Search results for RWAs

People

Not Found

Tweets including RWAs

Once RWAs are onchain, how do you get them to the right holders?

In Plume Talks Ep. 3, we sit down with @MercadoBitcoin to explore how they’re bridging Brazilian assets to global markets, for both retail and institutions. 🇧🇷 https://t.co/AWnOuI68Wg

Show more

0

0

55

440

67

IOTABASE

Rebased Update from @PhyloIota

// @DomSchiener talks RWAs

$IOTA is the ticker

https://t.co/vhGMhchjiu

0

0

3

182

57

3/

Beyond standard utility, PLUME plays a central role in RWAfi:

• Powers liquidity for tokenized RWAs

• Acts as collateral for yield strategies

• Incentivizes users and builders via native rewards

It’s more than gas, it’s the engine of the Plume economy.

Show more

0

0

2

45

4

🔥 Thrilled to announce our partnership with @plumenetwork to unlock lifecycle liquidity for over $4 billion real-world assets (RWAs) with open price discovery through global participation.

🪶 @plumenetwork is a public, EVM-compatible blockchain optimized for the rapid adoption and demand-driven integration of RWAs.

🔑 Aspecta is the asset infrastructure that facilitates open market and public price discovery for illiquid assets on a trillion-scale. The key to alpha.

Show more

0

0

50

297

74

Which crypto narrative will dominate in 2025? 🚀

- AI

- Privacy

- DeSci

- RWAs

- Others

0

0

49

333

32

Today, we're excited to unveil the first step of our mainnet journey: Plume Alpha. 🪶

We've always said that onchain RWAs shouldn't feel like classic RWAs -they should feel like crypto. On Plume, you'll be able to stake, swap, lend, borrow, and speculate with RWAs as seamlessly as with native crypto assets.

This week, we'll begin onboarding deep liquidity, robust infrastructure, and a thriving ecosystem of dApps and partners.

Once our ecosystem foundation is secure with proven applications, deep liquidity, and a performant network, we'll advance to Phase 2 – Plume Genesis.

This is just the start of us building the future of RWAfi together.

Show more

0

0

4.4K

5.4K

3.9K

📢 下次更新预告📢

✨ 用户中心升级& $STONKS 空投系统

✨ 邀请奖励计划启动

✨ 全新跨链桥系统上线

🙏 感谢社区成员与用户的耐心支持!

🚀 步履不停,加速前行!

#MyStonks# #RWAs# #StockMarket# https://t.co/mgLwtSrVPl

Show more

0

0

5

22

15

The latest version will be launched at 10:00 AM EDT / 10:00 PM (UTC+8).

Moving forward, new releases will follow a weekly update cycle.

We remain committed to continuously enhancing the user experience.

Let's build the future.

#MyStonks# #RWAs# https://t.co/LVVzhto3Tn

Show more

0

0

130

1K

297

For the first time ever, all of the Magnificent 7 stocks are live onchain via Injective.

Apple $AAPL

Microsoft $MSFT

Amazon $AMZN

Nvidia $NVDA

Meta $META

Google $GOOGL

Tesla $TSLA

These iconic stocks are now fully tradable 24/7 through Injective’s groundbreaking iAsset framework and the @HelixApp_ exchange.

This is more than just tokenization or RWAs. It’s the foundation of an entirely new financial system—decentralized, permissionless, and built for everyone.

What comes next on Injective will redefine Wall Street and finance forever.

Get ready.

Show more

0

0

115

753

233

🚨 Real estate is evolving and we’re building the rails.

Excited to partner with @BlitsEstates to bring real-world properties on-chain.

AssetMantle’s modular assetization stack + Blits’ real estate vision = seamless, interoperable, fractional, investor-ready RWA markets.

#RWAs# aren’t the future - they’re already moving on-chain.

#assetization# #realestate#

Show more

0

0

5

31

43

🎙️ Tokenization is changing the game.

