今天的回调,很多人都开始关心起来后市怎么走。Pickle Cat 的这个预测太详细了。

@0xPickleCati 结合宏观经济信号(如 FOMC 和美联储政策)以及加密市场的技术指标(如 F&G 指数、ETH/BTC 比率),为 7 月至 9 月的走势提供了清晰的框架。

我个人对 8 月的“清洗 vs. 震荡”情景和 9 月可能的牛市重启特别感兴趣,尤其是 ETH ETF 流入对 ETH 表现的支撑作用,这可能确实是 altseason 的催化剂。

Show more

The market’s rising in a weird, almost artificial way…

Crazy ETF inflows. FOMC just a week away.

Is altseason finally here? Will $BTC break above $130K next month — or is it setting up for a 10% correction?

🔍 Here’s my macro + crypto outlook for July to September 2025:

1. Pre-FOMC Drift (July 22–30)

• Market sentiment rising: Fear & Greed (F&G) Index ~70–75 (Greed increases).

• 📈$BTC ranges between 115k–125k → Cooling near ATH, no major breakdown yet.

• ETH/BTC bouncing at 0.032 → ETF inflows buffering ETH pair.

• Altcoins waking up → Traders rotating profits into higher-risk plays.

• 📉SPX edges up but weak breadth → Still tech-led, not broad-based.

• Derivatives: Open Interest is climbing and funding rates are neutral → Leverage is building, but there’s no visible froth yet.

• Key risk: low volatility + debt refinancing overhang → Debt-heavy firms might crack soon; small/mid caps vulnerable.

No major catalysts, just positioning for FOMC.

2. 📅FOMC Knee-Jerk (July 30–31)

This is the first real macro trigger in a while. Two possible outcomes:

• 🟥 If Fed sounds hawkish (not cutting rates) → $BTC wicks down.

• 🟢 If Fed sounds dovish (hinting at cuts) → Markets stay in range or bounce.

Other notes:

• Tech stocks might finally get volatile again.

• ETH likely outperforms altcoins if markets get shaky.

• Options markets show stress → short-term premiums rising.

3. 🪓 August = Chop Zone or Flush

• 🟥 If F&G ≥ 80: Expect a local BTC top, then correction to $105K–$108K.

• 🟢 If F&G ≤ 65: Likely choppy consolidation between $118K–$122K; Mirrors mid-2024 when sentiment dipped before a year-end rally.

• ETH/BTC likely holds 0.030–0.031 due to strong ETF inflows.

• SPX faces seasonal pullback risk.

Key risks and signals:

• ETH ETFs inflows pulling strong

• HSBC says investors are getting way too bullish (a contrarian sell signal). 20–30% of their internal signals are urging institutional de-risking.

• Morgan Stanley sees July–August weakness as a dip-buying opportunity.

• 60% chance of September rate cut (CME FedWatch).

• Fed minutes on August 21 may confirm dovish shift.

4. 🚀 September = Next Bull Leg?

• If Fed confirms dovish stance or a rate cut → BTC likely targets $130K+

• ETH/BTC > 0.033 could reignite an altseason wave

Why this matters:

• Dovish Fed = liquidity return

• Seasonal patterns favor strong moves starting Q4

• If August dip happens, September may be the restart of the uptrend

That’s how I’m seeing things based on the data I’ve been tracking — not financial advice.

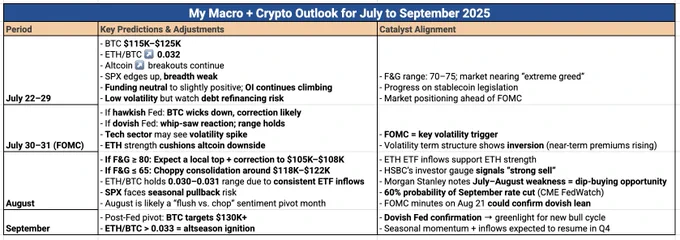

I’ve summarized the key points in the table below.

Curious how others are looking at this.

Are you leaning more breakout or correction?

Always down to learn from different perspectives.

Show more

0

0

0

0

0