Search results for inflation

People

Not Found

Tweets including inflation

Inflationary pressures, demographic shifts and changing consumption preference are emerging across sectors and geographies, making strategies and drivers for asset allocation increasingly crucial in the minds of asset owners and managers.

Vincent Mortier, Group Chief Investment Officer at @Amundi_ENG remarked that asset managers must be flexible in mobilising savings to support long-term economic development at AFF2025.

How can asset managers effectively contribute to a more resilient, sustainable economy? What strategies do you see as most impactful in directing capital toward growth?

Stay tuned for updates and event details of AFF2026 which will take place on 26-27 January in Hong Kong: https://t.co/oGFF1nRzDz

Show more

0

0

56

1.8K

404

Inflation explained … on monkeys https://t.co/SltjAIox3g

0

0

261

58.7K

8.5K

Inflation adjusted means that the Rangarajan poverty line is much higher now than it was 13 years back. As of 2023-24, for all India:

Rs 1940 (rural)

Rs 2759 (urban)

Which means that for a family of 4 in urban area, if they spend less than Rs.11,036 per month then they are poor.

Show more

0

0

73

1.2K

316

Don’t let inflation quietly erode your wealth. It’s time to make your money work for you! Trading stocks on ARM ONE is simple, fast, and hassle-free. With easy access to the stock market, you can start investing today and watch your money grow.

For more information send a message to

ARMSecCustomerService@arm.com.ng or call 081746447815.

#ARMSecurities# #InvestedInYourTomorrow# #StockMarketInvesting#

Show more

0

0

1

1

0

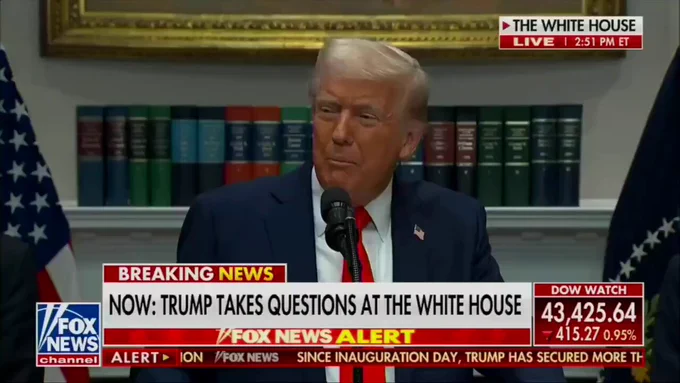

MSDNC: "The worst predictions that inflation was going to be fueled by this new tariffs regime have not turned out to be the case..." https://t.co/O5fzmzBITz

0

0

159

4.9K

842

Fiat is driven by debt and inflation; #Bitcoin# is built on math and code. The future of currency lies in #decentralization#.

0

0

1

2

20

GM degens🌞! #Trump# speech just dropped—#inflation#? #Downturns#? Yawn. But $Tariff? Bullish AF,

he won’t shut up about it! Stack that

47AJteSxmVhhH9ae6xYg9vQzzZ3XSB7aHaEcGrXxpump like it’s the only thing saving us from economic doom. #pumpfun# #CRYPTO# #TrumpTariffs# https://t.co/Igs5EwU0kz

Show more

0

0

20

20

3

BANK OF AMERICA CEO SAYS RESEARCH TEAM DOES NOT SEE RATE CUTS THIS YEAR DUE TO THE STICKY INFLATION

0

0

52

352

49

Gold breaks $3150 while S&P tanks - OG boomers stacking metal as inflation hedge 2.0 hits warp speed

BTC darknet dominance spikes 38% YTD - CEXs chasing privacy narrative but code > compliance theater

Miners bleeding? Hashrate ATH says HODLers DGAF about ETF paperhands

Show more

0

0

0

10

0

China's consumer price index (CPI), a main gauge of inflation, rose 0.2% YoY in 2024, official data showed Thursday. #ChinaInsider# https://t.co/GhBHWUNSWn

0

0

84

7.2K

496

The Fed acts like a government agency … sort of

The Fed acts like a business … sort of

The Fed tries to control inflation … sort of

The Fed plays an executive role … sort of, but—once its leaders have been confirmed—operates beyond the reach of the president

End the Fed https://t.co/1DjJSopDKC

Show more

0

0

395

6.7K

1.4K

Bitcoin now secures Nexus.

