Search results for stablecoins

People

Not Found

Tweets including stablecoins

Stablecoins are about to change everything.

On @CNBC, our CEO @chriseyin explains how the GENIUS Act could unlock a DeFi boom, and why clear legal protections for users will be crucial.

📺 Watch here: https://t.co/swslySrECs

Show more

0

0

38

377

91

Stablecoins connect the unconnected—$75B USDT on TRON is just the beginning.

0

0

39

122

27

Stablecoins may be crypto’s first “killer app” — our first real shot at making it so that sending money is more like sending an email. Open, instant, and borderless.

People are already recognizing the advantages.

In 2024, stablecoins moved $15.6 trillion in value, effectively matching Visa’s volume.

So how did stablecoins become poised to disrupt the global payments industry?

And how can builders and businesses think about stablecoins?

@a16zcrypto rounded up a guide to stablecoins to take a look at how we got here — and where we’re going next: https://t.co/osAPkrjYYh

Show more

0

0

59

693

120

Stablecoins are crypto’s clearest product-market fit. It’s composable digital money.

@SuiNetwork is going to converts this potential into real-world Web3 adoption. https://t.co/R0VwtRFNM7

0

0

410

2.9K

296

Stablecoins should be trusted, compliance-first, and built for real-world finance—RLUSD is setting the standard.

Now live in Ripple Payments, RLUSD powers enterprise payments, asset tokenization & DeFi: https://t.co/yKPF3zXSL7

📈 Nearing $250M market cap

📶 $10B+ in trading volume

🟢 Available on: @krakenfx, @LMAX, @Bullish, @bitstamp and more

Show more

0

0

93

1.3K

386

Stablecoins are on the rise with over $220B in value circulating. 🌏

What’s needed to unlock mass adoption? https://t.co/ZqK4TfaO9Q

1️⃣ Global regulatory alignment

2️⃣ Reliable reserves & risk controls

3️⃣ Compliance-driven approach

4️⃣ Enterprise-grade custody

5️⃣ Seamless customer experience

Show more

0

0

151

3.4K

994

For stablecoins and other digital assets to thrive globally, the world needs American leadership.

The Senate missed an opportunity to provide that leadership today by failing to advance the GENIUS Act.

This bill represents a once-in-a-generation opportunity to expand dollar dominance and U.S. influence in financial innovation. Without it, stablecoins will be subject to a patchwork of state regulations instead of a streamlined federal framework that is more conducive to growth and competitiveness.

The world is watching while American lawmakers twiddle their thumbs. Senators who voted to stonewall U.S. ingenuity today face a simple choice: Either step up and lead or watch digital asset innovation move offshore.

Show more

0

0

904

18.1K

3.7K

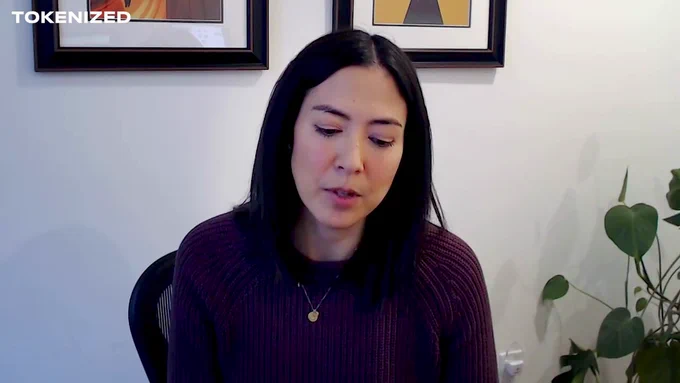

What’s ahead for stablecoins, custody & tokenized assets?

@MonicaLongSF dives into $RLUSD, XRP ETFs, growing Ripple Payments & Custody momentum and the next wave of institutional adoption with @TokenizedPod.

