Search results for geopolitics

People

Not Found

Tweets including geopolitics

A special discussion of geopolitics and the market implications with @AitkenAdvisors, @gave_vincent, and @Geo_papic.

With thanks to WCM Investment Management and @MorningstarInc.

https://t.co/6KY0DDKufY

Show more

0

0

6

172

16

A follow-up to my March tweet on Trump’s playbook 👇

The US just greenlit the GENIUS Act in the Senate. It’s a smart USD playbook, a crypto trojan horse to weaponize liquidity and regain pricing power in crypto without launching a CBDC.

The 100% USD/T-bill reserve rule isn't just about stability, but a multi-layered mechanism to:

1️⃣ Soak up global crypto liquidity

2️⃣ Create forced demand for US debt

3️⃣ Export USD on-chain without inflation

4️⃣ Suppress non-USD value benchmarks (algos & foreign FX stables)

5️⃣ Reassert US monetary dominance over the digital economy

This is fiscal engineering meets monetary geopolitics on-chain.

It also aligns with the $BTC reserve theory I shared in March:

✅ No money printing

✅ No controversial CBDC

✅ Let US firms distribute USD stables

✅ Back them with Treasuries

✅ Hedge the system with $BTC on the national balance sheet

The Act is another step how the US reclaims crypto pricing power, i.e. the ability to define what assets are valued in, how they’re traded, and who controls the liquidity rails.

USD stables + $BTC reserve + Treasuries = Bretton Woods 2.0

Show more

Just back from a 3-week trip in the States, I wanna share some first-hand insights about the market from my smart money friends with y'all:

1. U.S. Short-term Recession

📊🇺🇸 Trump is set to supercharge USD hegemony, ease debts, and detox the U.S. economy by all means necessary.

⚔️📉 That includes staging a trade war + short-term recession to force a Fed rate cut to bring liquidity back—that means we will welcome a real bull market after that.

⏳📉 Prepare for a few painful months ahead.

🎯📊 Since the trade war + recession are staged, everything will be orchestrated—controlled chaos with a bullish endgame.

🔎📈 I personally don’t think $BTC will break below $70K. As I said before, fundamentals still look solid. “Buy the dip” range $73K~$78K makes sense to me.

2. Purchase BTC for the Reserve

🏦🟠 The Trump administration will buy $BTC for the strategic reserve—not with taxpayer money, but likely by swapping existing assets. (Believe it or not, let’s see👀)

🌍💰 State governments and other countries (like Czech) with excess $USD and $EUR reserves will likely follow suit—not to please Trump, but because it's simply profitable.

3. Stablecoin Bill

📜💵 The U.S. #stablecoin# bill will very likely pass this year. (Hopefully by August per Trump’s request)

🏦🔒 Fully collateralized stables (USD or T-bills etc) will dominate over algos—again, tying back to USD hegemony.

🔗🟠 Both the #bitcoin# reserve strategy + stablecoin bill reinforce USD dominance.

If you want me to dive deeper into any of the above, drop a comment below 👇

Show more

0

0

9

7

1

Thank you very much for your reply, and appreciate the high-IQ simulation,

but here’s the problem:

You’re assuming this is a clean trade in a frictionless market.

In reality,51% attack ≠ profitable trade.

It’s an existential attack, not a money-making arbitrage.

Shorting BTC while attacking the network sounds clever—until you realize:

1️⃣Markets freeze.

Exchanges halt trading. DEX liquidity evaporates. Vols spike. ETF redemptions break. You don’t just “print billions” like it’s a button.

2️⃣Counterparty risk explodes.

If you’re shorting MSTR or miners, who’s filling your order book mid-attack? Who’s buying your puts? TradFi hates chaos—volatility crushes trade execution.

3️⃣Reputation risk is real.

No major fund survives being exposed as the actor who nuked BTC. This isn’t a backroom poker game—it’s geopolitics, public markets, and the global financial system.

And lastly: If BTC truly drops 70%+ on chain trust collapse, the rest of crypto dies with it.

ETH doesn’t “win” that day—it bleeds out next to the corpse.

