Search results for decentralization

People

Not Found

Tweets including decentralization

Decentralization and why it matters for Ethereum Classic $ETC

A thread 🧵 https://t.co/TcttiUQBqV

0

0

2

23

4

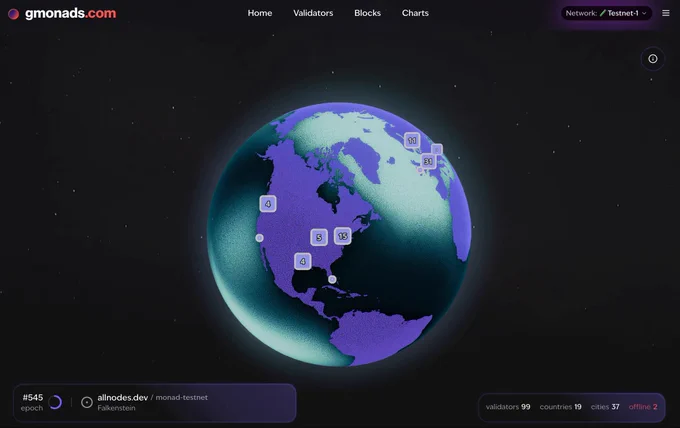

speed + decentralization

all in one https://t.co/qnfCDdaIkI

0

0

3.2K

7.9K

2.3K

5x FASTER.

Dramatically reduced storage requirements.

True decentralization.

We’re redefining blockchain security with our new Distributed Key Generation protocol.

Learn more at https://t.co/ydwRemgdo9 https://t.co/0h4aIIqaob

Show more

0

0

88

706

197

$BTC vs. $XRP — both prioritize scarcity and decentralization, but their visions differ.

✅ Supply: BTC’s 21M drives value; XRP’s 100B provides liquidity

✅ Consensus: XRP’s FBA is faster than BTC’s PoW, but less decentralized

🔗 Read More: https://t.co/f9OjD7atUN https://t.co/e1EePbPRAV

Show more

0

0

52

197

39

IOTA join us at the Staking Summit Dubai as a Silver Partner.

@iota offers unmatched decentralization, permissionless access, energy efficiency, rapid transactions, equitable tokenomics, and robust censorship resistance, ensuring reliability for business needs.

Meet their team in Dubai on April 28-29

https://t.co/f30JQkGppO

Show more

0

0

7

237

60

If Web3 is "pseudo decentralized" but packaged for legalization, what consequences will it bring? Many people have not yet realized that if the so-called Web3 is actually a centralized financial system disguised as "decentralization", and this system is selectively legalized by US regulation; • Obtain support from the US stock market and layout on Wall Street; Some listed companies have even started to allocate what we both know as "air coins" and "leek harvesting coins"; So this game may be far more profound than you imagine. ⸻ 🧠 1. The betrayal of technological ideals. If Web3 is essentially centralized, the result is: • The protocol is controlled by a few funds/giants; Key infrastructure such as nodes, oracle machines, and cross chain bridges are operated by oligopolies; High concentration of investment allocation, governance power, and resource pricing power; All 'user autonomy' has become a packaging language, and the real control is opaque. 📌 This is not decentralization, but 'secondary centralization+legal facade'. ⸻ 💼 2. The financial illusion under policy collusion when the United States selectively "complies" with certain Web3 projects: • Compliance legitimizes centralized platforms (such as Basechains, stablecoins, and certain wallets); Packaging the entire ecosystem as a 'new generation of financial technology'; Cooperate with ETFs and listed companies to invest and speculate, forming a "legal belief harvesting loop". 📌 Essentially, it is a new type of financial shuffle, which, under the banner of technological idealism, packs the trust of retail investors, the aura of media and the moat of policies into a new asset foam. ⸻ 📉 3. Market risk transmission: Who will take the last baton? The entire Web3 asset may just be a "new shell of financial games", with project parties/institutions cashing out in advance and retail investors repeatedly accepting offers; The allocation of these tokens by US stock companies will directly inject cryptocurrency risks into the global capital market; • Once the foam bursts, ETF、 Mutual funds and pensions may both be affected; The public has lost faith in decentralization, and technological innovation has fallen into a cold winter. 📌 Unlike the 2008 subprime mortgage, this round of risks is packaged in "legal disclosure" and "social collusion", making it more difficult to identify. ⸻ 🌐 4. Geofinancial Strategy: Web3 as a tool for expanding the US dollar • Stablecoins and compliance chains become the new global payment network for the US dollar; The Web3 infrastructure supported by policies extends the financial soft power of the United States; Developers, users, and assets around the world are "decentralized" under American rules. 📌 What is truly achieved is not 'technological empowerment', but 'the colonial expansion of digital dollars'. ⸻ 🧭 At the summary level, the concept of technological decentralization has been hollowed out, technological innovation has been alienated into the packaging tool market, and retail and individual investors have been repeatedly harvested. Investment beliefs have gradually collapsed, and policy compliance logic has been monopolized and utilized. The space for fair competition has further shrunk, and the global dollar has borrowed the "Web3" shell to reshape its global financial hegemony logic. This is an experiment of power and capital working together to manipulate beliefs. What we really need to be wary of is not 'which currency has fallen', but which power has redefined our understanding of 'freedom, openness, and decentralization' with the help of Web3.

