Search results for Hyperliquid

People

Not Found

Tweets including Hyperliquid

hyperliquid 为啥总能有这种赌性大的🐳几十倍杠杆开单的?

之前Wynn惊天归零局很多人觉得是 @HyperliquidX 给了他钱💰做广告,后来发现哥们儿赌的连推特都注销了,不像是剧本😂😂😂

Perpdex 这种赌场台子真的还是得花80%的精力去找到这些大赌徒并拉过来玩。已经不是28定律,是2% 98%定律了。 因为链上开单大家都能看见,比Cex里刺激的多,广告效应强的多。

Show more

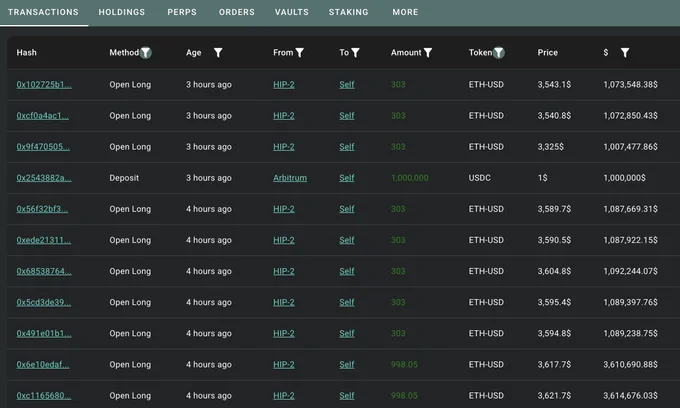

Whale 0x8F93 deposited 3M $USDC into Hyperliquid and opened a 20x leveraged long on $ETH, with a position of 7,200 $ETH($26.3M).

https://t.co/TWRs1hclTV https://t.co/6A2c65ryIB

0

0

4

2

0

Hyperliquid

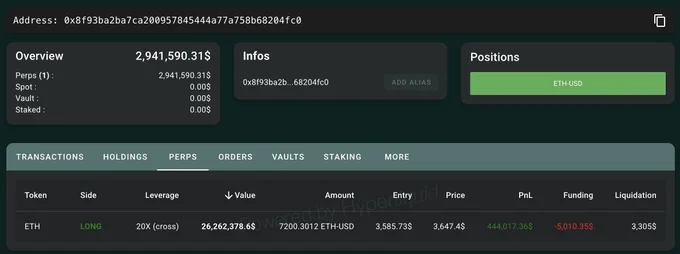

Open interest continues to reach new all-time highs, surpassing $14.7B. https://t.co/LqxharQVur

0

0

0

1

0

Hyperliquid的TVL最近一周增长了10亿,达到了恐怖的4.5B,每日交易额达到30B左右的水平。而币安的衍生品交易额是140B每天。进入前五的门槛是40B交易额。不过部分交易所的刷量剔除掉之后,感觉Hyperliquid已经进入前三了。

而币安的衍生品交易额是140B每天。进入前五的门槛是40B交易额。不过部分交易所的刷量剔除掉之后,感觉Hyperliquid已经进入前三了。

对于Perp Dex来说,TGE从来不是终点,而是增长飞轮的开始。

整个区块链还有40B级别的产品可能性吗?

公链?AI?几乎全部被证伪。创新很难,行业甚至于4B级别的产品目前新项目里都没有看见。全是VC流水盘和天亡级项目。

有且仅有Perp DEX赛道,因为其他全部赛道已经证伪。

我一直很信奉一个观点,如果这个赛道,我没押注到龙一,甚至错过了中期下注这个赛道的龙一。

去高位接盘FOMO龙一?不存在,我只押注龙二,龙三。

还没发币的龙二龙三是谁已经很明显的趋势了。

这个牛市,除了BTC之外没有吃到什么ALPHA收益,操作也菜的扣脚,天天被质疑,反串黑。

但是,无所谓,这个夏天结束。

我向未来下的筹码,将揭开它的底牌。

Let's fk go!!!

@Lighter_xyz @vnovakovski

@Backpack @armaniferrante

Show more

0

0

10

32

0

《Hyperliquid的改革》

Hyperliquid的价格已经从底部上来三倍了。

3月份,Hyperliquid经历了JELLY memecoin的短挤压事件,HLP面临超过1000万美元的未实现亏损。

Hyperliquid已经从HLP的挤兑中走了出来,基本遏制住了hlp被撸。

4月10日,HLP开始回升,而币价同期回升。尽管整个过程交易量并没有明显提升。

核心问题是,Hyperliquid对HLP机制是如何改革的呢?