Tune in now! 🎧👇

Show more

Ep. 20 of @TokenizedPod: Ripple USD, Stablecoins & Custody Ft. @Ripple President @MonicaLongSF 🔷

@sytaylor sits down with Monica to discuss:

02:15 Ripple’s dual focus: enterprise software & XRP Ledger

05:00 How Ripple powers cross-border payments with stablecoins

08:48 Ripple’s custody play: Metaco & major bank partnerships

13:16 Why Ripple launched its own stablecoin, RLUSD

16:53 U.S. crypto regulations shift—what it means for adoption

22:29 Tokenized assets & stablecoins are reshaping finance

27:00 XRP ETFs: why more approvals could be coming

33:28 Ripple’s next moves: expansion, execution, and M&A

39:34 The future of XRP Ledger & institutional finance

Watch and enjoy below! 👇

Links to YouTube & Podcasts also below ⬇️

Show more

0

0

115

3.6K

973

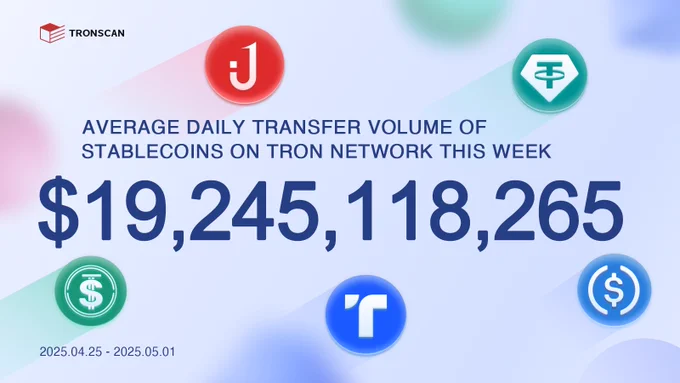

🎉The average daily transfer volume of #stablecoins# on #TRONNetwork# reached $19,245,118,265 (2025.04.25-2025.05.01)! #USDD# #USDT# #USDJ# #TUSD# #USDC# https://t.co/c2mZ96fpLH

0

0

0

4

2

🇺🇸 TODAY: Bank of America CEO says stablecoins are inevitable, hinting BofA may launch its own token pegged to USD deposit accounts if regulations allow. https://t.co/U3ZYwa6tH8

0

0

319

2.1K

467

Without proof of reserves and verifiable data, stablecoins would be worthless.

Without proof of consensus and verifiable information , Generated AI will be a disaster.

hodl 🫡

0

0

1

0

0

Coinbase CEO Brian Armstrong says every Fortune 500 company will adopt crypto stablecoins. https://t.co/gepUh2VuI3

0

0

450

4.8K

746

🔥 BULLISH: “We’re going to see the Fortune 500 start adopting stablecoins,” says Coinbase CEO. https://t.co/qjO0NNDCHv

0

0

107

897

153

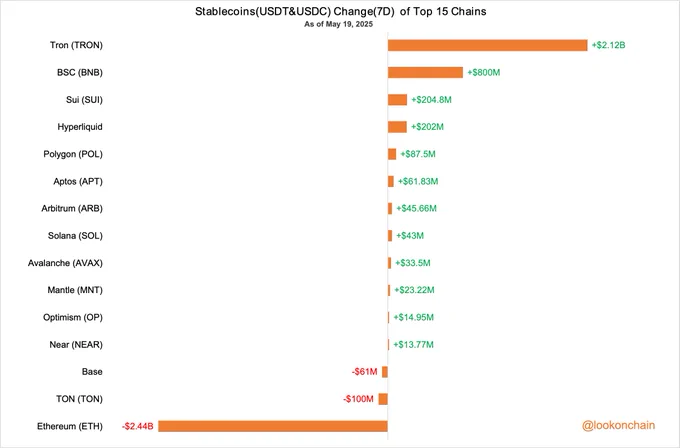

In the past 7 days, stablecoins(USDT&USDC) on #Tron# increased by $2.12B, and stablecoins(USDT&USDC) on #Ethereum# decreased by $2.44B.

https://t.co/LQ9aIGxqwo https://t.co/qrpoYeR71F

0

0

24

148

20

Banks want to control your money, but stablecoins are about to change everything.