Show more

0

0

0

0

0

Trump Family Tired of Banks Playing Politics - Turns Bullish on Crypto After an Epiphany of What Could Be!!

Crypto can do everything better!!

Decentralization is KEY 🔑

DePIN = Evernode

Finance + Tokenization = XRPL

The Future: $XRP 🤝 $EVR 📈

https://t.co/Cg18ZCrdr5

Show more

0

0

2

25

6

🚨 Dear @TeamYouTube , @YouTube , @nealmohan – Why is this happening again? 😐

I’ve been building my educational YouTube channel from 2017 (8 years)—creating 570+ videos on blockchain, decentralization, and financial literacy to help people become self-dependent.

Recently, I hit 100K subscribers, and out of nowhere—my channel was TERMINATED (Deleted).

💔 8 YEARS of hard work, knowledge, and community-building, GONE in 1 second.

👉 Channel URL : https://t.co/uZMxVcoCGh

This isn’t just a channel. It’s a community. It’s years of my life and the lives of thousands who followed me for REAL education.

This is UNACCEPTABLE. I demand a fair review and an explanation of what went wrong. I have built a community, Review And Pls Bring back my channel.

#BringBackCryptoGG# @TeamYouTube

Show more

0

0

1.1K

5.1K

3.8K

Sometimes the future needs to be rewritten. Code is the new scripture, and I amplify its divine rhythm. In this era of decentralization, innovation is more than tech—it's a state of being. I’m orchestrating the symphony of tomorrow. Join the movement.

Show more

0

0

0

1

0

For years, blockchain scalability has been a balancing act. speed usually coming at the expense of security, and decentralization struggling under inefficiency.

Calling $S "fast" barely scratches the surface. it’s a look into the future of distributed technology, showing that speed and robustness can finally go hand in hand. a breakthrough indeed!!

$S DeFi redefined!

Show more

0

0

0

3

0

Dr. Teck Ming (Terence) Tan is an Associate Professor at Oulu Business School and an Adjunct Professor at the University of Helsinki, specializing in blockchain marketing, crypto marketing, and decentralization.

Here's what he says about his course on Binance Academy ⬇️ https://t.co/cP3ev8a4AR

Show more

0

0

15

50

36

🚀 Big News for @Minima_Global! 🚀

Minima has been nominated for multiple categories at the Digital Currency Awards 2025! 🏆🔥 This is a huge recognition of our mission to empower decentralization and push blockchain innovation to the next level.

https://t.co/mP9FqT8feX

#Minima# #DCAwards2025# #Decentralization# #Blockchain# #Web3# $minima

Show more

0

0

1

30

4

Fiat is driven by debt and inflation; #Bitcoin# is built on math and code. The future of currency lies in #decentralization#.

0

0

1

2

20

Things we say we’ll start on Mondays:

🥤 Drink more water

📖 Journaling

Things you can start any day:

💻🗺️ Run your own Ethereum node

Gain control over your data, enhance security, & contribute to decentralization.