限制清算策略的资金分配:HLP用于清算策略的资金比例被设定为固定且明确的上限,减少在重大清算事件中的潜在损失。清算资金的重新平衡频率也降低,以进一步限制风险。

引入自动去杠杆(ADL)机制:当清算策略的损失超过特定阈值时,HLP会触发自动去杠杆(Auto-Deleveraging)。该机制通过利用同一资产对中其他交易者的未实现利润来弥补亏损,从而保护HLP的整体资金池。

动态未平仓合约(OI)上限:为防止低市值代币(如JELLY)被操纵,Hyperliquid对HLP支持的资产引入了动态未平仓合约上限,特别是在流动性较低的代币上,以减少类似事件的发生。

接下来核心就是看下HyperEVM的进展了。傻哥粗看下来,是没有看到让人惊喜的进展,还需要细看下。

Show more

0

0

0

0

0

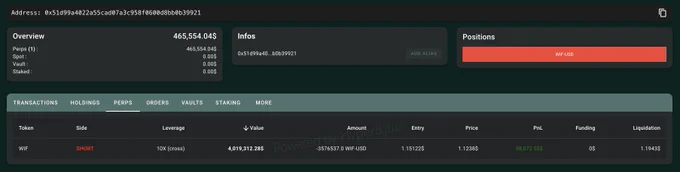

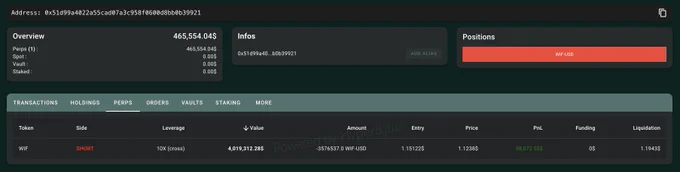

[Hyperliquid 50x 老哥] 在平掉 BTC 空后,刚刚又 10x 开空了价值 $402 万的 $WIF 。

$1.15 开空,爆仓价 $1.19。

(从这几个月看下来,老哥在 BTC 跟 ETH 操作上胜率非常高,但在山寨上的胜率偏低。可能也是跟他山寨开的倍数也不低,而山寨波动更大有关系。) https://t.co/Izs3SYwpqW

Show more

0

0

2

7

0

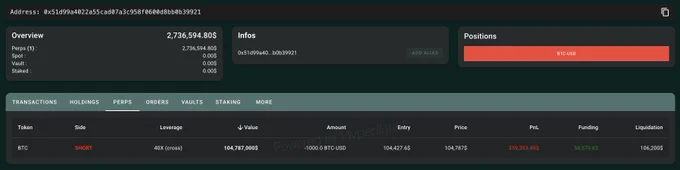

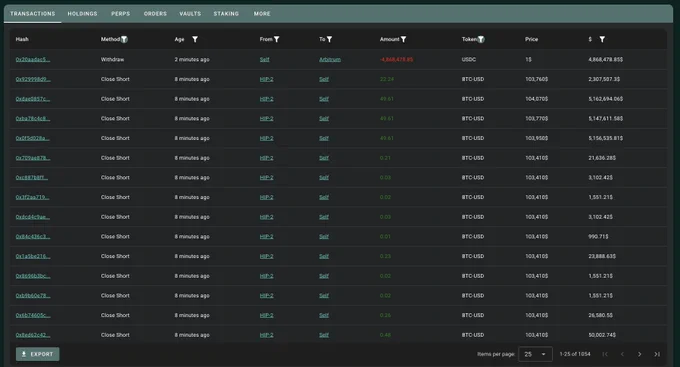

[Hyperliquid 50x 老哥] 刚才把 LDO 空单平掉、又转了 79.5 万 USDC 进 Hyperliquid 增加保证金,然后继续加仓了 BTC 空单。

现在他一共空了 1,000 枚 BTC,价值 $1.048 亿,开仓价 $104,427,爆仓价 $106,200。 https://t.co/cxfahVdJFY