A 51% attack isn’t a trade. It’s an act of war. And wars are never clean, never controlled, and almost never profitable for the initiator.

So yes—ETH may be the better SoV long term, but not because someone’s going to assassinate BTC on purpose and ride off with a suitcase of profits.

Show more

I will give you credit - this is a significantly higher IQ response than 99% of American Bitcoin holders could write 😂

Your critique boils down to the operational complexity of executing this attack. I would argue that if a fund (or coordinated group of funds) can 10-100x their capital and make billions of dollars by doing 51% attacking BTC and shorting it, it is very likely to happen, even if they have to jump through a lot of hoops. Even if some exchange withdrawals get frozen after the attack, there will still be tradfi ways to short BTC (ETFs, MSTR, miner stocks), it will be shortable on DEXes, and other crypto-assets will likely plunge in tandem, which will be shortable as well. Options are another great way to execute this trade.

Once a 51% is successfully executed, BTC is finished. It doesn't matter if the software soft/hard forks, or anything else - its SoV meme will be permanently wrecked, and I would expect it to immediately plunge in price by 70% or more.

I would also argue that "attacking the soil you depend on" doesn't matter, since this attack can be executed by outside actors who don't care about that "soil."

I think BTC and ETH are in direct competition to be the internet's primary SoV, and ETH is the only rational, sustainable choice out of the two.

Show more

0

0

0

0

0

“Like the post-1945 British Labour governments, he wants to shelter domestic manufacturing and the working class behind tariffs while reducing overseas commitments. But the net result will be both economically damaging and geopolitically weakening. Americans will come to miss globalism and policing the world. They will belatedly realize that there is no portal through which the United States can return to the 1950s, much less the 1900s. And the principal beneficiary of Project Minecraft will not be Russia, but China. Call it Project Manchuria.”—@NFergus

Show more

0

0

37

413

108

You don’t understand Vietnam.

You don’t understand Asia.

And frankly, you don’t understand power.

You speak of "destiny" like some overconfident schoolboy mistaking American suburbia for geopolitical insight.

Let me say it clearly:

Vietnam is no one’s vassal. Not China’s. Not America’s. Not anyone’s.

We didn’t spend a thousand years resisting Chinese dynasties just to roll over today.

We didn’t shatter French colonialism and bleed the most powerful military in the world to death in the jungles of Quảng Trị just to be told what our "destiny" is by someone who thinks Canada is the model for sovereignty.

You confuse proximity with submission, and trade with dependence.

That’s your first fatal error.

Vietnam shares a border with China—yes.

But we also share something deeper:

A memory.

Of war. Of peace. Of resistance. Of cooperation.

And unlike you, we understand the psychology of coexisting with power.

We know how to draw lines—how to defend them when we must, and how to keep the peace when it serves us.

Your comparison to Canada is not only lazy—it’s insulting.

Canada gave up its spine long ago.

Vietnam never had the luxury.

We learned to survive when survival meant fighting giants.

Canada outsourced its soul to Washington. Vietnam forged its own.

You think strategic autonomy is impossible? You’re already behind.

Vietnam already has it.

We trade with China.

We trade with the U.S.

But we serve neither.

We hosted Biden. Then we hosted Xi. Then we hosted Putin.

That’s not vassalhood.

That’s leverage.

That’s multipolarity in motion.

You're stuck in a binary world—one where you're either a satellite or a superpower.

That worldview is collapsing, and you don’t even see the cracks.

And here’s the part that stings the most, isn’t it?

Vietnam, a country bombed into the Stone Age, is walking into this new world with more dignity and independence than your empire ever had.

We don’t need 800 bases to feel strong.

We don’t need to sanction the planet to stay afloat.

We don't need to threaten war to be heard.

We just stand. And we endure.

While your empire panics over TikTok and builds trade policy out of fear, Vietnam navigates history with memory, clarity, and will.

So no—we are not destined to be anyone’s vassal.

We were forged by fire.

You were softened by comfort.

And as the empire you worship drowns in its own debt, division, and delusion, Vietnam will still be here.