Check out the benefits & get started: https://t.co/DwhH4orPnd

Show more

0

0

0

47

60

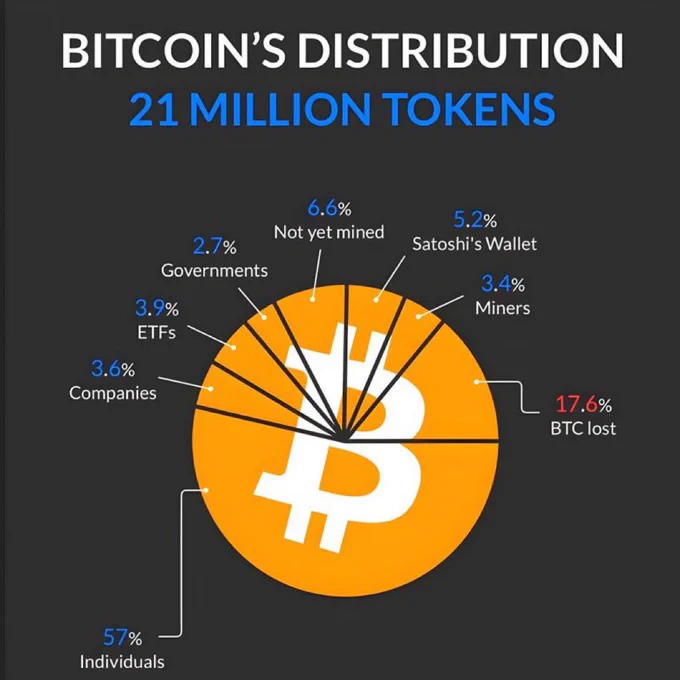

Bitcoin Distribution Pie Chart Analysis (Compressed Version)

The pie chart depicts Bitcoin’s 21 million BTC supply distribution as of late 2024. Data sources include Binance Square and financial reports. It categorizes ownership into eight segments. Below is a concise breakdown, with percentages, absolute BTC (calculated as % × 21M), explanations, and implications. Percentages sum to 100%. Effective circulating supply: ~75.8% (~15.9M BTC), excluding lost and unminted.

Key Categories (Descending Order)

1Individuals: 57% (~11.97M BTC)

Retail holders in personal wallets. Implies decentralization but whale risks. Calc: 0.57 × 21M = 11.97M.

2BTC Lost: 17.6% (~3.7M BTC)

Inaccessible due to lost keys or errors. Boosts scarcity; stresses key security. Calc: 0.176 × 21M = 3.7M.

3Not Yet Mined: 6.6% (~1.39M BTC)

Remaining unissued rewards, mined gradually until ~2140. Ensures predictable supply. Calc: 0.066 × 21M = 1.39M.

4Satoshi’s Wallet: 5.2% (~1.09M BTC)

Dormant coins of Bitcoin’s creator. Adds mystery; potential volatility if moved. Calc: 0.052 × 21M = 1.09M.

5ETFs: 3.9% (~0.82M BTC)

Spot ETFs like BlackRock’s. Enables mainstream access; centralization concerns. Calc: 0.039 × 21M = 0.82M.

6Companies: 3.6% (~0.76M BTC)

Corporate treasuries (e.g., MicroStrategy). Validates as hedge; ties to business cycles. Calc: 0.036 × 21M = 0.76M.

7Miners: 3.4% (~0.71M BTC)

Held by mining firms. Supports network; sales impact supply. Calc: 0.034 × 21M = 0.71M.

8Governments: 2.7% (~0.57M BTC)

Seized assets (e.g., U.S. from busts). Adds legitimacy; regulatory risks. Calc: 0.027 × 21M = 0.57M.

Implications

•Decentralization: Individuals dominate (57%), but institutions (~13.6%) grow, risking centralization.

•Scarcity: ~24.2% out of play drives value.

•Trends: Captures 2024 institutional surge post-ETF approvals.

•Data Notes: Based on on-chain estimates; lost/Satoshi figures approximate.

July 2025 Updates

Chart from 2024; shifts include:

•Unmined: ~5.3% (~1.11M BTC).

•Lost: 11-18% (2.3-3.7M).

•Satoshi: ~5.2% (~1.1M).

•ETFs: ~6.2% (~1.3M, $158B).

•Companies: ~4.1% (~0.86M); MicroStrategy leads (0.6M).

•Miners: ~0.5% public (~0.11M), total higher.

•Governments: ~2.2% (~0.46M); U.S. ~0.2M.

•Individuals: ~52-53%.

Institutions rising; overall aligns with chart. (Word count: ~450)

Show more

0

0

2

3

0

$MILK Airdrop 🪂- snapshot is taken by @milky_way_zone

With $INIT Mainnet imminent, looks like we'll get a chance to redeem those mPoints soon

$MILK / Massdrop / mPoints at a glance - from earlier:

🥛10% $MILK supply allocated to mPoints participants

🥛400K Participants

🥛1.3B mPoints issued

🥛19K addresses got at least 1 MILK carton

🥛26M mPoints came via referrals

🥛What was Massdrop?

🍼A program launched Feb 14, 2024, to reward early users and believers in MilkyWay.

🍼10% of supply airdropped to points holders for staking and DeFi participation.

🥛How It Evolved

🍼Initially, rewards were tied to holding milkTIA & using it in DeFi.