Show more

0

0

7

9

0

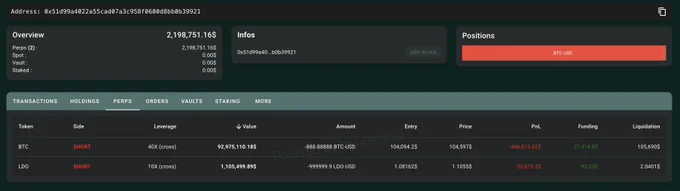

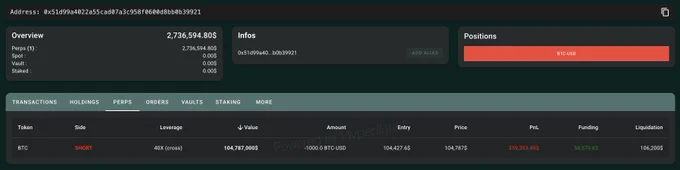

[Hyperliquid 50x 老哥] @qwatio 又来高倍开空 $BTC 了。

时隔 35 天,老哥再次在 Hyperliquid 上进行高杠杆大仓位合约开仓:使用 268.3 万 USDC 作为保证金

◉40x 开空 888.8 枚 $BTC ($92.93M),开仓价 $104,094,爆仓价 $105,689。

◉10x 开空 100 万枚 $LDO ($1.1M),开仓价 $1.08,爆仓价 $1.98。

地址链接🔗👉:https://t.co/fzrSs1Qliz

本文由 #Bitget|#@Bitget_zh 赞助

Show more

更新:

[Hyperliquid 50x 老哥] 在半小时前获利平多,然后把 639.5 万 USDC 提回地址。

$1459 开多价值 6900 万的 ETH,$1491 平多。赚到 $187 万 (+41%)。 https://t.co/k92DpLjhL1

Show more

0

0

5

6

0

#Hyperliquid# may be on track to become #FTX# 2.0.

The way it handled the $JELLY incident was immature, unethical, and unprofessional, triggering user losses and casting serious doubts over its integrity. Despite presenting itself as an innovative decentralized exchange with a bold vision, Hyperliquid operates more like an offshore CEX with no KYC/AML, enabling illicit flows and bad actors.

The decision to close the $JELLY market and force settlement of positions at a favorable price sets a dangerous precedent. Trust—not capital—is the foundation of any exchange (CEX and DEX alike), and once lost, it’s almost impossible to recover.

Moreover, the platform's product design reveals alarming flaws: mixed vaults that expose users to systemic risk, and unrestricted position sizes that open the door to manipulation. Unless these issues are addressed, more altcoins may be weaponized against Hyperliquid—putting it at risk of becoming the next catastrophic failure in crypto.

Show more

0

0

1.1K

2.5K

289

关注 @HyperliquidX 生态的话,可以嘴撸一下他们最近比较火的nft项目 @Illiquid_nft 。他们跟 @wallchain_xyz 有合作。

他们的白单规则如下

1. 嘴撸,具体的得分情况去这个网站查询:https://t.co/l7M4qS7hsl

2. 前1000,保证白;前1000-1500,先到先得白;

目前看了一下,这个不太卷。不过白单可以去抢一下。

原文可以参考:https://t.co/9er4xx6P4b

另外,这项目。基本上hl上比较出名的项目方都关注了,但是不知道是不是Wallchain Quacks做的新项目,感觉有点像。

Show more

0

0

6

13

1

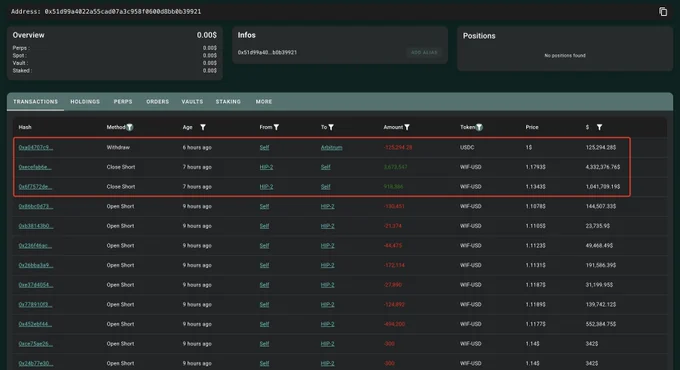

果然,[Hyperliquid 50x 老哥] 在 BTC 跟 ETH 上的胜率有多高,在山寨上的胜率就有多低😂

他昨晚开的 10x 空 WIF 在 7 小时前止损平仓,损失了 $24.3 万。

地址链接🔗👉:https://t.co/bKlu3ja5dN

本文由 #Bitget|#@Bitget_zh 赞助 https://t.co/J28DEoBUdw

Show more

[Hyperliquid 50x 老哥] 在平掉 BTC 空后,刚刚又 10x 开空了价值 $402 万的 $WIF 。

$1.15 开空,爆仓价 $1.19。

(从这几个月看下来,老哥在 BTC 跟 ETH 操作上胜率非常高,但在山寨上的胜率偏低。可能也是跟他山寨开的倍数也不低,而山寨波动更大有关系。) https://t.co/Izs3SYwpqW