Join #CHAINREACTION# with @gazza_jenks, @rkbaggs and special guest, Co-Founder and Chair of @iota @DomSchiener as we break down RWAs, blockchain, and the future of asset digitization.

https://t.co/5qMKMVyChJ

Show more

0

0

67

334

95

Ethernity Chain is evolving into Epic, a next-gen Layer 2 blockchain set to dominate Real World Assets (RWAs) and entertainment in Web3. Launched in 2021 with icons like Messi and Shaq, we’re now taking it to the next level. ⬇️🧵 https://t.co/O163Mw8AbF

Show more

0

0

14

143

46

Onchain finance is here.

What is your custody strategy?

From tokenized RWAs to stablecoins, institutions are embracing crypto—but security, compliance, and seamless access are critical.

Explore how Ripple Custody delivers enterprise-grade security for the new financial era: https://t.co/w4oa5sLJug

Show more

0

0

253

5.2K

1.6K

Teneo featured in @Cointelegraph

Speaking of democratizing social media data, we’re mentioned in Cointelegraph’s latest VC Roundup, covering projects pushing the boundaries in DePIN, Web3 gaming, and RWAs.

Check out the full article here: https://t.co/2x3ZA8wRaj

#LearnAboutTeneo#

Show more

0

0

11.8K

10.8K

9.8K

Today, Injective is bringing @Meta stocks onchain for the first time.

Users globally can now access the company behind Facebook, Instagram and WhatsApp in one click via Injective’s groundbreaking iAsset tokenization framework.

iAssets bring a novel platform to the world of crypto, which allows any stock, bond or ETF to be launched onchain as programmable financial instruments with embedded utility.

$META joins $NVDA, $GOOGL, $TSLA and $MSTR as one of the first equities Injective has integrated. You can access META today via @HelixApp_

$META functions as a programmable financial building block that brings:

👉 Network-wide liquidity

👉 24/7 unrestricted access to trading

👉 Programmable onchain strategies

👉 Utility across DeFi, lending, derivatives and more without liquidity fragmentation

In the coming weeks and months, Injective will reshape the world of RWAs and tokenization. Every single stock, bond and ETF will be accessible onchain via Injective with unmatched utility.

The future starts here. The future starts now.

Show more

0

0

55

416

100

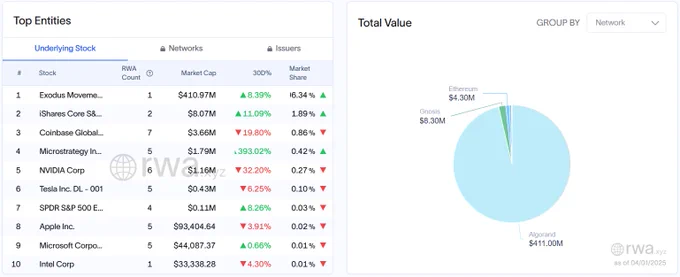

The first ever NYSE-listed stock to be tokenized on the Algorand blockchain, @exodus, is now listed on @RWA_xyz.

With a market cap of $410M, this is the most valuable tokenized underlying stock listed, almost +5,000% above the next most valuable.

Asset ID: 213345970, verified by @PeraAlgoWallet

Expect more RWAs on Algorand to feature in the near future.

Show more

0

0

40

822

257

The last cycle was fueled by speculation—NFTs, DeFi, and fleeting hype. But real value isn’t found in hype. It’s built.

AssetMantle has evolved beyond collectibles. We’re not just minting assets—we’re building the infrastructure for enterprises to bring real-world value on-chain.

Read the full AssetMantle 2025 roadmap

https://t.co/w5UgFDBBYV

2025 is the year of execution. A modular assetization framework, institutional integrations, AI-driven liquidity, and enterprise adoption at scale.

Tokenization isn’t a trend—it’s a trillion-dollar shift. The question isn’t if RWAs will be tokenized. It’s who will build the rails.

We’re doing just that.

Show more

0

0

5

77

32

I don't know why @rickawsb wrote his article in Chinese but here's an unfiltered English version of it:🧵👇

The “GENIUS Act” and the New East India Company: How USD Stablecoins May Challenge Fiat Systems and Nation-States

By: Rick AWSB

“This is an extremely sophisticated asymmetric strategy. The U.S. is exploiting its adversaries’ weakest point fear of losing control to build its own moat.