Congress is finally making moves to embrace crypto payments - and I'm here for it. This is how we take back financial freedom. 🚀 https://t.co/V9ym0AWhQE

Show more

0

0

2

20

3

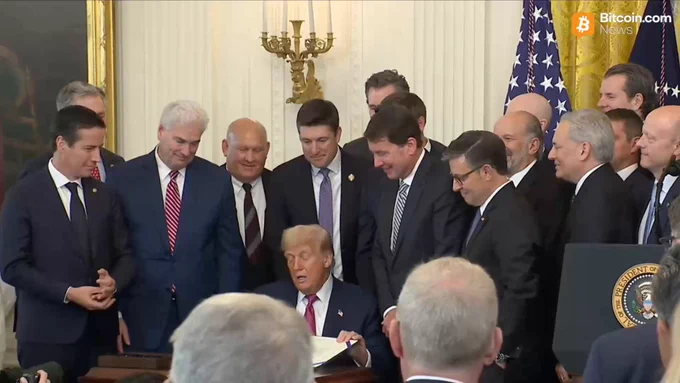

BREAKING: 🇺🇸 The President signs the GENIUS Act (S.1582), establishing regulations for payment stablecoins, officially signing the bill into law. ✒️ https://t.co/pFAN77zhbc

0

0

41

854

180

吴说获悉,CryptoQuant 创始人兼首席执行官 Ki Young Ju 发推表示,未来很可能会出现“暗黑”稳定币(Dark stablecoins)。暗黑稳定币的创建方式有两种:1. 不受政府控制的算法稳定币;2. 由不执行金融审查的国家发行的稳定币。USDT 曾被认为是一种抗审查的稳定币,如果未来 Tether 在特朗普政府时期拒绝配合美国监管,可能会被视为“暗黑稳定币”。https://t.co/58TKk8cMza

Show more

0

0

1

0

0

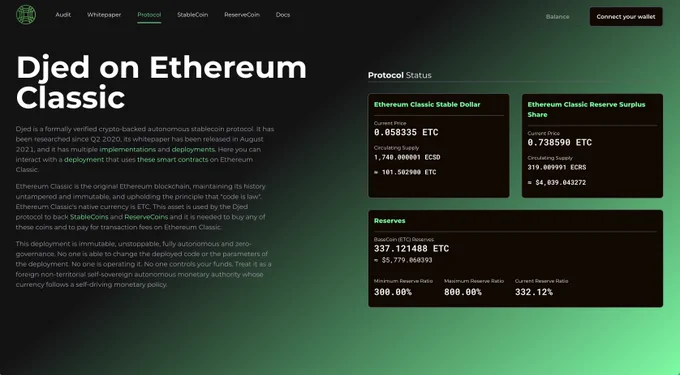

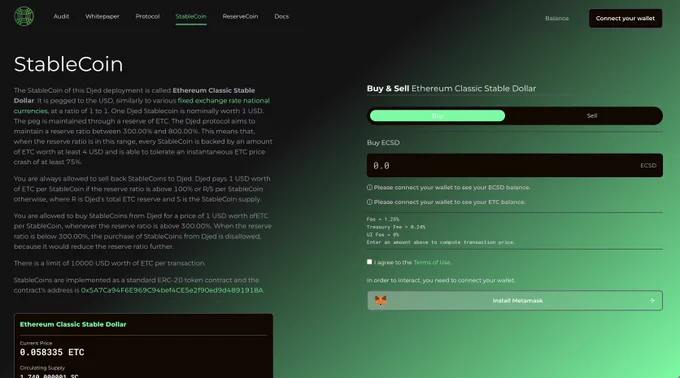

Curious about @DjedAlliance?