Through our partnership with @babylonlabs_io, we're adding 44,660+ BTC worth of economic security to protect your apps, assets, and data without relying on token inflation or complex bridges. https://t.co/N6y1dPSnCr

Show more

0

0

440

753

436

通胀框架,鲍威尔讲话的重点:

1. 现有的框架基于低通胀,低增速

2. 过去几年我们发现真实利率似乎上升了,使得通胀可能会波动更大

3. 以前Traditional inflation targeting(传统通胀目标)使得我们定下了2%的目标

4. 考虑修改CONSENSUS STATEMENT(共识声明),在声明里有明确表示2%的通胀目标

所有的讲话全部加在一起都在表示未来可能会修改2%的通胀目标,理由是08年以后的低通胀环境可能已经被疫情改变,那根据08年以后数据得出的结论可能不再有参考意义。疫情后真实利率的上升代表通胀可能会稳定在高于2%的位置。这些想法和思路并不会改变接下去短期的政策,但是如果未来美联储太高了2%的目标,不要意外,今天是在铺路。同时也意味着利率也不会回到以前的低位,举例,2%的通胀目标,2.5%的隔夜利率是共识,现在3.5的隔夜利率也许是中性利率。

Show more

0

0

27

132

12

再解释下对鲍威尔晚上讲话的理解:可能将重新回到2019年之前的货币政策框架,由“关注过去一段时间内的平均通胀是否达到2%”(Average Inflation Target, AIT),转为“只关注当下通胀是否达到2%”(Inflation Target, IT)。

但为什么说是在降息做铺垫?因为如果还是按照AIT(平均通胀率)的框架来操作,那么由于2021年以来通胀一直高于2%,那么未来3-4年美联储理应让通胀持续低于2%来确保“平均通胀=2%”。这意味着更强的紧缩预期。但鲍威尔在本次会议中也表示,疫情后的美联储早已在事实意义上回归了传统的IT框架,AIT“在我们的政策讨论中变得无关紧要“。

所以放弃平均通胀目标制,那么过去几年高于2%的通胀将不意味着美联储未来需要将通胀压到2%以下,这在边际上意味着相对更加宽松的货币政策、这也是晚上2年美债收益率(短端利率)快速下行的原因

当然我前面说到不用等到通胀会到2%并不准确,而是说不用等到通胀回到2%以下使得平均通胀率=2%才能达到实现通胀目标是的要求。

Show more

0

0

15

96

15

The Fed adopted changes to its policy setting framework in 2020 because the very low rate world of the previous decade had introduced a meaningful asymmetry to their inflation target.

The world had other plans. Freed from that regime, the Fed is now seeking to retool.

Show more

0

0

15

136

29

🚀 $ECHO Token Sale is LIVE — Only on EchoX

Earn daily USDC yield from 50% of all trading fees.

🔥 10% burned daily.

🗳 1 Token = 1 Vote. Real utility. Real governance.

No lockups. No inflation. No empty promises.

👉 Join the Revolution — Own the Revenue.

Buy now → [https://t.co/JDMYouUS9k]

#ECHO# #TokenSale# #CryptoYield# #EchoExchange# #RealYield#

Show more

0

0

21

49

41

ELON: THE MORE PEOPLE PRODUCE USEFUL THINGS, THE BETTER OFF THE COUNTRY WILL BE

“As government spending is made more efficient and spending is reduced, the tax via inflation is reduced.

One way or another, you will effectively be better off if resources in the United States are not wasted.

People will do more useful jobs than before, the total output of goods and services will increase, and then the average standard of living will increase.

The most important lesson in economics is simply common sense: the more people in a country that are engaged in producing useful products and services, the better off that country will be.

Generally, I think you want to minimize the number of people in government.

You want to keep that to a minimum and move people from low to negative-productivity roles to high-productivity roles in the private sector.”

Source: Town Hall in Green Bay, Wisconsin, March 30, 2025

Show more

0

0

812

8K

1.8K

Oil prices are down, interest rates are down (the slow moving Fed should cut rates!), food prices are down, there is NO INFLATION, and the long time abused USA is bringing in Billions of Dollars a week from the abusing countries on Tariffs that are already in place. This is despite the fact that the biggest abuser of them all, China, whose markets are crashing, just raised its Tariffs by 34%, on top of its long term ridiculously high Tariffs (Plus!), not acknowledging my warning for abusing countries not to retaliate. They’ve made enough, for decades, taking advantage of the Good OL’ USA! Our past “leaders” are to blame for allowing this, and so much else, to happen to our Country. MAKE AMERICA GREAT AGAIN!

Show more

0

0

39.1K

432K

59.9K

Discover the power of fiscal policy!

Learn how tax and spending decisions impact growth, inflation, and employment

Dive into the details in our latest article!

Read more: https://t.co/80hCEmEkor

0

0

16

36

50