Search results for Stanley

People

Not Found

Tweets including Stanley

M Stanley:中国将本季度下调存款准备金率 50 个基点,利率下调 15 个基点,下半年推出 1-1.5T 刺激计划

0

0

0

2

0

NEWS: Morgan Stanley has released a forecast claiming the humanoid robot market could expand to a staggering $5 trillion in annual revenue by 2050, with Tesla being uniquely positioned.

"A more cooperative and open trading relationship between the US and China can help accelerate the next phase for @Tesla beyond sales of human-operated EVs."

Show more

0

0

134

1.2K

179

据彭博社,Morgan Stanley 正计划于明年在其 ETrade 平台上线加密货币现货交易,允许客户买卖比特币和以太坊,并考虑与一家或多家加密公司合作。ETrade 已支持加密 ETF 及其衍生品交易,现货交易被认为是下一步扩展。与此同时,Charles Schwab 也计划于未来 12 个月内推出类似服务。在监管环境放宽的背景下,包括 SoFi 和纽约梅隆银行在内的多家机构也在重新推进数字资产业务。https://t.co/CP0Fns2pyE

Show more

0

0

1

0

0

#WATCH#: Montreal celebrates as the #Habs# eliminate Vegas and move on to the Stanley Cup final for the first time since 1993. Video credit: @by.ariane #GoHabsGo# https://t.co/9M5mVR5Nri

0

0

75

2.5K

833

People believing they are tasting luxury premium water but is secretly tap water

Listen to their reviews

📹 Stanley Chen

https://t.co/WGCYYA4Se4

0

0

10

17

2

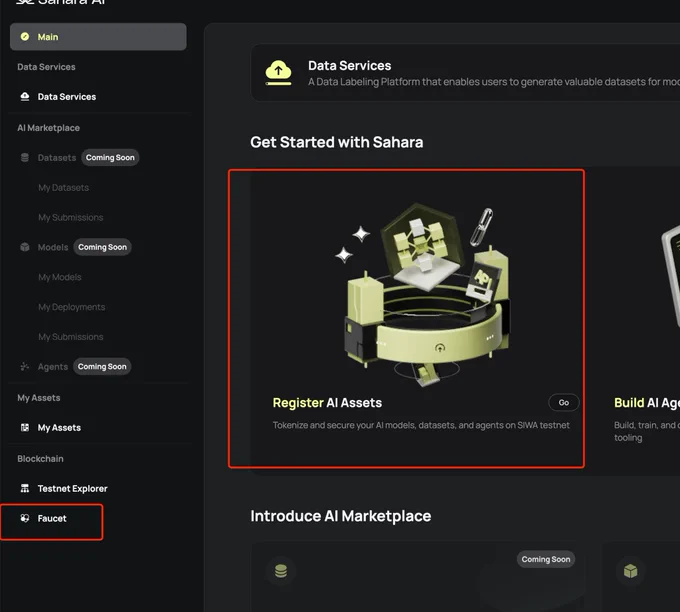

感谢 #Sahara# 送的礼物🎁,我们一直是你们最坚实的伙伴!#Stanley# 的杯子,我太喜欢了,您十分懂得我这个户外人的心,让我们一起让 #AI# 更伟大!🙏感恩

@SaharaLabsAI #AI# #Web3# https://t.co/md4epWQ48d

Show more

可以说,在 #AI# 赛道中,#Sahara# 是我们最看好的项目之一,从去年第一季测试网,就让大家要重视重视重视,未来一定是大毛,不光如此,它也是为数不多,真正能解决Web2实际问题和痛点的项目!

假如你错过了,第一季 #Sahara# 的测试网,这次 SIWA 测试网低调上线,不能再错过,意义非凡!

#Sahara# 是真正为 #AI# 而生的链,不卷 TPS,不争 L2,而是从根本上定义「AI 资产」的上链逻辑——从数据确权、模型许可,到协作与分润,全部打通。第一阶段开放创建和变现入口,面向的是全链开发者与 AI 构建者。

从我们团队研究理解来看,Sahara 不是单纯的 AI+链,它更像是一个「AI 协作启动器」,构建的是未来去中心化 AI 协作范式(De-AI):谁贡献数据、算法、算力、标注,就能按链上规则参与收益——让 AI 变成所有人都可参与、共建、共赢的经济体。

这次低调的发布SIWA 测试网的意义,不光是测试链性能,而是模拟一个“AI 协作文明”的试运行,设立规则、跑通机制、探索价值流动逻辑。

当下 #AI# 逐渐被巨头垄断控制的现状,#Sahara# 也许是极少数能代表「开放式 AI 未来」的基础设施项目,值得长期关注。

测试网玩法攻略:

1️⃣领水:https://t.co/6RJWOnMhGa

连接钱包,验证后,24h可领取一次!