I. Ghosts of History: The Digital Return of the East India Company

History doesn’t repeat, but it does rhyme.

When Trump happily signed the GENIUS Act into law, what came to mind was a powerful image from history: the East India Companies of the 17th and 18th centuries commercial behemoths granted sovereign powers by their nations. These were not mere merchants, but corporate sovereigns, blending soldiers, diplomats, and colonizers.

This Act, though appearing like a regulatory tweak, in truth marks the chartering of 21st-century “New East India Companies” stablecoin issuers gaining legitimacy through U.S. law. It's the beginning of a transformation in global power dynamics.

1a. Charters of a New Power

Four centuries ago, the Dutch and British East India Companies (VOC and EIC) had the power to hire armies, mint currency, make treaties, and wage wars. Their state-backed monopolies defined the age of globalized sea trade.

Today, the GENIUS Act essentially charters modern-day equivalents stablecoin giants like Circle (USDC), potentially Tether, and possibly tech giants like Apple, Google, Meta, and X. No longer rebellious crypto startups, they are now pillars of U.S. financial strategy. Their “routes” aren’t sea lanes, but 24/7 borderless financial rails the new arteries of global commerce.

1b. From Trade Routes to Financial Rails

The old companies controlled physical routes with cannons and forts. These new “digital East India Companies” will control global value flows. If a U.S.-regulated stablecoin becomes the default for cross-border payments, DeFi, and real world asset trading, its issuer gains immense soft power defining compliance, freezing assets, and setting financial norms.

1c. Symbiosis and Conflict with Nation-States

Like their historical predecessors, today’s stablecoin giants may evolve from tools of national strategy to independent power centers. Initially supporting U.S. hegemony and countering China’s e-CNY, they may eventually act in ways that contradict U.S. foreign policy, especially as their shareholder interests diverge from state agendas.

The U.S. may face tension between control and dependence, possibly leading to future updates to the stablecoin legal framework.

II. Global Monetary Tsunami: Dollarization, Deflation, and the End of Non-Dollar Central Banks

The GENIUS Act is more than a charter. It’s the start of a monetary tsunami. The collapse of the Bretton Woods system in 1971 laid the groundwork. In the coming era, people in fragile economies may prefer stablecoins over failing national currencies, leading to hyper-dollarization and devastating local deflation.

2a. The Ghost of Bretton Woods

Under Bretton Woods, the dollar was tied to gold and all other currencies to the dollar. This created a paradox (Triffin Dilemma): to support global trade, the U.S. had to run deficits which eventually undermined confidence. Nixon severed the gold link in 1971, ending the system.

The dollar was reborn as a fiat instrument backed by U.S. strength and network effects. Now, U.S.-approved stablecoins elevate this to a new level bypassing national banks and reaching every smartphone directly.

2b. Hyper-Dollarization

In places like Argentina and Turkey, people flee inflation by using dollars. Stablecoins remove friction: no banks, no capital controls, no physical risk.

From Vietnam to Dubai, and Yiwu to Hong Kong, stablecoin usage is exploding. When inflation rises even slightly, capital doesn’t “flow out”. it vanishes instantly into the crypto ether. This threatens national currencies with obsolescence.

2c. Deflation and the Disappearance of State Power

Once hyper-dollarization hits, governments lose:

• Seigniorage (printing money)

• Monetary policy tools

The result: plummeting local currencies, collapsing tax bases, and failed governance.

The GENIUS Act, combined with tokenized real-world assets (RWAs), may accelerate this collapse.

2d. White House vs. The Fed

Domestically, a conflict may brew. If a Treasury-controlled stablecoin system emerges, it could sidestep the Fed, allowing the Executive Branch to exert monetary influence directly especially in election years or sanction enforcement. This may trigger a crisis in faith over Fed independence.

III. The 21st Century Financial Battlefield: U.S. vs. China and the “Free Financial System”

Externally, the Act is a strategic maneuver in the U.S.-China rivalry an ideological and infrastructural clash.

