’s not just a transfer of power it’s a decentralization and de-nationalization of power.

We are witnessing the breakdown of an old world and the birth of a new order that grants individuals unprecedented freedom, but also unleashes unprecedented chaos.

Show more

0

0

26

37

14

Lessons To My Future Bull Market Self:

This is partly to keep me accountable during bull market euphoria and also serves as a guide for those coming into the markets for their first cycle.

I’d be extremely impressed if you managed to “make it” the first time and even more impressed if you managed to keep it.

The former isn’t even the hard part. It is very much the latter. A blind Bored Ape Yacht Club member could make money in a roaring bull market. This is why many enter the markets for the first time and throw money at something they saw on Twitter, hear from a colleague or (the best one) get shilled by their Uber driver and convince themselves they have cracked the markets.

Stuff goes up because more money flows into the system. The opposite is also true. Hence the past 2 years of pain.

Your mission, if you choose to accept it… is to bet on the fastest and fittest horses in the race. This way you don’t miss an opportunity of a lifetime sat holding some worthless piece of shit whilst the rest of the people around you are making serious dough.

There are plenty of ways to get to that arbitrary number that you think will help you achieve eternal happiness. Whether it will or not is a different matter.

The following are some of the most important points that I have sat and stewed over which I think were at times the parts I personally went wrong in the last cycle, primarily.

2017 was just a blur. I didn’t have a clue what I was doing if I am honest. If you check the residuals in my Coinbase account it would be very embarrassing indeed.

The last cycle was infinitely better from a performance perspective. That being said, in hindsight, there were still so many stupid and silly mistakes that either stunted my portfolio growth or cost me a small fortune in losses.

Let’s get to it.

Disclaimer: If you are not mature enough to read this and take responsibility for your own actions in the markets please just stop reading. There are probs a few things I have missed that I will add on as time goes by and I get a brain zap and remember. This is not financial advice, I am extremely stupid. You will lose all your money listening to me

Stay Curious and Try Shit - Funnily enough, I think this applies more to people who may be on their second or third cycle. Naturally, when you come into the markets for the first time, all you want to do is digest information and buy shit. The further down the rabbit hole you go the more likely you are to find something early. The reinforcement of making great returns from being early encourages you to continue your exploration of the crypto/on-chain world. Always maintain this edge of being one of the first to try shit out. You never know when you will stumble upon something great.

As a bull cycle goes on the edge in the markets tends to erode due to increased competition both on a capital and skill front. People will outwork and outsmart you and there’s always someone with more capital around the corner.

Edge can be reestablished by trying shit early and deciding for yourself whether it has something about it. There were many different times last cycle that you could have picked up assets before the masses just by trying the protocol and seeing for yourself. Never leave it down to someone else to tell you. They can’t and won’t do it for you.

It has happened recently with Solana. The masses tell you one thing when in reality it is the other. This results in the majority of the market being offside on something that clearly has a lot going for it. Stay curious and try shit.

Don’t Chase Yield - If you are new to this market, DO NOT try and chase yield. You do not need to earn 20% on a position less than $200,000 (minimum).

There are going to be plenty of times when you are drawn in by a very tasty yield on stable assets. There are also going to be plenty of times when you are drawn in by ridiculous APRs. You’re probably going to provide liquidity on a DEX and get rekt there too.

The long and short of it is this. You do not need to concern yourself with earning yield when you don’t have a worthwhile portfolio size.

Why earn 20% on stable(ish) assets when you could have liquid capital and earn much more than that, oftentimes in one day (if you choose correctly)? The additional complexity, counterparty risk and smart contract risk are categorically not worth it at this stage.

If you play the farm and dump game with new ponzis that come online, please do not even entertain for one second that you should purchase the token that everyone is farming. There are bigger fish with more capital and experience that know how to play these games to a tee. You will be bait.

I’d even go as far as saying if this is your first or second time around just buy tokens and don’t do anything else with them (other than sell of course).

Maybe there are a few exceptions:

Holding an LST like stETH, rETH, swETH or pxETH over ETH if you have a long-term view (again, not really for everyone).

Staking a token to match inflation i.e. SOL (in this case use the most lindy SOL LST stSOL or mSOL).

If TIME makes a comeback and we go full ponzi season and run it back turbo

Don’t chase yield, it doesn’t make sense until you make it.

Let Others Drink the Kool-Aid - I was definitely caught sipping from the communal ponzi Kool-Aid fountain a few times last cycle. It’s quite funny because you know deep down that there is something cult-like about certain founders, communities and tokens but at the time everyone is printing money so nobody cares.

It always ends up in tears, literally every time. That being said, when you see a ponzi cult that has a founder that people would jump off a bridge for, just buy it. These folks never tend to realise they’ve been dumped or that they in fact were in a cult until it’s too late. The beauty of this (for you; an awakened market participant) is that people tend to wrap their whole online personality up in, said cult and when you are selling they are writing 40 Tweet threads about why the recent fud is unjustified. Let them be the exit liquidity they desire to be.

TLDR; Scams pump the hardest, Let others drink the Kool-Aid.

Position Sizing - I was too small on the way up and too large on the way down at times. This ain’t good. Larger more concentrated bets on less volatile yet sure-fire wins whilst rotating proportions into higher-beta assets to make more of the underlying position is my typical play.

Be wary of liquidity, particularly for on-chain assets. You may get away with poorly timed entries in a bull market but if liquidity thins out you get screwed entering a position and also screwed exiting a position. If they have a buy-and-sell tax which is more popular now, then you get screwed again.

I don’t really have much more to say on this one other than pick your poison (which I already have) and don’t fuck up the remainder of your portfolio oversizing into lower conviction plays, undoing the great entry on the large position.