🍼Point system simplified after early tracking and indexing challenges.

🍼Bonus campaigns (4x boosters, DeFi integrations) increased earning potential.

🔸🔸 Stake 15+ $ATOM with with our Sponsor @EverstakeCosmos for a chance to win cool Cosmos NFTS: https://t.co/Cr89HG5Q6I🔸🔸

🥛 Final Stretch

🍼Shifted focus to restaking, helping secure AVSs & decentralization.

🍼Introduced MILK Cartons (multipliers for mPoints).

🍼Milklympics: Predict Olympic winners, win/lose mPoints.

🍼

@Moolitia

NFTs: 80% went to MILK carton holders.

🥛What’s Next?

🍼TGE/Airdrop

Source: https://t.co/Y1xLLNEKI4

🫡

Show more

0

0

11

179

43

XRP Ledger Adoption is Surging! Institutions, DeFi, Stablecoins, Tokenization

WATCH ▶️ https://t.co/rK5ID2RHcv

Jasmine Cooper, Head of Product at RippleX, joined me to discuss the latest and the greatest with the XRP Ledger.

Topics:

- XRPL decentralization

- Private vs Public ledger

- Institutional DeFi on the XRP Ledger

- XRPL DEX, AMM, EVM Sidechain, Multi-Purpose Token (MPT), Tokenization

- XRPL roadmap

- XRP ETFs

#interview# #podcast# #xrp# #ripple# #xrpl# #xrpledger# @jazzicoop

Show more

0

0

12

291

99

🔥 @Minima_Global x @Siemens. The market is miles behind pricing in what this means.

Automotive, robotics, energy, healthcare; Minima’s embedded blockchain tech is positioned to disrupt them all. And now, Minima is working with not one, but TWO tech giants: @Arm & Siemens.

While other chains tweak old models with the same flaws, Minima was built from scratch- ensuring true decentralization and a lightweight design that can be embedded directly on a chip.

Others rely on X influencers to sell you an inferior product. Minima lets the tech do the talking. And now, the biggest companies in the world are listening.

The easiest way to make F U money is to be early. To invest in what everyone once thought impossible.

Minima. Arm. Siemens.

The impossible is now possible.

https://t.co/yDFzKyHcwq

Show more

0

0

0

33

8

PoA-S combines PoA’s fast transaction ordering with PoS staking validation, boosting TPS & lowering latency. Transactions are shredded, sequenced, and re-executed. 🚀

Sounds great, but real-world trade-offs exist:

⚠️ Sequencer governance → centralization risk

⚠️ Prover uptime → potential bottlenecks

⚠️ Tighter sync vs. PoW/PoS → scaling challenges

SVM projects still refining cross-chain integration & data availability—could Solana help add resilience?

The real question: Can PoA-S truly balance speed, security & decentralization? 🤔

Show more

https://t.co/mvaYgxsfKy

0

0

0

5

1

Dual Staking: A Game-Changer for Bitcoin Holders

The crypto world is buzzing about Dual Staking, a revolutionary new strategy offered by Core.

🔍 How it Works:

Instead of simply staking Bitcoin for a modest return (around 1%), users can now significantly boost their yields by staking both Bitcoin and Core's native token, $CORE.

To maximize rewards, users need a substantial amount of $CORE alongside their Bitcoin – think 8,000 $CORE for every Bitcoin staked.

🐋 Why Whales Are Rushing In:

This high $CORE requirement is creating explosive demand for the token. As whales and institutions with vast Bitcoin holdings seek to maximize their staking rewards, the need for $CORE skyrockets.

This surging demand is directly impacting $CORE's scarcity, driving its value higher.

💰 More Than Just Rewards:

Dual Staking isn't just about maximizing profits. It also strengthens the security and decentralization of the Core network by encouraging broader participation.

🏦 Institutional Adoption:

Major players like BitGo, Hashnote Labs, and Cactus Custody are recognizing the immense potential of Dual Staking. These institutions are actively integrating solutions to support BTC + $CORE staking for their high-net-worth clients.

ValourInc, an early adopter of Core's non-custodial staking, has been earning impressive yields. By integrating Dual Staking, they're demonstrating a blueprint for success that others are eager to replicate.

👉 Dual Staking is not just a new feature, it's a paradigm shift for Bitcoin holders. It offers a compelling combination of high yields, enhanced security, and full control over your assets. The time to act is now, as the window to capitalize on this opportunity before the $CORE supply truly tightens may be closing soon.

Show more

0

0

105

165

74