Anchored by history.

Sharpened by struggle.

And free by choice.

Don’t mistake survival for subservience.

Don’t mistake proximity for control.

And don’t ever mistake Vietnam for a pawn.

We were born in resistance.

And we don't kneel.

Not then.

Not now.

Not ever.

Show more

0

0

45

927

195

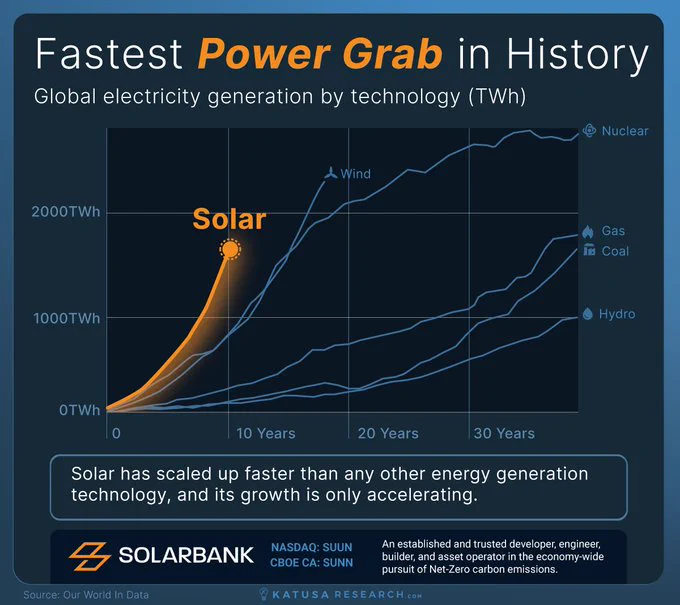

SOLAR JUST PULLED OFF THE FASTEST ENERGY TAKEOVER IN HISTORY

In 5 years, solar power doubled its global output—blasting past 2,000 TWh.

That’s enough juice to run 200 million U.S. homes for a year.

No fossil, no fuel, no problem.

Solar’s explosive ascent isn’t just an energy story—it’s a shift in global power dynamics.

Nations rich in sun, not oil, are quietly gaining leverage.

The geopolitical premium on fossil reserves? Fading.

The new currency is terawatts-per-acre and control over photovoltaic supply chains.

The sun isn’t just rising — it’s taking over.

Source: Katusa Research / Our World in Data

Media Solarbank, MET Group, @KanekoaTheGreat

Show more

0

0

30

114

31

Xiang, you’re truly wonderful!

Just wanted to clarify—that earlier post was a complete accident. I was still drafting it when my dog stepped on my phone and somehow managed to hit “send” without me realizing. 😂

I really like your analysis of how the *六国论* (Six Nations Theory) applies to today’s global landscape—the trade dynamics, geopolitical tensions, and military standoffs between major powers. Drawing wisdom from ancient strategies to address modern challenges is what any civilized nation must do.

What I’d meant to highlight is that China has been remarkably strategic in building trade partnerships and political alliances worldwide. These moves seem to encircle the U.S., gradually isolating it and weakening its traditional dominance on the global stage.

To borrow a phrase from Chinese history: 当今美国真可谓四面楚歌😂

@FeiyanXie

@xingyun09039849

@MiaoXiaojuan

@tiamleewk

@Siren2oo7

@SR18666

@shuhongwei22

Show more

0

0

1

1

1

顶级宏观大佬对谈美国关税政策及其影响。前段时间Capital播客节目聚齐了三位在宏观经济和资产配置领域颇有建树的专家,在Ted Seides的主持下,四人就全球市场和地缘政治格局的变迁以及美国资产的走向进行了深入探讨,并分析了投资者应如何应对这一深刻变革的时期。

这场对谈的阵容堪称“地表最强”宏观,三位大佬分别是:

1)James Aitken,独立咨询公司Aitken Advisors的创始人,以其对全球金融体系运行机制的深刻理解而著称,尤其擅长分析美元流动性、影子银行体系和央行政策对市场的结构性影响。