2️⃣进入测试网完成任务。

官网🔗:https://t.co/nbmsILra7W

1.设置个人信息

点击右上角连接钱包➡️按照图片所示要求填写个人信息➡️create➡️complete

2. 注册Sahara 资产

Register AI Assets 点击GO➡️按要求填写内容➡️Register

#SaharaAI# #SIWA# #DeAI# #CryptoAI# #Testnet#

Show more

0

0

0

1

0

Awaiting the final word but we’ll be giving away a pair of tickets to the Stanley Cup Finals.

Like & RT this to let #Habs# nation know!

Tickets are expensive and this is a once in a lifetime experience and a couple of you will get it for free.

Ça sent la coupe

Show more

0

0

97

2.5K

1.9K

1999年,Parag Khanna只是外交关系委员会(CFR)的一名普通研究助理。

没人想到,这位年轻人后来成为地缘政治领域的传奇人物之一:

他曾追随美国特种作战司令部指挥官Stanley McChrystal将军深入前线,并先后服务于多家顶级智库与国际机构;

创办全球战略咨询公司AlphaGeo,任CEO,长期为全球数十个国家政府提供决策咨询;

著有《亚洲世纪》、《连接力》、《大迁移》等畅销书,被《外交政策》杂志评为“全球百大思想家”。

如今,他提出一个惊人的观点:

美国正处于历史性转折点,不再是传统意义上的民主共和国,也不是过去的全球帝国,而可能转变为一种前所未有的“技术官僚共和帝国”。

在CFR最新访谈中,他揭示了8个深刻的洞察:

Show more

0

0

1

0

0

Tonight the #CNTower# will be lit red, blue, and white for the @CanadiensMTL who will go on to represent Canada's hope for a 2021 @NHL Stanley Cup! https://t.co/cEqsXqBefZ

0

0

1.8K

6.5K

1.5K

《一份中东北非的跨境支付作战地图|支无不言EP05》

👉 本期节目相当于一次120分钟的深度专家电话,数娱出海和传统跨境支付企业,千万不要错过!

1. 本期介绍

阿拉伯国家?穆斯林?海湾国家?谈及中东北非这个区域,人们常常有一些遥远又模糊的概念,时而是含着金汤匙出身富可敌国的白袍飘飘,时而又是动荡乃至战乱,是贫民窟里的人间百态。

这样一个给人分裂印象的区域,它的支付生态又会是怎样的?

《支无不言》第三期播客,我和 @0xHY2049 和节目的热心听众&本科学姐Essay聊了聊,她所在的PayerMax,正是这条赛道上的探索者。在中东北非,东南亚甚至拉美,这些充满复杂性的市场,PayerMax凭借对本地支付生态的理解,正在帮助中国企业精准落地。

嘉宾 Essay Zhu:PayerMax COO,前JPMorgan中国新经济行业负责人,Morgan Stanley, Bank of America, MSCI, 20年金融从业经验,支付专家。

-------本篇为精华节选,万字全文可以查看文末链接------

本期目录

👉 中东北非市场深度洞察

👉 中东宗教和政策如何影响支付策略

👉 中东支付环节上的痛点

👉 “委屈的大R”

👉 俄罗斯被两大卡组织“封杀”前车之鉴,中东发展MIR未雨绸缪

👉 合规的大原则

👉 支付成本优化

👉 本地化所需的努力

👉 市场策略:究竟怎么做?

这里也有一份交互式的内容大纲,可以点击各个节点来展开或折叠分支,查看细节 https://t.co/NPFzTesiWH

Show more

0

0

4

20

9

Web3最强资源局来了!5月1日,

#Token2049Dubai# 迎来史诗碰撞

孙哥 @justinsuntron 携手 @EricTrump、@ZachWitkoff,三大巨头同台,行业变局将启!

盲猜一手TRON、WLFI会有新的联动合作

本条推文抽3个绝对好看的「TRON限量款Stanley水杯」

关注 @justinsuntron @trondaoCN @Blackpink_Ox66

本推下留言,带话题 #随孙哥出征迪拜# ,猜剧情

5月2日开奖

#TRONEcoStar#

Show more

0

0

32

49

1

🚀 Web3最强资源局来了!

🌟5月1日,#Token2049Dubai# 将上演史诗级对话!