If you can’t outperform BTC, ETH and maybe even SOL this cycle. Just buy those and forget about it until McDonald’s puts the minimum wage up to $50 an hour because all their workers got paper rich and left, again.

I can’t reiterate the above enough, if you aren’t serious about this and you don’t have the time don’t bother. Just keep it simple.

Shitcoins are Generally Good - First, we should define a shitcoin. In my opinion, anything that is purely created for speculation. The irony is that 99.99% of the market are shitcoins but some projects are more honest about it than others.

You are gonna lose a fuck tonne of money playing the shitcoin markets. You also stand the chance of making large amounts of capital very quickly, which if you are smart, you can then play the games mentioned above.

I can’t stress the fact that you can go completely flat-ass broke trading shitcoins not knowing what you are doing. These trenches are well-trodden by professionals who have more capital, more experience and more information than you. They haven’t stopped all bear market, they are fucking born ready for the next PEPE or SHIB. What is your edge?

The chances of you buying a shitcoin out of pure luck that goes on to make you serious money is slim to fuck-all. There are thousands of complete rugs launched Every. Single. Day. Learn the trade if you must, sniff out the good accounts to follow and get ready to have sleepless nights and to start spamming the group family message with /wen_marketing, because this shit will take over your life.

If this isn’t for you stick to the point above BTC, ETH and SOL. If you are a born fucking nugget degenerate then see “Position Sizing”.

If you don’t get it, buy it - I am becoming a lot better at this next point but still struggle. A lot of the time because I struggle to think like an absolute fucking moron. But, you must be the idiot. Eat, sleep and think like an idiot, if you are to catch the almighty pump led by redacted coins.

I know I would have missed the Stepn seed round. Move to earn, like what?! GTFO. I knew better, I was investing in the future of financial technologies. All the while it went 1000x and I had 0 position. Come to think of it move to earn was such an easy sell for the rest of the world outside of the echo chamber of CT. I just didn’t get it at the time and I paid the price. Never again.

If you have a visceral reaction to something good or bad, investigate it more, there is probably something there. After all we are emotional beings and charts are just human emotions expressed in candle sticks… I think RT taught me that one.

Write, write, write - This is simple. Writing is the fastest way to growthhack your understanding of anything. You have to check your own understanding of things before you publish them or you look like a tit. Just write and do it even if you aren’t going to publish, it helps clear your mind and structure your thoughts.

Stay Healthy - I got fat as fuck during the bull market. More money, more time spent sitting at the desk. DO NOT DO IT. You need to train as you would for anything. Staying fit and healthy is a way to perform better.

You Can’t Own Everything - There will be unlimited shiny objects during a bull market. You can own them all but you will not perform well. Do your research, get the best entry you can get and let the thesis play out. If you are wrong, you will know a lot sooner in a bull market.

Over-diversification is terrible if you are looking to grow the portfolio quickly and well. You can’t physically manage all those positions as much as you would like to think so. There is also no way you know all the bull and bear cases for each token you hold too. If you do, then come work for us at blocmates because that is impressive.

The crypto markets are so reflexive that it makes no sense to be over-allocated across too many assets. Winners can often move alone but the full market pulls back together. Get conviction and stop being a little bitch.

Break your bags - This stems from the point above. You best know the bear argument for your position because if it begins to come true then you need to exit and move on. If there is no bear argument for your position then congrats you have joined a cult.

Supply Dynamics are Everything - Tokenization is such a difficult dynamic to wrap your head around if you are just starting out. But, know this... You best be aware of large token unlocks, who is getting unlocked, the inflation schedule for the tokens you hold and what the supply of your token will be 12 months from now.

If you do not know this, then you should not own a token. If you think you can simply beat the market because some 1920’s data said that HODL outperforms, then you are my exit liquidity, thank you.

Token supply increases in crypto are absolutely brutal. Large unlocks and cliffs can increase a token supply by 2x overnight. Many tokens from the last cycle will not reach their previous ATH because of the drastic increase in supply. They might hit their market cap ATH but the price could still be lightyears away. Choose wisely.

The flip side of this is that a lot of OG tokens from the early DeFi summer days are nearing complete unlocks so no additional supply is left to come onto the market. This is as close to fair pricing as you are going to get. I am not revealing what these are you will have to subscribe to The Meal Deal once it goes live.

“Just One More 2x” - If you are in the fortunate position where you say to yourself “Just one more 2x” or if you begin to look at your dream home, just sell everything right that moment. A portfolio ATH is always a good time to take some of the more fruity positions off. If you are thinking it, others are too, you are not special and you are not a market outlier. Do yourself a favour, and secure the bag.

Don’t Paperhand Bear Market Entries - If you have just been through the past two years and hated every minute of it but you stuck to the plan and bought as much of a specific asset as possible, the worst thing you can do is sell it early trying to chase other people’s winners. Put it in cold storage out of the way so you aren’t tempted to even “take a bit off and buy back lower”. If you are talented then yeah go for it, most aren’t.

Other tips not worth writing a lot about:

- Use a DEX and birdge aggregator to make sure you are getting the best price

- Always use a Ledger

- Check DeFi llama directory to find the correct URL of a site. If that faults go to their Twitter and verify.

- Get authenticator 2FA. Get off of your phone number for security backup.

- Find your crew, you can’t be everywhere.

- Make your own decisions

If you enjoyed this then please consider subscribing to The blocmates Newsletter which covers a lot of our thoughts on the market, every Friday!

Link - https://t.co/B3KNx1TkNz

We also talk to a lot of projects, founders, builders, traders and investors about this kind of thing on our podcast which is also linked below

📺 - https://t.co/QOqnROq9d9

Show more

0

0

136

1.1K

327