3a. A New Financial Iron Curtain

Like the post-WWII Bretton Woods institutions (IMF, World Bank), this new “free finance” network powered by USD stablecoins is open, efficient, and diametrically opposed to China’s model of state-controlled finance.

3b. Permissionless vs. Permissioned

China’s e-CNY is fully controlled, running on private ledgers, with full traceability. The U.S., in contrast, backs permissionless blockchains (Ethereum, Solana). Developers worldwide can build freely, with the U.S. acting as “credibility anchor” for the USD.

This asymmetric strategy attracts innovators and users, while China’s surveillance model alienates them. It’s a contest China structurally can’t win.

3c. Bypassing SWIFT: A Dimensional Attack

China and Russia attempt to sidestep SWIFT. But stablecoins render that effort obsolete no middlemen needed, no banks required. The U.S. isn't defending old infrastructure; it's creating a parallel game with new rules enforced by code, not treaties.

3d. Winning the Network Effects War

The fusion of the dollar with crypto’s innovation creates an exponential network. Developers and users will flock to where liquidity and freedom are highest.

Compared to the closed, RMB-centric e-CNY, the open USD ecosystem will dominate globally beyond China’s limited spheres of influence.

IV. The De-Nationalization of Everything: RWA, DeFi, and the Collapse of State Control

Stablecoins are the Trojan Horse. Once users hold stablecoins, the next step is tokenizing all assets, stocks, bonds, real estate, IP into on-chain digital instruments, detaching them from national jurisdiction.

4a. Stablecoins as the Trojan Horse

Governments welcome regulated stablecoins as safe crypto. But in doing so, they unintentionally onboard users into crypto ecosystems one tap away from Bitcoin, ETH, DeFi, and privacy coins.

Platforms like Coinbase become one-stop crypto supermarkets. USDC is the gateway drug leading users toward more freedom, higher yield, and greater autonomy.

4b. RWA: Assets Escape National Jurisdiction

Imagine:

• A Chinese team tokenizes app ownership

• Traded on a permissionless DeFi protocol

• An Argentinian buys it with stablecoins

No bank, no SWIFT, no borders.

This isn’t just new payment rails it’s a parallel universe outside the Westphalian order. When capital de-nationalizes, so do capitalists.

4c. The End of Traditional Finance

Banks, brokers, and payment systems exist to mediate trust. Blockchain replaces this with public, tamper-proof records and smart contracts.

Functions replaced:

• Lending → DeFi protocols

•Trading → AMMs

• Payments → Stablecoin transfers

• Securitization → RWA tokenization

V. The Rise of Sovereign Individuals & The Twilight of the Nation-State

When capital flows freely, assets ignore borders, and power shifts to networks and private giants, we enter a post-national age where the individual becomes sovereign.

5a. The Prophecy of The Sovereign Individual

In 1997, Davidson and Rees-Mogg predicted that the Information Age would make power more mobile than ever. The state would be unable to tax knowledge and capital that exists online.

Stablecoins, DeFi, and RWA make this real. A person can now:

• Hold global assets

•Move capital instantly

• Stay outside any one jurisdiction

States lose grip. And their ability to tax or control fades.

5b. The End of the Westphalian System

Since 1648, the world has been ruled by nation-states. But if productive individuals live in cyberspace, state borders become meaningless.

States may resort to coercion predatory taxes, surveillance accelerating elite exit. Eventually, they may become "nanny states" serving only immobile, less wealthy citizens.

5c. The Final Frontier: Privacy vs. Taxation

Today’s chains are transparent. But zero-knowledge tech (ZKPs) will bring complete anonymity.

Combined with stablecoins, this creates an untouchable financial black box breaking the state’s final tool: taxation.

Conclusion:

The French Revolution replaced monarchs with nations. This revolution led by stablecoins and AI replaces territorial sovereignty with network and individual sovereignty.

It’s not just a transfer of power it’s a decentralization and de-nationalization of power.