孙哥 @justinsuntron 联袂特朗普家族 @EricTrump 及 WLFI联合创始人 @ZachWitkoff ,三大领域巨头同台碰撞,行业将迎来怎样的信号?

🧠 盲猜一手:

TRON生态新动作?WLFI全球布局?还是更大的Web3变局?

🎯 参与方式:

▪️关注 @justinsuntron +@trondaoCN

▪️转发本推

▪️本推下带话题 #随孙哥出征迪拜# ,留言猜剧情

5月2日,抽5位预言家送出「TRON限量款Stanley水杯」🎁

🔔 收奖仅限中国大陆地址。

Show more

0

0

75

77

60

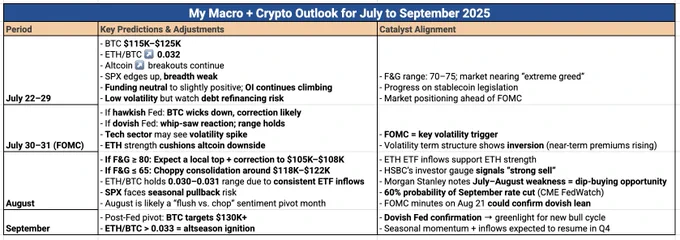

The market’s rising in a weird, almost artificial way…

Crazy ETF inflows. FOMC just a week away.

Is altseason finally here? Will $BTC break above $130K next month — or is it setting up for a 10% correction?

🔍 Here’s my macro + crypto outlook for July to September 2025:

1. Pre-FOMC Drift (July 22–30)

• Market sentiment rising: Fear & Greed (F&G) Index ~70–75 (Greed increases).

• 📈$BTC ranges between 115k–125k → Cooling near ATH, no major breakdown yet.

• ETH/BTC bouncing at 0.032 → ETF inflows buffering ETH pair.

• Altcoins waking up → Traders rotating profits into higher-risk plays.

• 📉SPX edges up but weak breadth → Still tech-led, not broad-based.

• Derivatives: Open Interest is climbing and funding rates are neutral → Leverage is building, but there’s no visible froth yet.

• Key risk: low volatility + debt refinancing overhang → Debt-heavy firms might crack soon; small/mid caps vulnerable.

No major catalysts, just positioning for FOMC.

2. 📅FOMC Knee-Jerk (July 30–31)

This is the first real macro trigger in a while. Two possible outcomes:

• 🟥 If Fed sounds hawkish (not cutting rates) → $BTC wicks down.

• 🟢 If Fed sounds dovish (hinting at cuts) → Markets stay in range or bounce.

Other notes:

• Tech stocks might finally get volatile again.

• ETH likely outperforms altcoins if markets get shaky.

• Options markets show stress → short-term premiums rising.

3. 🪓 August = Chop Zone or Flush

• 🟥 If F&G ≥ 80: Expect a local BTC top, then correction to $105K–$108K.

• 🟢 If F&G ≤ 65: Likely choppy consolidation between $118K–$122K; Mirrors mid-2024 when sentiment dipped before a year-end rally.

• ETH/BTC likely holds 0.030–0.031 due to strong ETF inflows.

• SPX faces seasonal pullback risk.

Key risks and signals:

• ETH ETFs inflows pulling strong

• HSBC says investors are getting way too bullish (a contrarian sell signal). 20–30% of their internal signals are urging institutional de-risking.

• Morgan Stanley sees July–August weakness as a dip-buying opportunity.

• 60% chance of September rate cut (CME FedWatch).

• Fed minutes on August 21 may confirm dovish shift.

4. 🚀 September = Next Bull Leg?

• If Fed confirms dovish stance or a rate cut → BTC likely targets $130K+

• ETH/BTC > 0.033 could reignite an altseason wave

Why this matters:

• Dovish Fed = liquidity return

• Seasonal patterns favor strong moves starting Q4

• If August dip happens, September may be the restart of the uptrend

That’s how I’m seeing things based on the data I’ve been tracking — not financial advice.

I’ve summarized the key points in the table below.

Curious how others are looking at this.

Are you leaning more breakout or correction?

Always down to learn from different perspectives.

Show more

0

0

15

43

3

Staley's impact on Aaron Lewis of Staind was significant. He felt Layne didn't receive the recognition he deserved.

Feeling a profound connection to his influence, Aaron penned a tribute in his honor titled “Layne.”

Poignantly, Aaron’s daughter was born the same day Layne died. https://t.co/VGyK5z8H9s

Show more

0

0

1

131

10

If there's one part of the Multiverse Saga missing from the previous films, it's the appearance of StanLee. https://t.co/iu3166h7YO

0

0

83

11.5K

1.6K