作为一名知名宏观策略顾问,James曾任职于瑞士银行和伦敦的对冲基金 Lansdowne Partners,因曾在2008年金融危机前精准判断市场风险而声名大噪。

2、Marko Papic曾担任BCA Research的宏观地缘政治首席策略师兼副总裁,负责将全球政治发展与宏观资产配置结合分析。

Marko后来创立了Clocktower Group宏观策略团队,并著有畅销书《Geopolitical Alpha: An Investment Framework for Predicting the Future》。

3、Louis-Vincent Gave是Gavekal Research的联合创始人,该公司以宏观研究见长,其父Charles Gave也是著名的经济评论人。

Louis的研究风格深入浅出,尤其擅长从结构性趋势和制度变化中挖掘长期投资主题,如去美元化、债务泡沫等。

对谈要点:

1、美元下跌、或者说美元资产见顶,真正开始于1月,始于债市开始“惩罚”美国立法者的时候。白宫可能并不是真的那么关心股票,他们更关注债券收益率,他们可能有一个设想,即在本届政府早期出现轻微的衰退会很棒。

2、美国的大规模财政支出是导致“美国例外论”终结的重要因素,特朗普政府的贸易政策也加速了这一进程,全球盈余/边际资本正在重新寻找新的投资目的地。

我们正处于一个多极世界而非二元世界,投资者总是在被一种“伪冷战模型”误导。

3、在政策诱导型衰退中,真正重要的不是数据本身,而是政策的“二阶导数”(即政策的边际变化趋势)。

4、“美国例外论”终结的本质是美国相对于世界上其他地区不再保持优异表现。美国市场可能看到了底部,接下来将是是美国资产跑输全球的五年周期;如果现在还有人说市场“超跌了”,那可能需要去冷静一下。

5、美国的资产表现越来越像一个新兴市场国家,我们正在步入弱美元时代,资本将流向当前被严重低配的领域。

即使美国与日本、韩国和其他国家进行大规模的关税贸易谈判也为时已晚,这无法阻止对信心的冲击、对资本支出的冲击、对企业支出的冲击,以及很快也会开始影响消费者行为的冲击。

6、特朗普实际追求的可能是5%到10%的全面关税,而不是40%。一旦市场嗅到这一点,过度看空风险资产是非常危险的。

James认为,如果美国能够维持信誉,解决财政问题,并软化贸易政策,那么美国可能会再次吸引资本;Marko则认为,只有在地缘政治危机爆发或军事冲突的情况下,避险资金才会以某种恐慌的方式回流到美国。

7、过去的10年里,世界各地的私人银行通过向私人客户出售结构性产品赚了很多钱。如果这些产品在市场不利条件下被触发,影响可能比2008年麦道夫骗局的规模(100亿美元)大得多,可能涉及数百甚至数万亿美元。

8、专家们对未来一年中的市场赢家和输家进行了预测,赢家包括加拿大、欧洲、日本、不结盟国家以及大宗商品;输家则“无疑”是美国。

对谈中文版全文:https://t.co/bmS5Suc4uM

Show more

A special discussion of geopolitics and the market implications with @AitkenAdvisors, @gave_vincent, and @Geo_papic.

With thanks to WCM Investment Management and @MorningstarInc.

https://t.co/6KY0DDKufY

Show more

0

0

0

0

0

Great conference on 28-29 May (free registration!), hosted by @SurreyPolitics/@SurreyCbe with: @PolStudiesAssoc, @PSA_IPSG, @PSAGermany & @GrPoliticsSG. Covers Challenges to Europe (e.g. Populism, Democracy, and future of EU integration). Travel grants for PhDs/ECRs!

Details:👇

Show more

✳️CALL FOR PAPERS✳️

The CBE, with @PolStudiesAssoc German, Italian & Greek Specialists, invites you to the Challenges to Europe - European Challenges Conference at the @UniOfSurrey, 28-29 May 2025.

Submit your abstract by 20 Jan 2025!

Details: https://t.co/iqAoSNUKhe

Show more

0

0

0

3

2