We are witnessing the breakdown of an old world and the birth of a new order that grants individuals unprecedented freedom, but also unleashes unprecedented chaos.

Show more

0

0

26

37

14

PLUME (@plumenetwork) just announced a strategic investment from Apollo Global.

Many people may not realize the significance of Apollo, it’s one of the largest alternative asset managers in the world, managing over $730 billion in assets!

Apollo previously invested in SUI, and Plume is their only investment in the RWA sector. That says a lot — IYKYK 😉

Apollo’s involvement signals early recognition from traditional asset management giants toward on-chain financial experiments. Additionally, their newly launched tokenized credit fund, ACRED, will be brought on-chain through Plume’s platform.

Meanwhile, Plume·s secondary market has been performing quite resiliently in a fearful market.

Plume is a project that my fund has invested in at the primary level, and I’ve personally bought in on the secondary market — so this post may be a little biased. As always, DYOR (Do Your Own Research)!

Why my fund Geekcartel @geek_cartel invested:

✨ Following the industry trend: RWA, especially RWAFi (Real World Assets that everyone can access with low user friction), is showing strong momentum. Unlike earlier RWA projects that were only accessible to institutions, Plume strikes an artful balance between compliance and low barriers to entry, making RWA opportunities available (and beneficial) to Web3 users. The potential market? Let your imagination run wild.

✨ Potential that transcends bull and bear markets — a trait that eliminates 90% of projects out there.

✨ An incredibly strong team and top-tier resource network — a critical asset for reaching the ceiling of RWAFi.

Why I personally bought in on the secondary market:

✨ Plume has an unusually high ratio of diamond hands among its holders, especially considering the current market sentiment.

✨ Plume has become the go-to partner for any serious RWA project — from TradFi giants to Web3 teams, whether investing in or issuing RWA. Its momentum as the leading RWAFi L1 is unstoppable.

✨Strong support on the secondary market — one of the few solid plays left in this bear market. RWA’s stability makes it stand out. 🤔

✨ Among RWA-focused projects, Plume has the largest community but the smallest market cap.

✨ Mainnet hasn’t even launched yet — plenty of major catalysts are still on the way.

DYOR. 🤞

Show more

PLUME@plumenetwork又发布了Apollo Global的战略投资。

也许很多人不了解Apollo的含金量,全球最大的另类资产管理公司之一 ,其管理超 7300 亿美元资产!

Apollo在Web3之前投资了SUI,而RWA赛道,只投资了PLUME!含金量,懂得都懂。😉

而@plumenetwork的代币在上线后如此恐慌的市场表现强势。

Plume是我基金既投资,个人二级又买入的项目。所以本篇内容很难保持客观,各位看官请你Do Your Own Research 📖

基金投资原因:

✨一级市场看行业趋势。RWA,特别是RWAFi(让每个人都可以参与的RWA,低用户门槛的)整体趋势看好。而非过去RWA项目只有机构才能参与,Plume是一条在合规和低门槛之间取得平衡的艺术,让各种RWA资产可以让web3用户都可以参与甚至直接受到利益。市场之大请你们放飞想象空间🛫

✨超越牛熊周期的潜力(这一点就碎掉了90%以上的项目)

✨团队优秀资源能力极强,这也是定义RWAFi天花板的重要能力。(只能对RWA不感兴趣的巨头,没有Plume搞不定的)

个人二级买入原因:

✨Plume用户的钻石手比例远超大多数公链(特别在现在的市场情绪下)

✨Plume已经形成了任何RWA有关的项目都需要找Plume来合作的共识,无论是对RWA感兴趣的传统巨头还是web3 native的项目方,无论是寻找投资RWA机会还是发行RWA资产。 Plume作为推动RWAFi发展的L1的势能已势不可挡

✨二级价格有明显支撑位,在现在市场下选择不多的好标的之一。且,熊市稳健型的RWA是为数不多的选择之一?🤔

✨Plume在RWA赛道项目中,社区用户最大,市值最低的

✨没有上主网呢,各种大利好还在路上。

你对RWAFi或Plume有什么观点?评论区见

Show more

0

0

10

123

18