Show more

0

0

0

2

0

更新:

[Hyperliquid 50x 老哥] 在半小时前获利平多,然后把 639.5 万 USDC 提回地址。

$1459 开多价值 6900 万的 ETH,$1491 平多。赚到 $187 万 (+41%)。 https://t.co/k92DpLjhL1

Show more

0

0

19

32

1

这一轮最强应用hyperliquid,AUM突破50亿,季度营收超过1.6亿美元。大毛估计也会是在几个perp dex之间诞生,大干猛上? https://t.co/hY9yPY6rXv

0

0

5

6

1

James Wynn,Hyperliquid巨鲸的多单开了7760个BTC,成本价105k,爆仓价100k。这种我觉得肯定被针对,时间问题,就看他先跑还是后跑。

Musical chairs 行情。

🔗🌲:https://t.co/ZyhnAJ7QlF https://t.co/LSxqGTjuKP

Show more

#BTC# 大周期剧本:收藏起来❤️

107k⬇️89⬆️108k⬇️60k⬆️150k

🔗🌲:https://t.co/ZyhnAJ7QlF https://t.co/catWWuu6EI

0

0

1

2

0

刚才的下跌让 [Hyperliquid 50x 老哥] 又赚钱了。他在 10 分钟前获利平仓,盈利 $118.8 万。

随着刚才的下跌,[Hyperliquid 50x 老哥] 的大手笔做空 BTC 由亏转盈。他在仓位盈利后迅速平仓保住胜利果实:

以 $103,478 的价格平掉他 $104,319 均价开空的 1414.14 枚 BTC ($146M),盈利 $118.8 万。

地址链接🔗👉:https://t.co/fzrSs1Qliz

本文由 #Bitget|#@Bitget_zh 赞助

Show more

[Hyperliquid 50x 老哥] 刚才把 LDO 空单平掉、又转了 79.5 万 USDC 进 Hyperliquid 增加保证金,然后继续加仓了 BTC 空单。

现在他一共空了 1,000 枚 BTC,价值 $1.048 亿,开仓价 $104,427,爆仓价 $106,200。 https://t.co/cxfahVdJFY

Show more

0

0

5

4

0

Plume 已经上线 @HyperliquidX。

通过集成进 Hyperbridge,$PLUME 现在可以通过 Hyperbridge 跨进 HyperCore 交易。

另外,Plume 前几天的 AMA 中有透露主网会在 5 月中旬上线,也就是说没几天了。像质押、治理和资产代币化等功能也都会随着 Plume 主网上线而解锁。

Show more

PLUME is now live on @HyperliquidX, accessible from dozens of chains for hundreds of thousands of new users.

We're proud to be a day 1 launch partner for Hyperbridge as we expand our multichain journey, powered by @LayerZero_Core. https://t.co/z8E5QjfxLQ

Show more

0

0

0

1

0

自上次hyperliquid空投了价值近百亿u空投后,大家第一次意识到原来链上衍生品的想象力竟如此恐怖如斯,作为华语区最早期hyperliquid推广者,我也被惊到了,所以这轮我持续押注链上衍生品,力图寻找下一个hyperliquid级机会

我试了几乎所有市面上的链上衍生品,目前只有edgex能成为下一个hyperliquid

我说下原因和大家比较关注的问题

1:生态布局广,叙事够大,潜在FDV高,edgeX不光是perp dex,edgeX生态有核心4大块,perp dex,高性能L2(跟base/op一个赛道),链上资管

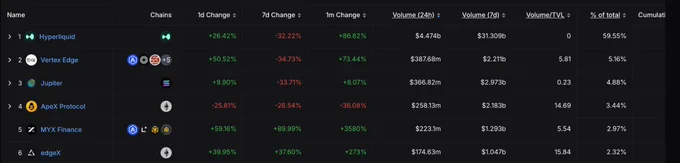

perp dex板块,目前从我12月底关注到现在,增长了好几倍,从defiliama的数据来看,稳居perp dex top6左右,没有发币的perp dex中排top2