They're leveraging HebeSwap Oracle for an innovative project: collateralizing ETC to generate stablecoins.

ETC ecosystem is rich with projects, just awaiting more liquidity to unlock their potential.

🚀 #ETCArmy# #ETC# $ETC #EthereumClassic# https://t.co/mPAfVvonDO

Show more

0

0

1

27

12

Ep. 20 of @TokenizedPod: Ripple USD, Stablecoins & Custody Ft. @Ripple President @MonicaLongSF 🔷

@sytaylor sits down with Monica to discuss:

02:15 Ripple’s dual focus: enterprise software & XRP Ledger

05:00 How Ripple powers cross-border payments with stablecoins

08:48 Ripple’s custody play: Metaco & major bank partnerships

13:16 Why Ripple launched its own stablecoin, RLUSD

16:53 U.S. crypto regulations shift—what it means for adoption

22:29 Tokenized assets & stablecoins are reshaping finance

27:00 XRP ETFs: why more approvals could be coming

33:28 Ripple’s next moves: expansion, execution, and M&A

39:34 The future of XRP Ledger & institutional finance

Watch and enjoy below! 👇

Links to YouTube & Podcasts also below ⬇️

Show more

0

0

27

733

240

關於香港通過《穩定幣條例》的解析:

引言:

香港在2025年通過了《穩定幣條例》(Stablecoins Ordinance),並將於2025年8月1日起生效。該條例並非由香港政府直接“成立”或發行穩定幣,而是建立了一個監管框架,允許合格的私人機構發行與法定貨幣掛鉤的穩定幣(fiat-referenced stablecoins, FRS),如與港元(HKD)或主要全球貨幣掛鉤的穩定幣。

以下從多個維度分析其核心邏輯:

1.維護貨幣穩定,防範風險:

穩定幣作為傳統金融與數位資產的橋樑,具有潛在的系統性風險,例如儲備資產不足、價格波動(如2022年TerraUSD崩盤事件的影響)、洗錢及跨境非法資金流動。香港金融管理局(HKMA)通過條例引入嚴格監管,包括要求發行人維持100%高流動性儲備(如現金或政府債券)、實施反洗錢措施和技術安全標準,以及設立贖回機制,以防止這些風險溢出至傳統金融體系。這有助於保護投資者並避免監管“盲區”。

2.促進數位金融創新:

穩定幣被視為未來數位金融基礎設施的重要組成部分,可解決跨境支付痛點(如高成本、低效率),並推動區塊鏈技術應用。條例通過“沙盒”機制和許可制度(如最低2500萬港元註冊資本要求),鼓勵信譽良好的發行人進入市場,同時提供法律清晰度,提升市場信心。這有助於香港培育虛擬資產生態,吸引全球加密企業落戶,並與e-HKD(香港央行數位貨幣)等項目協同。

3.提升香港國際金融中心地位:

香港是首批推出穩定幣監管框架的司法管轄區之一,遵循“相同活動、相同風險、相同監管”原則,並與國際標準(如金融穩定理事會2023年框架、歐盟MiCA法規)對齊。這不僅能擴大港元的影響力(即使發行人在境外,只要與港元掛鉤即需接受監管),還可促進港元與美元的跨境流動,受益於香港貨幣體系的穩定(HKD自1983年起與USD掛鉤)。戰略上,這鞏固了香港作為亞洲數位資產樞紐的角色。

4.響應全球趨勢與地緣經濟考量:

在中美博弈和全球加密監管競賽中,香港的舉措類似於美國擬議的穩定幣立法,旨在通過監管擴大法定貨幣影響力,避免被邊緣化。同時,這反映了香港對數位經濟的雄心:穩定幣可作為支付工具“破圈”,但需防範跨境支付中的合規風險(如穿透式監管識別資金路徑)。總體上,強調“負責任發展”,而非禁止。

Show more

0

0

1

4

1