高性能L2板块,官方roadmap显示,5月底6月初会出测试网。

链上资管板块,目前出了vault 1.0,实行白名单,APR200%左右,上线即被用户秒完,vault 2.0跟官方聊完,会在5月陆续开放更多策略,会结合cefi和defi双边的优势,为用户提供优质的资管策略

2:产品力足够,研发实力强,目前edgeX是目前热门的perp dex中唯一一个有手机端的,手机端丝滑程度比很多cex还强,cex该有的类似移动止盈止损,反向开仓,快捷开仓等都具备。

另外就是在产品稳定上,所有用过edgeX的用户都会发现,从没有出现过宕机问题,我说下你们看不到因素,就我接触edgeX团队的经历,他们是一帮极其谨慎细微的团队,可能在别人看来,他们节奏好慢呀,一个产品功能得打磨很久才上线

但在我看来,这是极其核心的优势,这玩意是链上衍生品呀,一个环节出现bug就完蛋了,还有一个原因就是他们不缺钱,背后也没有vc催他们,所以始终按照他们自己的节奏来

慢就是快,链上衍生品产品并不是过家家,必须建立在安全的前提下

3:积分获取难度较大,纯撸子不好撸到

根据官方edgeX Alpha 赛季第 20 周的积分分配,总共有 54544 个点分布在 1531 个地址中

把所有地址加起来也只有20000多个,卷吗?现在随便一个空投交互项目都是几十万地址

为啥分这么难获取?

那是因为edgeX 分发的积分总量本来就少呀,但空投比例不变呀,分更值钱呀,当年hyperliquid一积分给5.35个hype,一个hype高峰30美金

懂了没,因为积分总量设置的问题,别的平台动不动一个用户几万分、几十万分,尼玛总积分几百、几千亿,你看似撸了更多分,最后不值钱呀

4:Edgex的空投未来值钱吗?

根据我与官方人员的长期互动,我可以透露一些消息

因为edgeX 没有从任何vc那里融资,不是因为融不到资,我看到最近几个vc的朋友也找过去问是否要融资,目前都被拒绝掉了,原因是人家背后就是Amber Group,人家就是资本,不需要vc的钱,不需要给vc代币,杜绝了大量vc抛压盘。

edgeX的空投比例可能在代币总量的20~25%,多的我就不说,毕竟没人能保证纯撸一定就能100%赚钱发财

最后,作为hyperliquid、parti撸毛大获成功的我,我告诉大家当下及未来的空投逻辑:

不要问这个项目能撸吗?而是问,这项目牛逼吗?

因为币圈正在经历一场颠覆过去路径的风暴,一切都要回归本源,何为本源?

项目产品有吸引力吗?是伪需求还是刚性需求?有真实收入模型,还是卖币盈利模型?有真实用户吗?如果没有空投计划你还会继续用吗?

一切都要回顾本源,过去的路径你们不管是炒二级的,还是撸毛自己都能明显感觉到这轮压根使不上劲,因为你们压根没有想过问题到底在哪

所以我撸到了hyperliquid、撸到parti,而你们只有无尽的反撸和维权,而且我更加轻松,道理也很简单

我从来都没有刻意去撸空投,我只是一直在寻找牛逼的项目,随便撸个牛逼的空投,这就是症结所在

下一个步该做啥?

去体验edgeX的产品,你就简单的试下,尤其是它的app端,然后你会惊讶,卧槽,你不说这是链上衍生品,我还以为这是cex

对,就这么牛逼,谁用谁tm服气

这才是真正能打的链上产品呀,牛逼的产品呀

后面我就不多说了,走我专属edgeX邀请链接,我跟edgeX官方是长期合作关系,我的粉丝有部分优先权和福利

https://t.co/aQ8T1J8PfS

走完我链接后,加入庞教主的独家edgeX电报社区

https://t.co/j7fHfUsLNY

Show more

0

0

0

2

0

去中心化衍生品协议 Hyperliquid 宣布推出支持开发者自主部署永续合约的功能(HIP-3),目前已上线测试网。该机制实现合约市场的完全去中心化上线,部署需质押 100 万枚 HYPE 并通过荷兰式拍卖支付 gas,部署者可设定手续费分成与市场参数,若恶意操作将被验证人投票罚没质押。https://t.co/52OtyrU2vt

Show more

0

0

1

0

0

吴说获悉,Hyperliquid 官方推特账户疑似被黑客攻击,发布虚假空投信息。吴说提醒请勿点击可疑链接。https://t.co/sfdk36YH3G

0

0

1

0

0